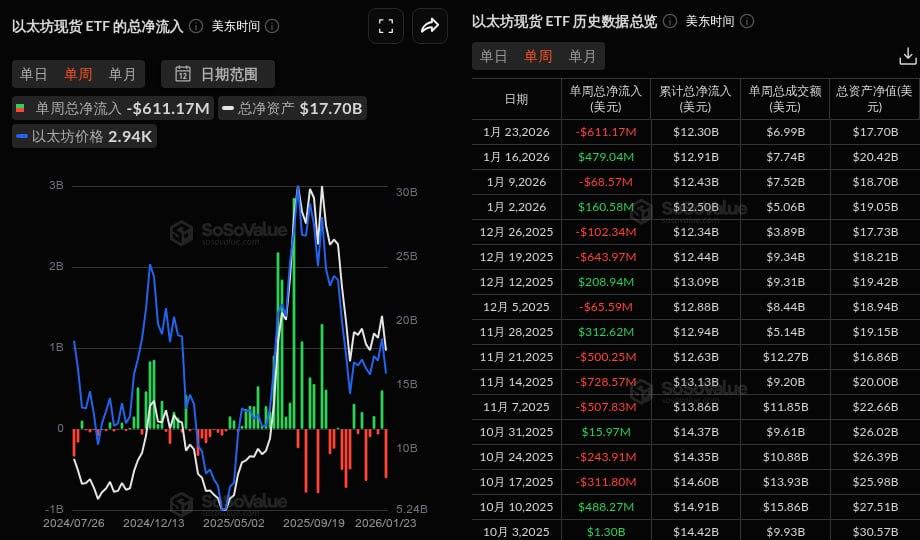

PANews reported on January 25 that, according to SoSoValue data, Ethereum spot ETFs saw a net outflow of $611 million this week (January 19 to January 23, Eastern Time).

The Ethereum spot ETF with the largest net outflow this week was BlackRock ETF ETHA, with a weekly net outflow of $432 million. ETHA's historical total net inflow is currently $12.51 billion. This was followed by Fidelity ETF FETH, with a weekly net outflow of $78.03 million. FETH's historical total net inflow is currently $2.59 billion.

The Ethereum spot ETF with the largest net inflow this week was the Grayscale Ethereum Mini Trust (ETH), with a weekly net inflow of $17.824 million. The total historical net inflow of ETH has now reached $1.64 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $17.7 billion, an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 4.99%, and a historical cumulative net inflow of $12.3 billion.