The report covers a wide range of topics in the crypto market, including macroeconomics, Bitcoin, protocol layers, DeFi, stablecoins, consumer crypto, cutting-edge technologies, institutional adoption, regulatory policies, and themes for 2026.

Article by: Dogie

Article source: Running Finance

Binance Research has released its annual report, "FULL YEAR 2025 & THEMES FOR 2026," which not only provides a comprehensive review of 2025 but also forecasts industry development themes for 2026.

The report covers a wide range of topics in the crypto market, including macroeconomics, Bitcoin, protocol layers, DeFi, stablecoins, consumer crypto, cutting-edge technologies, institutional adoption, regulatory policies, and themes for 2026.

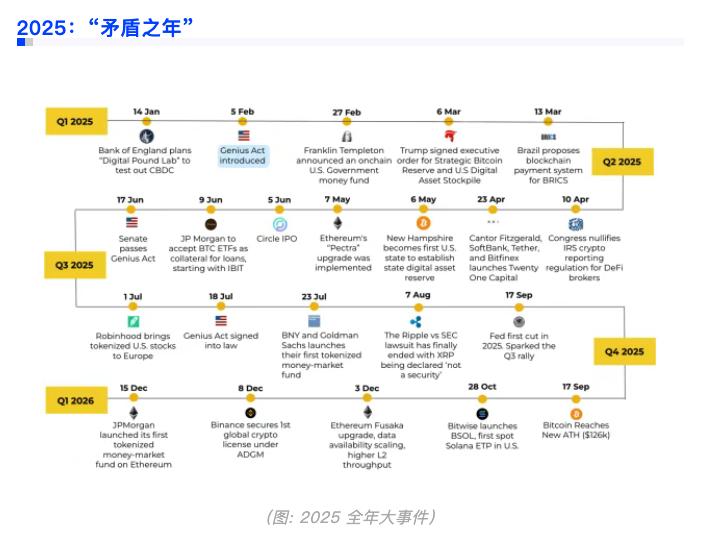

If you had to summarize the crypto market in 2025 in one sentence, it would be: "Milestones and volatility coexist."

On the one hand, tangible progress has been made in infrastructure and institutional acceptance.

Bitcoin ETFs continue to attract funds, with net inflows exceeding $21.3 billion in the US alone. Products from asset management giants like BlackRock are even larger than the largest gold ETFs.

Stablecoins have gained widespread popularity, with annual transaction volume soaring to $33 trillion, surpassing traditional payment giants like Visa and becoming a new backbone of global payments.

Nearly 200 listed companies have included Bitcoin in their balance sheets, with total holdings exceeding 1.1 million coins, accounting for 5.5% of the total Bitcoin supply.

However, the market remains quite volatile.

Although the global cryptocurrency market capitalization reached a peak of $4.2 trillion for the first time, with BTC even hitting a record high of $126,000, the market bucked the trend and fell by 7.9% at the end of the year, with the total market capitalization hovering around $3.35 trillion.

(Chart: Total cryptocurrency market capitalization decreased by 7.9% in 2025)

Behind these dramatic ups and downs lies the strong dominance of macroeconomic factors. Is the crypto market "malfunctioning"?

It is no longer an independent track.

In the past, we looked at halvings and technological upgrades. Now, market pricing power has shifted to the Federal Reserve's interest rates, US fiscal legislation, and geopolitical conflicts.

The report points out that the correlation between Bitcoin and US stocks will surge to 0.43 in 2025, and during the US government shutdown and data vacuum, the crypto market will decouple from traditional assets and fall in a rare manner.

This reveals a key signal .

The price of crypto assets is increasingly influenced by traditional macroeconomic and financial cycles, and is no longer just a matter of technology or narrative within the crypto community.

In other words, cryptocurrencies are "mature," needing to enjoy the glory of institutional funding while also enduring the growing pains brought about by global economic fluctuations. Those who used to make quick money through hype and narratives now need to understand government bond yields and fiscal deficits.

Trend 1: "Risk Reboot" in 2026

The report argues that the biggest driver of the market in 2026 will likely come from policy. In summary, fiscal stimulus, monetary easing, and regulatory relaxation will collectively inject liquidity into the crypto market.

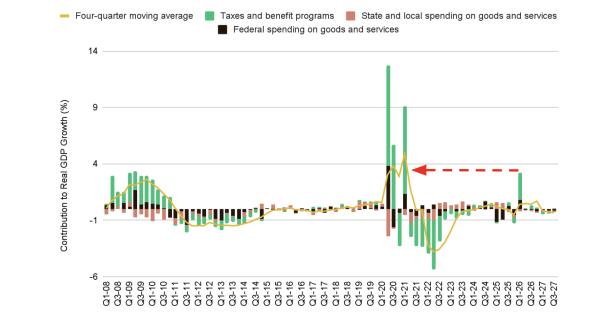

The first is fiscal stimulus .

Fiscal stimulus measures, such as tax rebates and corporate investment incentives, exemplified by the U.S. "OBBBA" bill, are expected to inject a large amount of cash into the economy in the first quarter of 2026.

Historical experience shows that cash flowing directly into households tends to flow more quickly into high-risk assets (such as meme coins and NFTs).

(Chart: Fiscal stimulus in the first quarter of 2026 will be close to the highest level since 2021)

Secondly, there is monetary easing .

The Federal Reserve is expected to continue cutting interest rates, with the policy rate potentially falling to around 3%, while also restarting its asset purchase program, injecting an estimated $500-600 billion in liquidity throughout the year.

Central banks in Europe and other countries are also expected to shift towards interest rate cuts and balance sheet expansion, providing more ample liquidity to the market. For crypto assets, low-cost funding means more money will flow to high-risk, high-return markets.

Finally, there is the need for clearer regulations .

In addition to the stablecoin regulatory framework (the US GENIUS Act established the first federal-level regulatory framework for stablecoins, and the EU MiCA regulation has also entered the implementation stage), the US Clarity Act is expected to be passed in 2026, clarifying the regulatory jurisdiction of crypto assets and reducing industry uncertainty.

The clearer the path to compliance, the more it can dispel the concerns of traditional institutions and attract "regular forces" to enter the market.

What does this mean for ordinary people?

A more accommodative monetary environment and clearer rules of the game could shift market sentiment from the "data fog" of 2025 to a "risk restart".

However, it should be noted that this does not mean a one-sided rise, but rather that the market structure may shift from being driven by retail investors to being more dominated by institutional and sovereign liquidity.

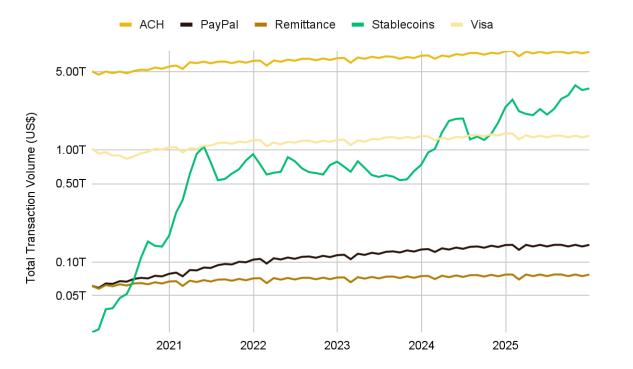

Trend Two: Stablecoins are moving towards becoming financial infrastructure

In 2025, stablecoins (crypto assets pegged to fiat currencies) experienced their "golden age." Their market capitalization surged nearly 50% throughout the year, exceeding $305 billion, with daily trading volume reaching $3.54 trillion. This figure is 2.6 times that of Visa, meaning that a massive amount of funds flowed globally through stablecoins every day.

(Image: Stablecoin monthly trading volume surpasses VISA)

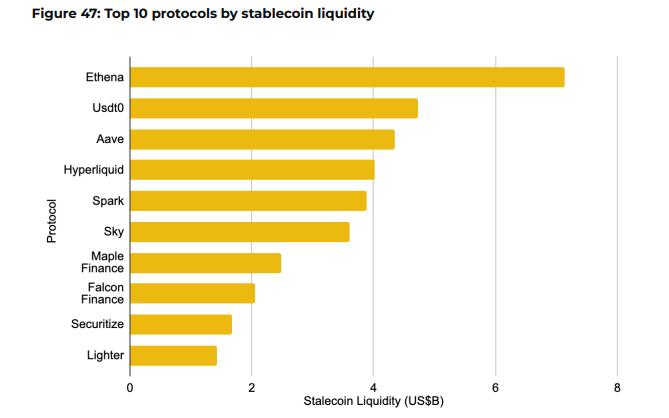

Ethena's USDe performed the best, becoming the third largest stablecoin at one point through government bond collateral and hedging strategies, with a peak market capitalization of $14.8 billion.

(Image: Top 10 stablecoin protocols by liquidity)

If 2025 was the "breakout year" for stablecoins, then 2026 may be the "application year" for them to integrate into daily life.

The report points out that the next stage of growth for stablecoins will be deeply integrated with Neobank applications. These blockchain-based applications, with their lower operating costs, can offer users higher savings returns than traditional banks.

More importantly, payment giants like PayPal and Stripe, as well as card organizations like Visa and Mastercard, are actively embracing stablecoins and integrating them into their products.

Stablecoins are no longer just "intermediary tools" for crypto transactions, but are beginning to penetrate into real-world scenarios such as cross-border payments, corporate settlements, and personal savings.

Trend 3: Institutions are shifting from "buying cryptocurrencies" to "using blockchain technology".

Institutional attitudes toward cryptocurrencies are undergoing a fundamental shift: from mere price speculation to embedding blockchain technology into core financial workflows .

The most obvious signal is the booming US spot BTC ETF – with a net inflow of over $21.3 billion throughout the year, of which BlackRock's IBIT ETF alone attracted $25 billion, far exceeding other similar products.

More importantly, institutional funds are no longer limited to BTC, but have extended to the RWA (Real World Assets, which is the tokenization of traditional assets such as government bonds and stocks) field.

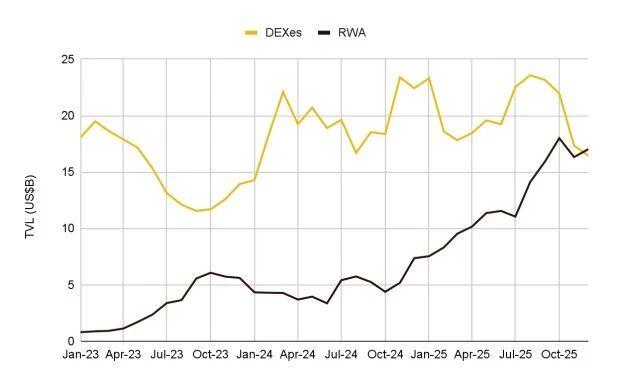

In 2025, RWA's total value locked (TVL) exceeded $17 billion, surpassing DEX (decentralized exchanges) for the first time and becoming the fifth largest category in the DeFi field.

(Image: RWA TVL surpasses DEX)

The deeper implication of this trend is that in the future crypto market, value will come not only from asset appreciation, but also from the demand for blockchain as an efficient and programmable financial infrastructure.

The institutions bring not only funds, but also real-world application scenarios and liquidity.

Important warning: Beware of the "digital bond" bubble

Amid the frenzy of listed companies buying up Bitcoin, the report also issued a sobering warning: the business model risks of some "digital asset bond companies" need to be guarded against.

As of the end of 2025, 194 listed companies held more than 1.1 million BTC, accounting for 5.5% of the total supply. Among them, Strategy (formerly MicroStrategy) held 672,500 BTC, making it the largest corporate BTC holder.

These companies primarily engage in the high-leverage hoarding of Bitcoin through bond issuance or financing.

In a bull market, their stock price increases may far exceed those of Bitcoin itself. However, once the market corrects, they will face double pressure :

- The stock price may fall much more than the Bitcoin price.

- Rising financing costs or the closure of financing channels may force companies to sell assets to maintain operations.

In the second half of 2025, the share prices of some such companies had already traded at a significant discount relative to the net asset value (NAV) of their Bitcoin holdings, reflecting market concerns.

The report cautions that investors should focus on entities with moderate leverage and long-term cash flow plans, rather than "castles in the air" that rely solely on asset price appreciation.

Looking ahead to 2026, how should we act?

The report's implied recommendations are clear for different participants.

For ordinary investors

We need to understand that the market has entered a deeper phase of "institutionalization".

There's no need to blindly chase niche assets; instead, focus on two types of opportunities :

- Compliant leading crypto asset ETFs (especially BTC and ETH related products).

- Stablecoins and RWA products with real-world applications have lower risk and higher certainty.

For industry builders

With relatively mature infrastructure, institutional services, RWA infrastructure, and cross-chain (interconnection between different blockchains) will be the three major growth areas.

As the integration of traditional finance and the crypto market deepens, projects that can solve compliance, liquidity, and efficiency issues are more likely to attract capital.

For the observer

Instead of focusing on price charts, pay more attention to less "trivial" indicators: the adoption rate of stablecoins, the on-chain settlement volume of multinational corporations, and the scale of tokenization of mainstream financial products .

These are the real signals of whether an industry has a solid foundation.

The crypto world is losing its early hype and mystery.

"Blockchain is dead, long live blockchain."

Technology itself will become invisible, but the “verifiable credit” it brings will permeate our lives.

Appendix: Other key information mentioned in the report

Bitcoin

Market capitalization remained at $1.8 trillion, hashrate exceeded 1 ZH/s, mining difficulty increased by 36.4% year-over-year, and on-chain activity slowed. Liquidity and demand shifted to off-chain channels (ETFs, institutional custody).

Protocol layer (Layer 1 / Layer 2)

ETH, Solana, and BNB Chain dominate the market.

in:

- Ethereum : Leading in developers, DeFi liquidity, and total value, but the ETH/BTC exchange rate is weakening.

- SOL : With over 100 million daily transactions and over 13.5 billion daily transactions, it became the third crypto asset to be approved as a US spot ETF.

- BNB Chain : DEX trading volume increased by 164%, attracting institutions such as BlackRock and VanEck to issue tokenized assets.

DeFi

- TVL reached $124.4 billion, with funds shifting towards stablecoins and yield-generating assets.

- The DEX/CEX spot trading ratio reached 20%, while derivatives trading saw significant growth.

- The prediction market is booming, with Polymarket and Kalshi reporting a trading volume of $51 billion.

Consumer-grade encrypted applications

Wallets have become killer applications, with MetaMask and Phantom leading in user numbers, and CEX user base continuing to grow; social networking and gaming have cooled down, and Farcaster has shifted its focus to wallet development; NFT market value has fallen by 69%, and blockchain game financing has cooled down.

Cutting-edge technology

- x402 Protocol : Supports AI-assisted payments, with cumulative transaction volume exceeding $30 million.

- On-chain privacy : Demand for privacy coins such as Zcash is rising, and compliant privacy solutions are developing.

In addition, the rise of DePAI (Decentralized Physical Artificial Intelligence) is driving the integration of the machine economy with blockchain.