Author: Chloe, ChainCatcher

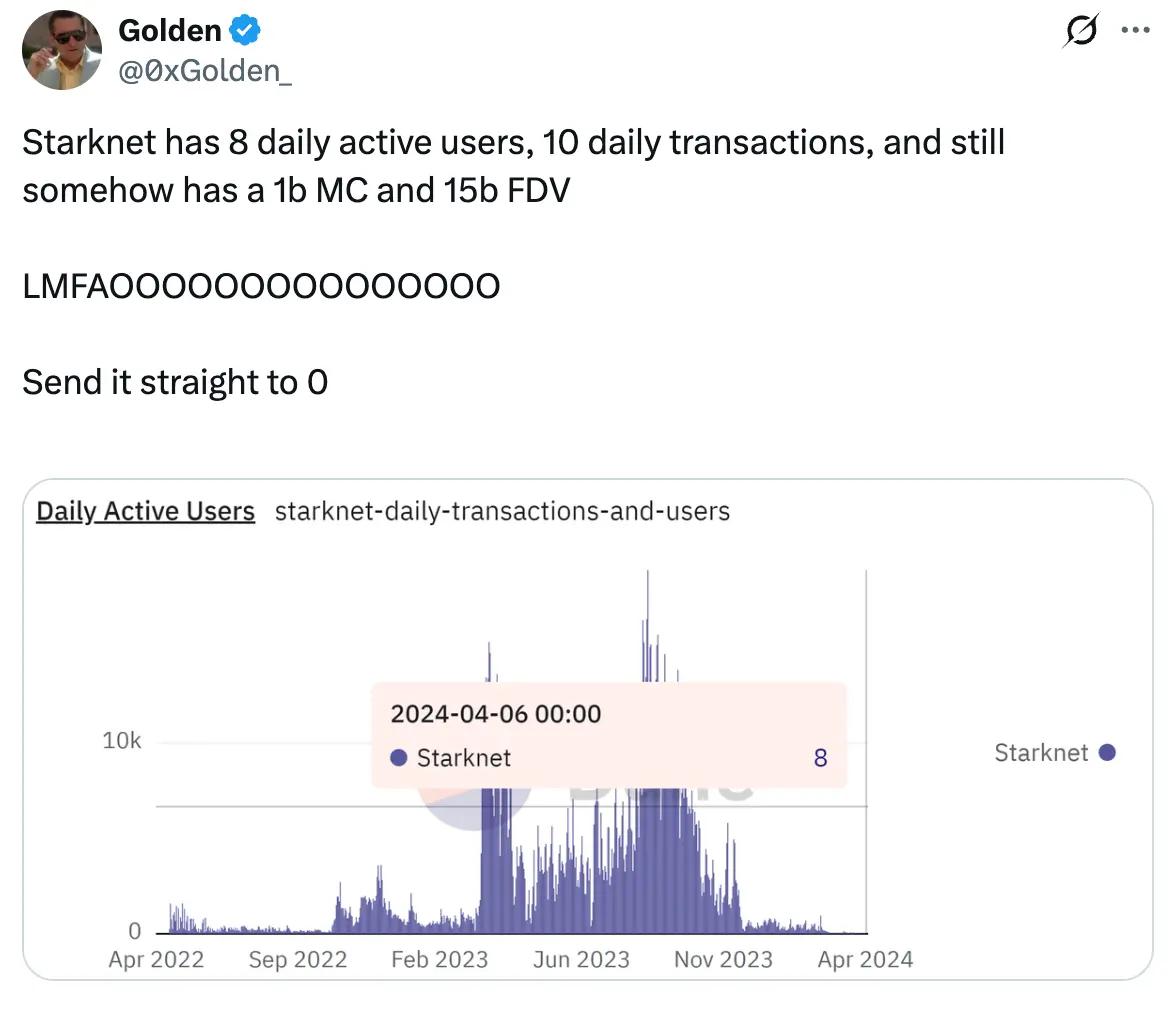

Last night, Solana's official X account posted a message pointing out that "Starknet currently has only 8 daily active users and only 10 daily transactions, but its market value is still $1 billion, and its fully diluted market value (FDV) is as high as $15 billion."

The tweet quickly sparked heated discussions in the market, attracting responses from several industry figures, including Bubblemaps, MegaETH, and Pump.fun co-founder Alon Cohen. Many users began to question: "8 daily active users, 10 transactions, $1 billion market capitalization—how does Starknet explain this?"

The tweet also drew a personal reply from StarkWare CEO Eli Ben-Sasson, who said, "Solana has eight marketing interns who maintain a high market value by posting 10 tweets a day." Solana co-founder Toly jokingly responded, "This is an unnecessary violent conflict between bald CEOs."

Is Starknet's activity level really as dismal as Solana claims? These figures have even led some users to criticize it, saying it "looks more like an inactive testnet than an active blockchain with a market capitalization of a billion dollars."

After more than a year of decline, Starknet's various metrics have shown a significant recovery.

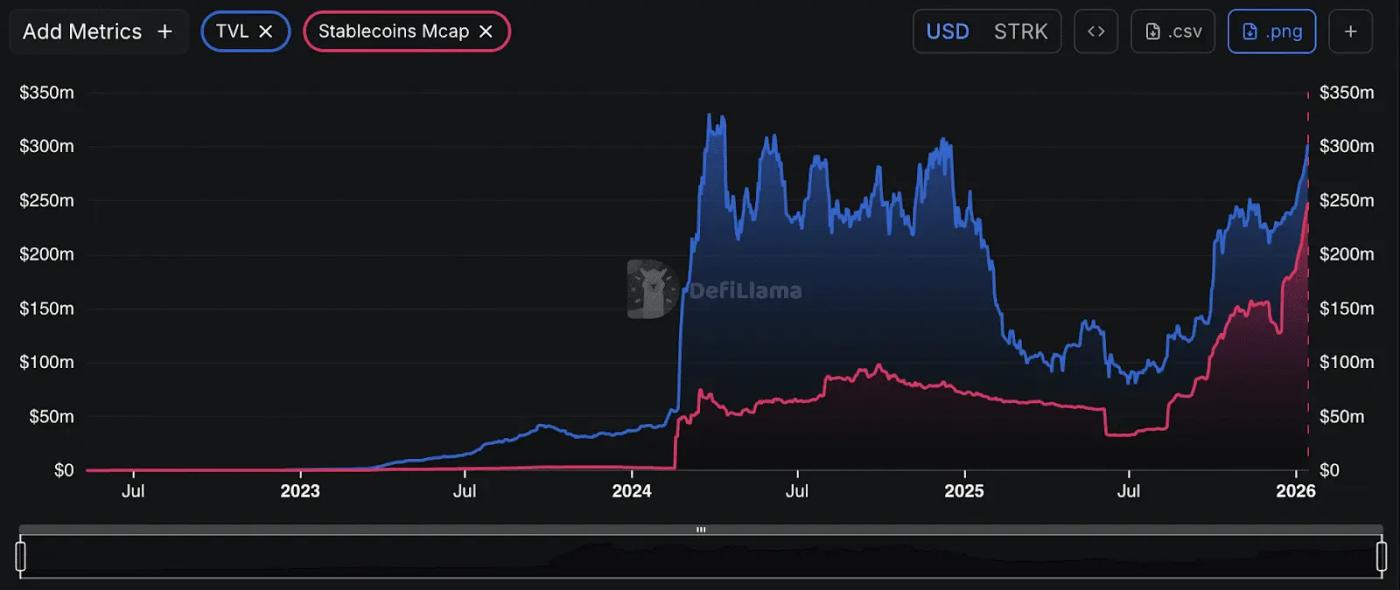

According to DeFiLlama data, Starknet's TVL has now climbed to $302 million, marking its first return to $300 million since 2024, recovering from that low point. The network's stablecoin market capitalization has also risen to approximately $248 million, a record high. The growth in stablecoin market capitalization is often seen as a key indicator of increased DeFi participation.

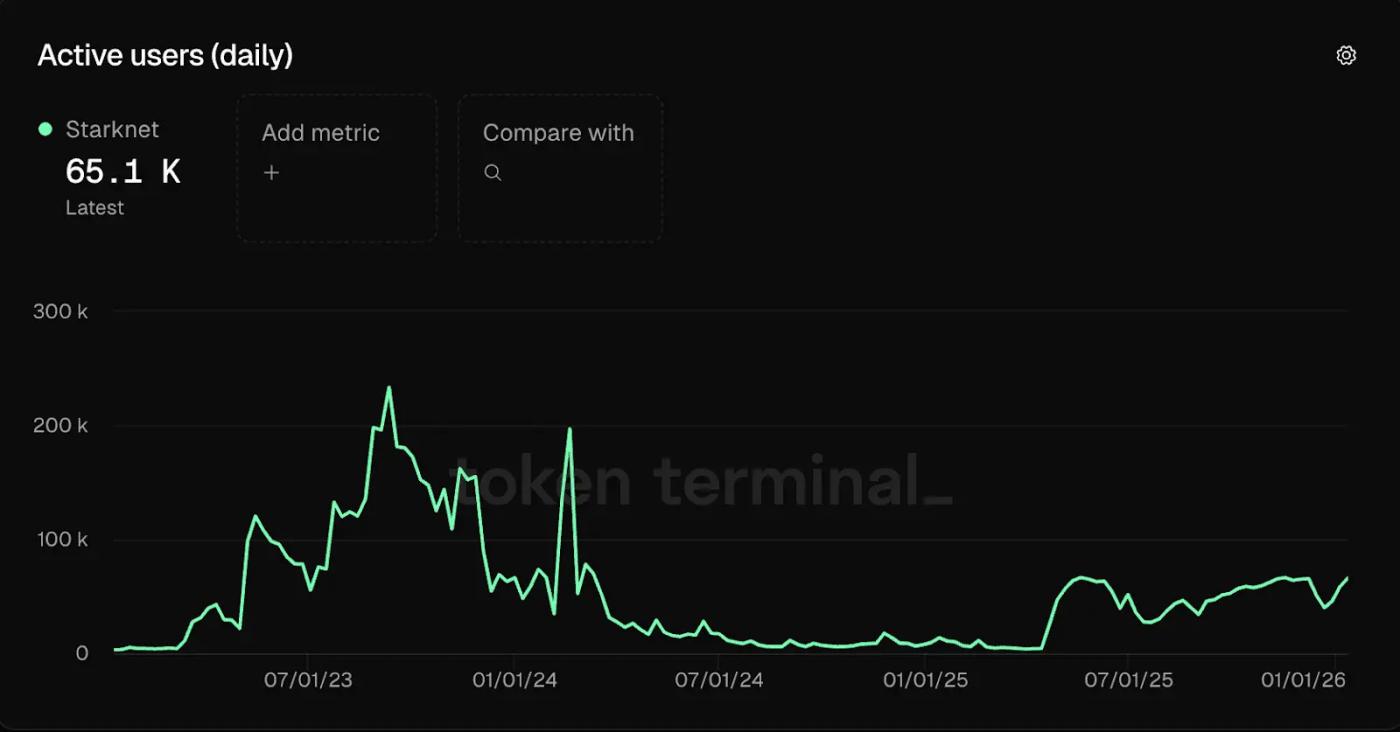

Furthermore, according to data from Token Terminal, Starknet currently has an average of approximately 65,000 daily active users, far exceeding Solana's claim of "8 daily active users".

In the past, Starknet experienced a decline of more than a year due to weak sentiment in the Layer 2 market and reduced on-chain activity. Now, various data highlight Starknet's recovery. Although it is still far below its historical peak and has not yet entered the first tier in the fierce Layer 2 competition, Starknet's overall performance still lags behind leading Layer 2 networks such as Base and Arbitrum. However, the recovery to the $300 million level represents the capital strength it has gained over the past year.

However, Starknet also faces technical challenges during its recovery. Last week, the network experienced a brief mainnet outage. The official post-outage analysis report indicated that the cause was a state inconsistency between the execution layer and the proof layer, leading to abnormal transaction execution. This is the second major outage since 2025; the previous outage in September was caused by a sorter vulnerability that resulted in a more than 5-hour outage. Major technical glitches have become a significant problem that Starknet needs to overcome in its competition with other Layer 2 networks.

According to the latest news, Starknet is actively building its BTCFi ecosystem. Re7 Labs, which manages $1 billion in assets, has already implemented structured BTC yield strategies on Starknet, and institutional custodian Anchorage Digital has added Bitcoin staking support. Furthermore, Starknet introduced network upgrades and staking functionality at the end of 2024, significantly reducing gas costs. In less than eight weeks, over $115 million worth of BTC has been staked on the network.

Where does Solana's reference data come from?

Solana's official tweet actually referenced data from two years ago. Starknet experienced a massive user exodus after its airdrop on February 20, 2024, with daily active users plummeting by 80-90% from 380,000 on the day of the airdrop to only about 20,000 by mid-April. Many airdrop hunters left after receiving their tokens, and the controversy surrounding the airdrop eligibility rules led to extremely negative community sentiment, with every Starknet tweet being tagged with "#scamnet".

Against this backdrop, some jokingly exaggerated, claiming Starknet had only "8 daily active users" left, to satirize the network's desolation. This data is now outdated, and Solana's revival of this outdated information has been met with skepticism, with the market questioning whether it's a deliberate attempt to hype the issue.

In response to Solana's tweets about data, Starknet posted a gorilla emoji and asked, "Who told them this data?" Solana co-founder Toly responded to the controversy by saying, "We're going to fire the intern."

In response to Solana's mockery of Starknet and Starknet's subsequent response, Binance Co-CEO He Yi posted on X, saying, "Take a deep breath and relax. We're all friends, let's keep things peaceful." She urged the public to take a more relaxed approach to the discussion and avoid excessive controversy caused by comparing on-chain data.

From being ridiculed by users for having "only 8 users" to now boasting 65,000 daily active users and a TVL exceeding $300 million, Starknet is struggling to emerge from the shadow of the 2024 battle royale frenzy. The BTCFi ecosystem development, institutional-grade custody, and yield strategies are providing momentum for its recovery; however, major technical glitches and significantly lower fee revenue compared to leading networks like Arbitrum also cast uncertainty over its future development. To truly enter the top tier of Layer 2 networks, technological stability and ecosystem depth remain unavoidable challenges.