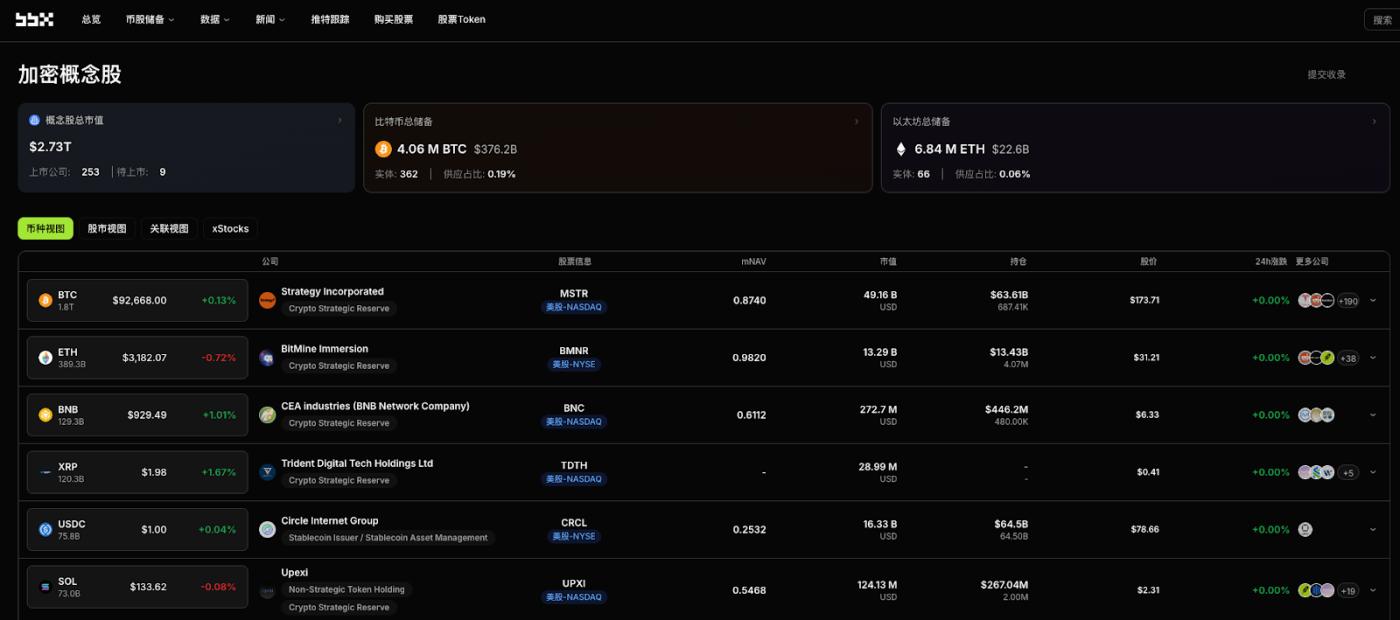

According to ME News, on January 20th (UTC+8), BBX's comprehensive disclosure of crypto concept stock information revealed that due to the US stock market being closed yesterday for Martin Luther King Jr. Day, the trading focus of the global crypto treasury briefly shifted to the Asian and Canadian markets. Long-dormant Hong Kong-based established crypto concept stocks returned to the buying side, while Canadian fintech companies continued to increase their holdings in Solana, demonstrating the rotation effect of institutional allocation globally.

Hong Kong Stock Market: Established Giants Return

Meitu, Inc. (HKSE: $1357), a Hong Kong-listed company, broke its two-quarter-long quiet period yesterday by issuing a voluntary announcement to restart its cryptocurrency purchase program. The announcement revealed that on January 19, the company purchased 180 Bitcoins at an average price of US$93,200 per Bitcoin and 2,500 Ethereums at US$3,210 per Ethereum on the open market.

Canadian Market: SOL Treasury Expands

DeFi Technologies (CBOE CA: $DEFI), a Canadian-listed fintech company, disclosed yesterday that, following in the footsteps of U.S.-listed Upexi, it has increased its SOL holdings in its treasury by 65,000, with a total transaction value of approximately $10 million.

US Stock Market (Holiday Off-Cycle Updates)

Although Nasdaq was closed yesterday, Strategy (NASDAQ: $MSTR) did not stop its activities. An update on the company's investor relations page showed that it used its cash reserves to purchase another 450 bitcoins, taking advantage of over-the-counter (OTC) liquidity over the weekend and Monday. This demonstrates that for this company with a Bitcoin-centric mission, public holidays are no longer an obstacle to balance sheet expansion.

Market perspective

Yesterday's market dynamics revealed the "all-weather" and "global" characteristics of crypto treasuries in 2026: First, "Eastern stockpiling is being activated," with Meitu's return signifying that early entrants in Asian listed companies are becoming active again in this bull market cycle, no longer letting Japan's Metaplanet dominate. Second, there's the "North American Solana consensus," with North American mid-cap tech stocks, from US-listed Upexi to Canadian DeFi Technologies, creating a cross-market synergy in their allocation to Solana. Third, "uninterrupted liquidity," as Strategy's holiday cryptocurrency purchases demonstrate that top treasury companies have the ability to access liquidity at any time, and the influence of traditional stock market closures on crypto treasury operations is weakening. (Source: ME)