In 2026, both TradeFi and Crypto will be unified under the banner of "On-chain Finance".

Article author and source: CoinFound

On January 21st, CoinFound officially released its annual report, "CoinFound Annual Report: TradeFi x Crypto 2026 Outlook," which focuses on the deep integration trend between TradeFi and Crypto. The following is a summary of the report:

2025 will be the year when traditional finance and crypto move from "parallel experiments" to "deep entanglement".

Timeline of Key Events in Traditional Finance x Crypto in 2025

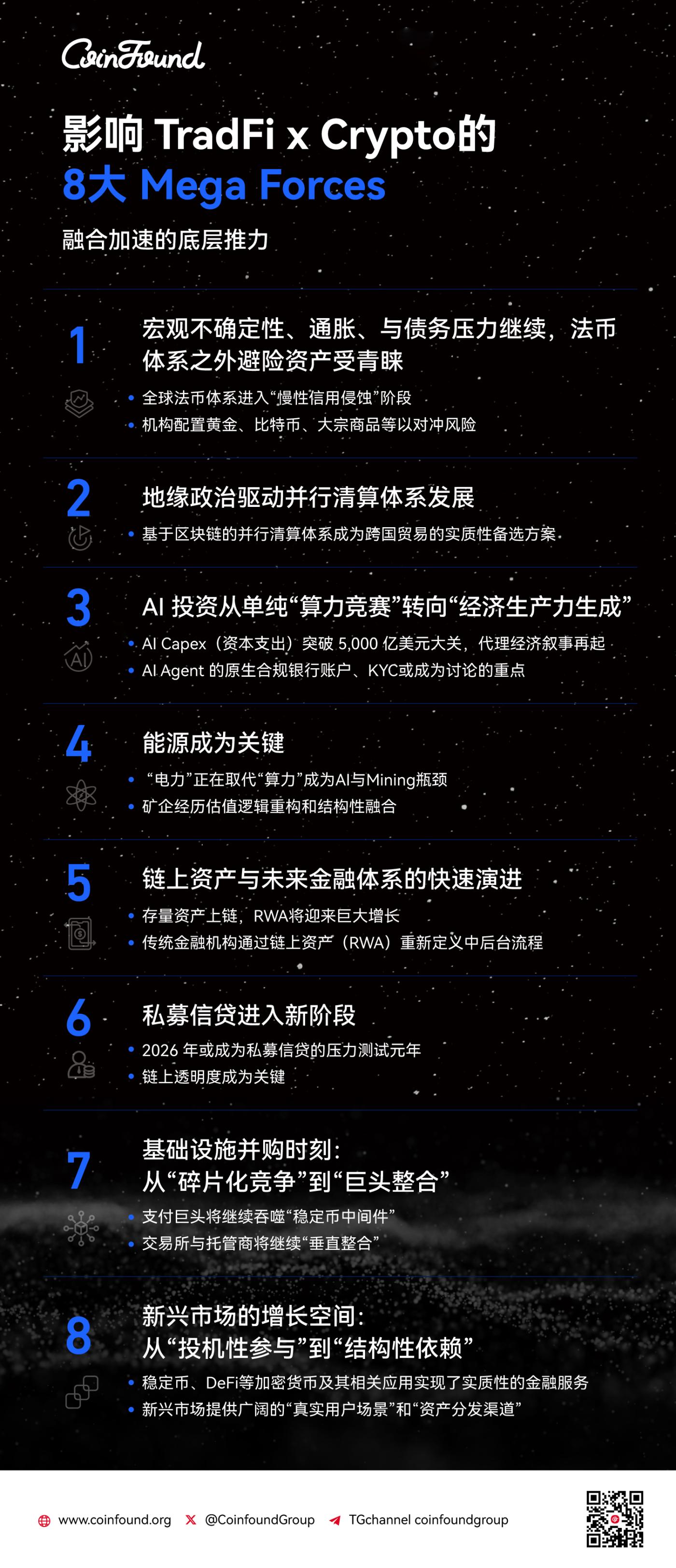

In 2026, the following macroeconomic trends will impact the TradeFi x Crypto space:

o Fiat currency system trust crisis and return of hard assets: Faced with the global debt spiral and the risk of "fiscal dominance", institutions are accelerating the allocation of "hard assets" such as gold, Bitcoin and commodities to hedge against the erosion of fiat currency credit.

o Geopolitical drive for the implementation of parallel clearing systems: The need to "deweaponize" financial infrastructure has propelled blockchain to become an alternative settlement solution independent of SWIFT, and atomic settlement mechanisms have effectively reduced trust and counterparty risks in cross-border transactions.

o AI productivity monetization and the rise of machine payments: The focus of AI investment has shifted from computing hardware to the generation of economic productivity, giving rise to a rigid demand for compliant stablecoins and on-chain automatic settlement for AI Agents in order to realize the value confirmation between machines.

o Energy becomes a core asset and mining companies become infrastructure-oriented: Power shortages have prompted mining companies to transform into "hybrid computing centers," and their scarce power access (time-to-power) has triggered mergers and acquisitions by tech giants, driving the valuation of mining companies to be restructured towards data center infrastructure.

o On-chain assets (RWA) are moving from issuance to utility: Asset tokenization is entering the "programmable finance" stage. RWA is no longer just a digital certificate, but a core collateral that greatly improves the capital efficiency of the repurchase market and global liquidity as 24/7.

o Private lending faces stress tests and a transformation towards transparency: A wave of debt maturing in 2026 may trigger default risks, forcing the industry to shift from a "black box" approach to real-time on-chain transparent auditing based on zero-knowledge proofs (ZK) in order to avoid a chain liquidation crisis in DeFi.

Infrastructure is shifting from fragmented competition to consolidation by giants: The market is entering a consolidation phase similar to the telecommunications industry, with payment and financial giants securing their positions in the market through mergers and acquisitions of stablecoin intermediaries and custodians, eliminating redundancy and building compliance barriers. Emerging markets are shifting from speculation to structural dependence: Crypto assets have become a fundamental tool for payments and remittances in emerging markets, and their vast real-world user base makes them a core hub connecting traditional financial assets with global retail liquidity.

The trend outlook for 2026 is as follows:

1. RWA market experiences structural growth, stablecoins establish a base at 320 billion, equities and commodities to become new growth drivers.

2. Stablecoins enter the 2.0 era, from crypto payments to competing for global payment infrastructure.

3. Equity tokenization liquidity may grow rapidly, and DeFi integration will be key.

4. Private lending RWA is shifting towards an "asset-driven" approach, which may accelerate its differentiation under pressure from "default" risks.

5. Gold and Commodities: RWA Ushers in a New Era of "Full Asset Collateral"

6. RWA liquidity will become more concentrated, and three types of RWA assets are gaining favor with exchanges.

7. The Rise of Crypto Concept Stocks and the Differentiation and Concentration of DAT (Digital Assets and Technologies)

Summarize

2025 Summary: 2025 was a year of "demystification and integration" for TradeFi and Crypto. Blockchain technology is moving away from its "revolutionary" aura and returning to being a highly efficient accounting and settlement technology. The success of RWA (Retail Asset Management) bonds proved the feasibility of putting traditional assets on-chain, while the full-scale entry of giants like BlackRock provided irreversible credit endorsement for the industry.

2026 Forecast: 2026 will be a year of "secondary market boom and credit expansion." We predict:

- Liquidity explosion: With the improvement of infrastructure, RWA will shift from "holding for interest" to "high-frequency trading".

- Credit downsizing: Asset classes will shift from high-credit government bonds to corporate bonds, stocks, and emerging market credit, with risk premiums becoming a new source of returns.

- Risk warning: As RWA grows in scale, the complexity of off-chain defaults escalating to on-chain liquidation will be the biggest systemic risk.

In 2026, both TradeFi and Crypto will be unified under the banner of "On-chain Finance".

The full report, "CoinFound Annual Report: TradFi x Crypto 2026 Outlook," can be found here:

https://app.coinfound.org/zh/research/4

About CoinFound

CoinFound is a TradeFi × Crypto data technology company serving institutional and professional investors, providing services such as RWA asset data terminals, RWA asset ratings, Web3 risk relationship graphs, AI analytics tools, and customized data. From data integration and risk identification to decision support, it helps institutions acquire key intelligence and transform it into actionable insights at a lower cost and higher efficiency, building the underlying infrastructure for global RWA.