Aave’s decentralized stablecoin GHO reached over $500 million in market capitalization, hitting a new milestone in adoption. According to data from CoinGecko, circulating supply has stayed above half a billion as of early February, and has grown more than 245% since the start of 2025.

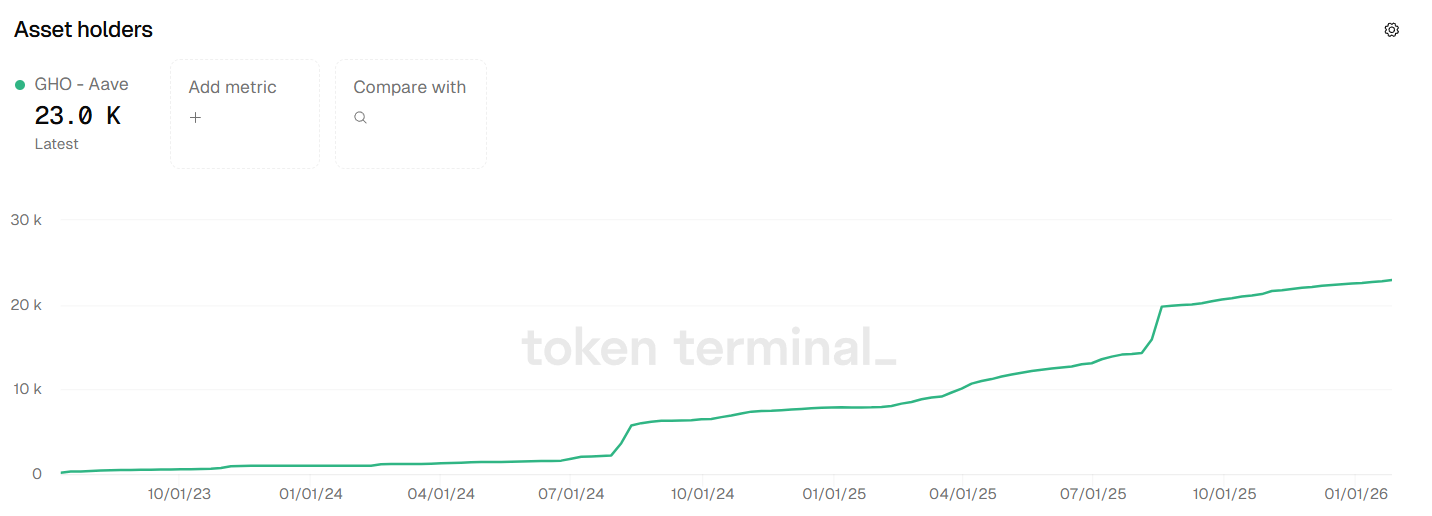

Data from analytics firm Token Terminal shows that GHO’s holder count also grew over the past year, now standing near the 23,000 mark, up roughly 300% since January 2025.

The boost in stablecoin supply also reflects Aave’s push to expand GHO’s usage. In July, the protocol rolled out Savings GHO (sGHO), a yield-bearing version of GHO that lets users deposit the stablecoin into a vault to earn interest on their stablecoin savings.

Later on, sGHO was integrated across Arbitrum, Base, and Gnosis, with different liquidity programs and incentive schemes on partner platforms like Bybit and Bitget.

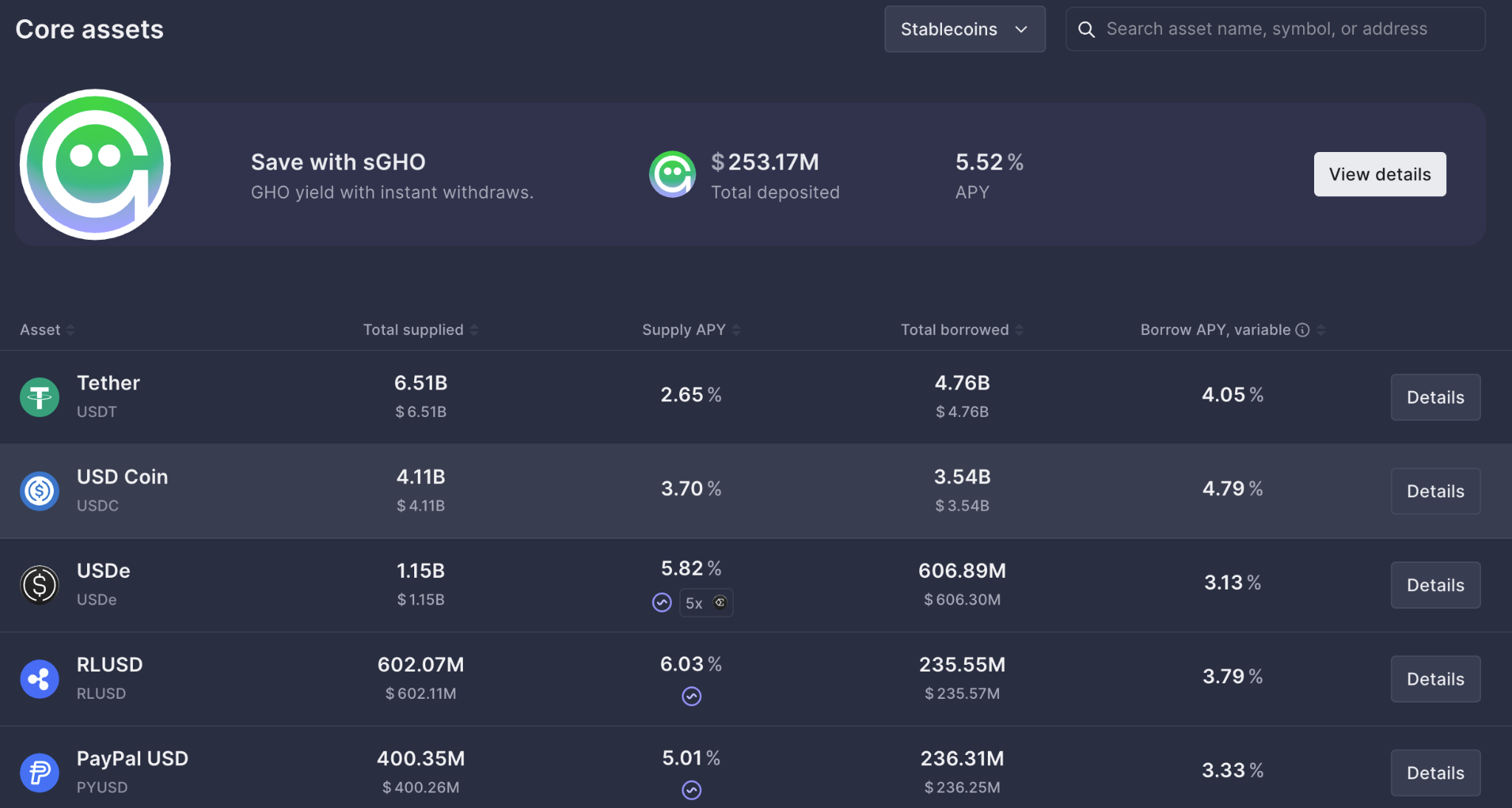

On top of that, Aave incentivizes GHO use directly by offering a comparatively higher yield on sGHO than for most other stablecoins on its platform.

GHO holders can currently earn 5.52% APY on their deposits while, by comparison, the APY for lending Circle’s USDC is 3.7 %, and for Tether’s USDT is 2.65%. Staking USDC or USDT via Aave offers higher yields, but the staking rate for GHO is still a bit higher.

Other DeFi Stablecoins

Aave is the largest protocol in DeFi by total value locked (TVL), currently with over $30 billion on the protocol across 18 chains.

GHO’s 2025 growth pushes it ahead of other DeFi protocol-linked stablecoins such as Curve’s crvUSD and Hyperliquid’s USDH. Curve launched its native stablecoin in 2023, and its current supply stands at about $307.5 million.

Hyperliquid’s USDH launched in late September, after a heated competition to become the developer and issuer of the native stablecoin for the largest perpetuals DEX by volume. USDH’s supply has stayed around $20-25 million since then.

Aave’s native token, AAVE, is up 2.4% today, but it’s down over 50% on the year.