Author: Muyao Shen

Compiled by: TechFlow TechFlow

TechFlow Summary: The collapse of BlockFi and Celsius in 2022 brought the crypto lending industry to a standstill, but now, a Vault model that touts "transparency and non-custodial" is making a comeback with $6 billion in assets.

This article provides an in-depth analysis of this new business model: how it uses smart contracts to circumvent the black-box risks of traditional centralized lending, and how, under pressure to pursue high returns, it repeats the mistakes of Stream Finance.

As the Genius Act pushes stablecoins towards mainstream adoption, is Vault the cornerstone of the maturation of crypto finance, or the next shadow banking crisis disguised in a transparent guise?

This article will reveal the old and new logic behind high returns.

The full text is as follows:

When the crypto platform Stream Finance collapsed late last year, resulting in the loss of approximately $93 million in user funds, it exposed a familiar breaking point in digital assets: the promise of a so-called "safe yield" often crumbles when the market turns to volume.

This failure stems not only from the disturbing losses incurred, but also from the underlying mechanisms. Stream had touted itself as part of a new generation of more transparent crypto yield products, aiming to avoid the hidden leverage, opaque counterparty risk, and arbitrary risk decisions that dragged down centralized lending institutions like BlockFi and Celsius in the previous cycle.

Instead, it demonstrates how quickly the same drivers—leverage, off-platform exposure, and centralization risk—can resurface when platforms begin pursuing revenue, even if the market's infrastructure appears more secure or transparent.

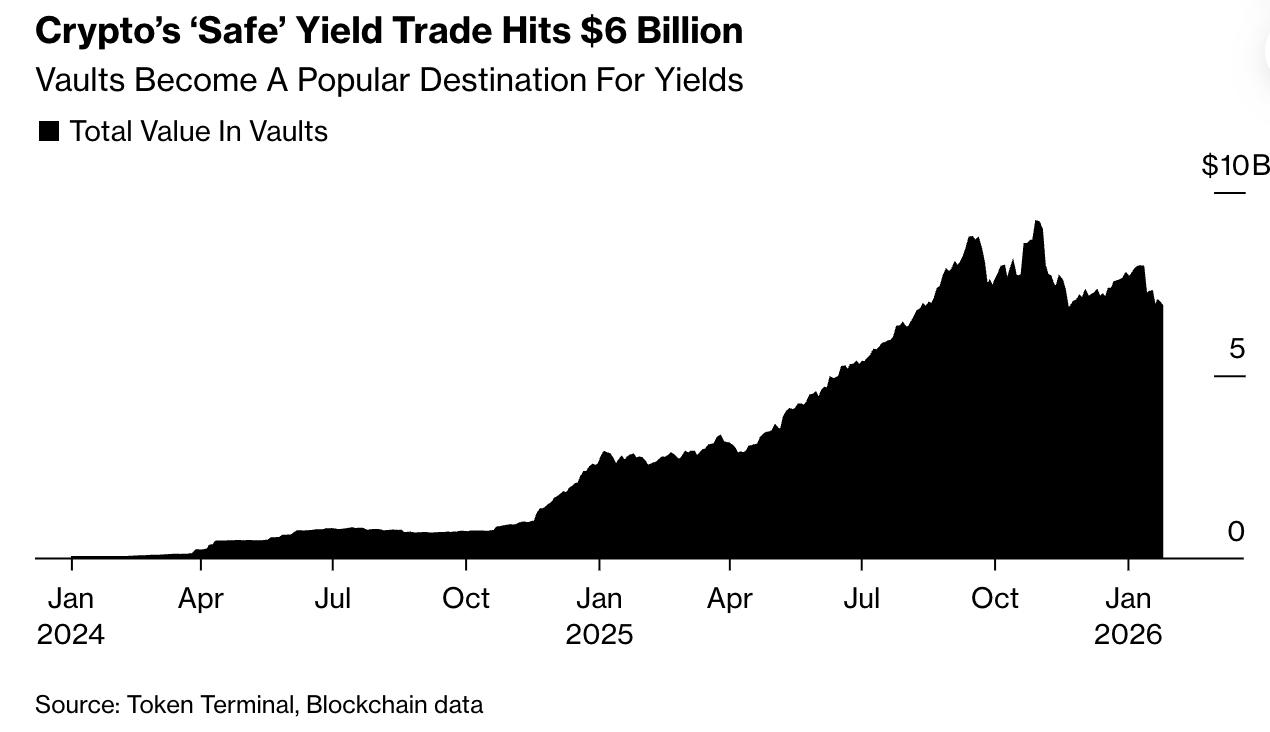

However, the broader promise of more secure crypto yields remains. According to industry data, Vaults—on-chain investment pools built around this concept—currently manage over $6 billion in assets. Crypto asset management firm Bitwise predicts that the assets in Vaults could double by the end of 2026 as demand for stablecoin yields grows.

Cryptocurrency "safe" profit trading reaches $6 billion

At its core, Vault allows users to deposit cryptocurrency into shared pools, where these funds are invested in lending or trading strategies designed to generate returns. What sets Vault apart is its marketing approach: it's touted as a complete departure from the opaque lending platforms of the past. Deposits are non-custodial, meaning users never hand over their assets to the company. Funds are held in smart contracts, automatically deploying capital according to pre-defined rules, with key risk decisions clearly visible on the blockchain. Functionally, Vault resembles familiar components of traditional finance: pooling funds, converting them into returns, and providing liquidity.

However, its structure has distinctly cryptographic features. All of this occurs outside the regulated banking system. Risk is not buffered by capital reserves or overseen by regulators—it is embedded in the software, where algorithms automatically rebalance positions, liquidate collateral, or break up transactions as the market fluctuates, thus automatically realizing losses.

In practice, this structure can produce mixed results as curators (the companies that design and manage Vault strategies) compete for returns, and users discover just how much risk they are willing to take.

“Some participants will do a terrible job,” said Paul Frambot, co-founder of Morpho, the infrastructure behind many lending vaults. “They may not survive.”

For developers like Frambot, this shift is less a warning sign and more a characteristic of an open, permissionless marketplace—where strategies are tested in the open, capital flows rapidly, and weaker approaches are replaced by stronger ones over time.

The timing of this growth is no coincidence. With the passage of the Genius Act, stablecoins are moving into the financial mainstream. As wallets, fintech apps, and custodians race to distribute digital dollars, platforms face a common challenge: how to generate returns without risking their own capital.

Vaults have emerged as a compromise. They offer a way to technically keep assets off a company's books while generating returns. Think of it like a traditional fund—but without the need to relinquish custody or wait for quarterly disclosures. This is how curators market the model: users retain control of their assets while receiving professional management strategies that run automatically on-chain.

“The curator’s role is similar to that of a risk and asset manager, just like BlackRock or Blackstone do for the funds and endowments they manage,” said Tarun Chitra, CEO of Gauntlet, a crypto risk management firm that also operates Vault. “However, unlike BlackRock or Blackstone, it is non-custodial, so the asset manager never holds the user’s assets; the assets are always in a smart contract.”

This structure aims to correct recurring weaknesses in crypto finance. In previous cycles, products touted as low-risk often concealed borrowed funds, reused customer funds without disclosure, or heavily relied on a few vulnerable partners. The algorithmic stablecoin TerraUSD offered yields close to 20% through subsidized returns. Centralized lending institutions like Celsius quietly channeled deposits into high-risk bets. When the market shifted, the damage spread rapidly—and without warning.

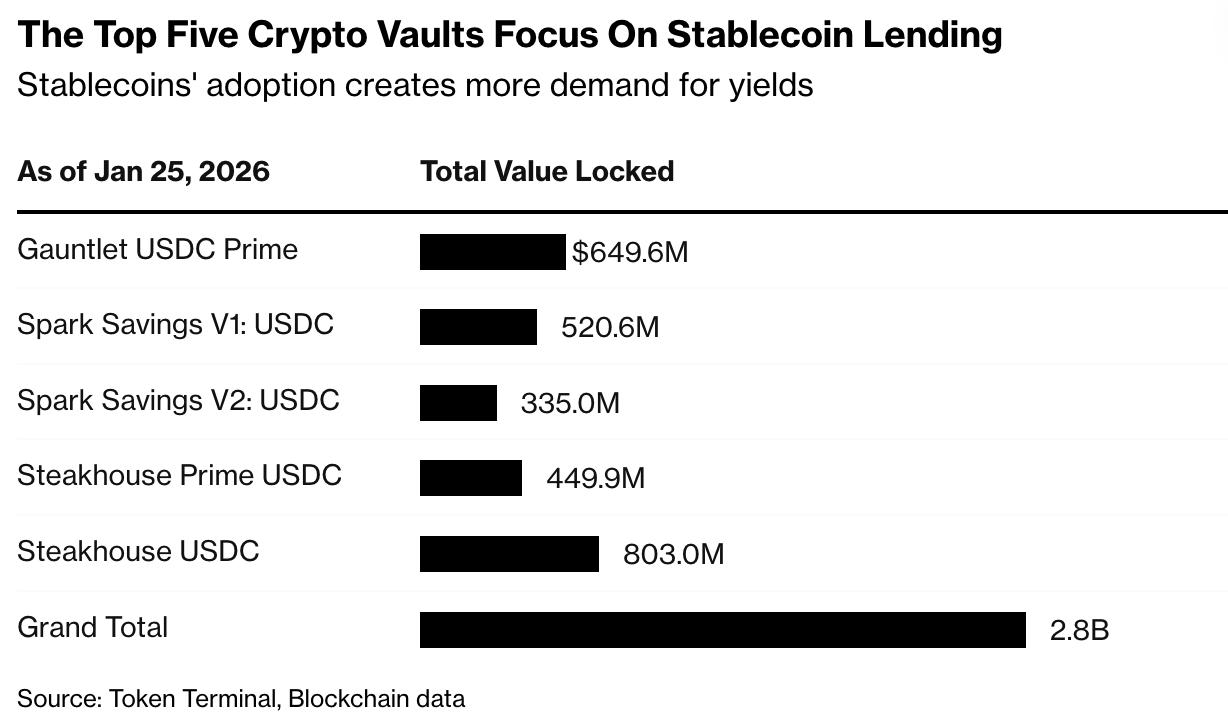

Most Vault strategies today are more restrained. They typically involve floating-rate lending, market making, or providing liquidity to blockchain protocols, rather than pure speculation. Steakhouse USDC is one such example, lending stablecoins against its described blue-chip cryptocurrencies and tokenized real-world assets (RWAs), offering returns of around 3.8%. Many Vaults are deliberately designed to be “boring”: their appeal lies not in excess returns, but in the promise of earning yield through digital cash without relinquishing custody or making users creditors of a single company.

“People want returns,” said Jonathan Man, portfolio manager and head of multi-strategy solutions at Bitwise, which just launched its first Vault. “They want their assets to generate returns. Vaults are just another way to achieve that.”

Vault could also gain further momentum if regulators take action to prohibit direct payouts of yield on stablecoin balances (a proposal put forward in market structure legislation). If this happens, the demand for yields won't disappear; it will simply shift.

“Every fintech company, every centralized exchange, every custodian is talking to us,” said Sébastien Derivaux, co-founder of Steakhouse Financial, one of the curators of Vault. “The same goes for traditional financial companies.”

But this restraint isn't hard-coded into the system. The pressure shaping this industry comes from competition, not technology. With the proliferation of stablecoins, yield has become the primary means of attracting and retaining deposits. Underperforming curators risk losing capital, while those offering higher returns attract more inflows. Historically, this dynamic has driven non-bank lending institutions—whether in the crypto industry or others—to loosen standards, increase leverage, or move risk off-platform. This shift has already reached large consumer-facing platforms. Crypto exchage Coinbase and Kraken have bothlaunched products offering retail clients access to Vault-like strategies, advertised yields as high as 8%.

In conclusion, transparency can be misleading. Public data tools and visible strategies build confidence—and confidence attracts capital. But once funding is in place, curators face pressure to deliver returns, sometimes by reaching into off-chain transactions that are difficult for users to assess.

Stream Finance later exposed this breaking point, having advertised returns as high as 18% before reporting significant losses linked to an unnamed external fund manager. This event triggered a sharp pullback across the entire Vault industry, with total assets falling from a peak of nearly $10 billion to approximately $5.4 billion.

Supporters of the model argue that Stream is not representative. Stream Finance did not respond to a request for comment via private message from X.

“Celsius, BlockFi, all of these, even Stream Finance, I kind of categorize them all as failures in disclosure to end users,” said Man of Bitwise. “People in the crypto space are always more focused on what the upside potential might be and less focused on what the downside risks are.”

This distinction may seem important now. Vault was created to address the previous wave of failures, with the explicit goal of making risk visible, not hidden. The unresolved question is whether transparency itself is sufficient to constrain behavior—or, as in previous shadow banking cases, whether a clearer structure simply makes investors more tolerant of risk before the music stops.

“Ultimately, it’s about embracing transparency, and also about proper disclosure for any type of product—whether DeFi or not,” Man said.