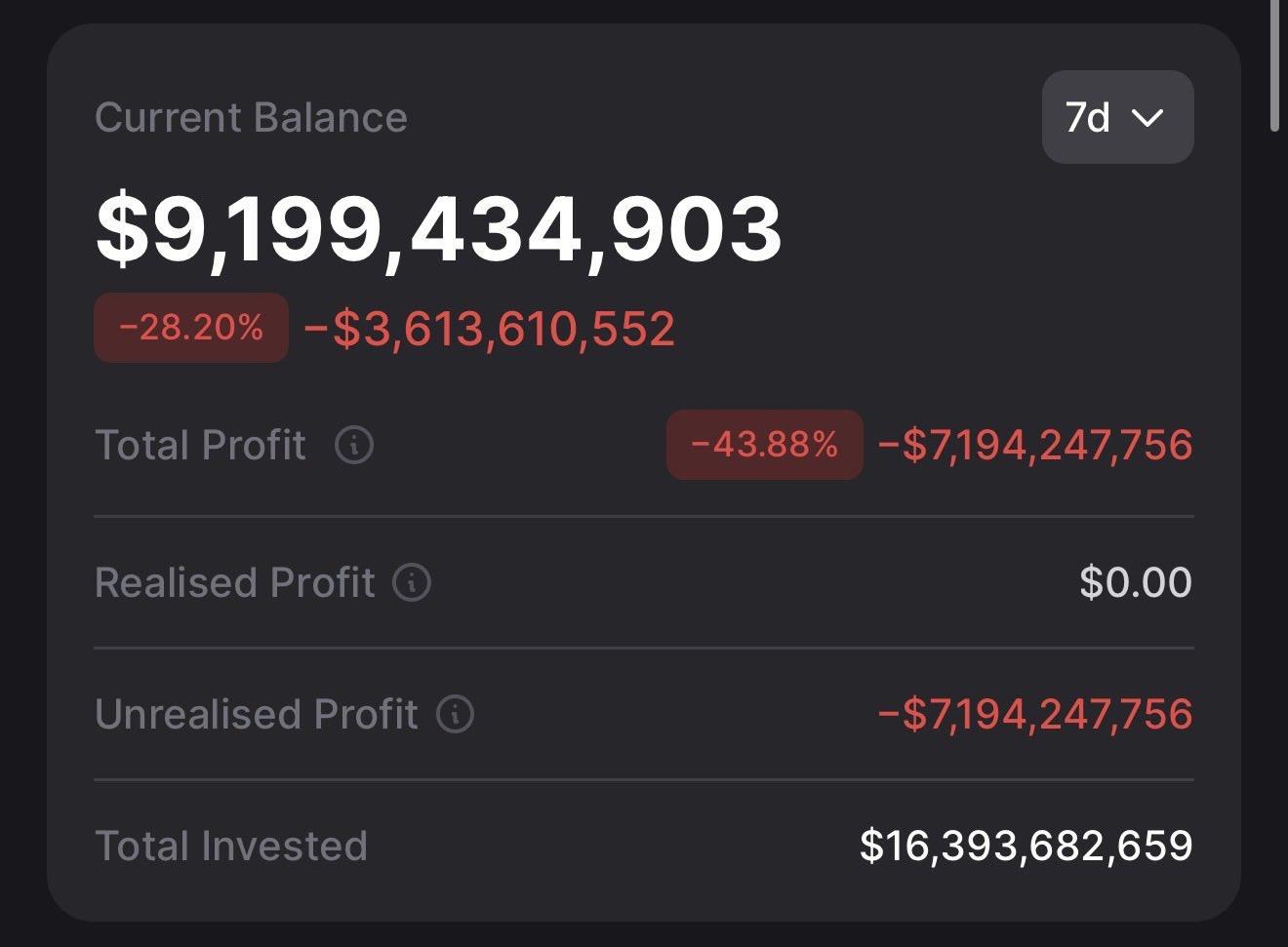

Ethereum's recent sharp decline is putting BitMine Immersion Technologies – a company associated with renowned investor Tom Lee – on one of the biggest losses ever recorded in the history of institutional investment in crypto.

According to market data and portfolio reports, when the price of Ethereum fell below $2,100 , BitMine's unrealized losses ballooned to over $7.4 billion .

BitMine holds a massive amount of Ethereum.

BitMine currently owns approximately 4,285,125 ETH. While the total circulating supply of Ethereum is around 121.4 million ETH , BitMine's holdings represent approximately 3.52% of all ETH on the market. This is an extremely large number, making BitMine one of the world's largest Ethereum whales.

High cost of Capital led to a sharp increase in losses as ETH fell.

According to published data, BitMine's Medium Ethereum purchase price was around $3,837/ ETH. This means: If ETH traded at $3,000, BitMine would have suffered a significant loss. But when ETH dropped below $2,100 , the losses skyrocketed.

Estimated losses if ETH falls below $2,100:

Medium cost of Capital : $3,837

Hypothetical ETH price: $2,100

Loss per ETH: ~1,737 USD

Multiplying that by the total amount of ETH held results in a total unrealized loss of approximately $7.4 billion. This is an extremely large paper loss, even by the standards of global crypto investment funds.

BitMine continues to buy when the market is down.

What surprised the market was that BitMine didn't reduce its position when ETH plummeted. On the contrary, the company continued to buy more. During the period of ETH sharp decline, BitMine bought an additional 41,787 ETH, worth approximately $108 million, at an Medium purchase price of around $2,601. This move shows that the company's leadership, especially Tom Lee, is still heavily betting on Ethereum's long-term prospects.

From a Bitcoin mining company to an "Ethereum treasury"

BitMine only began its ETH accumulation strategy in mid-2025 after completing a $250 million Capital round. In less than six months, the company completely transformed its operating model from a Bitcoin mining company to a global Ethereum accumulation business. This strategy caused BitMine's stock to surge from around $4 to $161 in a short period. However, when the price of Ethereum dropped sharply, the company's stock also plummeted and is now trading around $22–23.

BingX: A reliable trading platform with a range of benefits for users of all levels.

A big gamble on the future of Ethereum.

The loss of over $7.4 billion puts BitMine at high risk, but it also reflects an extreme investment strategy: betting almost the entire value of the company on Ethereum. If ETH recovers strongly in the next cycle, BitMine could become one of the biggest beneficiaries. Conversely, if Ethereum continues to weaken, the financial pressure on the company will be immense.

Ethereum's drop below $2,100 not only affected individual investors but also caused large institutions like BitMine to suffer billions of dollars in losses. Tom Lee and BitMine's loss of over $7.4 billion is currently just a "paper loss." However, the sheer size of their position is drawing significant market attention, as it could become an important indicator of long-term confidence in Ethereum.

This content is for analytical and informational purposes only, not investment recommendations.