In the past 24 hours, approximately $736.6 million (about 10.767 trillion won) of leveraged positions in the cryptocurrency market have been liquidated.

According to the current aggregated data, long positions accounted for $643 million, or 87.3% of the total, while short positions accounted for $93.6 million, or 12.7%.

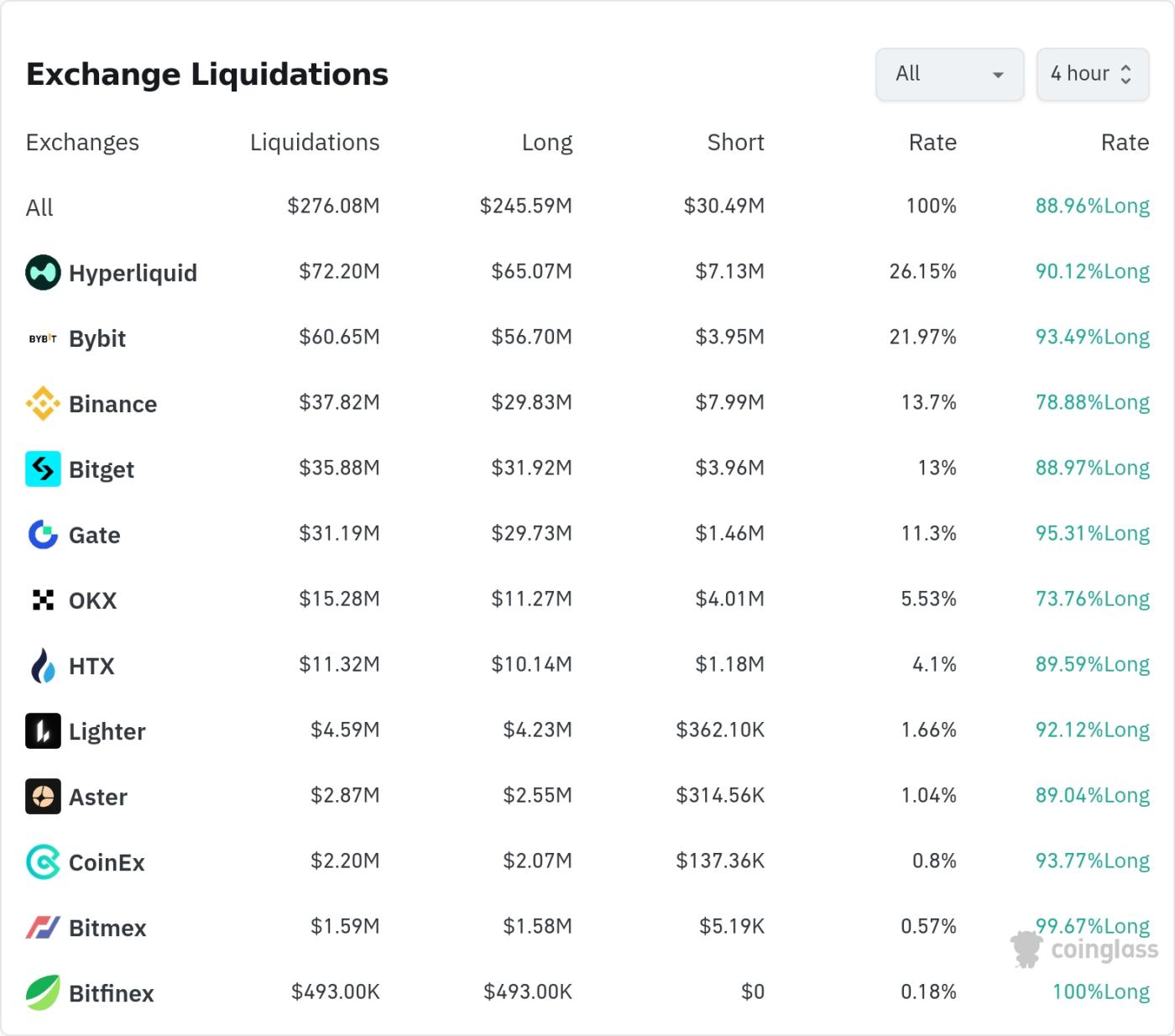

In the past four hours, Hyperliquid saw the most position liquidations, totaling $72.2 million (26.92% of the total). Of these, long positions amounted to $65.07 million, or 90.12%.

Bybit had the second-highest liquidation volume, with $60.65 million (22.62%) of liquidated positions, of which $56.7 million (93.49%) were long positions.

Binance experienced approximately $37.82 million (14.10%) in liquidations, representing 78.88% of its long positions.

It is worth noting that Bitfinex experienced a $493,000 liquidation, and all of the liquidations came from long positions (100%).

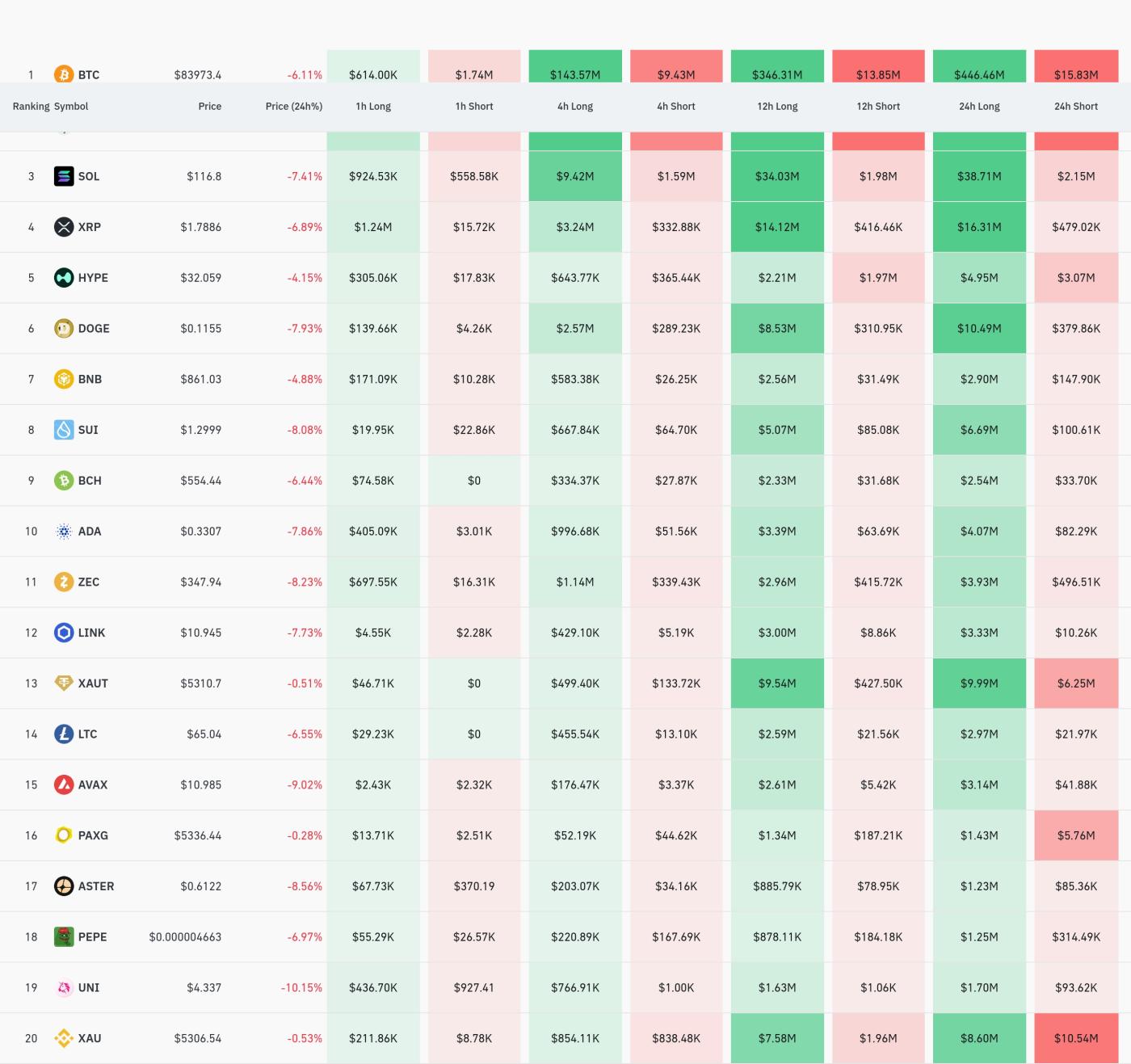

By currency, Bitcoin (BTC) saw the most position liquidations. Approximately $462.3 million in Bitcoin positions were liquidated in the past 24 hours, or about $153 million on a 4-hour basis. The current price of Bitcoin is $63,973.4, down 6.11% in the past 24 hours.

Ethereum (ETH) saw approximately $194.59 million in positions liquidated within 24 hours.

Solana (SOL) saw approximately $40.85 million in liquidations within the last 24 hours, with $11.01 million liquidated on a 4-hour basis. The price of Solana was $116.8, down 7.41% in the last 24 hours.

Among other major Altcoin, ranked by liquidation volume, they are XRP (US$3.57 million on a 4-hour basis), Zcash (ZEC, US$1.47 million on a 4-hour basis), and Cardano (ADA, US$1.04 million on a 4-hour basis).

Dogecoin (DOGE) price fell to $0.1155, down 7.93% in 24 hours, with approximately $2.86 million in liquidations on a 4-hour basis.

In particular, Uniswap (UNI) saw the largest drop among the analyzed cryptocurrencies, falling by 11.05%, triggering liquidations of over $760,000; Avalanche (AVAX) also recorded a significant decline of 9.22%.

Overall, with the market downturn, most cryptocurrencies experienced price drops of 6-9%, leading to large-scale liquidation of long positions. This was particularly evident on major exchanges such as Hyperliquid, Bybit, and Binance, where long position liquidations reached as high as 78-93%.

In the cryptocurrency market, "liquidation" refers to the forced liquidation of positions when traders holding leveraged positions fail to meet margin requirements. This large-scale liquidation is a consequence of the recent sharp decline in the cryptocurrency market, and market participants need to remain vigilant.

Article summary by TokenPost.ai🔎Market Analysis : Approximately $736.6 million in leveraged positions were liquidated within the last 24 hours, with 87.3% occurring in long positions. Major exchanges, ranked by liquidation volume, are Hyperliquid, Bybit, and Binance, with Bitcoin ($462.3 million) and Ethereum ($194.59 million) experiencing the largest liquidations. Most cryptocurrencies saw declines of 6-9%, with Uniswap (-11.05%) and Avalanche (-9.22%) experiencing the largest drops.

💡Key Strategy Points : Investors holding highly leveraged positions should pay special attention to risk management, as market volatility may persist. The short position liquidation rate is only 12.7%, indicating the market may still be preparing for further declines. Monitor support levels for major cryptocurrencies and confirm rebound signals.

📘Terminology Explanation : Liquidation refers to the forced liquidation of a position in leveraged trading when the value of the collateral falls below a certain level. A long position is a buy position held in anticipation of a price increase, while a short position is a sell position held in anticipation of a price decrease. Leverage is a borrowing concept that allows the opening of positions exceeding one's own capital.

TokenPost AI Notes: Article summarization uses a language model based on TokenPost.ai. The main content may be omitted or may differ from the facts.