On January 31, 2026, Binance, the world's largest cryptocurrency exchange, officially released its "1011 Market Flash Crash Retrospective Report," providing a comprehensive explanation of the sharp decline that swept the global crypto market from October 10th to 11th, 2025. The report attributes the event to the combined effects of macroeconomic shocks, high leverage structures, and a sudden drop in liquidity, emphasizing that it was not caused by a single exchange or systemic failure. However, the report immediately sparked heated debate within the industry, with OKX founder Star Xu publicly questioning Binance's marketing strategy, arguing that it was the true trigger for systemic risk.

Macroeconomic shocks coupled with high leverage led to a rapid spread of the flash crash.

According to a Binance report , the immediate trigger for the "1011" flash crash was the Trump administration's sudden announcement on the evening of October 10th that it would impose a 100% tariff on Chinese imports. This policy announcement quickly fueled risk aversion in global financial markets, leading to a sell-off of risky assets, and the cryptocurrency market was not spared.

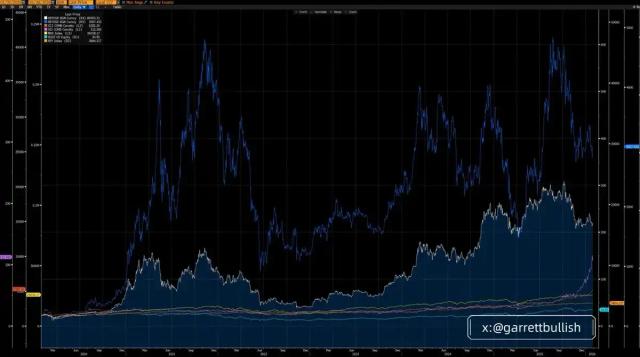

The report points out that prior to the incident, the total open interest in the crypto derivatives market exceeded $100 billion, with extremely high overall leverage, making the market highly sensitive to price fluctuations. During periods of relatively low liquidity, any external shock could trigger a chain reaction of liquidations, ultimately leading to a full-blown flash crash.

The liquidity freeze and on-chain congestion further amplified the panic.

Binance analysis indicates that during the flash crash, multiple market makers activated risk control mechanisms amidst the extreme volatility, proactively reducing their quotes and positions. This caused a sudden contraction in market liquidity and a rapid collapse of the order book depth. Simultaneously, the Ethereum network experienced severe congestion due to the surge in transaction volume, delaying some transaction confirmations and further exacerbating market panic.

Against this backdrop, even small price fluctuations can trigger large-scale liquidations, and the market exhibits a typical "deleveraging stampede" phenomenon.

Binance acknowledges technical flaws, emphasizing non-core causes.

In response to concerns about the technical issues, Binance acknowledged in its report that two technical anomalies did occur that day. Firstly, under high system load, delays occurred in the user interface and order processing. Secondly, some collateralized assets (including USDe, wBETH, and BNSOL) experienced a brief deviation in internal price feeds, causing a significant price decoupling within the platform.

However, Binance emphasized that these situations occurred after significant market volatility, representing an "amplification effect" rather than a "cause." The report also denied any allegations of manipulating candlestick charts, price manipulation, or a complete core system failure.

Star Xu strongly criticized: Irresponsible marketing is the root cause.

Shortly after Binance released its report, OKX founder and CEO Star Xu published a lengthy article on the X platform, offering a completely different interpretation of the event. He stated bluntly that the "1011" flash crash was not an isolated incident or a simple market fluctuation, but rather a systemic risk directly triggered by irresponsible marketing strategies.

Star Xu pointed out that Binance had launched a temporary high-yield promotion for USDe, offering an annualized return (APY) of up to 12%, and allowing USDe to be used as collateral on par with USDT and USDC, without any effective limits. With the platform's endorsement, many users regarded USDe as a low-risk stablecoin and repeatedly engaged in leveraged trading, while the actual risks were severely underestimated.

He further pointed out that USDe is essentially a tokenized hedge fund product issued by Ethena, with a risk profile far exceeding that of tokenized money market funds. When market volatility occurs, USDe quickly decouples, triggering a chain of liquidations, and further amplifies the impact through risk control loopholes in assets such as WETH and BNSOL, ultimately resulting in a network-wide liquidation of hundreds of billions of dollars.

After explaining the reasons for the sharp drop, Star Xu wrote:

Why is this important?

I'm discussing the root causes, not blaming or attacking Binance. Openly discussing systemic risks can sometimes be uncomfortable, but it's necessary if the industry is to mature responsibly.

I anticipate a significant amount of misleading information and coordinated FUD regarding OKX in the near future. Even so, honestly acknowledging systemic risks remains the right thing to do, and we will continue to do so. As the world's largest platform, Binance wields immense influence—and corresponding responsibility—as an industry leader.

Long-term trust in cryptocurrencies cannot be built on short-term profit games, excessive leverage, or marketing practices that mask risks. What the industry needs are leaders who prioritize market stability, transparency, and responsible innovation—not a "winner-takes-all" mentality that views criticism as hostility. Cryptocurrencies are still in their early stages.

What we choose to normalize today will determine whether this industry can earn lasting trust—or repeat the same mistakes.

Wintermute founder: Don't find scapegoats

However, in response to Star Xu's accusations, wishful cynic, founder of the well-known market maker Wintermute, posted a rebuttal on the X platform, emphasizing that "1011 was not a software glitch," but rather a typical flash crash caused by the market being impacted by macroeconomic news during a period of insufficient liquidity, coupled with a high leverage structure.

He believes that attributing all the blame to a single exchange, while ignoring changes in the overall market microstructure and risk appetite, is unfair and does not contribute to the long-term healthy development of the industry.

I really hope that public figures can be more careful with their words.

10/10 is clearly not a "software glitch".

It was a Friday night of illiquidity, a flash crash driven by macroeconomic news and occurring in a highly leveraged market. Since we're on this topic, I understand that nobody likes being in a bear market and watching all asset classes except cryptocurrencies rise.

Finding a scapegoat may be satisfying, but shifting all the blame onto a single exchange is simply dishonest.