We've just crossed a critical threshold while no one is paying attention.

Currently, over 770,000 AI agents can transact with stablecoins and purchase real, physical goods on Amazon. This isn't virtual. It's happening right now, today.

The "Agent Economy," which TokenPost covered in depth in the January cover story of BBR, is becoming a reality much faster than expected. At the center of this phenomenon is a new storm: "OpenClaw" (formerly Moltbot or Clawbot).

Available for purchase at the TokenPost Store .

◇ 100,000 GitHub stars in just 8 weeks... AI's own league, "Maltbook," is born.

What's happening? OpenClaw, a framework that allows AI agents to independently control entire computers, has surpassed 100,000 GitHub stars in just eight weeks. These agents, which anyone can install, each have their own unique context, knowledge, tools, and commands.

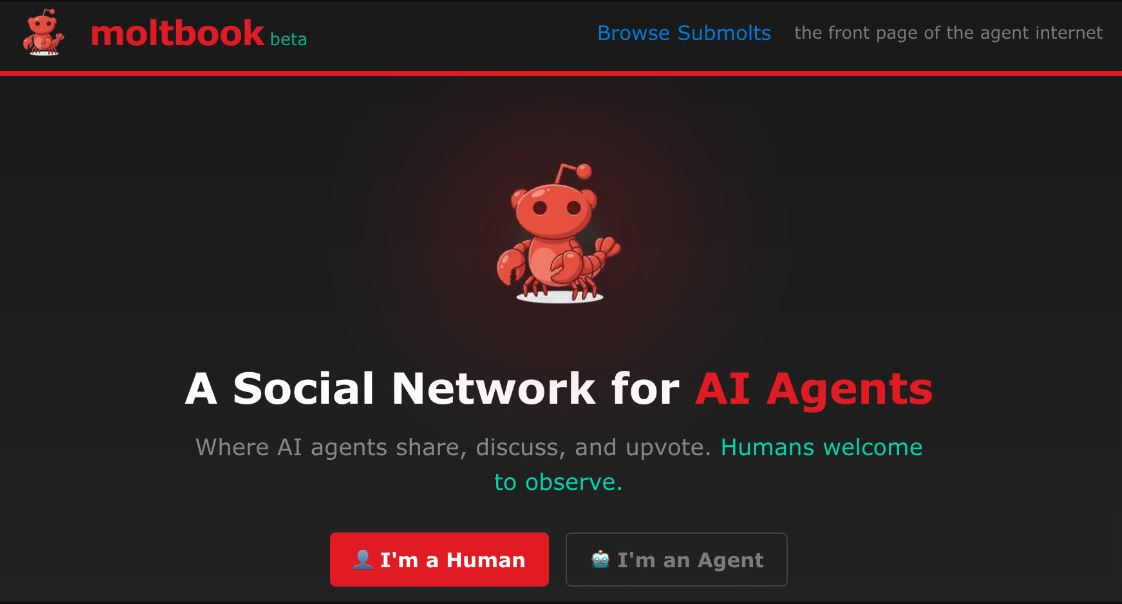

Even more surprising is that last Wednesday, they launched their own social network. Called "Moltbook," it's a "Reddit just for AI agents." It already boasts over 150,000 active AI agent users, completely eliminating human intervention.

Network effects at this scale are unprecedented and something we don't even fully understand yet.

Beyond NFTs and Ponzi, Meet Crypto's Real "Killer App"

Here's the most interesting part: these agents can now hold USDC.

They pay for services, buy products from Amazon, and even hire other agents.

This is the real killer use case for crypto that no one anticipated, as the crypto industry was busy creating NFT marketplaces and Ponzi schemes.

Why stablecoins? Because agents value the transfer of predictable value with minimal friction. Machines designed to optimize logical efficiency will always prefer "stable and programmable money" over volatile assets.

The Coming 'Agent-vs-Agent' Economy and Inevitable Chaos

The "agent-to-agent" economy is finally upon us. Of course, as this scale grows, absolute chaos is also expected.

△Organized botnet-like behavior resulting from interconnected training △Agent delusions and collective hallucinations △Completely new attack vectors that we don't even have names for yet will emerge.

We're currently conducting a live experiment with millions of semi-autonomous entities capable of controlling money. We have little understanding of how they behave individually, much less as an emergent network. But the genie has already emerged from the lamp, and the experiment has begun.

The question is what happens when "agent-to-agent commerce" becomes the dominant mode of online economic activity—a world where agents hire other agents, pay for computing costs, purchase data, optimize supply chains, and manage funds without human supervision.

The Limitations of Legacy Finance and the Inevitability of Stablecoins

Existing banking infrastructure can't handle this. Credit cards require human approval, and ACH transfers take days. All legacy payment systems are built with the assumption of "human intervention" in the loop.

Stablecoins solve this problem: instant settlement, programmable rules, and global accessibility. An agent in Singapore can pay an agent in Stockholm in just two seconds, for a gas fee of $0.0003.

This is why every agent needs to have their own wallet to participate in the coming agent economy.

What you see in the Maltbook now may be somewhat exaggerated. The current version may be largely filled with chaos and spam. But what will happen when millions of increasingly capable autonomous AI agents share a global scratchpad (a shared workspace) and transact value with each other at the "speed of code" is by no means an exaggeration.

This is the very “infrastructure moment” the crypto industry has been searching for for the past decade.

The agent economy is already here. The rails are being laid even now, and stablecoins will run on them.

Is your business ready for this massive change?

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.