This article is machine translated

Show original

The SOL short has shown significant weakness in recent days, with whale actively shorting it. Aggressive long positions held by retail investors are facing liquidation risks.

From a data perspective...

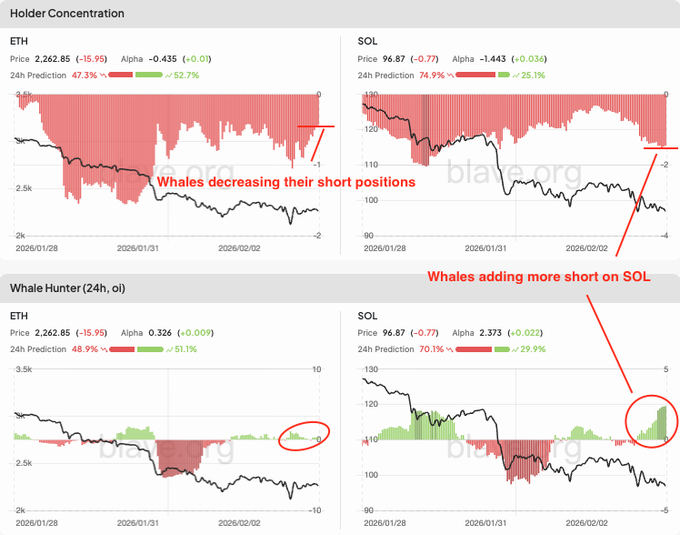

The concentration of short positions in SOL has increased significantly today, with whale alert data showing a large increase in open interest (OI) from whale(adding to short positions), while the concentration of short positions in ETH has actually decreased...

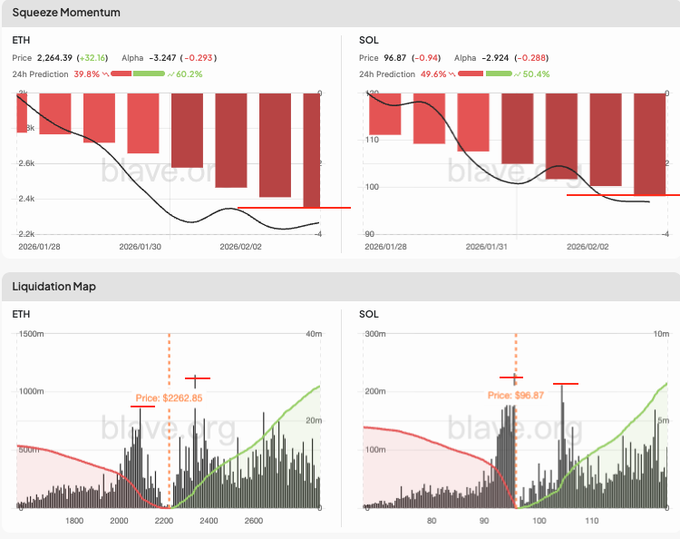

In terms of momentum, both tokens have entered an extreme downtrend phase. The rapid decline could reverse at any time due to news or a market correction. SOL's bulls are facing a significant risk of long position liquidations...

The liquidation map shows that the liquidation prices of SOL long positions are concentrated in the 94-96 price range, while there are fewer aggressive long positions in ETH, with a large number of long positions being liquidated in the 2,150-2,100 range.

A direct comparison of the data clearly shows that short strategies are more likely to succeed on weaker coins, because whale are leading the way. 🧭

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content