Hypersurface is a decentralized finance protocol specializing in volatility yield mining, currently operating on the Base and HyperEVM networks. The project provides financial tools that help users transform market volatility into cash flow through Derivative strategies and sophisticated order management. Let's explore this project further in the article below.

What is Hypersurface? Learn about the protocol for profiting from price fluctuations.

What is Hypersurface? Learn about the protocol for profiting from price fluctuations.

What is Hypersurface?

Hypersurface is a profit-optimizing platform designed to help users profit from the price volatility of cryptocurrency assets. Instead of simply holding assets (HODL) or providing liquidation , Hypersurface allows users to participate in more complex strategies such as options trading in an automated manner.

What is Hypersurface?

What is Hypersurface?

The project Vai as an intermediary layer, simplifying access to Derivative instruments for the general public while providing high-performance trading infrastructure for professional traders. Hypersurface's key feature lies in leveraging the abundant liquidation on HyperEVM to execute financial strategies with low latency and optimized costs.

Key features of Hypersurface

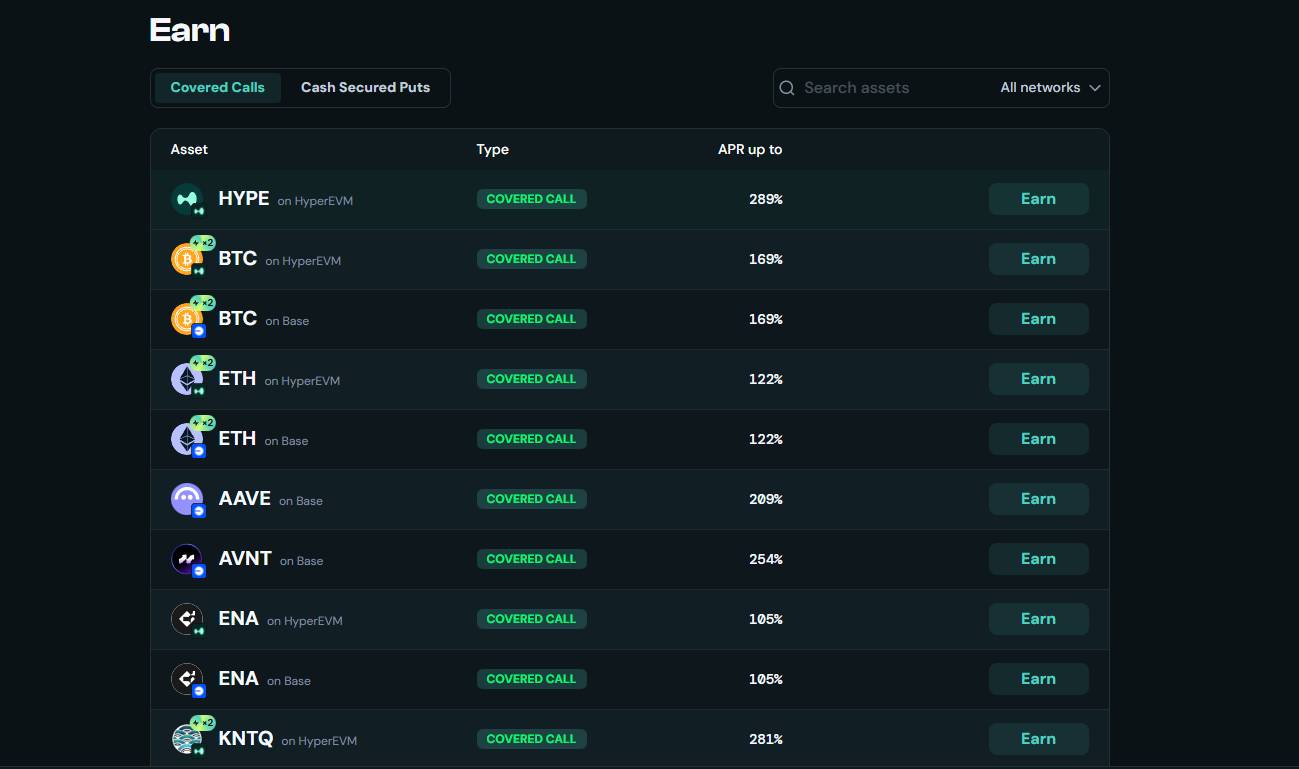

Earn

Earn feature

Earn feature

This is the core product that helps users generate profits. Users deposit assets (ETH, SOL , or Token on the Hyperliquid system) into strategy pools, and the system executes a strategy of selling covered Call Option . Users receive option premiums from those who buy the options. This is the main source of income, helping to increase the amount of Token held over time.

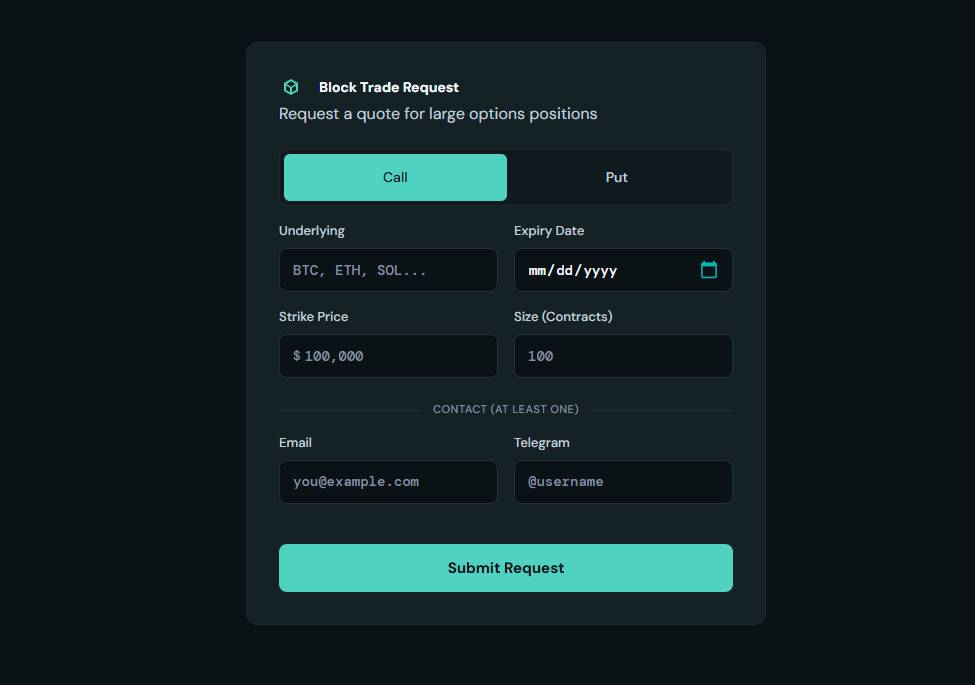

Block Numbers

Block Orders feature

Block Orders feature

This tool is designed for institutional or individual traders who need to trade large volumes. Instead of placing orders directly on a Order Book and causing significant price volatility, Block Orders allow for the execution of large orders confidentially or through separate auction or agreement mechanisms. This ensures transactions are executed at the best possible price and protects users from price manipulation (MEV).

How Hypersurface works

Hypersurface operates based on the Volatility Yield model. The system continuously monitors market volatility indicators to adjust parameters in the options strategy.

When the market experiences high volatility, option fees increase, allowing users in Earn pools to earn greater profits. This entire process is executed through automated smart contracts, ensuring transparency and eliminating the need for third-party intervention. Specifically, when implemented on HyperEVM, the project leverages a high-speed matching engine to optimize execution efficiency.

Development team

The Hypersurface development team consists of two main members:

- Monica Quaintance - Co-founder & CEO : Advisor at Kadena. She also previously worked as a Senior Data Engineer at Rent the Runway.

- Andrei Anisimov - Co-founder & CTO : Formerly a software engineer at Coinbase.

Investors

As of now, Hypersurface has not disclosed details about Capital rounds or the amount of Capital raised from investment funds. Coin68 will update when more information becomes available.

Summary

Above is all the information about the Hypersurface project. Coin68 hopes that readers have grasped the basic information to better understand the project and how it works. We wish you more useful knowledge!

Note : The information in this article is for informational purposes only and is a compilation of publicly available information about the project; it is not investment advice. Coin68 is not responsible for any financial decisions you make.