There is a seat belt but no car

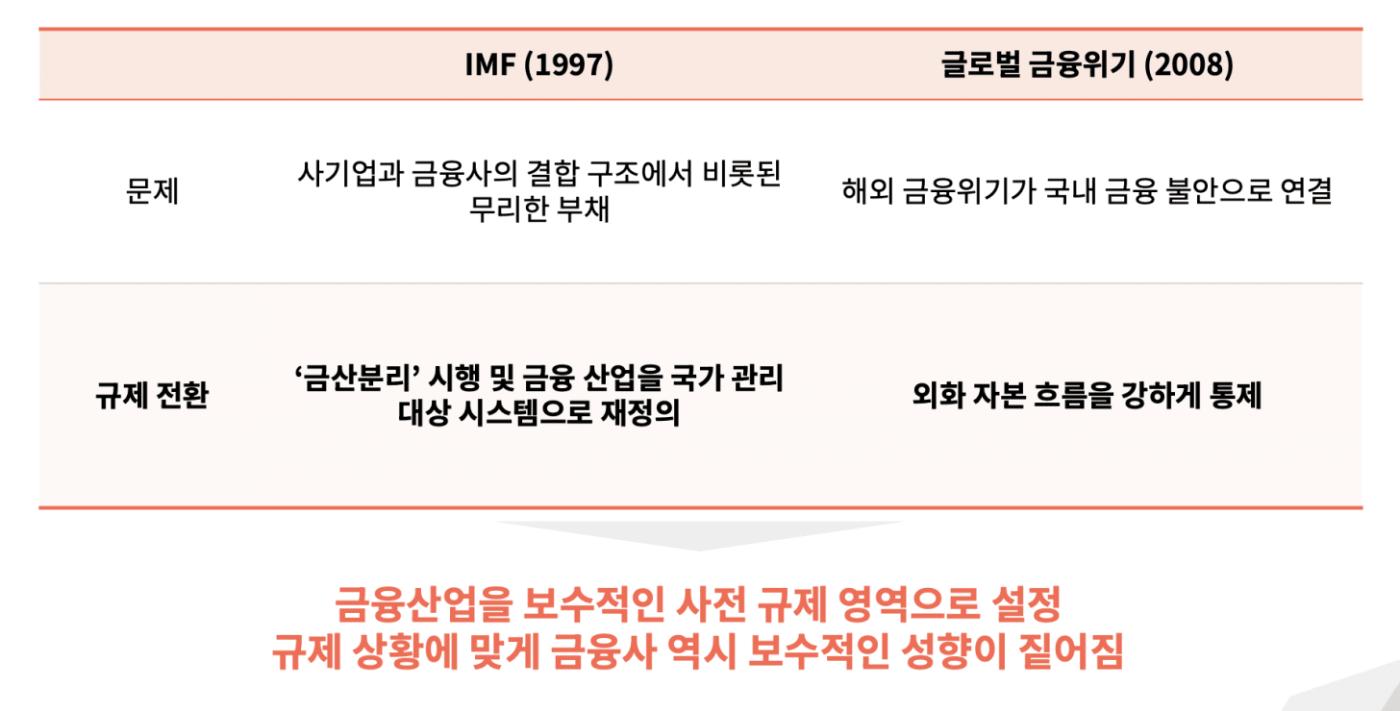

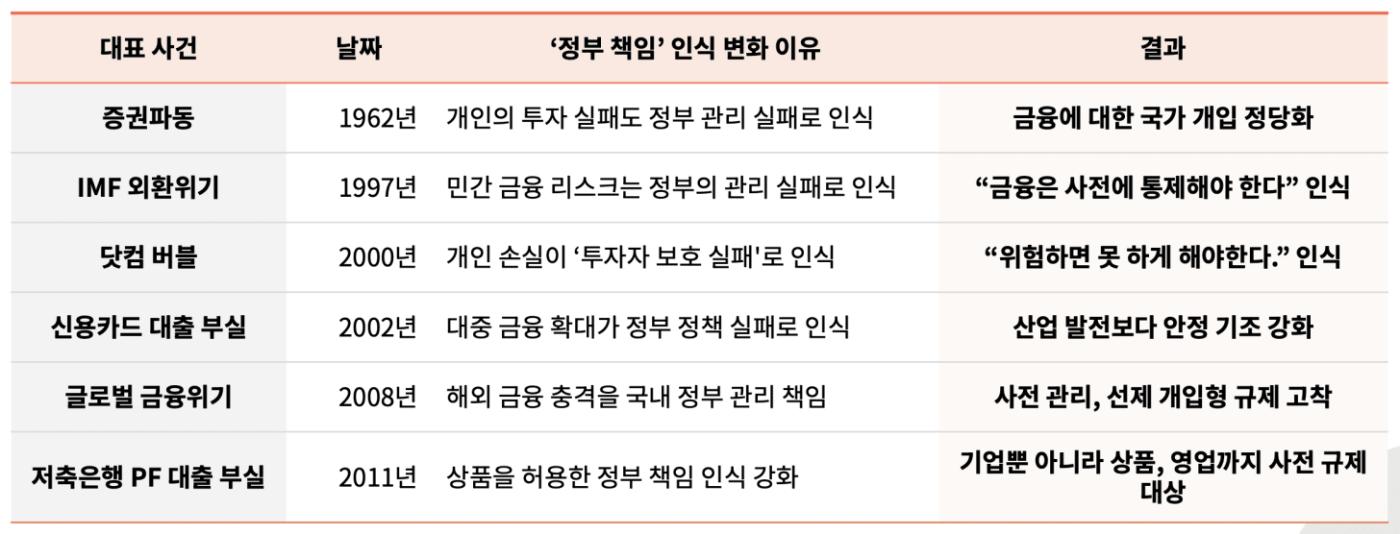

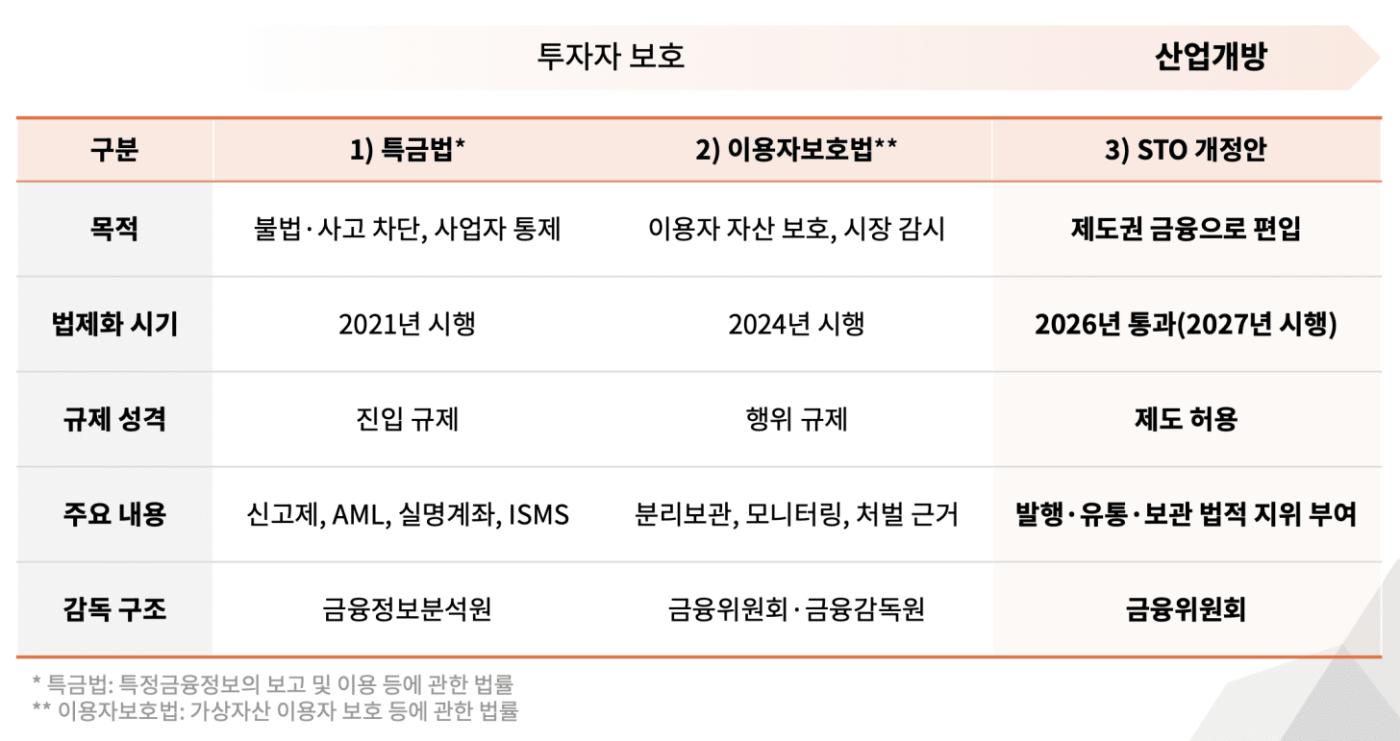

Korea's virtual asset regulation is based on a "preemptive regulation" structure. This "preemptive regulation" structure has persisted through the IMF foreign exchange crisis and the global financial crisis, and continues to apply to the web3 industry. Accordingly, over the past decade, the Special Financial Transactions Act (2021) and the User Protection Act (2024) have focused on investor protection-focused regulations.

The recently passed STO amendments are attempting to achieve limited institutional integration, and the following four key discussions are underway.

Spot ETFs: The current administration is continuously considering introducing virtual asset spot ETFs in its presidential campaign pledges and economic growth strategy.

The Korean Won Stablecoin: The Financial Services Commission maintains an industrial policy perspective that allows fintech participation, while the Bank of Korea maintains a monetary stability perspective that advocates a 51% bank consortium (the most acute issue).

Virtual Asset Taxation: Taxation of individual virtual asset transactions has been delayed for several years, but is expected to be fully implemented in 2027.

Exchange share limits: The Financial Services Commission's proposal sparked a debate, and the Digital Assets Association (DAXA) officially expressed its opposition.

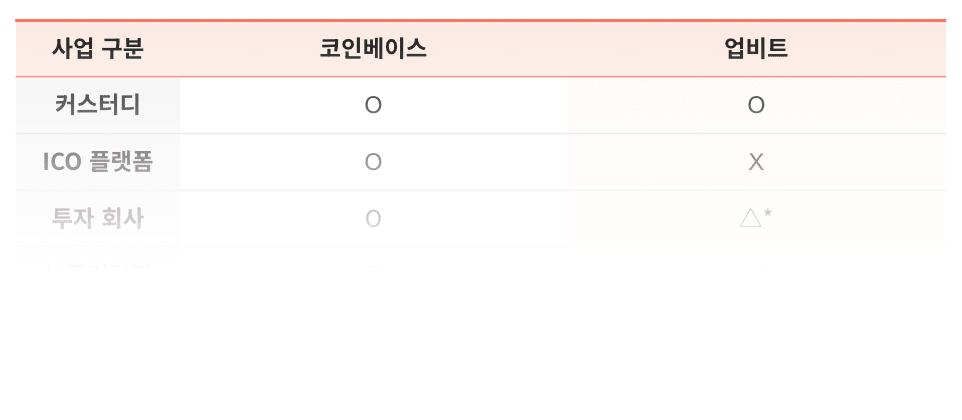

The most disappointing aspect of this report is that the exchange's focus on "transaction intermediation" has fundamentally blocked its expansion into custody, brokerage, and ICO platforms. Unlike Coinbase, which has evolved into a comprehensive crypto finance platform, Upbit remains solely an "exchange," failing to generate a trickle-down effect for the development of the domestic ecosystem.

In short, while Korean regulations succeeded in "accident prevention," they failed to "promote industry development." It's like having a seatbelt but no vehicle to ride in. Despite being the most active participant in the global Web3 ecosystem, Korea has failed to foster the ecosystem, resulting in a market but no industry.

Even now, we need to transition to a regulatory leader where investor protection and industrial innovation coexist through close dialogue with industry.

Key regulations in Korea you need to know in 2026. From discussions about introducing spot ETFs to the conflict between the Financial Services Commission and the Bank of Korea over won-denominated stablecoins, check out the key issues you absolutely must watch in the Korean market in 2026.

📥 Download the 2026 Key Regulatory Report

The basic tenet of Korean financial regulation = "ex-ante regulation."

A culture that blames government for failure

From investor protection to limited industry opening

1) Special Act: Limiting the trickle-down effect of exchanges

📥 Download the 2026 Key Regulatory Report

Disclaimer

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.