Highlights of this episode

This week's statistics cover the period from January 17, 2026 to January 23, 2026.

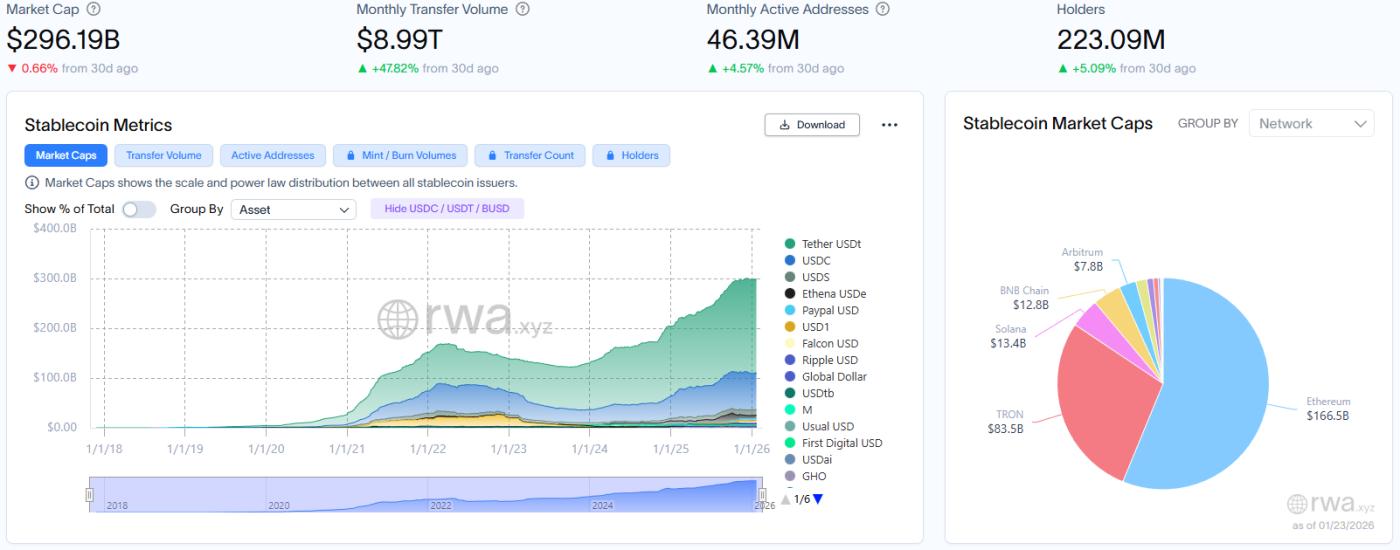

This week, the total market capitalization of RWA on-chain steadily increased to $22.59 billion, with the number of holders exceeding 640,000. The growth is still driven by user expansion. The total market capitalization of stablecoins slightly decreased to $296.19 billion, while the monthly transaction volume soared to $8.99 trillion, and the turnover rate jumped to 30.3 times. The market has entered a stage of high turnover of existing assets, and the pace of new capital inflows has slowed down.

On the regulatory front, Hong Kong is expected to issue its first batch of stablecoin licenses this year, providing clear support for smart contract technology for China's digital yuan. On the institutional front, the NYSE announced the development of a tokenized securities platform, and F/m Investments applied to the SEC for a pilot program for tokenized shares, demonstrating that mainstream exchanges and asset management institutions are actively integrating traditional assets onto the blockchain.

At the project level, Ondo Finance expanded its tokenized stocks and ETFs to Solana, RedStone acquired Security Token Market to strengthen its RWA data foundation, and Superstate completed a large-scale financing round to build an on-chain issuance layer. Payment scenarios continue to deepen, with companies like Argentina's Pomelo raising funds to advance the adoption of stablecoin credit cards.

Overall, the market, dominated by traditional finance, is shifting from user expansion to a focus on both efficiency and scale, while the stablecoin market presents a complex picture of high-frequency settlement and differentiation in the activity of the underlying ecosystem.

Data Perspective

RWA Track Panorama

According to the latest data disclosed by RWA.xyz, as of January 23, 2026, the total market value of RWA on the chain reached US$22.59 billion, an increase of 7.58% compared to the same period last month, showing steady growth; the total number of asset holders increased to approximately 646,100, an increase of 8.36% compared to the same period last month.

The fact that the growth rate of asset holders is higher than the growth rate of asset size indicates that the market is still in the "user expansion driven" stage.

Stablecoin Market

The total market capitalization of stablecoins shrank to $296.19 billion, a slight decrease of 0.66% compared to the same period last month, reflecting the depletion of incremental capital inflows or the pressure of net outflows; monthly transaction volume surged to $8.99 trillion, a dramatic increase of 47.82% compared to the same period last month, and the turnover rate (transaction volume/market capitalization) jumped significantly to 30.3 times, highlighting the high liquidity advantage of stablecoins.

The total number of monthly active addresses increased to 46.39 million, a 4.57% increase compared to the same period last month; the total number of holders reached 223 million, a 5.09% increase compared to the same period last month, indicating a continued expansion of the user base.

Data indicates that the market has entered a "normalized stage of zero-sum game." The divergence between market capitalization contraction and soaring turnover suggests that funds may be "idling" within the system through high leverage, derivatives collateral, or arbitrage strategies, rather than being used for ecosystem expansion.

The leading stablecoins are USDT, USDC, and USDS. Among them, the market capitalization of USDT decreased slightly by 0.04% month-on-month; the market capitalization of USDC decreased slightly by 0.01% month-on-month; and the market capitalization of USDS increased slightly by 0.11% month-on-month.

Regulatory news

Paul Chan: Hong Kong is expected to issue its first batch of stablecoin licenses later this year.

Hong Kong Financial Secretary Paul Chan Mo-po stated at the Davos Forum that Hong Kong will issue its first batch of stablecoin-related licenses later this year, implementing the principle of "same activities, same risks, same regulation" to steadily promote the development of digital assets. Currently, licenses have been issued to 11 virtual asset trading platforms, and three batches of tokenized green bonds totaling approximately US$2.1 billion have been issued. He emphasized that digital assets can improve financial efficiency and risk management, and are also a key force in promoting the integration of the real economy and technology.

Local News

According to Caixin, a technical expert familiar with the digital yuan revealed that both smart contracts based on the account system and smart contracts on public blockchains are essentially "conditionally triggered, automatically executed code," differing only in whether they possess full Turing completeness. Smart contracts based on the account system are restricted Turing complete, with their programming strictly limited to template scripts permitted by the central bank, supporting only preset, simple condition-triggered functions. This design is primarily for security and risk control considerations. The development of digital yuan smart contracts supports multiple programming languages, including fully Turing complete languages such as Ethereum's Solidity, so the technology itself is not the problem. The core challenge lies in designing a standard access and auditing mechanism acceptable to the financial system.

KuCoin announced today that it has reached an equity investment agreement with King Jun Services Limited and will support its in-depth cooperation with the Hong Kong Gold Exchange (HKGX) to jointly promote the construction of a comprehensive gold industry chain platform integrating trading, settlement, warehousing and related management functions.

Against the backdrop of the accelerated upgrading of the Hong Kong gold market, this collaboration aims to enhance the efficiency of cross-regional circulation and collaboration in the gold market through technology and system integration. This strategic investment reflects KuCoin's continuous exploration in financial infrastructure construction, aiming to promote the integration of digital technology and the physical gold industry, and help build a more efficient and transparent gold industry ecosystem.

Project progress

Bhutan will run Sei network validator nodes to explore cooperation in payments and tokenization.

According to Cointelegraph, Bhutan's sovereign wealth fund, Drug Holding and Investments (DHI), will partner with the Sei Development Foundation in the first quarter of this year to deploy and operate Sei Network validator nodes as part of its digital transformation. A DHI official stated that the two parties may further collaborate in areas such as payments, tokenization, and digital identity. The report notes that Bhutan has already provided approximately 800,000 residents with an Ethereum-based self-identity system and accumulated approximately 11,286 BTC through Bitcoin mining for national projects including the Gelephu Mindfulness City.

The New York Stock Exchange announced that it is developing a tokenized securities platform.

According to Businesswire, the New York Stock Exchange has announced it is developing a tokenized securities trading and on-chain settlement platform and will seek regulatory approval for it. The platform will support a tokenized trading experience, including 24/7 operation, instant settlement, dollar-denominated orders, and stablecoin-based funding. Its design integrates the exchange's Pillar matching engine and a blockchain-based post-trade processing system, and will support multi-chain settlement and custody.

Once approved by regulators, the platform will provide the New York Stock Exchange with a new trading venue supporting the trading of tokenized stocks that are interchangeable with traditional securities, as well as natively issued digital security tokens. Tokenized shareholders will enjoy traditional shareholder dividends and corporate governance rights. The trading venue is designed in accordance with established market structure principles and will be distributed to all qualified broker-dealers through non-discriminatory channels.

F/m Investments applies to the SEC for a pilot program for tokenized shares.

According to Bloomberg, F/m Investments has applied to the U.S. Securities and Exchange Commission (SEC) for an exemption to register a portion of its $6.3 billion 3-month Treasury ETF (ticker symbol TBIL) on a blockchain, serving as a testing ground for the tokenization of traditional assets. The application will not alter the ETF's holdings structure or trading methods; it will only involve on-chain registration of shares in the back-end, ensuring consistency with existing shares in terms of fees, rights, and information disclosure. If approved, this case will be a key test of the integration of blockchain technology into the U.S. asset management system.

Laser Digital, backed by Nomura Securities, launches tokenized Bitcoin yield fund

According to CoinDesk, Laser Digital, a crypto trading arm of Nomura Securities, has launched a tokenized Bitcoin yield fund. The fund aims to provide returns for long-term holders through strategies such as market-neutral arbitrage, lending, and options. Its goal is to achieve a net return exceeding 5% of Bitcoin's spot performance over a rolling 12-month period.

The fund will be natively tokenized through KAIO, a tokenization specialist, and custodied by Komainu, a joint venture custodian of Nomura, CoinShares, and Ledger. It is open only to select accredited investors in eligible jurisdictions (excluding the United States), with a minimum investment of $250,000 or the equivalent in Bitcoin.

Solana ecosystem DEX Jupiter stated on the X platform that the initial intention behind launching the stablecoin JupUSD was to focus on security, inclusiveness, and transparency. Currently, JupUSD is still in its early stages and will continue to be developed within the project and ecosystem.

1. JupUSD will proactively return native treasury revenue to the ecosystem;

2. The JupUSD reserve is backed by 90% of BlackRock's BUIDL fund and 10% of USDC;

3. Earn native treasury rewards when offering JupUSD on Jupiter Lend;

4. Like JLP, the interest-bearing asset jlJupUSD can be used as a core composable tradable token and a basic DeFi module;

5. Jupiter will seek more stablecoin use cases, integrations, and partners to enhance JupUSD.

According to CoinDesk, Ondo Finance announced the expansion of its tokenized stock and ETF business to the Solana blockchain, bringing more than 200 tokenized US stocks and ETFs to the network for the first time. This will further expand its Ondo Global Markets platform from its original Ethereum and BNB Chain.

According to Cryptobriefing, oracle service provider RedStone has acquired digital asset data platform Security Token Market (STM.co) and its flagship conference TokenizeThis to accelerate the tokenization of real-world assets and expand its influence in the US and institutional markets.

Founded in 2018, STM operates the world's largest tokenized RWA database, tracking over 800 tokenized stocks, real estate, debt instruments, and funds with a total market capitalization exceeding $60 billion. Its annual conference, TokenizeThis, brings together banks, asset management firms, regulators, issuers, and blockchain leaders to discuss asset tokenization in traditional and decentralized finance.

USD.AI approves up to $500 million in GPU funding for Sharon AI.

According to an official announcement from USD.AI, USD.AI has approved providing up to $500 million in asset-backed, non-recourse debt financing to Australian AI computing power provider Sharon AI. This financing will be provided through an on-chain credit system using stablecoin liquidity to fund GPU deployments. The financing is expected to be available as early as the first quarter of 2026, with an initial phase of approximately $65 million.

Tokenization startup Cork raises $5.5 million in seed funding, led by a16z and CSX.

According to The Block, startup Cork announced the completion of a $5.5 million seed funding round, co-led by Andreessen Horowitz (a16z), CSX, and Road Capital, with participation from 432 Ventures, BitGo Ventures, Cooley, DEPO Ventures, Funfair Ventures, G20 Group, Gate Labs, Hyperithm Gate, IDEO Ventures, PEER VC, Stake Capital, and WAGMI Ventures.

Cork aims to build a "programmable risk layer" that makes the risks inherent in real-world assets transparent and tradable through tokenization. Its infrastructure allows asset managers, issuers, and others to create customized swap markets to improve on-chain asset redemption liquidity, risk transparency, and market confidence. This tool can also be used to assess the risks of crypto-native products such as stablecoins and staking tokens. The team plans to launch the first production-grade risk markets in the coming months and expand its partnerships with vaults and asset issuers.

Fintech and asset tokenization company Superstate raises $82.5 million in Series B funding.

According to Cointelegraph, fintech and asset tokenization company Superstate announced the completion of an $82.5 million Series B funding round, led by Bain Capital Crypto and Distributed Global, with participation from Haun Ventures, Brevan Howard Digital, Galaxy Digital, Bullish, and ParaFi. The company plans to use this funding to build a complete on-chain issuance layer on the Ethereum and Solana blockchains for issuing and trading stocks registered with the U.S. Securities and Exchange Commission (SEC). Its goal is to leverage blockchain technology to make the company's fundraising and IPO processes more efficient.

Superstate currently manages over $1.23 billion in assets and operates two tokenized funds. As an SEC-registered transfer agent, the company, through its "Opening Bell" platform, has been supporting publicly traded companies to issue and sell digital shares directly to investors on public blockchains by the end of 2025, enabling real-time management of issuance, settlement, and ownership records.

According to Bloomberg, Argentina-based fintech company Pomelo has raised $55 million in Series C funding, led by Kaszek and Insight Partners. The funding aims to deepen its presence in the Latin American market and expand its global operations. The funds will be used to expand its credit card payment processing business in Mexico and Brazil, and to launch a global credit card settled in the stablecoin USDC. Pomelo also plans to develop a real-time and intelligent agent payment system that can operate across borders, serving traditional banks and large international clients. Current partners include Visa, Mastercard, Binance, and Western Union.

River has announced the completion of a $12 million strategic funding round, with investors including Tron DAO, Justin Sun, Maelstrom Fund founded by Arthur Hayes, The Spartan Group, and several Nasdaq-listed companies in the US and Europe. This funding round will support River's expansion into both EVM and non-EVM ecosystems, including multiple networks such as TRON and Sui, and will continue to build its on-chain liquidity infrastructure.

Insights Highlights

Fortune magazine points out that the Genius Act, which took effect last July, has already begun to impact the $900 billion remittance market, and competition between cryptocurrency companies and traditional remittance companies such as Western Union and MoneyGram is expected to intensify. Nate Svensson, senior equity research analyst at Deutsche Bank, believes that traditional remittance companies still have certain advantages, especially given their well-established global regulatory framework. Jessica Wachter, a finance professor at Wharton School, states that cryptocurrency-native companies have the advantage of flexibly utilizing stablecoin technology, while traditional remittance companies, by combining stablecoins with existing fiat currency remittance systems, may find themselves "competing against themselves."

PANews Overview: The New York Stock Exchange, the world's largest stock exchange, has officially announced the development of an independent tokenized securities trading and settlement platform. This marks the beginning of a deep "surprise attack" by traditional financial giants and may dominate the future landscape of asset tokenization.

The platform adopts a hybrid architecture of "high-performance matching engine + on-chain final settlement", aiming to achieve stock "fragmentation", support 24/7 trading and instant atomic settlement, thereby significantly improving capital efficiency and retail accessibility.

This move not only sparked a digital arms race with global exchanges like Nasdaq, but could also have a profound impact on the crypto ecosystem: on the one hand, it brings unprecedented mainstream regulatory certainty and institutional trust to tokenized assets; on the other hand, it may also siphon funds and users from the crypto market, forcing native crypto projects to transform and giving rise to a new generation of "dual-purpose" liquidity service providers that integrate traditional market makers with DeFi protocols.

This indicates that the underlying logic of the financial system is undergoing an irreversible "code-level" reconstruction, and asset tokenization has leaped from a peripheral innovation to a battleground for mainstream financial infrastructure.

PANews Overview: Starting January 1, 2026, the digital yuan will begin paying interest to users. Money held in one to three types of real-name wallets will earn interest at the current account rate (0.05% in the example), giving people a new reason to keep their idle funds there. Simultaneously, its positioning has shifted from pure cash (M0) to a broader money supply (M1), allowing banks to utilize some funds for business operations and thus providing greater incentive to promote it. Furthermore, relying on programmable smart contracts, the digital yuan can achieve more complex financial functions such as prepaid installments and restricted consumption, and supports offline payments, adapting to more scenarios. Although its interest rate is not high and its usage is not as widespread as Alipay and WeChat Pay, with its security guaranteed by national credit and its expanding applications such as cross-border payments, the digital yuan is attempting to transform from a policy-driven tool into a more attractive and practical digital financial infrastructure.

PANews Overview: Crypto cards (payment cards that allow users to spend using stablecoins or cryptocurrencies) have become one of the fastest-growing sectors in digital payments, with annual transaction volume surging to over $18 billion by the end of 2025, comparable to the volume of mainstream peer-to-peer stablecoin transfers. This rapid growth relies on a three-tiered infrastructure: payment networks (dominated by Visa), card issuers (including project management platforms and full-stack platforms), and consumer-facing products (such as exchange cards and wallet cards).

Market opportunities are concentrated in specific regions such as India (using credit cards to fill compliance requirements) and Argentina (for hedging against inflation), while opportunities in developed markets lie in serving high-value crypto-native users.

Although merchants may directly accept stablecoins in the future, crypto cards, with their mature global acceptance network, fraud protection, credit and rewards services, will remain the most convenient and efficient bridge connecting digital assets and physical businesses in the short to medium term, and are especially irreplaceable in everyday consumption scenarios.

PANews Overview: The Neo Finance ecosystem, centered on tokenization (RWA), stablecoins, and Neobanks, is becoming the fastest-growing sector in the global financial system and may give rise to a large number of "billion-dollar unicorns".

Tokenization entered a stage of large-scale application in 2025, bringing real-world assets such as government bonds and stocks onto the blockchain; stablecoins, as the most successful crypto product, saw rapid growth in their "yield-generating" variants; and emerging banks provided users with a yield experience far exceeding that of traditional banks (such as a 5% current account interest rate) through DeFi backends.

This ecosystem, through the combination of a user-friendly front-end experience and efficient DeFi infrastructure, is fundamentally changing the way users interact with funds, marking a "dream come true" moment for crypto technology, moving from conceptual hype to reshaping real-world finance.