In this article, the RockFlow investment research team will outline the 2026 non-ferrous metals allocation strategy for US stock investors from aspects such as the paradigm shift in non-ferrous metals, the deep value of copper, aluminum, tin and nickel, and a multi-dimensional analysis of non-ferrous metal giants.

Article author and source: RockFlow

Key points

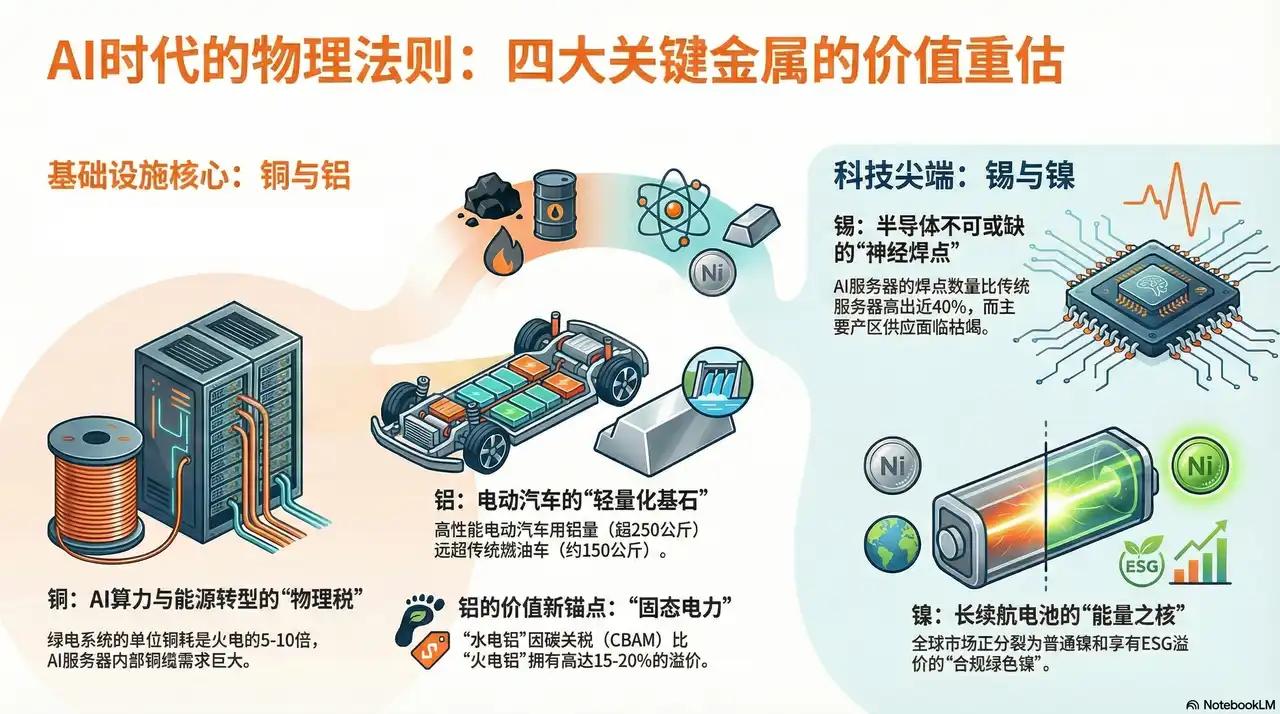

① Over the past two decades, the internet has reshaped the world, but it has also led investors into the trap of "bits devouring atoms." For a long time, non-ferrous metals have been solidified as a "traditional industry." But in 2026, industrial metals will no longer be simply cyclical stocks that follow the trend, but rather "priority beneficiaries" of the AI physical foundation.

② We are at a singularity in the great migration of energy media: copper, as the lifeblood of computing power, faces grade deflation; aluminum, as "solid-state electricity," enjoys a full premium; tin has become a silent tax in the miniaturization of semiconductor packaging; and nickel has regained its valuation sovereignty with the return of high-nickel batteries. The "perfect storm" on both the supply and demand sides has taken shape, and the production lag caused by the decade-long capital expenditure gap is making existing mineral resources burst with greater value.

③ In 2026, the key to success in investing in non-ferrous metals will no longer be profiting from price fluctuations, but rather locking in scarce resources. McMoran (FCX) leverages its extreme cost anchoring to compete with early energy giants, while Alcoa (AA) fully capitalizes on energy arbitrage. Against the backdrop of fluctuating dollar credit, heavily investing in the physical world and embracing non-ferrous metals is not only a must for asset hedging, but also a ticket to the AI revolution.

Over the past two decades, most investors have been immersed in the illusion that “bits” are devouring “atoms”, firmly believing that software defines everything and that algorithms are enough to reshape the world.

However, looking at 2026, reality has made more investors realize that the end of AI is not code, but electricity; and the end of electricity is not just energy, but also non-ferrous metals such as copper, aluminum, tin, and nickel.

As the computing power race among tech giants intensifies, commodities such as copper, aluminum, tin, and nickel are quietly undergoing a belated revaluation. What we are experiencing is not just another supercycle in non-ferrous metals, but a battle for pricing power in industrial metals.

In this article, the RockFlow investment research team will outline the 2026 non-ferrous metals allocation strategy for US stock investors from aspects such as the paradigm shift in non-ferrous metals, the deep value of copper, aluminum, tin and nickel, and a multi-dimensional analysis of non-ferrous metal giants.

1. In-depth scanning of four major non-ferrous metals: searching for the physical alpha of the AI era.

For a long time, non-ferrous metals have been categorized as a "traditional industry." The market has been accustomed to looking at real estate construction starts, infrastructure growth, and home appliance shipments to deduce demand.

But by 2026, this old map will no longer be able to guide us to new routes. We are undergoing a "great migration of energy media": from chemical energy based on "molecules" (carbon, hydrogen) to "physical energy" based on "atoms" (copper, aluminum, tin, nickel).

If copper is the irreplaceable "blood vessel" in this migration, then aluminum, tin, and nickel respectively constitute the skeleton, nerves, and heart of the modern industrial system.

Copper: The "Physical Foundation Tax" for AI and the Energy Transition

If everyone was scrambling for GPUs in 2024 and 2025, then in 2026 global giants will be scrambling for copper mining share.

The development cycle for copper mines is as long as 10-15 years. Currently, major copper mines worldwide (such as Escondida in Chile) are facing inevitable grade decline. Twenty years ago, mining one ton of ore could produce 10 kilograms of copper; now it only yields 4 kilograms. This means that mining companies must mine twice as much rock to maintain production—an unsolvable physical deflation.

If oil is the lifeblood of the industrial age, then copper is the nerves and blood vessels of the digital age. It is the only carrier that combines cost advantage and conductivity on a large scale, making it the most insurmountable bottleneck in AI computing power and the new energy revolution.

In the past, the market believed that data centers were undergoing a "fiber-to-the-home" transition, with long-distance transmission inevitably replacing copper cables. However, with Nvidia's Blackwell (GB200) and even subsequent architectures, the laws of physics are beginning to challenge this trend.

In pursuit of ultimate response speed and reduced cooling power consumption, the connections within server racks have largely reverted to direct-connect copper cables (DACs). Over extremely short distances, the latency and energy consumption caused by photoelectric conversion have become bottlenecks for AI inference. Within each GB200 NVL72 rack, the length of copper cable connections can reach several miles.

This means that for every high-performance chip that tech giants buy, they are not only paying money to Nvidia, but also paying a "physical infrastructure tax" to copper mine owners worldwide. The stronger the computing power, the more pronounced the "black hole effect" on copper becomes.

Aluminum: "Solid-State Electricity" and Structural Premium in the Era of Carbon Reduction

If the demand for copper stems from its electrical conductivity, then the long-term growth logic of aluminum is rooted in its dual attributes as a "lightweight cornerstone" and an "energy carrier".

Under the global decarbonization narrative of 2026, the demand curve for aluminum has completely decoupled from real estate. To offset the weight of bulky batteries and improve range, electric vehicles (EVs) are undergoing a comprehensive "aluminization" revolution.

According to relevant data, traditional gasoline-powered vehicles use approximately 150 kg of aluminum per vehicle, while high-performance pure electric vehicles have exceeded 250 kg. In particular, Tesla's "integrated die-casting" technology integrates dozens of steel chassis parts into a single massive aluminum alloy casting. This is not merely a technological advancement, but a cross-dimensional substitution of steel by aluminum. By 2026, the increased demand for aluminum in the automotive sector alone will be enough to offset the decline in the traditional construction industry.

On the supply side, aluminum production is an extremely energy-intensive process, requiring approximately 14,000 kilowatt-hours of electricity to produce one ton of aluminum. Therefore, aluminum is also known as "solid electricity."

In 2026, global electricity prices fluctuated dramatically due to geopolitical factors and economic transition. At this time, aluminum companies with self-sufficient clean energy (such as hydropower) (like Alcoa) built a formidable competitive advantage. With the formal implementation of the Carbon Credit Act (CBAM), each ton of "hydropower aluminum" commanded a premium of approximately 15%-20% over "thermal power aluminum."

The rise in aluminum prices is essentially a cost compensation for the disappearance of cheap electricity globally.

Tin: The "nerve endings" behind the semiconductor boom

If copper is the blood vessels, then tin is the nerve solder joints of the electronic world. It is the indispensable "glue" for all electronic components, a property that makes it a direct beneficiary of the semiconductor cycle.

Globally, 50% of tin is used in electronic solder. In the year 2026, the year of AI inference, the increasing complexity of hardware architecture will lead to a "second explosion" in tin consumption. Taking high-performance servers as an example, NVIDIA's Blackwell architecture uses chiplet packaging technology, which allows the density of logical connection points in a single processor to increase exponentially.

According to research, the number of solder joints inside AI servers is nearly 40% higher than that in traditional general-purpose servers. This means that no matter how the underlying architecture evolves, as long as electromigration continues, tin will remain an unavoidable "silent tax."

Meanwhile, tin supply is highly concentrated in Indonesia, Myanmar, and Peru. In 2026, Wa State in Myanmar—once a major supplier of 10% of global tin production—faced resource depletion due to long-term over-exploitation, resulting in a precipitous drop in production. Simultaneously, Indonesia followed suit with its nickel mining ban, comprehensively tightening its primary tin export controls.

With this mismatch between historically low inventory levels and explosive demand driven by industry upgrades, tin prices are experiencing a surge that is detached from the macroeconomic cycle. It is currently the non-ferrous metal with the tightest supply-demand relationship and the greatest upward elasticity.

Nickel: The "energy core" of power batteries

Nickel's narrative hit a low point in 2024-2025 due to overcapacity in Indonesia, but in 2026, with the return of demand for high energy density, nickel regained its valuation sovereignty.

Despite the prevalence of LFP (lithium iron phosphate) batteries in the low-to-mid-range market, high-nickel ternary batteries (such as NCM811) will remain the "pillar of long range" in the global high-end passenger vehicle market in 2026.

In pursuit of a 1000km driving range on a single charge, automakers must continuously increase the proportion of nickel. Behind every long-range EV lies the consumption of 50-70kg of high-purity Tier 1 nickel. This extreme pursuit of "energy density" has effectively capped any downward pressure on nickel demand.

In 2026, the pricing power of nickel ore is undergoing a second shift.

Western giants (such as Vale) are using ESG principles to build non-tariff barriers. European and American governments have begun imposing carbon tariffs on Indonesian nickel, which relies on thermal power and is highly polluting. This has led to a split in the global nickel market into two parallel worlds: one is primary nickel, characterized by low prices and high carbon emissions; the other is "compliant green nickel" that enjoys a premium and is integrated into the supply chains of Europe and the United States.

This structural shortage has given compliant companies with top-tier mining rights unprecedented bargaining power.

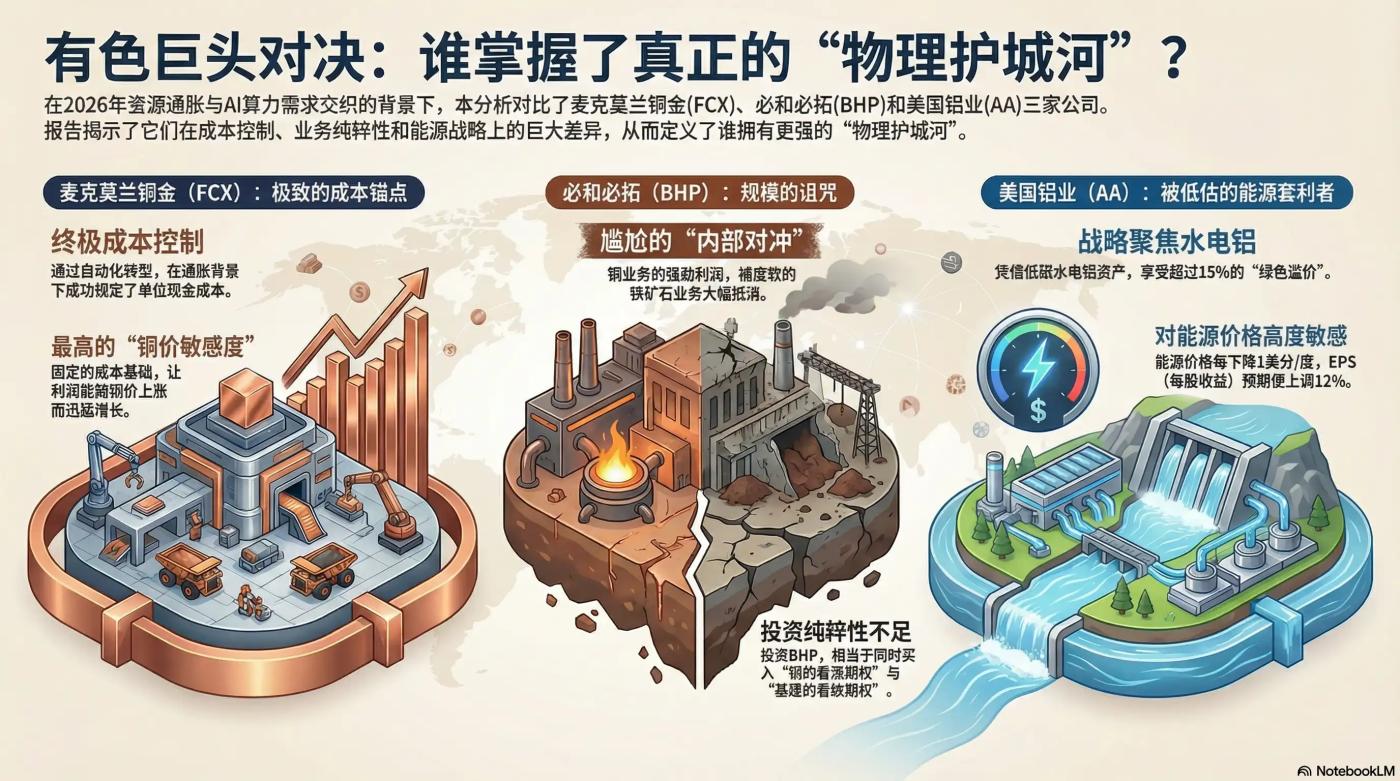

2. Dissecting the Non-Ferrous Metals Giants: Who Controls the "Physical Moat"?

In 2026, a pivotal year marked by the intertwining of resource inflation and the AI computing revolution, investing in non-ferrous metals is no longer simply a matter of "playing the cycle." The RockFlow research team believes that we need to deeply understand the giants and seek out Alpha opportunities that truly possess a "physical moat."

McMurland Bronze (FCX) vs BHP (BHP)

In the US copper sector, FCX and BHP are two unavoidable giants. However, through a thorough analysis of their fiscal year 2025 annual reports and Q1 2026 outlooks, we have found that their underlying logics have diverged dramatically.

FCX: The Ultimate "Cost Anchor" and Operating Leverage

The reason why the market is chasing McMorland (FCX) so hard in 2026 is not because it has mined more copper, but because of its cost control capabilities in the midst of inflation.

Located in Indonesia, the Grasberg mine is one of the world's largest gold and copper mines. FCX completed its automated transition from open-pit to fully underground mining in 2025. This means a dramatic decrease in unit energy consumption and labor costs.

According to its financial report, FCX has successfully locked in its unit net cash cost. Given the anticipated global rise in labor and energy costs in 2026, this is tantamount to an "anti-inflation privilege."

Due to its fixed costs, FCX's operating profit elasticity will increase rapidly when copper prices rise. It is currently the US stock market stock with the highest "copper price sensitivity" and the cleanest balance sheet.

BHP: The Curse of Scale and the Burden of Iron Ore

BHP, the world's largest mining company by market capitalization, presents an embarrassing "internal hedging" in its financial statements.

While BHP's copper business continues to expand in Chile and Australia, its iron ore business, which accounts for approximately 50% of its revenue, is facing a systemic crisis. The excess profits generated by BHP's copper business are largely offset by weak iron ore profits.

For investors seeking a premium in "AI computing power fuel," buying BHP is equivalent to purchasing a "call option on copper" plus a "put option on traditional infrastructure." This impurity makes it far less profitable than FCX in terms of alpha returns.

Alcoa (AA): An Undervalued "Energy Arbitrage" Giant

The key to success for aluminum companies lies in energy costs.

In 2025, AA made a highly strategic move: decisively closing inefficient smelters in high-electricity-price regions and instead increasing its investment in hydroelectric aluminum production bases in Iceland, Norway, and Australia. With the formal implementation of the Carbon Tax Act (CBAM) in 2026, low-carbon aluminum (hydroelectric production) will have a 15%-20% green premium over thermal aluminum.

According to its financial outlook, AA's performance is highly sensitive to energy prices. Financial models show that for every 1 cent per kilowatt-hour decrease in average energy prices, its EPS (earnings per share) is expected to increase by 12%. As the cost of connecting renewable energy to the grid continues to thin globally, AA is enjoying a silent "energy dividend."

3. 2026 Portfolio Strategy: Shifting from "Paper Assets" to "Physical Sovereignty"

In 2026, industrial metals will no longer be simply cyclical stocks following the trend; they will be the "prime beneficiaries" of the AI physical foundation. Under the dual pressure of dollar credit volatility and explosive growth in physical demand, investors should shift their strategy from "profiting from price differences" to "locking in scarcity."

According to the RockFlow research team, the current price surge in non-ferrous metals is not a repeat of the old cycle. There are three reasons for a long-term bullish outlook:

1. A decade-long gap in CapEx (capital expenditure): Over the past decade, mining companies have been busy repairing their balance sheets, with exploration investment only reaching 30% of that in 2011. The lag in physical production has a rigid and irreparable 3-5 year timeframe.

2. The physical hedging of the dollar's hegemony: Global central banks are undergoing a process of "asset commodification." Metals are no longer merely industrial raw materials; they are regaining their attributes as reserve currencies.

3. ESG's reverse moat: Stringent environmental approvals make it virtually impossible for new mines to start operations. This means that existing compliant mines have become irreplaceable assets, and their premium will persist for a long time.

We are optimistic about the following US stock allocation strategy:

Core configuration (ballast): FCX + RIO

- McMoran (FCX): A pure copper industry leader, enjoying the absolute premium brought by computing power infrastructure.

- Rio Tinto (RIO): Although it also has iron ore, RIO made significant acquisitions of second-tier copper and lithium assets in 2025. Its extremely strong cash flow and high dividend policy make it an excellent choice to hedge against macroeconomic fluctuations.

Target of attack: AA

- Alcoa (AA): Capitalizing on energy arbitrage and the surge in demand for lightweight products, its profit elasticity ranks first among non-ferrous metals.

Target of defense: VALE

- Vale (VALE): The market currently still views it as an iron ore producer. However, VALE holds some of the world's top nickel resources, and with the return of high-nickel batteries to long-range driving solutions, VALE is at a critical juncture for value reassessment.

Conclusion: Embrace the "atom" and invest heavily in the physical world.

Storage investment teaches us a lesson: whoever controls the bottleneck controls the premium. Storage chips are the bottleneck in the digital world, while non-ferrous metals are the bottleneck in the physical world.

By 2026, non-ferrous metals will have become the "HBM" of the physical world. RockFlow's research team believes that investing heavily in non-ferrous metals and the physical world will be a major investment theme this year. They serve as both an inflation hedge and a ticket to the AI revolution.