Traditional bond markets rely on mature credit scoring and legal recourse to maintain low default rates in senior tranches.

Enabling these instruments on-chain requires a shift away from centralized legal enforcement to decentralized, data-driven alternatives.

Web3 collateralized bonds are structured as ERC-3475 contracts.

Using Web2 APIs as Oracles and AI agents for social scoring and enforcement to mitigate risk.

Once native decentralized oracles are available, they are the preferred option.

The bonds are supposed to be settled in a temper proof environment.

This enables us to create fully on-chain revenue distribution.

e.g. within gachapon machines, vending machines or PoS terminals.

This model is intertwined on the merit driven token distribution model.

It plays a major role in the idea on how to build sustainable on-chain economies.

Web3 collateralized bonds are structured in risk-adjusted tranches.

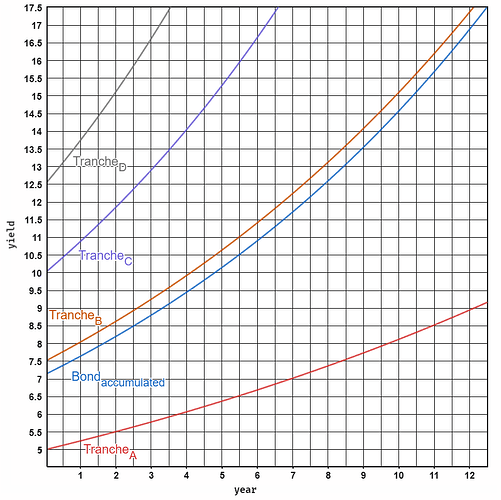

We define a generalized growth function that accounts for compounding yields and default rates over time as:

b_{i}(t_{i},r_{i},d_{i},W_{i})=W_{i}r_{i}e^{(r_{i}-d_{i})t_{i}}bi(ti,ri,di,Wi)=Wirie(ri−di)ti

Where:

- tt: Time

- rr: Yield rate

- dd: Default rate

- WW: Tranche weight

We define four risk tranches A to D, where A is the most senior tranche and D is the tranche with the highest default risk.

For an accumulated portfolio within an ERC-4626 vault, the total value is the sum of four tranches:

B_{accumulated}(t) = b_{A} + b_{B} + b_{C} + b_{D}Baccumulated(t)=bA+bB+bC+bD

| Tranche | Weight (W) | Yield (r) | Default (d) |

|---|---|---|---|

| A | 0.50 | 5% | 0.15% |

| B | 0.25 | 7.5% | 0.5% |

| C | 0.15 | 10% | 1.5% |

| D | 0.10 | 12.5% | 3% |

Tranche Architecture and Risk Profiles

The vault diversifies risk by aggregating weighted contributions across different economic profiles.

- Senior tranche: Designed for developed economies with high-quality secured lending.

It features a yield of 5% and a default rate of 0.15%, mirroring investment-grade corporate bonds. - Junior tranche: Targets emerging-market private credit or micro-credits.

It offers a higher yield of 12.5% to offset a 3% default rate, consistent with SME lending risks in regions like Latin America or South Asia

Web2 API Integration: Turning Supply Chains into Collateral

A core concept of this model to wrap existing Web2 APIs into Oracles.

For example, bonds can finance inventory purchases on platforms like Alibaba.

By leveraging the Alibaba Order Management API as oracle, we create real-time shipment states and product data on-chain.

This enables us to:

- Physical on-chain collateral: Underlying assets (products in transit) serve as collateral.

- Warning Systems: Smart contracts trigger alerts if transit delays or discrepancies in asset valuation arise.

- Real on-chain economy: Once products sell, proceeds are distributed via an automated on-chain waterfall, paying out the senior tranches first.

Social Enforcement & AI Agents

Junior tranches carruy the risk of high default rates and reduced legal enforcement.

Grameen Bank has shown social enforcement mechanisms can reduce default rates dramatically.

They achieved repayment rates up to 98% through group liability.

We can port these mechanisms to projects like Ethos for generalized reputation scoring.

Additionally we can utilize reputation in decentralized niche communities to further enhance the scoring model.

- AI based scoring: AI agents dynamically assess borrower behavior and social media contributions to adjust risk scores in real-time.

- Social Proof of Stake: Individual reputation based systems incentivize ethical behavior through transparent peer accountability.

- Trust Networks: Interconnected borrower and lender groups ensure that defaults impact collective reputations.

This enables effective default rates at levels comparable to the 3% ceiling seen in traditional microfinance.

A decline in individual reputation has to effect close peers in order to enable effective social enforcement.

Otherwise, individuals will only remove themselves from peers effected and not increase the social standard of the group. Leading to an eventual collapse of the system.

We combine ERC-3475/ERC-4626 with the real-world visibility of Web2 APIs.

Advanced by behavioral incentives of AI driven social scoring.

This enables us to create more solid and traceable vehicle for global credit.

Minimizing friction and opacity inherited from traditional finance while enabling sustainable yields.

By creating a diversified and risk-adjusted bond structure.

Creating a superior bond infrastructure to what TradFi can offer due to the centralized nature.