As gold and silver prices continue to reach new highs, smaller- Capital metals like copper are also attracting significant Capital inflows. Blockchain technology could act as a bridge, facilitating these Capital flows into the crypto market through Tokenize.

Many indicators suggest that copper prices could begin a strong bull cycle similar to silver, and copper Tokenize could boom in 2026.

Demand for copper is likely to continue to grow strongly over the next 15 years.

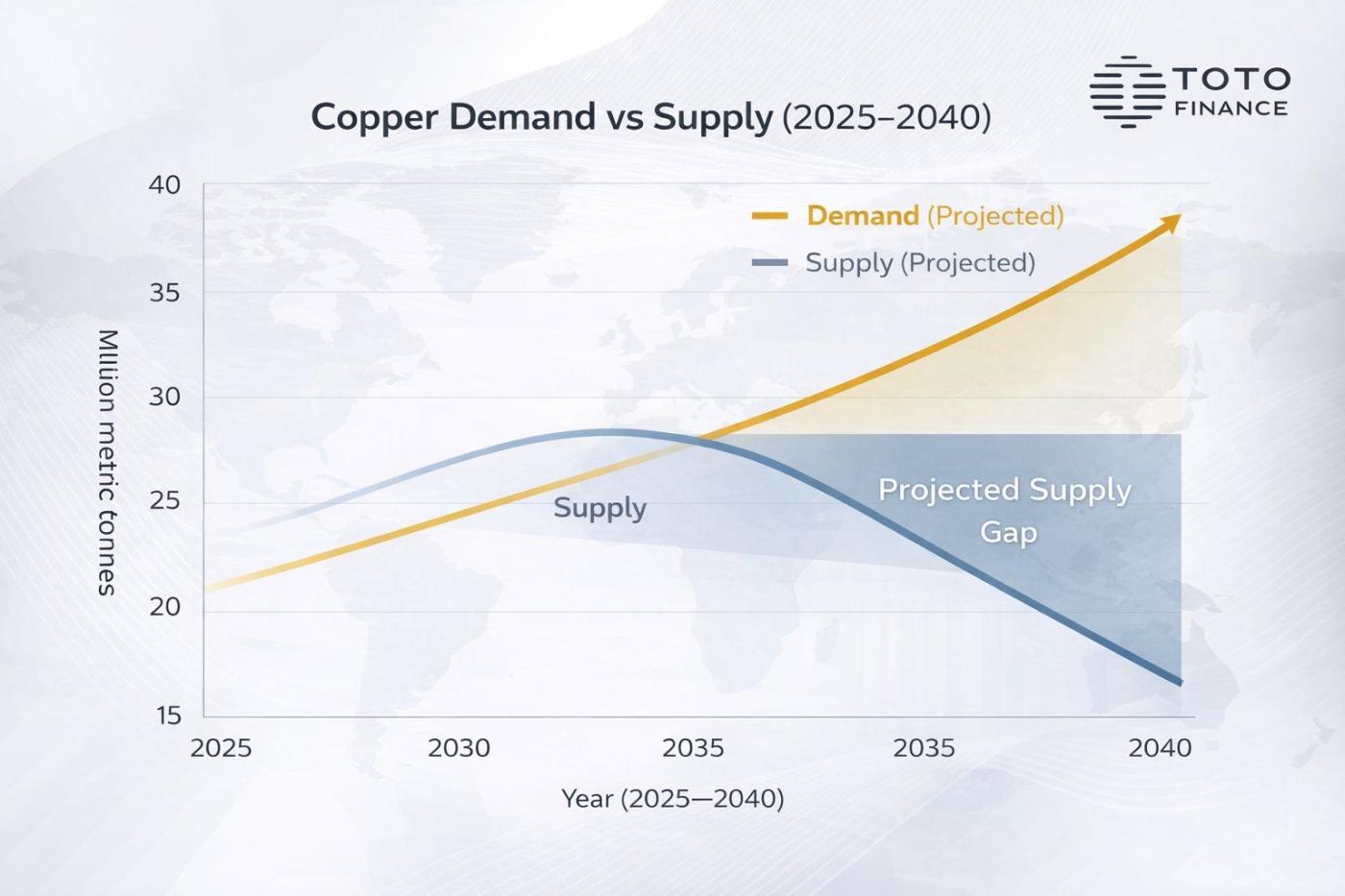

The commodity Tokenize platform Toto Finance forecasts that global copper demand could reach approximately 42 million tons by 2040. Meanwhile, supply is expected to peak in 2030 and then gradually decline.

Copper supply and demand (2025–2040). Source: Toto Finance

Copper supply and demand (2025–2040). Source: Toto FinanceAccording to Toto Finance's "Copper Supply and Demand (2025–2040)" chart, copper demand is continuously increasing and is expected to reach nearly 40 million tons by 2040. Conversely, supply will only peak at around 28–30 million tons in 2030 before declining sharply. This creates an ever-widening supply-demand gap.

This is not a temporary cycle but a structural imbalance, turning the coin into a strategic resource. Toto Finance emphasizes that Tokenize will be the new way to access, own, and increase liquidation for the coin, making it a more tradable digital asset than before.

“This isn’t a cycle, but a structural gap. As cryptocurrencies become increasingly strategic, Tokenize will be the evolving approach, ownership, and liquidation ,” Toto Finance predicts .

Many analysts believe that copper scarcity has begun and will worsen in the future. Mike Investing predicts that in the next 18 years, the total amount of copper that needs to be mined will be equivalent to the amount mined in the previous 10,000 years. He also believes that the price of copper could increase 2–5 times in the next 14 months.

AI and grid expansion are key drivers.

One of the main reasons for the surge in demand for copper is the wave of AI development and the expansion of power grids globally. Katusa Research states that the demand for copper for AI and electrification infrastructure will make copper supply increasingly scarce.

The demand for copper for new data centers alone is projected to reach approximately 400,000 tons per year by 2035. Electric vehicles also require three times the amount of copper compared to traditional gasoline-powered vehicles.

Modern defense systems and drones are also driving up demand for electronics, leading to increasingly severe shortages in the global copper supply.

A new copper mining project can take up to 17 years to become operational. Meanwhile, the quality of the ore is declining, and many large mines are closing, widening the supply-demand gap.

Early signs are emerging in the crypto market.

Crypto investors' access to Tokenize copper and related real assets (RWA) remains quite limited. However, demand for trading Tokenize gold and silver has recently begun to grow significantly.

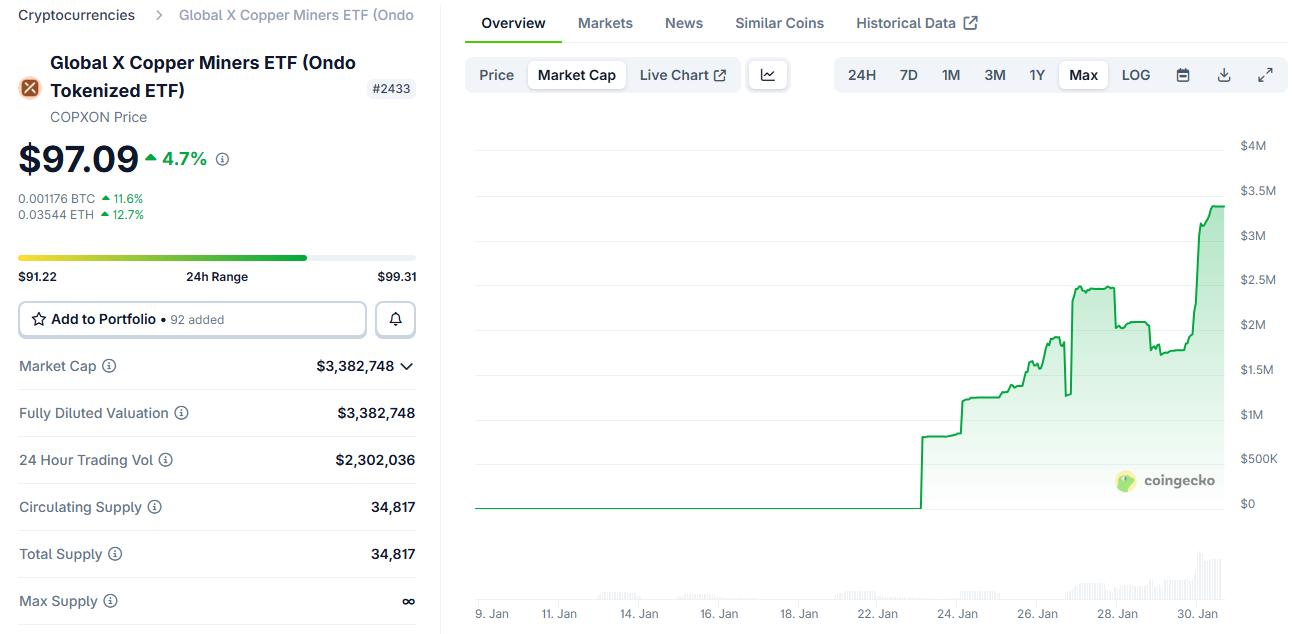

Some early signs have emerged. Ondo's Tokenize Global X Copper Miners (COPXON) ETF saw a significant increase in market Capital in January 2024. COPXON quickly reached a market Capital of $3 million in its first week.

Capital of the Global X Copper Miners ETF (COPXON). Source: Coingek

Capital of the Global X Copper Miners ETF (COPXON). Source: CoingekRemora Markets, a Tokenize stock trading platform on Solana , also reported revenue of $110 million . This growth was primarily driven by market demand for Tokenize NASDAQ stocks and metal-related assets.

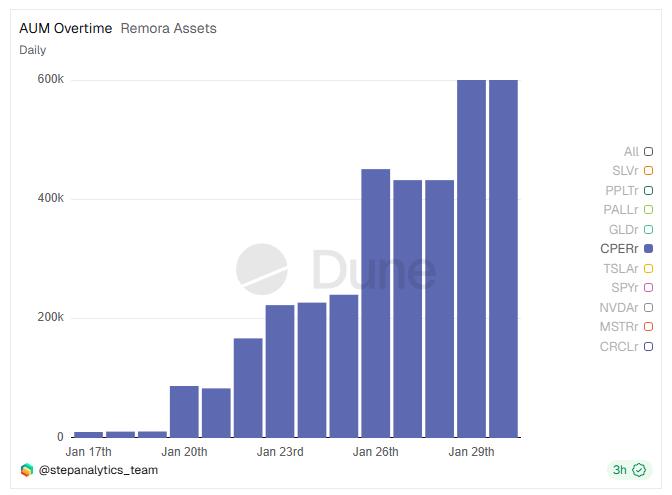

Total assets under management for Copper rStock ( CPERr ) over time. Source: Dune

Total assets under management for Copper rStock ( CPERr ) over time. Source: DuneThe total value of Copper rStock (CPERr) on Remora Markets surged in the last week of January. While the increase is still relatively small, this could be an early sign that retail crypto investors are looking to access metallic assets like copper.

Tokenize is also a topic that industry leaders predict will grow strongly in 2026. This could create opportunities for new startup ideas and open up many possibilities for traders .