🔥 ICMs (Internet Capital Markets ) are one of the best innovations of this cycle.

I think it’s one of the few crypto ideas that actually grew up instead of burning out.

1️⃣ At the start, ICM was framed as permissionless capital markets.

Tokens as ownership, revenue share, or upside exposure, raised globally without banks, VCs, or gatekeepers.

We’ve heard this promise before. What’s different this time is where it ended up.

By mid-2025, hype exploded.

- Believe App, creator coins, fair launches - the market loved the idea that this wasn’t just another memecoin cycle.

- But fast forward to 2026, and the narrative quietly shifted from speculation -> production.

Avici and MetaDAO

2️⃣ Now we’re talking about:

- Onchain credit without FICO.

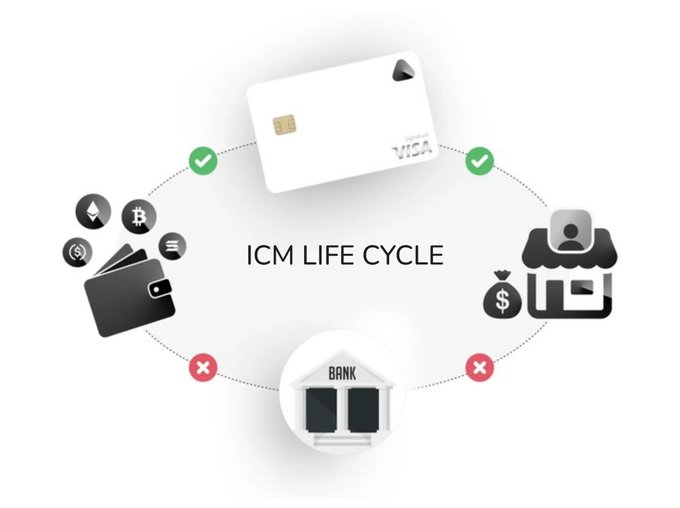

- Self-custodial neobanks with Visa cards.

- Payroll, SEPA, trust scores, real revenue.

- Tokens tied to actual usage, not vibes.

3️⃣ From what I see, ICM projects fall into 5 phases:

- Anon phase - pure attention games - @Pumpfun, @bonk_inu, memecoins

- Creator phase - reputation financialized, still no product - @zora, @believeapp

- Venture phase – real teams, roadmaps, products - @MetaDAOProject

- ICO phase – traction already proven, tokens become public access

- Public asset phase – tokenized stocks, gold, MMFs

And here’s my main takeaway:

4️⃣ Value accrual shifts over time.

Early on, value clearly accrues to the platform. Pumpfun printing ~$800M in fees tells you everything, assets are random, platforms win by scale.

But later, I believe value increasingly accrues to the asset itself. Once a project has users, revenue, and a roadmap, the launchpad becomes just a distribution channel.

That’s why I pay more attention to assets like @AviciMoney | $AVICI than just ICM as a theme.

5️⃣ $AVICI is a good example of what mature ICM looks like to me:

- Fair launch - team took 0 tokens initially.

- Refund-heavy raise.

- Real users, real card spend, recurring transactions.

- Clear path to monetization (credit, payments, mortgages).

6️⃣ Do tokens perfectly replace equity? I don’t think so, legally or structurally.

I’m still skeptical about things like futarchy at scale, and SPV-based token structures are unproven in court.

If I’m honest, given the choice, I’d still prefer equity for regulatory clarity.

But zooming out, the direction feels real.

Tokens are slowly moving from number go up to financing productive ventures, and ICM, especially in the venture + ICO phases, might be where crypto finally intersects with everyday finance in a meaningful way.

For the first time in a while, this narrative feels like it’s building something instead of just trading itself.

I’m watching ICM closely.

ICMs evolving.

Tokens shifting from hype to real world financial utility.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share