The positive impact of an IP will not automatically translate into an increase in the value of its associated NFTs or tokens.

Written by: @somanyfigs

Compiled by: AididiaoJP, Foresight News

Currently, the total market capitalization of the entire crypto gaming sector is even less than the total amount invested by venture capital firms in this field. Meanwhile, 2025 became a year in which NFT projects collectively transformed and distanced themselves from the "NFT" concept.

The above content is excerpted from The Block's "Digital Asset Outlook 2026" report.

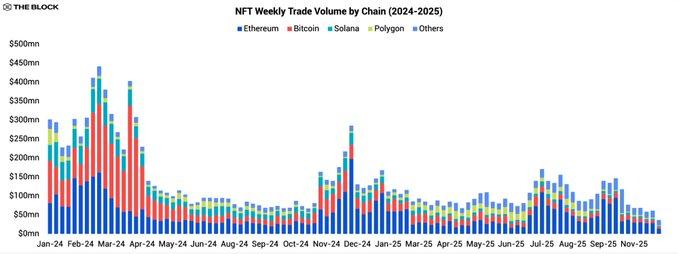

The NFT market entered 2025 already showing signs of decline, and the downward trend persisted throughout the year. Transaction volumes across all blockchains shrank, and market activity became increasingly concentrated on a few popular IPs and incentive programs, while the vast majority of NFT series and niche sectors remained largely ignored. Data clearly reflects this market contraction: total NFT transaction volume in 2025 was only $5.5 billion, far below the level of 2024, demonstrating a significant drop from its peak.

A smaller, more centralized NFT market

Ethereum consolidated its dominance in the remaining market activity. Approximately 45% of NFT transactions in 2025 occurred on the Ethereum mainnet. Bitcoin and Solana briefly attracted attention in 2023-2024 with the "Inscription" and SOL NFT craze, but have since lost momentum. Bitcoin's share of NFT transaction volume has fallen to around 16%, less than half of last year's; Solana's share has plummeted to single digits.

The conclusion of this section is clear: the NFT trading market has shrunk and become increasingly Ethereum-centric. Liquidity has thinned, secondary trading of most series has nearly ground to a halt, and blockchains that once attracted attention with market hype are now struggling to maintain their user mindshare.

Platform and product transformation

Although overall transaction volume declined, the product landscape in 2025 was not static. Marketplaces and creators experimented with new underlying technologies and business models, and in many cases, NFTs were no longer the sole form of on-chain asset.

Zora shifts to a "token" model

One of the most typical examples of this shift is Zora. At the beginning of the year, Zora began to gradually remove NFT minting and commenting features from its app, and in late February 2025, it launched a "token" upgrade. Since then, every new piece of content posted by a user on Zora will be minted as an independent ERC-20 "token" with a fixed total supply of 1 billion, instead of the unique NFTs of the past.

This shift essentially transforms creators' posts into more liquid, less frictional micro-tokens, rather than non-fungible collectibles. This move can be seen as a clear judgment: compared to one-off NFTs with poor liquidity and weak value dependence in the secondary market, users prefer lightweight tokens that are easy to accumulate, trade, and can be used for incentive programs, and possess liquidity.

Trading markets are evolving into "one-stop" platforms.

Zora isn't the only player expanding its business boundaries. Major NFT marketplaces, especially OpenSea and Magic Eden, are also continuously positioning themselves as multi-asset platforms rather than simply NFT listing sites. They are all aggressively expanding token exchange functionality and more versatile trading tools beyond their core marketplace businesses to adapt to trends in liquidity and shifting user interests.

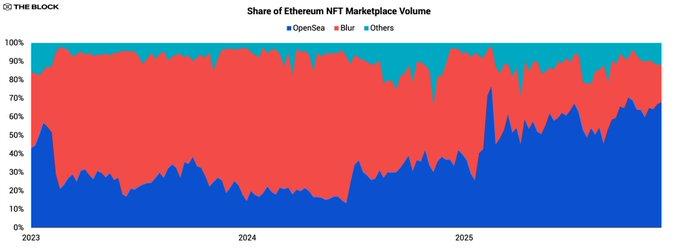

OpenSea regains market leadership

Taking OpenSea as an example, the most obvious change is reflected in the reversal of its market share in Ethereum NFTs. After relinquishing the top spot to Blur for about three years, OpenSea regained the number one position in 2025 and significantly widened its lead throughout the year.

At the beginning of 2025, OpenSea held approximately 36% of the Ethereum/EVM NFT market share, while Blur accounted for 58%. By the end of 2025, OpenSea's share had climbed to over 67%, while Blur's share had fallen below 24%. Despite the overall industry-wide decline in transaction volume, OpenSea's own NFT transaction volume achieved double-digit year-over-year growth, exceeding $1.4 billion. In contrast, Blur's annual transaction volume plummeted by over 73%.

Important events of the year

Against the backdrop of a cooling overall market, only a few significant events in 2025 truly influenced the narrative of the NFT space. Most of these revolved around token distribution tied to NFT IP, or experiments conducted in vertical sectors with clearly defined practical applications.

Magic Eden launches platform token

Magic Eden's platform token issuance and incentive program were one of the main catalysts driving market activity this year. The process was divided into three steps: the ME token airdrop in December 2024, the expansion of the staking and trading mechanisms in April 2025, and the retrospective rewards program announced in August.

Despite these initiatives, Magic Eden's market trading volume remained on a downward trend for most of the year. While occasional bursts of activity occasionally occurred, they were insufficient to fully offset the overall sluggish demand for NFTs. This reveals a core reality for 2025: incentive programs may guide existing liquidity, but in a shrinking market, they struggle to create new liquidity.

A well-known NFT IP issues liquidity tokens

Another major trend is that some leading NFT series are beginning to issue fungible "ecosystem tokens" to create liquid investment exposure for their brands. The most notable examples include:

- Pudgy Penguins — PENGU

- Doodles — DOOD

- Azuki — ANIME

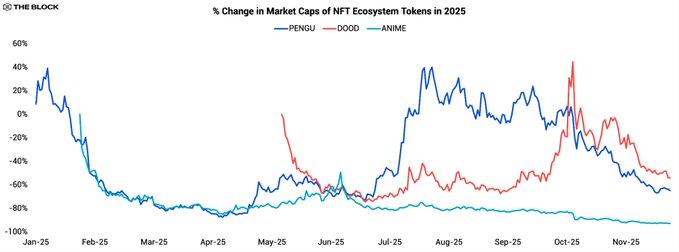

The common goal of these token issuances is to expand the previously limited and relatively static NFT series into a broader token ecosystem, allowing backers to trade, stake, or use these tokens in future products. However, their price movements clearly illustrate the difficulty of maintaining the popularity of "cultural concept coins" in 2025.

Launched at the end of 2024, PENGU had a strong start to the new year, with its price rising nearly 40% in the first week, but then plummeted by more than 90% within three months. It saw a strong rebound in the second quarter, with its valuation increasing tenfold within three months, but then fell into a downward trend again in the second half of the year. As of the time of writing, PENGU's cumulative decline this year exceeds 60%.

This trend is typical: in the early stages of issuance, it relies on airdrop speculation and brand narrative (especially Pudgy's strong brand awareness and offline influence) to gain popularity, but then faces difficulties: after the early incentives are exhausted, there is insufficient organic demand; apart from trading and vague future reward promises, there is a lack of clear token consumption scenarios or practical uses; in addition, there is a severe macroeconomic environment facing risk assets and "cultural coins" as a whole.

Doodles' ecosystem token, DOOD, followed a similar trajectory, but at a different time. It plummeted nearly 75% within two months of its launch, then entered a period of consolidation before rebounding by approximately 160% between September and October 2025. However, this rebound was unsustainable, and by the end of 2025, DOOD had fallen by nearly 50% year-to-date.

Azuki's token ANIME stands out for its near-absence of any rebound. It fell shortly after its launch in late January 2025 and, unlike PENGU or DOOD, never experienced a meaningful upward trend. Its price steadily declined throughout the year, currently down over 90%, making it the worst-performing token in the three major NFT ecosystems. The market's general fatigue with "cultural coins" seems to have completely overshadowed the initial curiosity.

Overall, the total return for these three tokens this year is approximately -67%, placing them among the worst-performing categories in the market, similar to memecoins and the gaming sector index (mentioned in Chapter 1 of this report).

The key conclusion is not that the ecosystem token model itself is flawed, but rather that the market in 2025 lacked structural demand for "culture-driven tokens." In an environment of tight liquidity and investors increasingly valuing clear cash flow or protocol utility, tokens that primarily rely on brand recognition to support their value struggle to gain sustained appeal. Without a robust token consumption mechanism, revenue sharing, or substantial governance, these assets resemble leveraged bets on short-lived trends rather than long-term investments in IP value.

Pudgy Penguins: Entering the Mainstream Vision

If we're talking about NFT series that persevered in a weak market in 2025, Pudgy Penguins was undoubtedly one of the best. From a branding and marketing perspective, the project had its busiest year in the space:

- In January 2025, the team launched Abstract, a dedicated blockchain built on the Layer-2 technology stack, on the mainnet.

- Walmart and Target continue to sell Pudgy toys and related merchandise, extending their retail reach to a broad non-crypto user base.

- The launch of Pudgy's branded animated series on YouTube further solidifies its IP presence in digital media.

- In August, it gained sporting exposure through a collaboration with NASCAR Darlington race car livery.

- Pudgy appeared as a large plush toy in the second season of the Apple TV series Platonic, and in November teased a collaboration with DreamWorks' Kung Fu Panda IP.

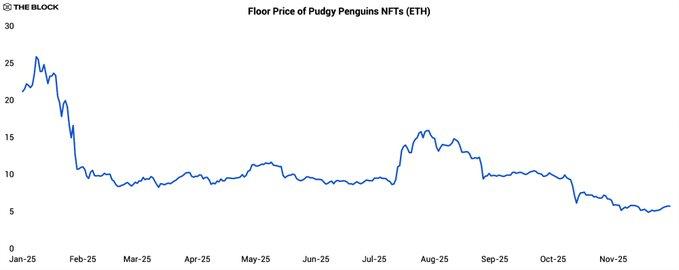

These developments demonstrate that even with weak on-chain data, NFT IPs can still effectively penetrate mainstream culture. However, despite the continued positive developments in IP, the floor price of Pudgy Penguins NFTs has fallen by approximately 75% this year.

Meanwhile, its ecosystem token, PENGU, has also underperformed, falling by about 60% this year, though still slightly better than NFTs themselves. This suggests that for investors looking to invest in the Pudgy brand, the token may have become a more convenient and liquid investment tool, even though its economic model is not directly linked to merchandise sales or media revenue.

Pudgy's case reveals a common structural problem faced by NFT projects and IPs: positive developments in an IP do not automatically translate into value growth for its NFTs or tokens. Mass consumers engage with brands through toys, shows, and collaborations, but they may never actually access the blockchain assets that initially launched the brand.

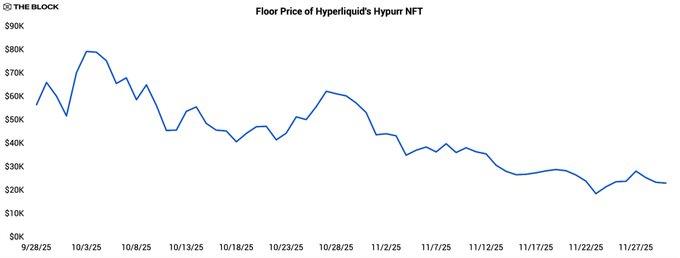

Hyperliquid's Hypurr NFT

While many NFT projects are shifting towards issuing fungible tokens, some native token communities are doing the opposite, issuing NFTs on top of existing ecosystems as identity markers and participation credentials. Hyperliquid's Hypurr NFT is a prime example.

Hypurr was distributed to Hyperliquid community members according to eligibility rules, designed to reward users who actively participated in trading before the platform token's official launch in November 2024. In the secondary market, its initial floor price exceeded $55,000, with an all-time high of approximately $79,000, before gradually declining to around $28,000.

The platform’s early strength stemmed from a number of factors: the platform had a highly active and loyal community of traders; holding rare NFTs associated with successful trading platforms had a status symbol effect; and the market’s expectation of potential future utility (such as exclusive access, rewards or governance rights).

However, as time went on, prices gradually declined due to limited practical functions, reflecting a general mentality of taking profits and indicating that not all collectors are willing to hold high-priced NFTs as illiquid "identity badges" for the long term.

Hypurr's example demonstrates that building a "token → NFT" path remains viable within a mature community that has proven product-market fit. However, it also emphasizes that if these NFTs are to transcend initial hype, their role must be clearly defined, whether as access credentials, loyalty tools, or collectibles.

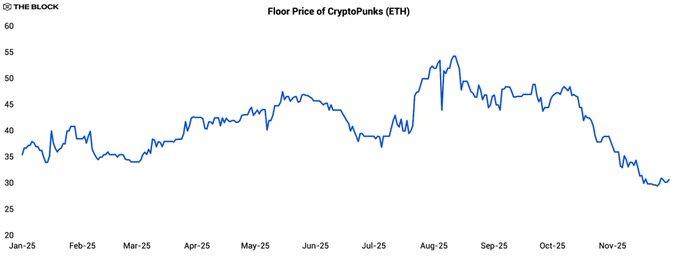

CryptoPunks' brief rebound

Even during a quiet year, CryptoPunks did garner some brief attention. The series' base price surged by approximately 40% between July and August 2025, peaking at around 54 ETH in mid-July. However, its price subsequently nearly halved, falling back to around 30 ETH at the time of writing.

Notable factors include not only the magnitude of price fluctuations but also the changing correlation between the price of Punk and the price of Ethereum (ETH). From the beginning of 2025 until the rebound in July, the correlation coefficient between Punk's floor price and ETH was approximately -0.28, showing a weak negative correlation.

During the three-week rebound, the correlation coefficient rose only slightly to 0.24, indicating a still weak correlation. This suggests that this was more of an independent rally triggered by specific factors (possibly driven by large investors) rather than a broad increase in market risk appetite. A significant change occurred after prices peaked.

Starting from its local high, the correlation coefficient between Punk and ETH surged to 0.87. This means that Punk has essentially resumed its role as a representative asset of ETH's high beta (high volatility). This is typical of a bubble burst: once the catalyst effect unique to the series fades, market participants revert to viewing it as a leveraged tool for betting on Ethereum price fluctuations, rather than a completely independent investment.

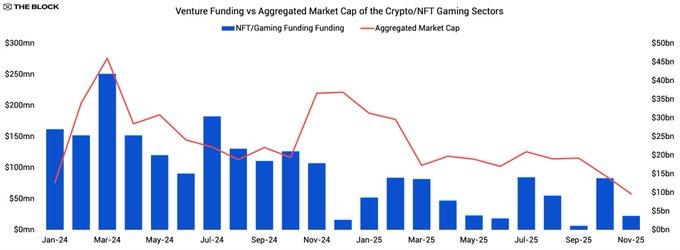

NFT/GameFi: The Gap Between "Funding Amount" and "Realized Value"

Since the Axie Infinity craze, the combination of NFTs and gaming has been a major investment theme, but data from 2025 suggests that the sector has yet to live up to the massive investments it has received.

Despite the slowdown, venture capital continues to fund NFT and GameFi projects, but annual funding in the sector in 2025 was only around $1 billion, a decrease of about 65% from 2024. Meanwhile, the total market capitalization of NFT/game tokens fell by more than 60% during the year, reflecting both price declines and the poor performance of many launched projects.

More thought-provoking is the fact that the current total market capitalization of NFT/gaming tokens is approximately $14 billion, lower than the total historical funding raised in the sector ($19 billion). In other words, at current market prices, theoretically, all circulating tokens in the sector could be bought with less money than the total funding raised over the years. This inverted phenomenon, where "fundraising amount" exceeds "total token market capitalization," reflects the fact that many projects, despite receiving substantial funding, struggle to achieve sustainable user adoption.

NFT and Gaming Outlook for 2026

Looking ahead to 2026, data from 2025 suggests that the NFT, NFT-related IP, and their token industry will exhibit a "K-shaped" development: a small number of projects will continue to build an audience and occasionally cause liquidity fluctuations, while the vast majority of series and ecosystems will remain sluggish in terms of attention and price.

In the baseline scenario, NFT transaction volume will remain at a moderate level, with market activity concentrated in the upper half of the "K-shaped" curve. This includes specialized ecosystems with established user bases, offline distribution channels, or mature monetization models, such as Pudgy Penguins, CryptoPunks, and Pokémon Trading Cards, which justify continued investment in infrastructure and market support. The lower half of the "K-shaped" curve includes a large number of NFT series launched between 2021 and 2024, characterized by low trading volume, declining floor prices, and token experiments that have yielded minimal results beyond brief rallies.

One of the key lessons of 2025 is that the benefits of an IP do not automatically translate into increased value for its associated NFTs or tokens. The ownership credentials (NFTs/tokens) initially used to launch these brands are just one part of the overall value system, which is increasingly coexisting with mass-market channels such as retail, streaming, and social media that bring in the main audience and revenue.

For investors and builders, the wisest approach is to maintain highly selective optimism. This sector is smaller, more concentrated, and more demanding than ever before. But within this more focused landscape, projects that can tightly integrate on-chain assets with real-world products, revenue, and community may still find room for growth, even though the era of a general NFT price surge is over.