Author: Zhou , ChainCatcher

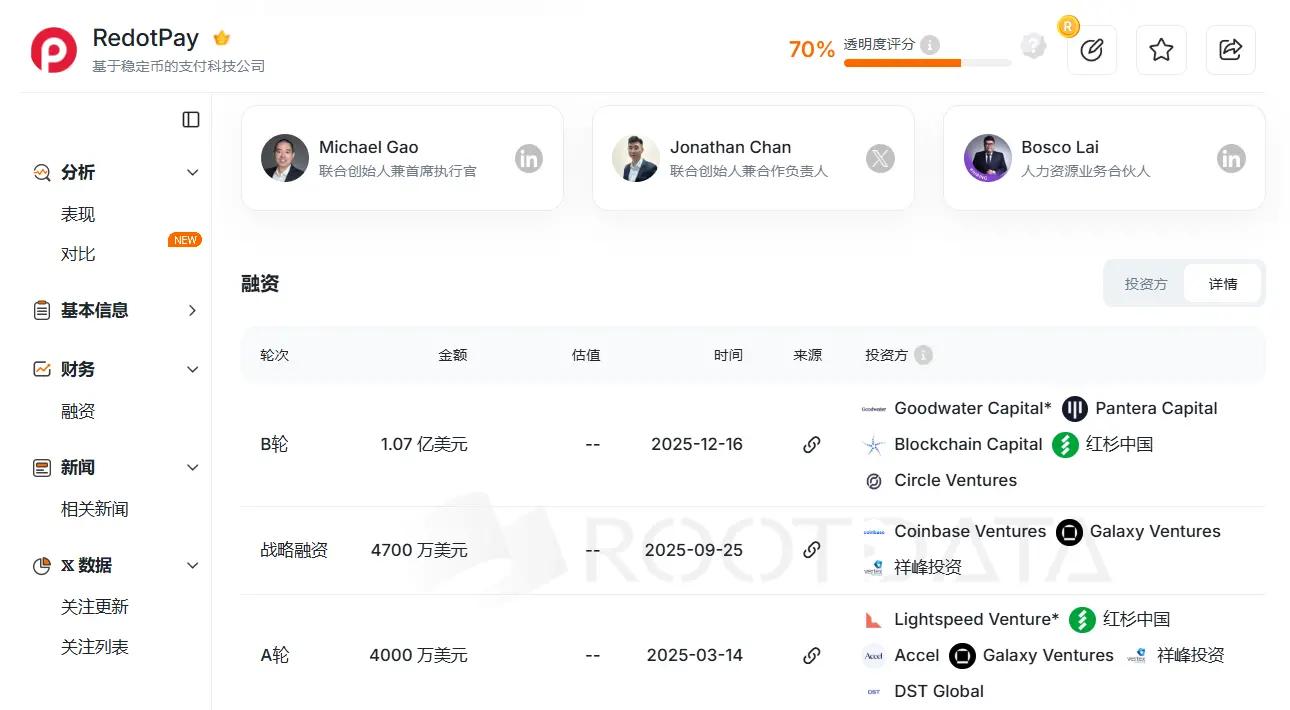

In late 2025 , Hong Kong-based crypto payment company RedotPay completed a $ 107 million Series B funding round led by Goodwater Capital , with top institutions such as Sequoia China, Pantera Capital , and Circle Ventures among the investors.

Image from RootData

Why did it become a dark horse in the payment industry?

RedotPay 's story began in early 2023. Its co-founder and CEO, Michael Gao, previously worked for top banks such as HSBC and DBS , and was also a core member of the crypto technology service provider ChainUp . Furthermore, the company's COO, Troy Yao , and CTO, Xinman Fang, both have years of experience in the crypto industry or software development, having come from platforms such as Huobi or VCB .

According to sources, RedotPay was initially incubated by Yuan Dawei, who began researching Bitcoin in 2010. He was one of the early co-founders of Huobi and the founder of Cobo Wallet. He had a deep influence and trust among early Bitcoin investors and miners, and was one of the key players behind several popular tokens in recent years. He was also familiar with the early user growth and narrative logic of the crypto industry.

The team's background determined that RedotPay followed a typical Chinese internet strategy: first, seize market share at any cost; then, after achieving economies of scale, raise funds continuously; and finally, monetize through diversified financial services.

Specifically, RedotPay 's core business is driven by a Visa co-branded debit card. Users can deposit cryptocurrencies such as USDT and BTC into the app and then use the card for instant settlements across the global Visa payment network, including offline ATM withdrawals, supermarket card payments, online subscriptions, and Apple Pay/Google Pay . The system automatically completes the clearing of cryptocurrencies to fiat currency.

Building on this foundation, RedotPay has further developed Global Payout (local fiat currency payment), a P2P fiat currency trading zone, and the Earn & Credit financial module, which features interest-bearing and lending functions.

- Visa payment card: Supports direct settlement with stablecoins, covering more than 100 countries worldwide.

- Global Payout : Supports direct withdrawal of local fiat currency (such as BRL , NGN ).

- OTC and P2P Markets: By introducing local OTC merchants, users can directly buy or sell cryptocurrencies in their local currency.

- Earn : Increase the length of time funds remain in the portfolio through financial products.

- Crypto Credit : Provides credit lines secured by cryptocurrencies.

Image from RedotPay APP

RedotPay 's early focus was heavily on emerging markets with volatile fiat currencies, such as Nigeria, Brazil, and Southeast Asia.

- May 2023 : RedotPay officially launched in Hong Kong and quickly obtained an MSO license.

- October 2023 : Officially launched virtual and physical Visa cards, supporting Apple Pay and Google Pay .

- August 2024 : User base exceeded 5 million.

- March 2025 : Completed a $ 40 million Series A funding round, led by Lightspeed .

- June 2025 : Global Payout feature officially launched.

- September 2025 : Received $ 47 million in strategic investment, introduced capital from Coinbase Ventures and others, and its valuation reached the $ 1 billion mark.

- October 2025 : Announced that the P2P market now supports transactions in more than 50 local fiat currencies.

- December 2025 : Completed a $ 107 million Series B funding round, attracting top-tier institutions such as Sequoia China, Pantera Capital , and Circle Ventures . Simultaneously, the company officially disclosed that it has over 6 million registered users globally, annualized payment volume exceeding $ 10 billion, covering over 100 countries, and has already achieved profitability.

According to sources, RedotPay currently has over 10 million registered users worldwide, and its latest valuation may reach $ 2 billion . From its official launch in 2023 to achieving stable profitability, RedotPay has taken less than three years, a rare feat in the illiquid crypto market.

Its growth logic is based on a combat model known as the " Army System. " Simply put, it abandons high-cost online user acquisition and instead builds an offline distribution network .

An anonymous crypto card entrepreneur emphasized that RedotPay initially relied almost entirely on this ground-based sales system, maintaining high activation fees and transaction fees to allow for significant profit margins for its offline sales team. Currently, its virtual card activation fee is $ 10 , and its physical card is $ 100 , with each transaction including approximately 1% in transaction fees.

The high profit-sharing mechanism allows every local KOL , OTC merchant, community leader, and even micro-loan intermediary to become a promoter of RedotPay .

An industry observer stated that RedotPay experienced a leap in traffic in early 2025 , with almost all of it coming from user-initiated searches . This indicates that it generated word-of-mouth among users in various scenarios, making its customer acquisition efficiency among the top in the industry in the early stages.

According to official data, as of November 2025 , RedotPay added over 3 million new users that year alone, with its annual payment volume nearly tripling year-on-year. Industry insiders say that among RedotPay 's users, there may be a core group of users with high spending power and frequency, who contribute a significant proportion of the company's revenue .

The valuation premium behind NeoBank's closed loop

However, how far can a strategy of relying on high fees to maintain incentives go?

Although users are willing to pay high costs at this stage, the model of relying on high fees to " feed " offline agents is essentially exchanging financial interest rate spreads for growth rate.

In the fiercely competitive environment of crypto payments in 2026 , RedotPay seems to be caught in a paradox: to maintain agent loyalty, it must keep high profit sharing; but to cope with the encroachment of licensed giants, it must lower its fees.

The high valuations given by the capital market are clearly not just about paying for the spread . In fact, what capital values is who can get users to keep their money in the bank, and the market is currently paying a premium for this potential banking attribute .

RedotPay's real value lies in its high level of integration from a payment tool to a crypto-native bank ( NeoBank ).

Simple payment channels have extremely low profit margins and are easily replaced. RedotPay, on the other hand, builds a complete closed-loop fund system of " top-up - earn interest - borrowing - consumption " through Earn interest and Crypto Credit lending functions, so that users no longer have to top up and leave immediately.

Under this logic, users deposit USDT into the app , retain the funds through the Earn (interest-bearing) function, and then use Credit (collateralized lending) to obtain fiat currency for consumption. As industry observers have noted, even if only 10% of the $ 10 billion transaction volume is converted into retained funds, the resulting interest spread and financial derivative income will make its profit margin far exceed that of traditional payment methods.

According to Boyan, head of marketing at BKJ, the key to RedotPay 's success lies in its early willingness to make product decisions based on real-world usage scenarios, because users' real needs are the driving force behind its development .

However, behind this seemingly perfect closed loop lies a liquidity game. Boyan also cautioned that if there is a lack of sufficient risk control buffers between interest income, credit extension, and consumption, the highly nested financial closed loop may face significant pressure risks during extreme market conditions or liquidity shortages .

Whether assets have achieved true legal segregation under the NeoBank shell is the next question it must answer.

Compliance concerns and the race against boundaries

From another perspective, RedotPay actually took advantage of the window of opportunity when regulations had not yet fully covered emerging markets to complete a race between efficiency and compliance boundaries.

After all, the booming payment sector is always hampered by the Damocles' sword of compliance.

Chaintech founder Kevin Piao emphasized that the well-known " compliance cliff " theory also applies to the Web3 payment field, namely that the smaller the scale, the safer it is, and the larger the scale, the more dangerous it is.

Rapid early growth often stems from exploiting regulatory gray areas or the lag in bank risk control. However, once transaction volume exceeds a certain threshold (e.g., tens of millions of US dollars per month), it triggers in-depth compliance audits by the issuer and clearing network ( Visa/Mastercard ). Many once-popular crypto card vendors have failed at this point.

Despite RedotPay's active efforts to achieve compliance and the high costs associated with compliance maintenance, the challenge it faces remains the dynamic upgrading of regulatory standards.

RedotPay employs a " puzzle-like compliance " structure. Although it holds MSO (Money Service Operator), Money Lender , and TCSP (Trust or Corporate Service Provider) licenses in Hong Kong, and is registered as a VASP in Lithuania, Argentina, and other countries, this does not mean it can rest easy.

Mankiw law firm lawyer Liu Honglin analyzed that this combination is generally able to " run the business and explain itself to regulators " , but it is not a license that can cover everything.

Why is it called a jigsaw puzzle? Because it actually combines several traditional financial businesses that are completely different in legal jurisdiction, such as receiving payments, exchanging currency, transferring funds, cross-border payments, lending, and earning interest.

The biggest risk of this structure is that some links in the product chain may only " look similar " but remain in a gray area in terms of legal characterization .

Lawyer Liu Honglin pointed out that Hong Kong's MSOs essentially regulate " fiat currency exchange, " but " stablecoin to fiat currency " is not automatically considered a currency exchange business in many countries. Furthermore, the real regulatory gray area lies in the enforcement of guarantees for crypto-collateralized lending and the nature of Earn products.

Regarding the Earn interest-bearing function, which has attracted significant capital attention, Attorney Liu stated bluntly that such products are highly likely to be considered unregistered securitized products or collective investment schemes under the regulatory perspectives of many countries. " If regulators believe you are issuing a financial product with expected returns to the public, you should be subject to securities laws, not circumvent them with ' crypto innovation. ' The heavy penalties imposed on BlockFi by the US SEC serve as a cautionary tale. "

In the realm of Crypto Credit , while a lender's license resolves the " lending qualification, " the legal certainty of crypto assets as collateral is far weaker than that of traditional collateral. In the event of extreme market conditions or liquidation disputes, there is currently a lack of a mature legal framework to ensure that the collateral rights can be upheld by the courts.

Conclusion

The crypto market in 2026 is in a window of opportunity for IPOs , with RedotPay and its competitors accelerating their efforts. In January of this year, its core competitor Rain announced the completion of a $ 250 million Series C funding round, valuing the company at $ 1.95 billion.

For RedotPay , the license is merely a shell; its true strength lies in its ability to maintain continuous compliance, which is precisely the team's weakest link. Whether it can mend its puzzle-like structure through compliance before regulatory crackdowns will determine whether it ultimately becomes a financial giant in the crypto world or merely a shooting star in payment history.

In short, this race about efficiency, greed, and boundaries has entered its second half.