So, FOMC tomorrow, no rates move expected…

But let’s take a moment to look at corporate earnings, which arguably have an increasingly significant impact on the US economy and on household wealth…

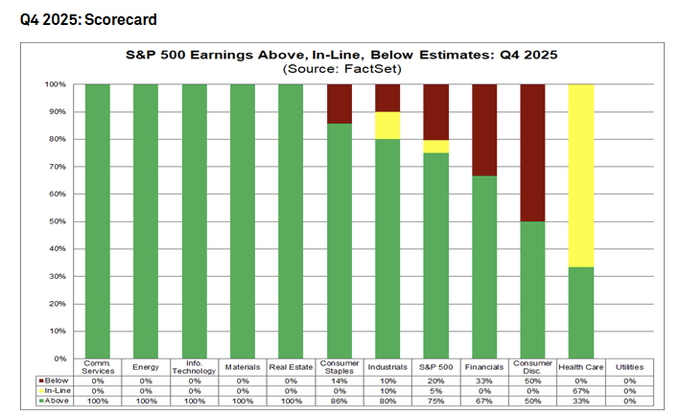

With reporting season under say, earnings are doing well… /1

(chart @FactSet)

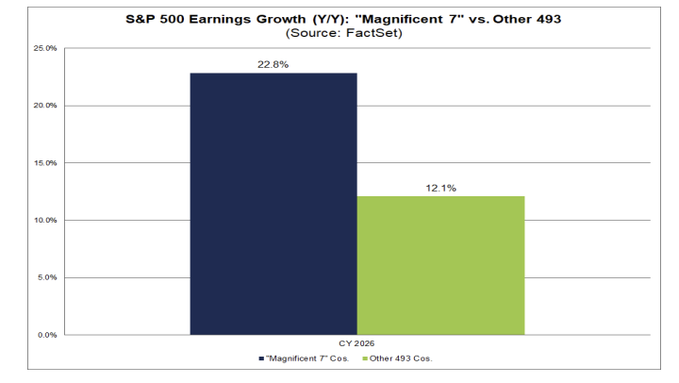

What’s more, they’re expected to continue to do well in 2026.

Even the components of the S&P 500 outside the Mag5 are expected to see 2026 earnings growth of >12%, vs ~4% in 2025.

That’s pretty good. /2

(chart @Factset - links below)

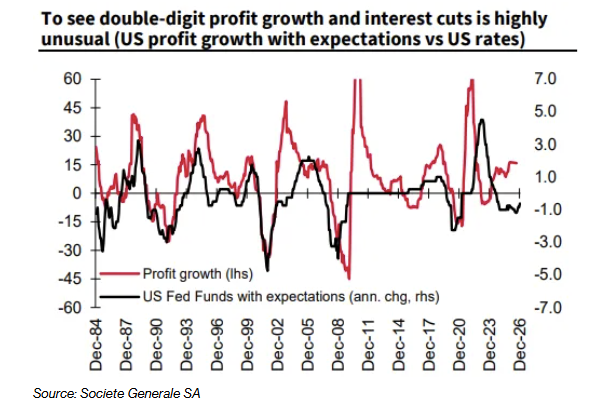

BUT periods of high earnings growth usually DO NOT COINCIDE with rate cuts. Very unusual.

Why would this time be different? Rick Rieder says “mortgage rates”, but they aren’t decided by FOMC moves, they’re more closely linked to the long-term bond market. /3

(chart @opinion)

And the jobs market may be slowing but not crashing, arguably healthy given the drop in the workforce and the AI impact.

So, seriously, why – in a time of solid and rising earnings – would the FOMC feel the need to lower rates?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content