This article is machine translated

Show original

How many points would you give this "steering wheel"?

In order to have a good New Year when I returned to my village, I gritted my teeth and opted for genuine leather interior.

As a result, the budget was exceeded, and the steering wheel could only be temporarily replaced with a "battle-damaged version".

After all, you have to drift while driving a luxury car.

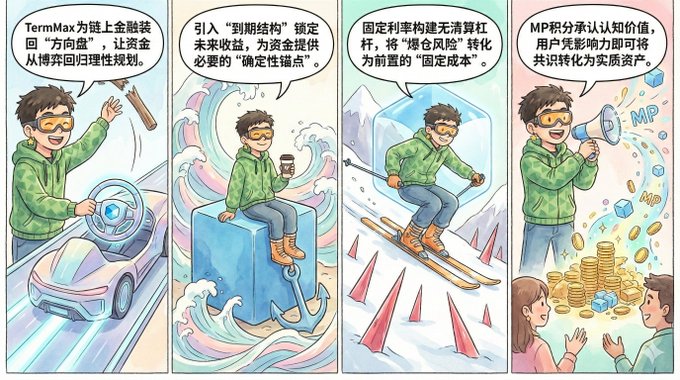

The image above is the most accurate metaphor for the current DeFi market. The emergence of TermMax (@TermMaxFi) is precisely to remove this rudimentary handle and, by introducing fixed interest rates and structured products, put back the "steering wheel" that originally belonged to on-chain finance, allowing the movement of funds to return from random games to rational planning.

____🛞____🛞____🛞____🛞____🛞____🛞____

Certainty Premium: Reconstructing the Time Value of Interest Rates

In existing DeFi lending, users are forced to expose themselves to highly uncertain interest rate fluctuations, which is essentially an abuse of the time value of capital.

TermMax's core argument, as stated by @TermMaxFi, is that without fixed interest rates, there is no true bond market.

By introducing a "maturity structure," it allows both lenders and borrowers to lock in future costs and returns at the moment of the transaction. This design not only eliminates market noise but, more importantly, provides institutional funds and long-term strategies with a necessary "anchor of certainty."

____🛞____🛞____🛞____🛞____🛞____🛞____

"Reinventing Leverage: Combating Price Manipulation with Non-Clearing Game Theory"

Traditional on-chain leverage is like "dancing on a knife's edge," where extreme price spikes often cause the right direction to fall just before dawn.

TermMax's Alpha Markets (@TermMaxFi) is essentially a "lower-dimensional attack" on risk exposure. By building up non-liquidation leverage through fixed-rate borrowing, it essentially transforms "liquidation risk" into upfront "fixed costs."

This mechanism design gives the allocation of highly volatile assets the asymmetric return characteristics of a "call option".

____🛞____🛞____🛞____🛞____🛞____🛞____

"Cognition as Asset: A Revolution in Value Distribution within the MP System"

Unlike traditional protocols that rely solely on TVL (Total Value Locked) for evaluation, TermMax @TermMaxFi's Mindshare Campaign attempts to solve the problem of "attention pricing."

The core logic of its MP points system is to acknowledge that "cognitive dissemination is also a form of fluidity".

By quantifying the value of content creation and community interaction, the protocol breaks the whale' monopoly on early-stage chips.

This means that in the Pre-TGE phase, ordinary users do not need to hold huge amounts of capital; they can convert their "influence" into substantial "profits" simply by having a deep understanding of the protocol mechanism and by spreading the message.

This is an institutional innovation that solidifies community consensus into assets through algorithms.

#TermMax #DeFi #TermMaxFi #BNBchain

Okay, DC!

Keep pushing

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content