Ondo (ONDO) is creating a remarkable paradox. The price of the ONDO Token has dropped more than 80% from its all-time high (ATH), but the Total Value Locked has just reached a new record.

This disparity has led many to question the project's true potential. Meanwhile, industry experts remain optimistic about Tokenize by 2026.

Ondo's price dropped sharply after unlocking.

Ondo is a decentralized finance (DeFi) protocol focused on Tokenize real-world assets (RWAs). The platform allows users to access traditional financial products such as US Treasury bonds, trust funds, and Tokenized Stocks on the blockchain.

According to price data from BeInCrypto, ONDO has fallen from its peak of over $2.10 to around $0.35. This represents a drop of over 80%. In early 2026, ONDO continued to hit new Dip and showed no clear signs of recovery.

Ondo (ONDO) price performance. Source: BeInCrypto Price

Ondo (ONDO) price performance. Source: BeInCrypto PriceThis negative price movement may stem from Dump pressure due to the Token Lockup unlocking. Recently, Ondo completed unlocking 1.94 billion Token on January 18, 2026. This amount represents 57.23% of the total Token issued.

The sudden increase in circulating supply created significant selling pressure and caused anxiety among many investors. Following this unlocking, ONDO continued to fall by another 10%.

Ondo's January Paradox: Is the project undervalued?

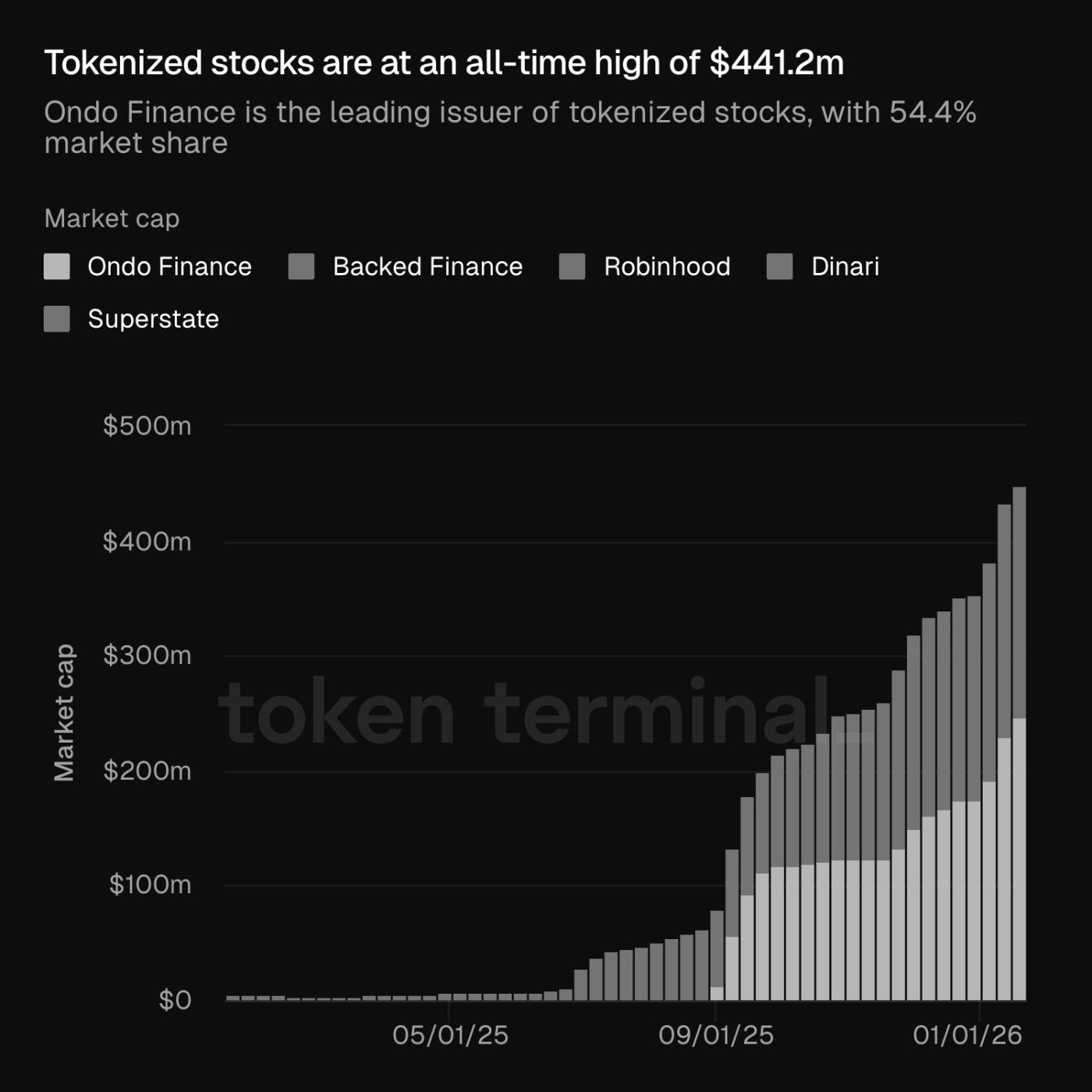

However, data from Token Terminal shows that the Tokenize stock sector is experiencing strong growth. The total market Capital of Tokenize stocks has reached a new all-time high of $441.2 million. Ondo Finance is leading this sector with a 54.4% market share.

Total Capital capitalization of Tokenize stocks. Source: Token Terminal

Total Capital capitalization of Tokenize stocks. Source: Token TerminalThe chart shows that the market Capital of Tokenize stocks has surged since last September. This growth occurred even as the overall crypto market trended downward around the same time.

This data shows that even though many retail investors have withdrawn Capital, large institutions continue to pour money into Tokenize stocks.

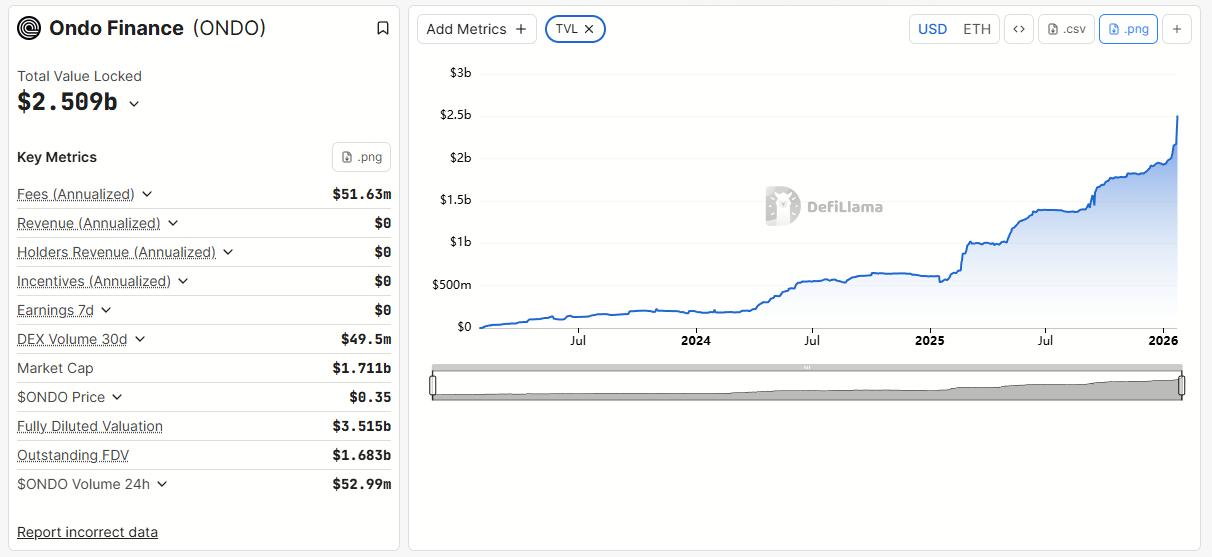

In addition, TVL on Ondo also increased sharply in January. According to data from defillama, TVL reached a new record high, exceeding $2.5 billion.

Total Value Locked of Ondo. Source: defillama

Total Value Locked of Ondo. Source: defillamaThe TVL (Total Value in Lending) index represents the total value of assets users deposit into a protocol, reflecting user participation and trust. The contrast between the sharply falling Token price and the surge in Capital inflow has led many experts to suspect that Ondo is undervalued. Markets are often driven by emotions and psychology, causing retail investors to easily overlook fundamental factors.

"The current fear in the market actually creates good opportunities, especially for projects like Ondo," investor Kyren Chia .

This paradox became even more apparent when Tokenize became a central theme at Davos 2026. Global leaders expressed optimism about Tokenize assets, XEM it as a bridge between traditional finance and DeFi.

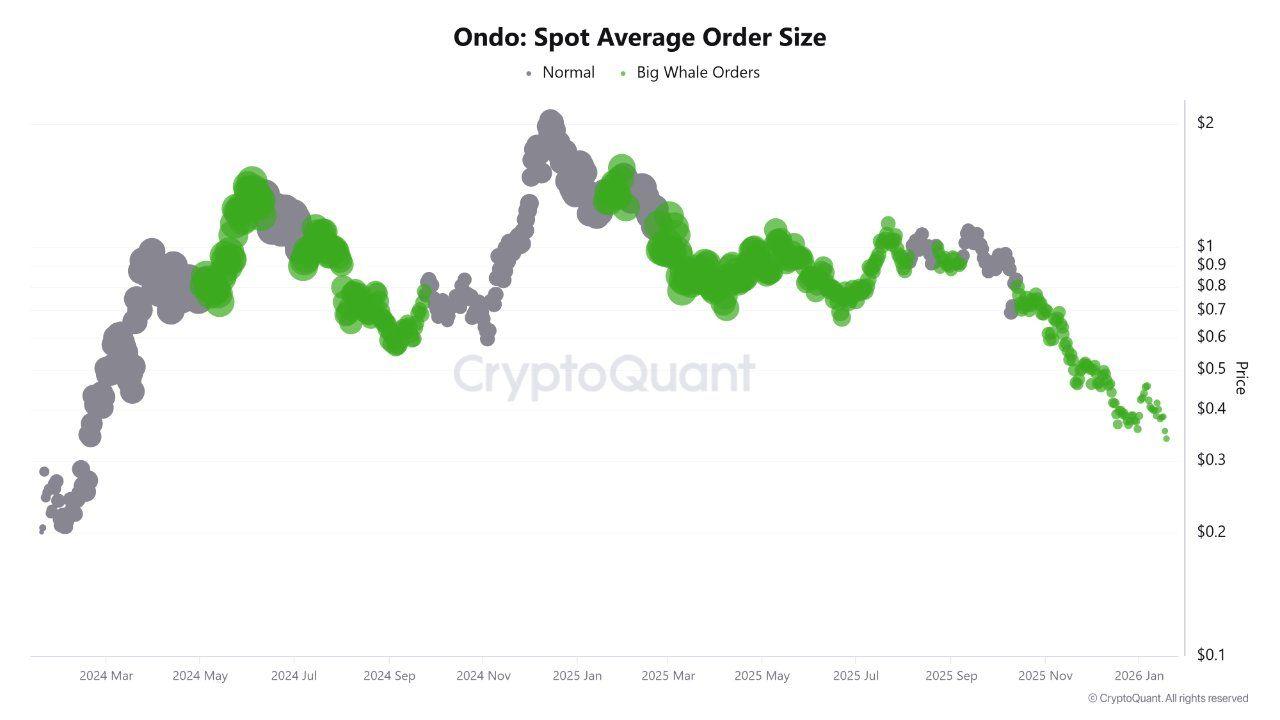

Data from the exchange also shows that, despite the price drop, many large investors XEM this correction as a buying opportunity.

Medium order size for Ondo spot trading. Source: CryptoQuant .

Medium order size for Ondo spot trading. Source: CryptoQuant .CryptoQuant's Medium order size data shows that large orders from whales have dominated in recent months, indicated in green on the chart.

This model suggests that ONDO could experience a strong recovery once selling pressure stemming from concerns about Token unlocking subsides and the market stabilizes.