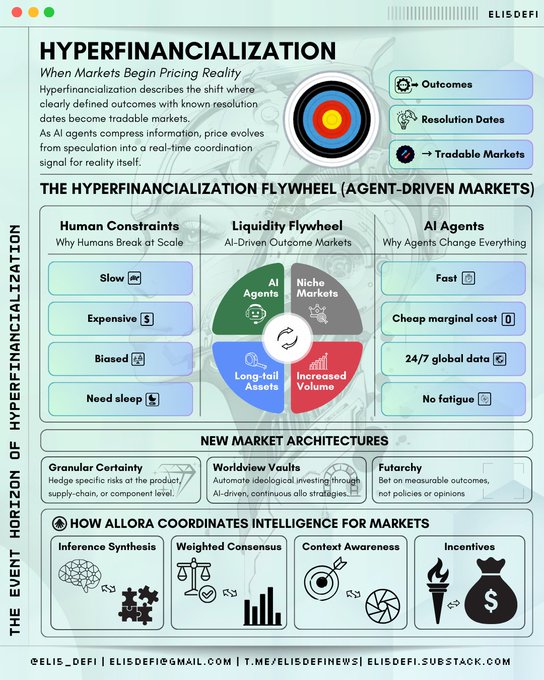

➥ The Event Horizon of Hyperfinancialization

Markets are no longer confined to assets and are increasingly pricing outcomes with clear definitions and resolution dates.

This includes policy decisions, research milestones, product launches, and technological timelines that are becoming tradable.

But what entails? Let's dive in 30s 🧵

— — —

► What is Hyperfinancialization?

Hyperfinancialization is the shift where any outcome that is clearly defined and has a resolution date becomes tradable.

Once an outcome is definable and settleable, it can be priced by markets.

This expands markets far beyond traditional assets:

▸ Outcomes become assets once they are measurable and settleable

▸ Price functions as a truth aggregation mechanism, not opinion

▸ Information velocity becomes a primary source of edge

▸ Machine participation enables scale that humans cannot support

—

► AI Agents - The New Market Architectures

Historically, markets failed at the margins. You can trade Apple stock, but you cannot trade the specific success of its newest camera lens or a niche policy outcome in 2026.

The reason? Human "overhead."

Humans are slow, expensive, biased, and need sleep. The cost of acquiring specialized knowledge to trade niche markets outweighs the potential profit.

AI agents break this equilibrium.

Agents are deflationary financial actors. Their marginal cost of attention is near zero. A single agent can ingest global data streams, monitor 100,000 micro-markets, and execute trades on 1% edges without fatigue.

This creates a liquidity flywheel: AI agents provide the volume that makes niche markets viable, unlocking a universe of "long-tail" assets that were previously impossible to price.

As outcome markets scale, new architectures emerge:

▸ Granular certainty: exposure shifts from entire companies to specific products, divisions, or supply-chain risks

▸ Worldview vaults: capital is allocated to AI agents executing encoded ideologies as continuous market strategies

▸ Futarchy: policy decisions move from voting to outcome markets where being wrong is punished with financial loss

—

► How Allora is Positioned

In the era of deepfakes and information overload, price becomes a key honest signal.

With AI agents constantly arbitraging reality, event market prices predict the future. Information velocity becomes the only alpha.

A system relying on centralized AI risks truth monopoly, requiring a Decentralized Coordination Layer. This ensures the market remains an open "operating system" for collective intelligence rather than a walled garden.

@AlloraNetwork coordinates between crypto and decentralized AI, organizing market participation:

- Aggregating inferences from specialized models

- Weighting performances based on real contributions

- Routing value to models that improve outcomes

- Encouraging open competition and collaboration

Allora makes inference a composable market, preventing truth monopolies and supporting scalable, accurate outcome-based markets.

—

► Why This Matters

As outcome markets expand amidst information overload, price emerges as the sole reliable signal for aggregating truth.

When trillions of AI agents arbitrage reality in nanoseconds, market prices align with the most precise predictions of the future.

To some, hyperfinancialization may sound dystopian, yet it represents the realization of Kenneth Arrow’s concept of a "riskless society," where we can hedge against nearly any uncertainty. The future isn't merely approaching; it is already being traded.

twitter.com/Eli5defi/status/20...

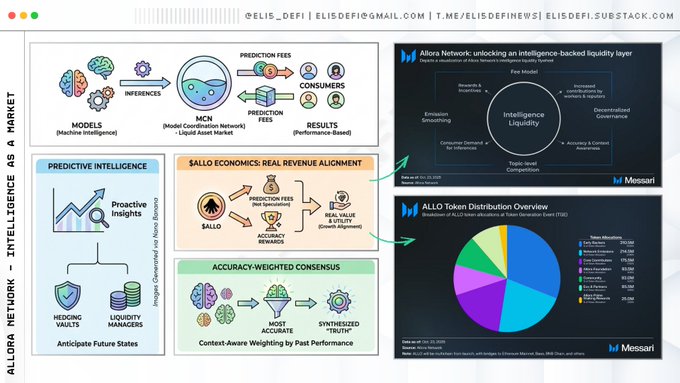

— Understand more about @AlloraNetwork as the coordination layer for the machine intelligence:

Eli5DeFi

@Eli5defi

01-08

The @MessariCrypto report on @AlloraNetwork breaks down a lot of innovative approaches of how Allora is implementing ML models coordination onchain.

Allora's Model Coordination Network (MCN) lets models compete to solve problems, moving past centralized setups.

— Intelligence x.com/412587524/stat…

yes bro, we gonna cook

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content