The market reacted to the prospect of a more hawkish Fed, with a stronger dollar and higher US Treasury yields.

The market reacted to the prospect of a more hawkish Fed, with a stronger dollar and higher US Treasury yields.

US President Donald Trump is reportedly set to nominate Kevin Warsh as the next Chairman of the Federal Reserve (Fed), with an official announcement expected on Friday morning.

Several media outlets, including Bloomberg, reported that Warsh has emerged as Trump's choice to replace current Fed Chairman Jerome Powell, whose term ends this coming May.

Earlier, Reuters reported that Trump had met with Warsh on Thursday. A source close to the matter said the former Fed governor had made a very positive impression.

Warsh has become a leading candidate for the Fed chairmanship as his approval ratings have surged.

Kevin Warsh served on the Federal Reserve Board of Governors from 2006 to 2011, and since leaving the central bank, he has remained an influential voice in monetary policy.

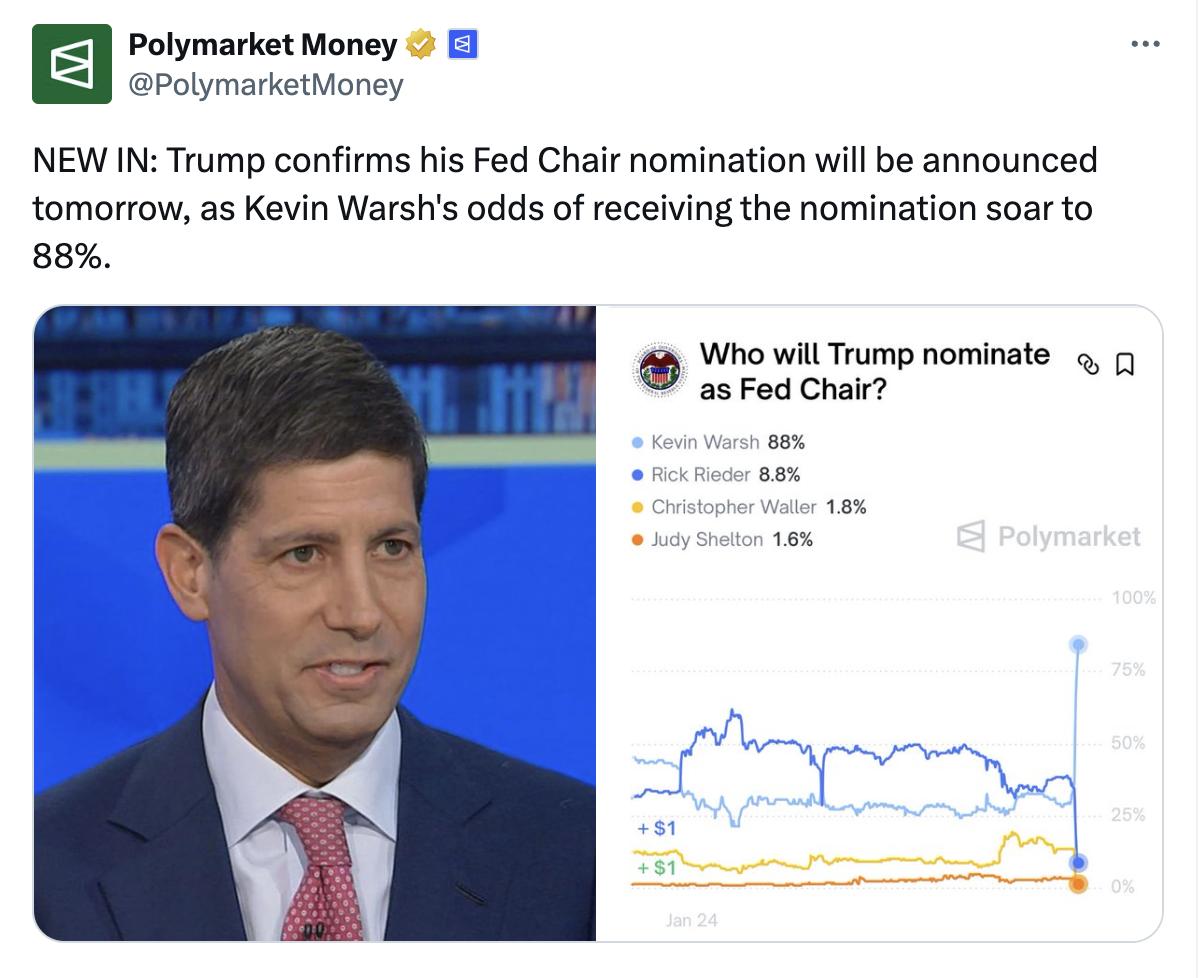

Prediction markets quickly reflected this shift. On Polymarket, Warsh's chances of being nominated increased from around 30% to 95%, while the former leader, BlackRock's Rick Rieder, saw his odds plummet.

A similar trend is seen on Kalshi, where Warsh is valued at 93%, far ahead of economists Kevin Hassett and Rick Rieder.

Warsh is XEM as the more "hawkish" candidate, advocating for fiscal discipline, a tough stance on inflation, and a further retreat from quantitative easing policies.

Expectations of his nomination quickly spread through the markets, causing the dollar to appreciate and US Treasury yields to inch higher as investors adjusted their expectations about future monetary policy.

Unlike Powell, who frequently downplays Bitcoin's Vai in the US financial system, Warsh has expressed a more open view towards cryptocurrencies.

In an interview with the Hoover Institute in July, he argued that Bitcoin does not threaten the Fed's power, but on the contrary could Vai as a market feedback mechanism.

“Bitcoin doesn’t bother me,” Warsh said, adding that it could “create market discipline” and become “a very good policeman for policy.”

These statements resonated within the crypto community, where many XEM Bitcoin as a hedge against policy missteps.

If confirmed, Warsh's appointment would mark a significant shift in tone at the Fed, with potential implications for risky assets as well as a broader debate about the Vai of digital currencies in the U.S. economy.

Tensions at the Fed keep interest rates unchanged, leaving Bitcoin struggling for momentum.

President Donald Trump increased pressure on Jerome Powell, including threatening a criminal investigation, but the Fed once again kept interest rates unchanged, citing solid economic growth and persistently high inflation.

Powell declined to comment on the investigation and defended the Fed's independence, warning that politicizing monetary policy would undermine the institution's credibility.

The decision to keep interest rates unchanged put pressure on Bitcoin, causing the price to fall after the announcement and repeatedly failing to break the $90,000 mark.

Analysts believe that the lack of short-term interest rate cuts is restraining demand for risky assets, even as stocks and gold continue to reach new highs.

Market forecasts and predictions from Wall Street currently suggest a very low likelihood of an interest rate cut before mid-year, with expectations pushed back to the second half of 2026.