Original author: Raoul Pal , CEO of Real Vision and GMI

Original translation by CryptoLeo ( @LeoAndCrypto )

This morning, Raoul Pal, CEO of Real Vision and GMI (Raoul Pal's investment bible), published an article titled " False Narratives...and Other Thoughts ," explaining the recent downturn and crisis facing the crypto industry through data comparison and macro analysis. He stated that the industry winter will soon pass, and everyone needs to remain patient and not lose faith in the industry. Odaily translated it as follows:

These are insights I came up with while writing to GMI over the weekend, and I hope they can give you some confidence. I usually save these topics for GMI and Pro Macro, but I know you all need these to relax a bit.

Mainstream narrative: Is encryption over?

The prevailing view is that Bitcoin and cryptocurrencies have crashed, the cycle is over, everything is finished, and things will never be the same again. Cryptocurrencies have become decoupled from other assets, and this is blamed on CZ, BlackRock, etc. This is undoubtedly a very attractive narrative trap, especially given the daily plunge in the prices of mainstream cryptocurrencies.

But yesterday, a GMI hedge fund client sent me a text message asking whether I should buy SaaS stocks on dips, or whether, as everyone is saying, Claude Code has already killed the SaaS industry.

So I started researching SaaS, and in the process I found that the conclusions I came to overturned both the mainstream narrative of Bitcoin and the narrative of the SaaS industry. The price charts of SaaS and BTC are exactly the same.

UBS SaaS Index and Bitcoin Price Movement

This indicates that there is another factor that everyone has overlooked influencing the trend.

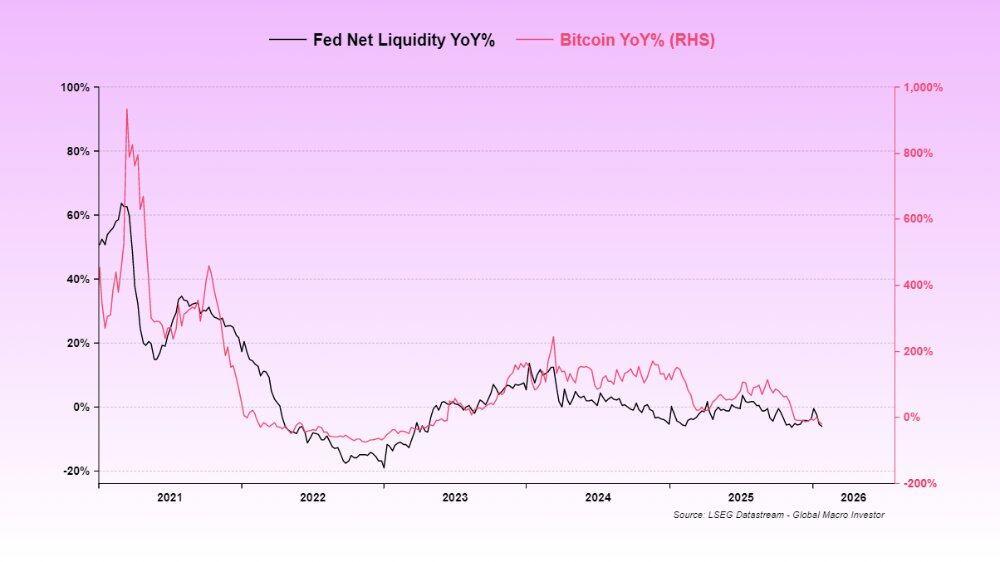

This factor is that, due to the two shutdowns and problems in the underlying US financial system (the liquidity from the reverse repurchase mechanism will not be fully replenished until 2024), US liquidity has been suppressed. Therefore, the TGA (Treasury Account) rebuilding in July and August lacked corresponding monetary offsetting measures, leading to a reduction in liquidity.

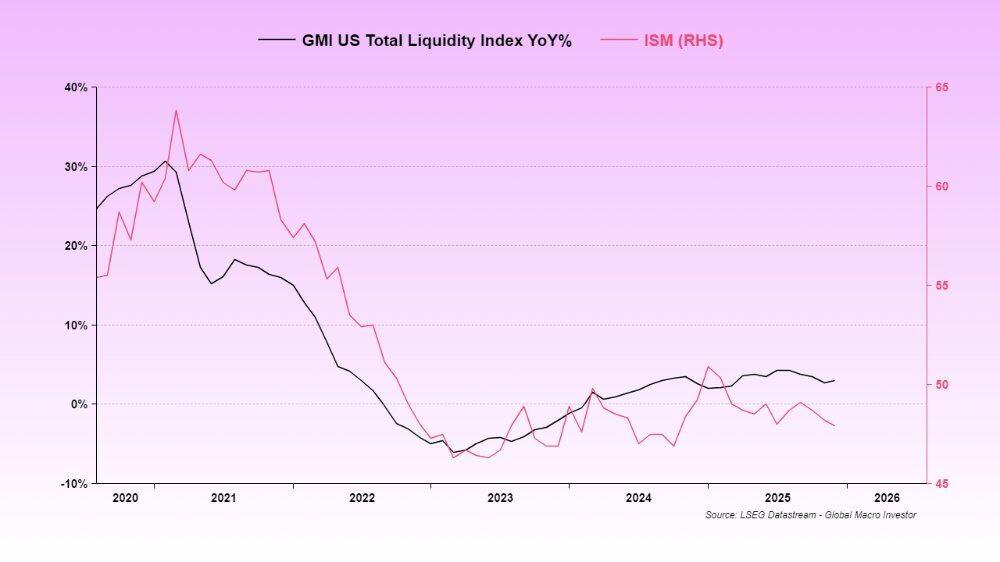

The persistently low level of the ISM Manufacturing Index is due to persistently low liquidity.

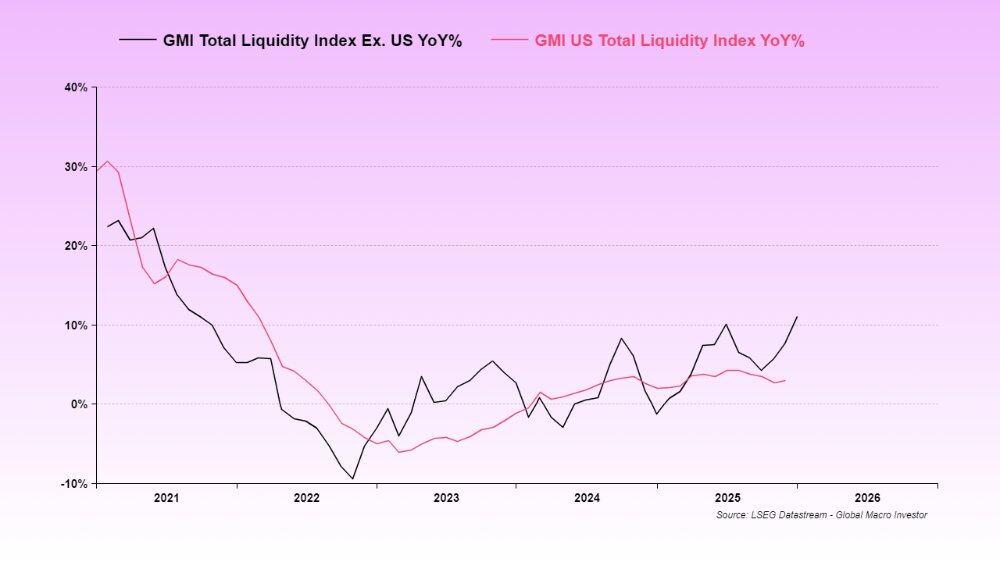

We typically use the global total liquidity metric because it has the highest long-term correlation with BTC and the Nasdaq , but at this stage, US total liquidity seems to be more important because the US is the main provider of global liquidity.

During this period, the GMI Global Total Liquidity Index outperformed the US Total Liquidity Index and is poised to rebound (thus also driving up the ISM Index).

This is precisely what's affecting SaaS and BTC. Both of these assets are among the longest-lived assets and have both fallen due to a temporary withdrawal of liquidity.

The rise in gold prices has essentially drained the marginal liquidity that could have flowed into the Bitcoin and SaaS markets. Without enough liquidity to support these assets, high-risk assets have been impacted and have fallen. There's really nothing that can be done about it.

Now, the US government is shutting down again, and the Treasury Department has taken precautionary measures: after the last government shutdown, no TGA funds were used; instead, the asset size was increased (i.e., further liquidity loss). This is the crisis we are currently facing, which has led to violent price fluctuations, and the cryptocurrencies we love still lack liquidity.

However, all indications suggest that the government shutdown will be resolved this week, clearing the last liquidity hurdle.

Odaily Note: U.S. House Speaker Boris Johnson said in an interview with NBC News' "Meet the Press" on Sunday that he believes he has secured the Republican vote and can ensure that the partial government shutdown ends by Tuesday.

I have mentioned the risks of this government shutdown many times before, but it will soon pass, and we can continue to deal with the upcoming liquidity injection, which includes partial repatriation from eSLR and TGA, fiscal stimulus, interest rate cuts, and other measures, all of which are related to the midterm elections.

Odaily Note: A bill by U.S. regulators to relax leverage requirements in order to ease capital pressure on several major banks, including Bank of America (BAC.US).

In a complete trading cycle, time is often more important than price. Prices may be severely impacted, but as time passes and the cycle evolves, everything will eventually settle down.

That's why I keep emphasizing the importance of "patience." Events need to progress and develop. Focusing solely on the risk-reward ratio will only affect your mental health, not your investment portfolio.

The Federal Reserve's False Narrative

Another misconception regarding interest rate cuts is that Kevin Warsh is a hawk. This is complete nonsense; these statements are primarily from 18 years ago.

Warsh's job and mission is to execute the strategies of the Greenspan era. Both Trump and Bessant have said (details omitted here, but the main direction was interest rate cuts) to keep the economy hot and assumed that productivity gains from artificial intelligence would curb core CPI increases (as was the case in the 1995-2000 era).

Odaily Note: Greenspan was one of the longest-serving chairmen in the history of the Federal Reserve. His proposed monetary policy (controlling inflation + promoting maximum employment) was highly flexible, but in practice, he prioritized anti-inflation and actively injected liquidity during crises.

He doesn't like balance sheets, but the system is constrained by reserves, so he's unlikely to change his current practices, which would destroy the credit market.

Warsh will cut interest rates, but will do nothing else. He will not interfere with Trump and Bessant's efforts to manage liquidity through banks. Federal Reserve Governor Milan will likely push for a comprehensive reduction in the eSLR to accelerate this process.

If you don't believe me, then believe Druck ↓

The image above shows investment guru Stanley Druckenmiller's views on Warsh's monetary policy philosophy and the agreement he reached with Bessant after becoming Federal Reserve Chairman.

I know how difficult it is to hear optimistic narratives when the crypto market looks so bleak. My SUI holdings are terrible, and we don't know what or whom to believe anymore. First of all, we've seen this situation many times before. When BTC drops 30%, Altcoin can drop as much as 70%. But if it's a high-quality altcoin, its rebound will be much faster.

Mea Culpa (My Fault)

GMI's mistake was failing to recognize US liquidity as the current driver, whereas global aggregate liquidity typically dominates throughout the cycle. But now that things are clear, anything is possible.

The two are not unrelated. It's just that we couldn't predict the combined effect of a series of events (reverse repos exhausting liquidity > TGA reconstruction > government shutdown > gold price increase > another shutdown), or we failed to anticipate its impact.

It's almost over, and soon we'll be able to go back to normal work.

We cannot guarantee that every step will go perfectly (we now have a deeper understanding of this), and we remain very optimistic about the prospects for 2026 because we understand the strategies of Trump/Bessenter/Warsh. These three have repeatedly told us: we simply need to listen and be patient; in full-cycle investing, time is more important than price.

If you're not a cyclical investor and don't have a high risk tolerance, that's perfectly fine. Everyone has their own style, but Julien (Head of Macro Research at GMI) and I aren't good at swing trading (we don't care about intraday fluctuations), but we have a proven track record in full-cycle investing, consistently leading the industry for the past 21 years. (Warning: We make mistakes, like in 2009), and now is not the time to give up. Good luck, and let's achieve even greater results in 2026.

Liquidity rescuers are on their way!