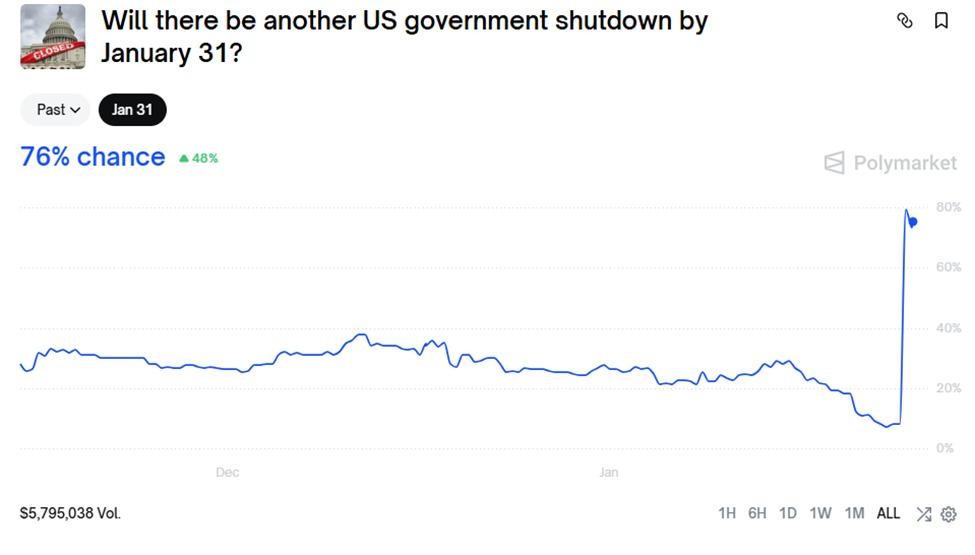

Market forecasts on Polymarket are currently pricing the likelihood of a US government shutdown before January 31st at around 78%, a sharp increase from just 10% three days earlier.

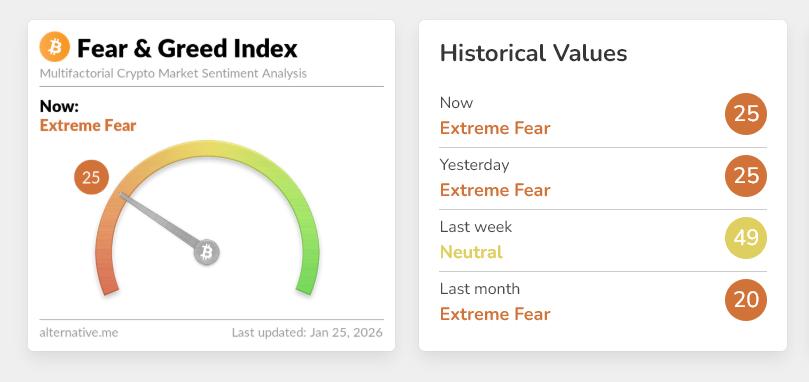

Amid rising risks of a US government shutdown, many investors are flocking to safe-haven assets due to concerns about instability. The Crypto Fear and Greed Index now shows "Extreme Fear" sentiment. Less than a week ago, this sentiment was neutral.

Crypto Fear and Greed Index. Source: Alternative

Crypto Fear and Greed Index. Source: AlternativeThe impasse among US policymakers is raising the likelihood of a government shutdown on Polymarket.

Disputes over funding for the U.S. Department of Homeland Security (DHS) are intensifying. The increased likelihood of a government shutdown coincides with a surge in gold and silver prices , a trend reminiscent of the record 43-day shutdown that ended in November 2025.

The U.S. House of Representatives passed a temporary budget bill with 341 votes in favor and 81 against. However, the Democrats in the Senate, led by Majority Leader Chuck Schumer , refused to move the bill forward. Notably, funding for the Department of Homeland Security, including the Immigration and Customs Enforcement (ICE), remains a key sticking point.

“Democrats have proposed reasonable reforms in the budget bill for the Department of Homeland Security, but because Republicans are afraid to stand up against President Trump, this bill is completely insufficient to control ICE’s abuses of power. I will vote against it,” Schumer Chia on his personal page.

This impasse has created a "data shortage." Key economic indicators such as the CPI and jobs report are delayed, making policymaking by the Fed and risk assessment models more complex. This could lead to increased market volatility.

“The government will be shut down for the next six days. Last time it shut down, gold and silver rose to new record highs. But if you’re holding other assets like stocks, you need to be especially cautious… Because we’re about to enter a period of complete data scarcity,” warned NoLimit, a well-known macro analyst on X.

In fact, forecasters on Polymarket also believe a similar scenario will unfold, with a 76% probability that the US government will shut down again before January 31st.

Betting odds on the likelihood of a US government shutdown before January 31st. Source: Polymarket

Betting odds on the likelihood of a US government shutdown before January 31st. Source: PolymarketSimilar bets also indicate a 77% probability that the US government will face Capital shortfalls by January 31st. If this happens, experts predict it could face four main risks:

- Delays in the release of economic data.

- There is a possibility of a credit rating downgrade.

- Liquidation in the market is frozen.

- GDP growth could fall by around 0.2% per week if the deadlock continues.

“Most people are ignoring this risk, but the threat of a shutdown is becoming increasingly apparent. Deadlines are approaching, budget negotiations are stalled. When the government slows down, everything else slows down too. Payrolls are delayed, contracts are suspended, decisions are postponed. At first, the market won’t care, but at some point, things will change unexpectedly,” said Justin Wu , a DeFi researcher.

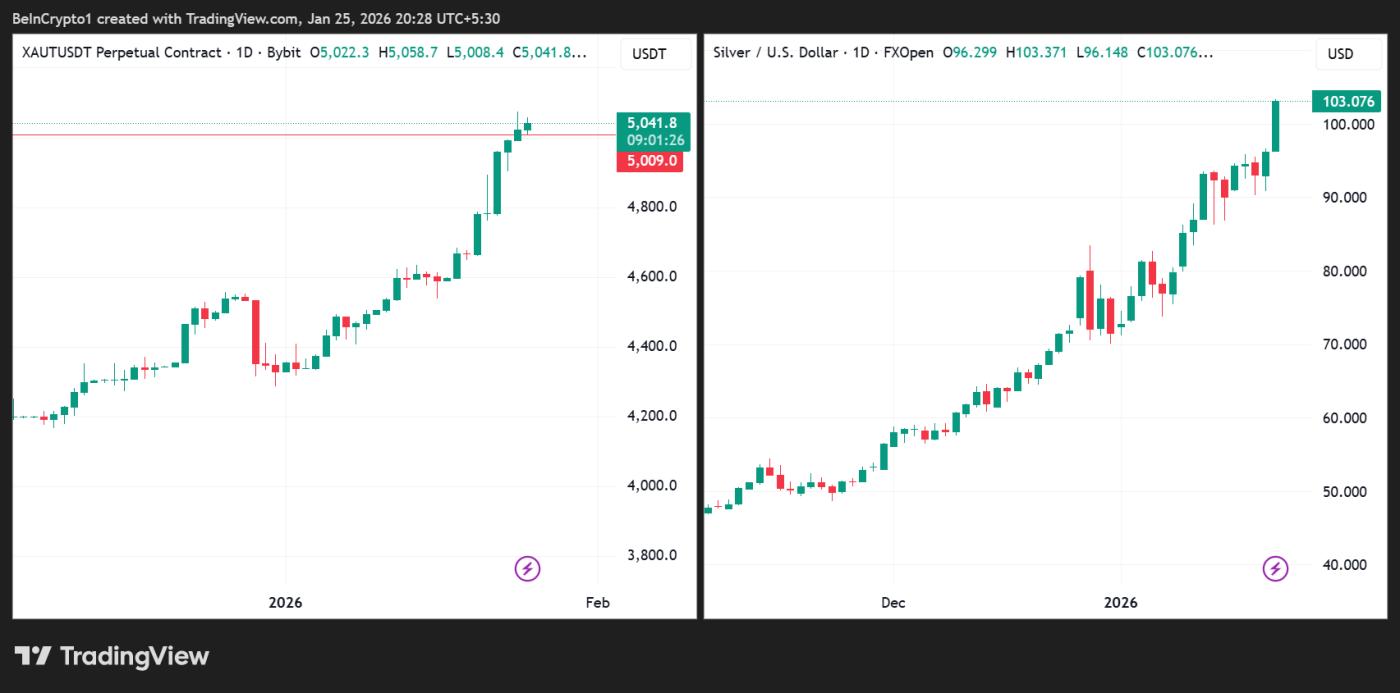

Safe-haven metals rise as crypto volatility increases amid closure risks.

Precious metals are the clearest beneficiaries. Gold prices have reached a new high above $5,000 per ounce , trading at $5,041 at the time of writing. Meanwhile, silver prices have surpassed the $100 mark for the first time , trading around $103.07 per ounce at the time of writing.

Gold (XAU) and silver (XAG) price movements. Source: TradingView

Gold (XAU) and silver (XAG) price movements. Source: TradingViewBesides the safe-haven factor, supply shortages in the market , demand for silver from the electronics and solar energy industries, and broader geopolitical concerns are also strongly supporting the upward trend of these two metals.

Historical precedent reinforces this trend because during the budget shutdown at the end of 2025 , the price of gold rose from around $3,858 to over $4,100 per ounce. In addition, silver also tested the $54 mark, reflecting safe-haven sentiment and insurance premiums for uncertainty.

In contrast to traditional markets, the crypto market has experienced significant volatility amidst this uncertainty. Bitcoin, the largest cryptocurrency, fell by approximately 20% in the 43 days leading up to the 2025 budget cut . Bitcoin remains highly sensitive to liquidation shocks and delayed economic data, leading many investors to become more cautious.

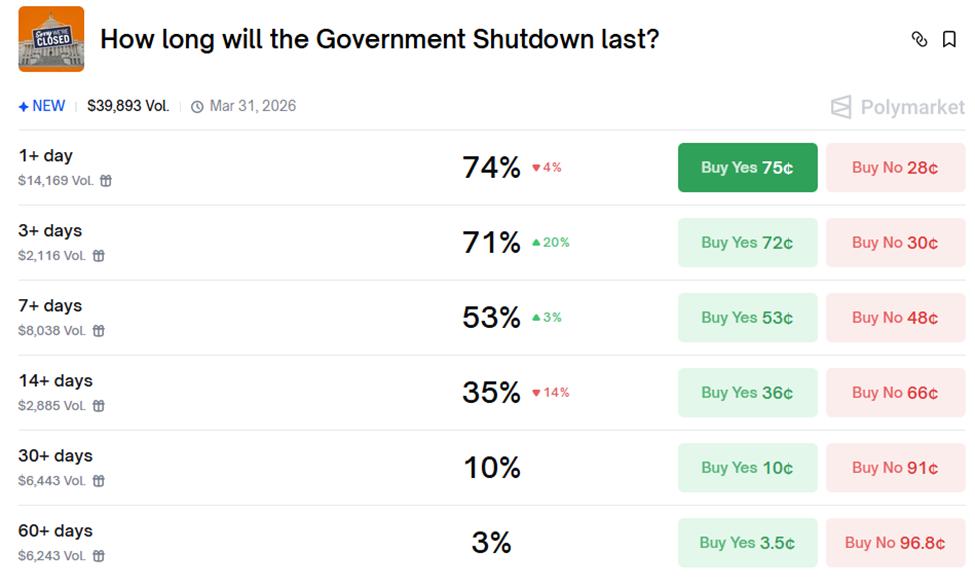

If the budget shutdown continues, pressure on the repo market and money market funds could worsen, with some predicting the possibility of a US government shutdown lasting up to two months.

The probability of an extended US fiscal shutdown. Source: Polymarket

The probability of an extended US fiscal shutdown. Source: PolymarketAlthough the risks are quite high, a budget shutdown is not a certainty. The US Congress can still prevent this by passing remaining spending bills or extending the budget temporarily once more.

“…we just went through the longest budget shutdown in history just a few months ago…obviously nobody really wants this to happen again,” Chia Rachel Bade, co-host of The Huddle.

Recent bipartisan agreements have helped mitigate risks, but with the Senate still deadlocked and the January 30 deadline less than a week away, investors are still assessing the potential for instability as quite significant.

Against this backdrop, investors on Polymarket continued to place their bets, while the prices of gold and silver continued to rise. This stems from the view that during times of political instability and financial hardship, safe-haven assets like gold and silver often act as a protector of value for investors.

However, it should also be noted that the market could fluctuate sharply in either direction depending on the outcome of this deadlock. Therefore, investors should conduct thorough research before making any decisions.