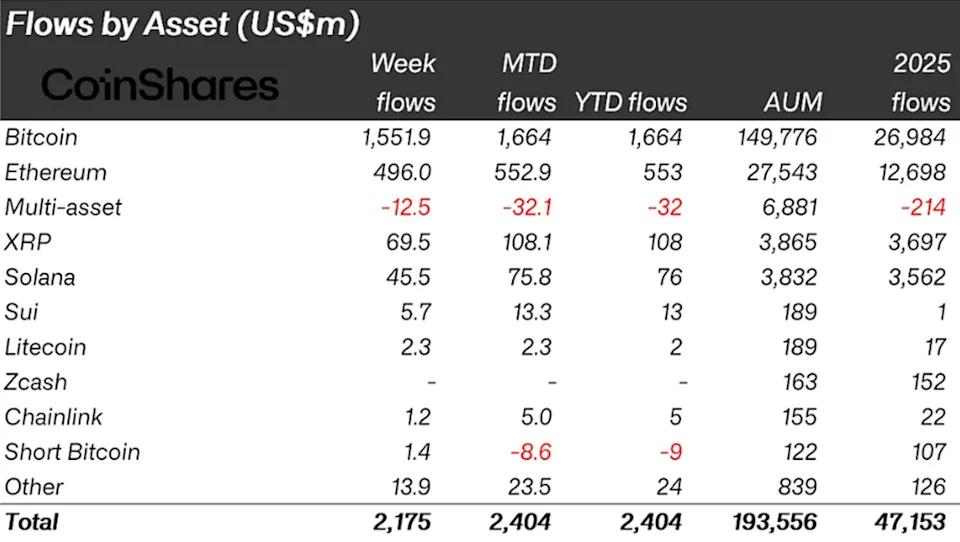

A recent report from CoinShares shows that Capital into cryptocurrency funds surpassed $2 billion last week, marking the strongest weekly Capital since October 2025.

A recent report from CoinShares shows that Capital into cryptocurrency funds surpassed $2 billion last week, marking the strongest weekly Capital since October 2025.

This development is occurring as investors seek opportunities to access the crypto market amid escalating geopolitical tensions, the risk of renewed tariffs, and growing uncertainty about economic policy.

Policy uncertainty fuels crypto Capital to $2.17 billion.

The wave of Capital inflows occurred despite a sharp reversal in sentiment at the end of the week. According to the Weekly Digital Asset Funds Capital Report, the majority of the money flowed into the market in the early days of the week, before shifting to a trend of Capital withdrawal on Friday.

This shift comes after diplomatic tensions over Greenland and renewed threats of additional trade tariffs, which significantly weakened risk sentiment in global financial markets.

By the end of the week, digital asset investment products recorded $378 million withdrawn in a single day, somewhat mitigating earlier gains.

Policy uncertainty also contributed to worsening market sentiment. Investors reacted to news that Kevin Hassett – XEM a dovish figure and a strong candidate for the future chairmanship of the Federal Reserve – is likely to remain in his current position.

This scenario dampens expectations for a short-term monetary policy shift, increasing caution in an already sensitive Capital market environment.

“…market sentiment weakened on Friday due to geopolitical tensions, tariff threats, and policy-related uncertainty,” the report stated.

Bitcoin led the inflow of Capital, attracting $1.55 billion this week. The scale of this inflow shows that investors still XEM Bitcoin as a primary macro-hedging tool, especially during periods of geopolitical and policy uncertainty.

Smart contract platforms and altcoins continue to attract Capital despite regulatory pressure.

Ethereum also recorded positive results with $496 million in Capital , while Solana attracted $45.5 million.

These increases occurred despite regulatory pressure, including proposals in the US Senate Banking Committee's CLARITY bill, which could restrict stablecoin issuers from offering yields.

The continued interest in smart contract platforms shows that investors are looking beyond short-term legal distractions and betting on long-term adoption trends.

Altcoins also contributed to this influx of Capital . XRP stood out with $69.5 million, while Sui, LIDO, and Hedera recorded inflows of $5.7 million, $3.7 million, and $2.6 million respectively.

The broad inflow of Capital across large- and Medium Capital Token reflects improved risk appetite in the first half of the week, although subsequent macroeconomic factors curbed the gains.

In addition to Token, blockchain stocks also had a positive trading week, attracting $72.6 million in Capital . This demonstrates the enduring interest of investors in the entire digital asset ecosystem, not just spot cryptocurrencies.

The inflow of Capital into crypto funds last week reflected the rapid volatility of market sentiment, especially considering that the week ending January 10th saw outflows of as much as $454 million.

The weekly cash flow figures indicate that geopolitical instability, trade risks, and uncertain policy signals are increasingly driving Capital flows into digital assets as part of risk diversification strategies.