The bottom navigation bar of my OKX App has quietly changed.

As one of the first "creators" to receive an invitation to the beta test, I've had the opportunity to experience OKX's long-awaited strategic product – OKX Planet (Orbit) – over the past few days. To be honest, at first I thought it was just a defensive follow-up to "Binance Square," but after experiencing it, I realized that the OKX team wanted to create a different kind of product.

Exchanges' "Midlife Crisis" and Traffic Anxiety

Looking ahead to early 2026, the CEX (Content Exchange) landscape is already incredibly competitive. Asset competition? Everyone's listing speed is fast. Wealth management? APY is slightly lower, and funds don't stay in place for long. Liquidity? The top exchanges already offer more than just "sufficient" liquidity. Not to mention the constant emergence of new DEXs like Perp, which are continuously grabbing market share.

Exchanges face a common predicament: they've become mere "tools." Traffic resides in the Web2 ecosystem, trust is held by KOLs (Key Opinion Leaders), and exchanges are at the very end of the value chain, earning only meager transaction fees. This "traffic gap" leaves exchanges feeling extremely insecure.

Looking back at the history of cryptocurrency exchanges, we can clearly see the evolution of the focus of competition:

Phase 1.0 (the early days): The core competitiveness lay in "having coins to trade." Exchanges competed on the speed of listing coins and the basic stability of deposits and withdrawals.

Phase 2.0 (Infrastructure Era): The core competitiveness lies in "depth and derivatives." During this phase, OKX established technological barriers with its powerful contract matching engine and unified account system.

Phase 3.0 (The Era of Ecosystem and Attention): When technology and liquidity become standard features, and market depth can be shared, users' time and trust become scarce resources. Simple trading tools are cold and impersonal, and users are easily churned; while social relationships are warm and can generate high stickiness.

OKX's strategic intent is to reclaim the "decision-making starting point." By breaking down the current physical separation between social relationships, content consumption, and asset transactions, OKX attempts to build a closed loop where "transaction is social interaction, and social interaction is transaction."

It is not a "plaza", but a walled garden in a "private space".

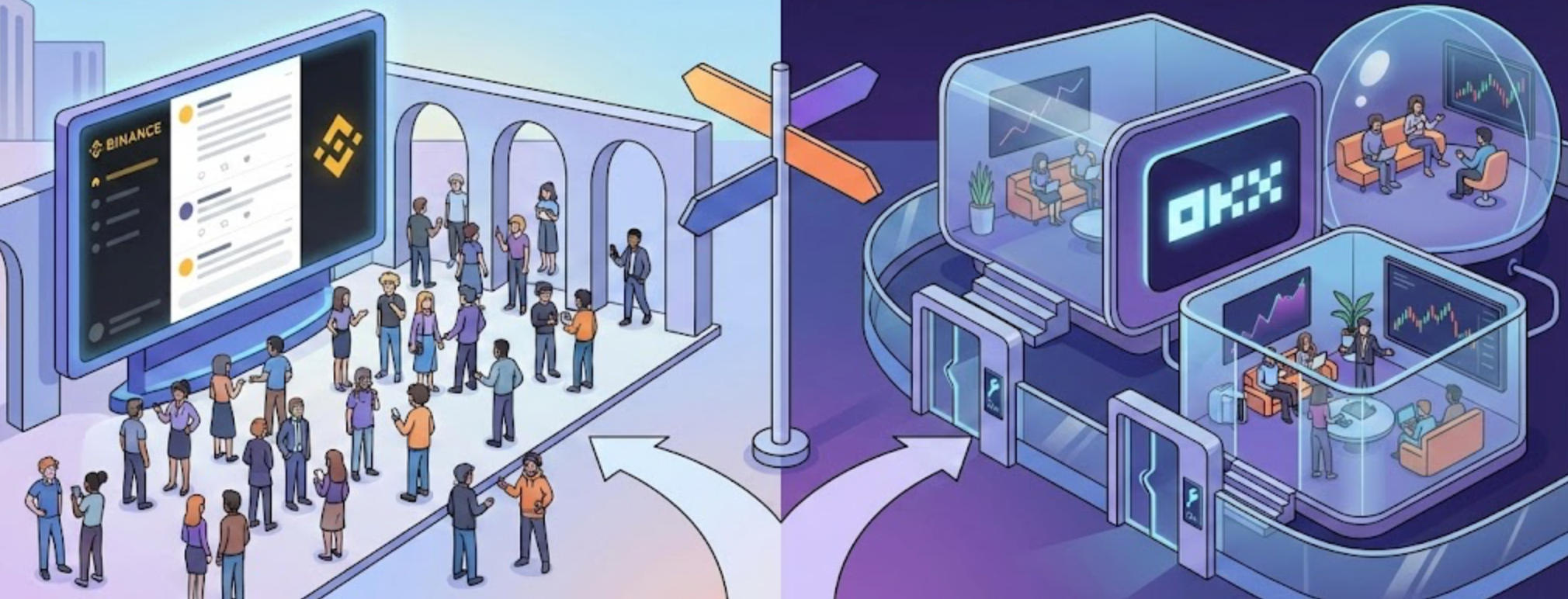

Many people, upon first seeing Planet, will compare it to Binance Square, given the latter's huge success and the subsequent trend of other competitors implementing similar features. However, in my opinion, while neither is inherently superior, their underlying logic is fundamentally different.

Binance Square is the X of Web3: it focuses on public domain traffic. It emphasizes the breadth of information, the dissemination of information, and the discussion of industry hot topics; it is a noisy public forum.

With its user base of over 300 million, Binance Square has indeed created a "high ground" for public opinion in the industry. It hopes that users will read news and discuss market trends here, maintaining user activity by capturing user time. This is a flood-like approach, with the advantage of being lively, but the disadvantage of being noisy and having a high decision-making cost for users seeking precise trading.

OKX Planet is a Web3 DC + TG: it focuses on private domain traffic. It explicitly targets professional creators with a core fan base who can output high-quality trading strategies. It aims to be a "private domain monetization and fan management tool for KOLs/traders."

Every feature of OKX Planet is designed with extreme pragmatism in mind—everything is aimed at shortening the transaction path.

In traditional online communities, KOLs typically shill like, "Buy BTC at the current price, stop loss at xxx." Users need to memorize the price points, open their chat app, access their exchange, search for the currency pair, and input the price. In this community, this process is encapsulated as a "trading card." Creators publish the card, users click on it, and the system directly pops up an order placement window with leverage and stop loss automatically pre-filled.

This is not just a UI optimization, but a "digitalization of responsibility." The system tracks the actual profits and losses and copy trading volume generated by this card. For "talk-it-all" analysts, this is a disaster; but for practical traders, it's a money-printing machine that directly monetizes their skills.

If you're a KOL with core trading strategies, posting on the public forum might get you likes and comments; but on the platform, you get real money in "subscription fees" and "commission sharing for trading." OKX uses "trading cards" and "paid groups" to directly transform previously vague "social relationships" into quantifiable "trading assets."

In the crypto knowledge-sharing industry, subscription groups often rely on Telegram/WeChat groups and off-exchange transfers, frequently exposing subscribers to the risk of being scammed. However, Planet allows creators to establish "paid subscription groups," where users can join by paying monthly or yearly fees, eliminating concerns about being scammed or having their groups banned.

OKX Planet's product logic is built on a closed and efficient economic model: discovery-connection-transaction-incentive.

Users discover high-win-rate traders through live streaming rooms or recommendation algorithms. The data here is based on real on-chain/exchange trading data, not user-generated false profiles. Users then establish strong connections with creators through "paid group access" or "following live streams." These connections have a barrier to entry (money or time), therefore their quality is far higher than ordinary follow relationships.

In high-concentration scenarios such as live streaming or group chats, creators post "trade cards" or attach "featured tokens." Users can place orders directly with a click without leaving the interface. Transaction fees are captured by the system and automatically distributed to the creator according to predetermined rules, creating a positive feedback loop.

This solves the trust issue currently plaguing the crypto market. Creators' performance (ROI, win rate) is directly retrieved from the OKX exchange's backend data, making it tamper-proof. This also resolves the trust crisis surrounding "Photoshop masters" in external communities. By using paid groups, creators essentially use a pricing mechanism to filter out high-net-worth users, reducing community maintenance costs and increasing output per user.

For OKX, this closed loop locks in KOLs, indirectly locking in the most active trading users behind them. If Planet succeeds, OKX will no longer be a cold, impersonal matching engine, but a warm and welcoming community ecosystem. This moat based on "connecting people" is far more robust than a moat based on "fees and rebates."

Opportunities and hidden concerns coexist

While the business logic of Planet is excellent, we must point out the risks involved.

Regulatory Issues: "Paid shill" are easily classified as "investment advisory services" in strictly regulated jurisdictions such as Europe and the United States. If the KOLs on the platform do not have the corresponding licenses, the exchange, as the provider of the tools and the payment channel, is very likely to face regulatory inquiries.

Trust Backlash: Social relationships become extremely fragile once money is tied to them. When a KOL (Key Opinion Leader) makes a misjudgment that leads to user losses, users will not only blame the KOL but also resent the platform's inadequate review process. Finding a balance between "open creation" and "quality control" will be a huge challenge for the OKX operations team.

Summarize

After experiencing OKX Planet, my biggest takeaway is that it signifies a comprehensive upgrade in the competitive dimension of exchanges, shifting from "hard power" (performance, liquidity) to "soft power" (social relationships, content ecosystem).

Moreover, this may be the closest Web3 SocialFi has ever come to practical application. Past on-chain SocialFi projects (such as Friend.tech) were short-lived because the interaction was too cumbersome, and users primarily used them to obtain airdrops or rewards; once the rewards stopped, users immediately abandoned them. Planet, however, directly places social interaction in the place closest to money—the exchange—and directly links it to mainstream assets.

For traders, this is the most efficient "ATM" for cashing out; for ordinary users, this is the closest channel to the "secret to wealth".

OKX's move was risky, but also very accurate. If we see a large number of "teachers" from paid groups moving to Xingqiu (a Chinese online community platform) within the next year, then OKX will have truly carved out its own moat in this zero-sum game.