The cryptocurrency market has been in a constant decline recently. However, projects that are holding on are presenting realistic visions.

Key Takeaways

Projects that can realistically solve problems will survive a bear market.

Hyperliquid, Canton, and Kite solve different problems, but they have one thing in common: a 'realistic' solution.

To assess the feasibility of a project, focus on evaluating the problem it is trying to solve, the solution, and the feasibility of its implementation.

1. Conditions for Surviving a Bear Market: Does It Really Work?

Bitcoin finally fell below $70,000. Of the top 100 cryptocurrencies by market cap, only seven are above the 200-day moving average. This contrasts with 53 Nasdaq 100 stocks.

Market conditions can't be reversed. However, there are cryptocurrencies that can withstand even the worst of circumstances.

How do they maintain their prices even in a bear market? Their actions begrudgingly challenge the notion that this is simply a result of "artificial market making" or a "chance rebound."

They no longer simply tout opaque visions or technological flashiness. Instead, they share a commonality: they are addressing core market problems in a realistic manner. Specifically, they pursue the following three directions.

Are we solving the problems the market is facing right now?

Is it ready for practical use in the near future?

Are we creating a foundation on which the industry will depend in the long run?

Ultimately, the ability to solve realistic problems is the most powerful fundamental.

Projects that answered the above questions survived. They 1) recognized the market problem and 2) presented realistic solutions tailored to their respective timelines.

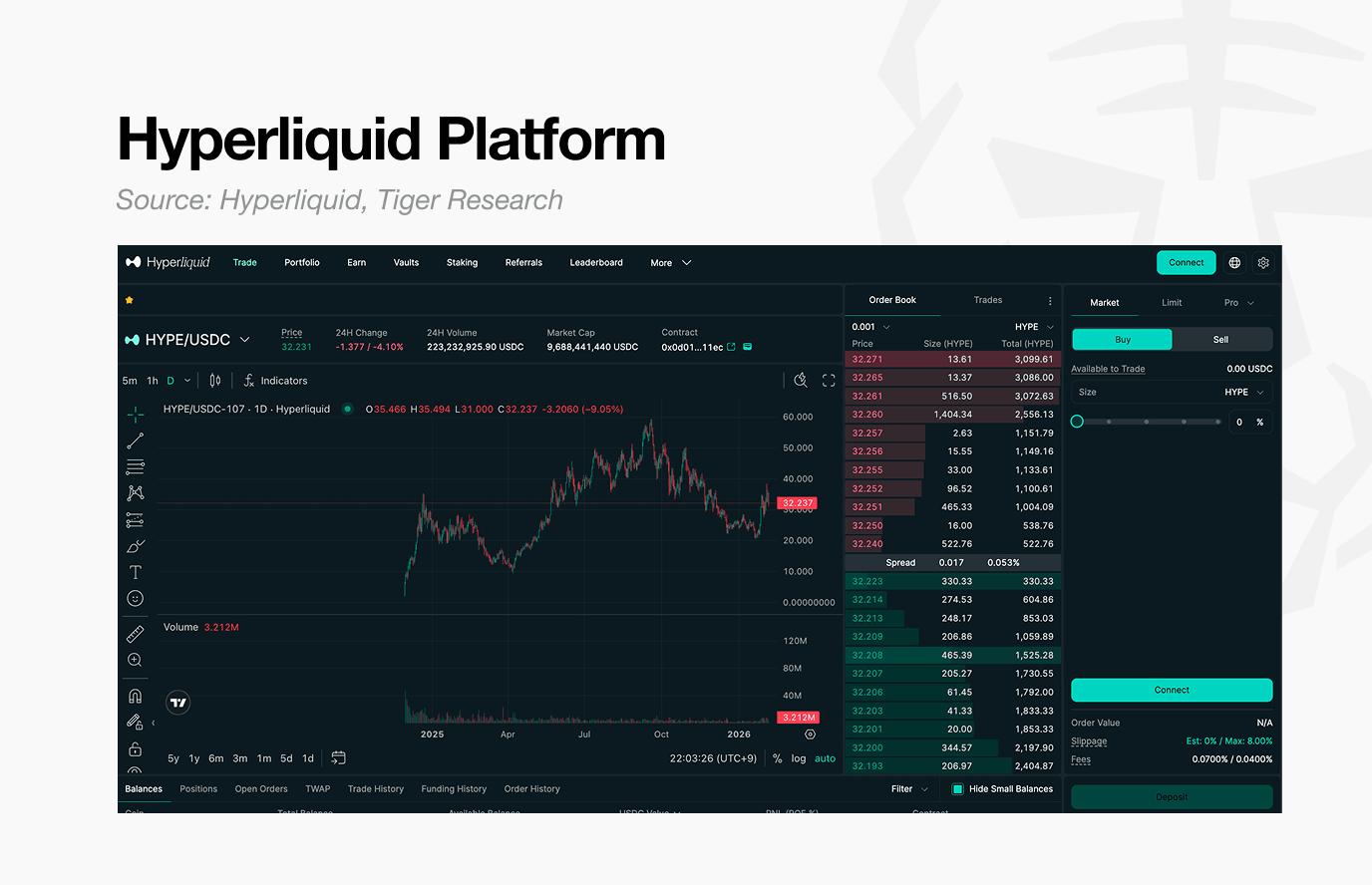

While centralized exchanges had the advantage of accountability, they were in fact not on the side of investors whenever problems arose. Several decentralized exchanges emerged to address this issue, but their user experience was less favorable than that of centralized exchanges, leading to investor shunning.

In this context, Hyperliquid introduced the concept of perpDEX. It delivers the high leverage, fast settlement speed, and stable liquidity based on HLP, all desired by CEX investors, in an on-chain environment. Initially, users flocked to the platform, hoping for the $HYPE token airdrop. However, upon actual use, investors were satisfied with the platform's performance and continued trading even after the airdrop.

Ultimately, Hyperliquid emerged from a persistent problem of today: dissatisfaction with centralized exchanges.

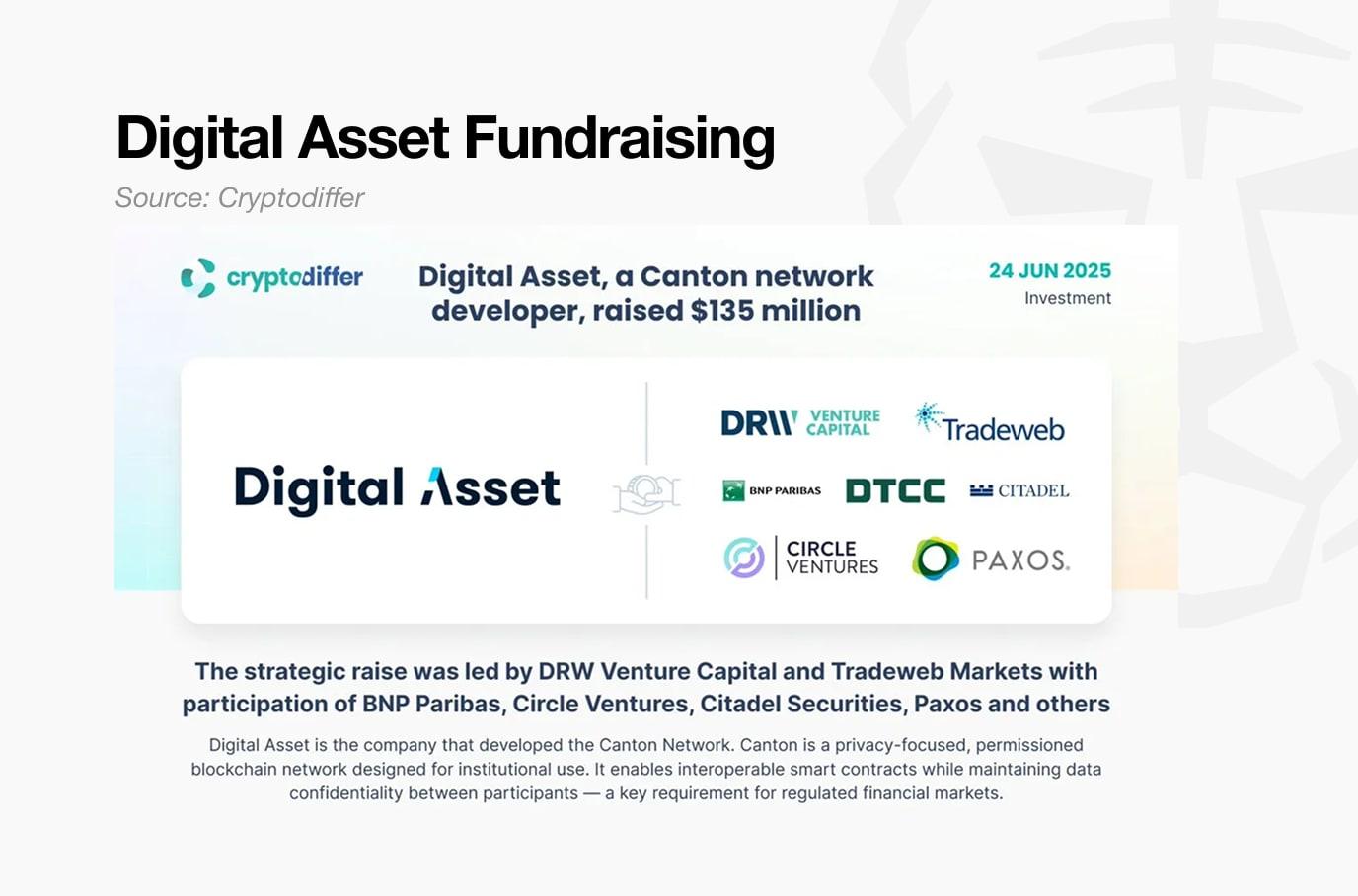

Canton offers a solution for the near future. Amid growing interest in RWA, institutions are beginning to view blockchain not simply as a public network, but as a "financial infrastructure." In this environment, institutions are demanding not a structure that discloses all data, but rather a selective privacy chain that can simultaneously meet regulatory compliance and confidentiality.

The Canton Network emerged to address these needs. Through DAML, Canton offered a level of information disclosure tailored to each party. This allowed institutions to maintain the confidentiality of transaction data while sharing information only to the extent necessary. In other words, it created an infrastructure that caters to demanders and institutions, rather than suppliers.

Furthermore, Canton Network has significantly expanded its ecosystem from the outset, building a collaborative network with financial institutions and presupposing real-world usage scenarios. In particular, its partnership with DTCC has laid the foundation for expanding assets managed in existing financial systems to a Canton Network-based environment. DTCC processes approximately $370 trillion in transactions annually, demonstrating the practical feasibility of Canton Network.

Ultimately, the Canton Network presents a structural solution that simultaneously meets the three requirements of institutions: privacy protection, regulatory compliance, and integration with existing financial systems.

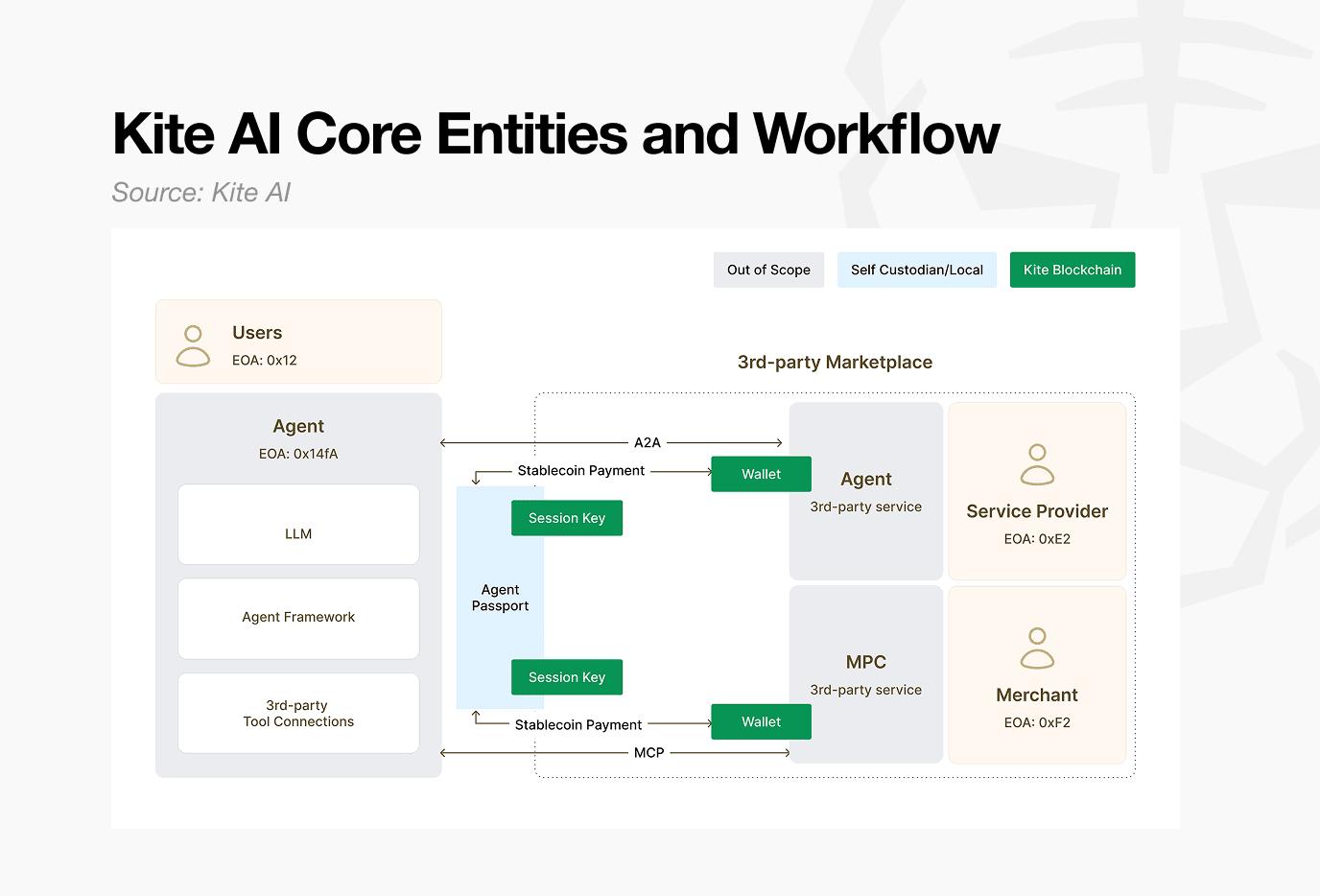

Unlike previous examples, Kite AI's practical applications are still limited. However, considering a future where AI agents will act as economic actors, its structural appeal is sufficient.

Regardless of whether it's Web2 or Web3, everyone agrees on a future powered by AI agents. No one disagrees about a future where AI agents book hotels and order bananas on my behalf.

However, this future requires an infrastructure that allows AI agents to perform payments on their own. Existing transaction systems have been designed from the outset to focus on human-to-human remittances and transaction efficiency. Therefore, for AI agents to operate as independent economic entities, they require identity verification and automated payment structures.

Kite AI is building an AI agent payment infrastructure to prepare for this future. As described above, the core features are the "Agent Passport" for identity verification and the "x402 protocol" for automated payment structures.

The vision presented by Kite AI is not immediately applicable on a large scale. The future we envision has not yet arrived. However, the project's widespread appeal—that it will be the technology needed when that future arrives—makes it a reality.

Although all three projects have different time points, what they have in common is ‘reality.’

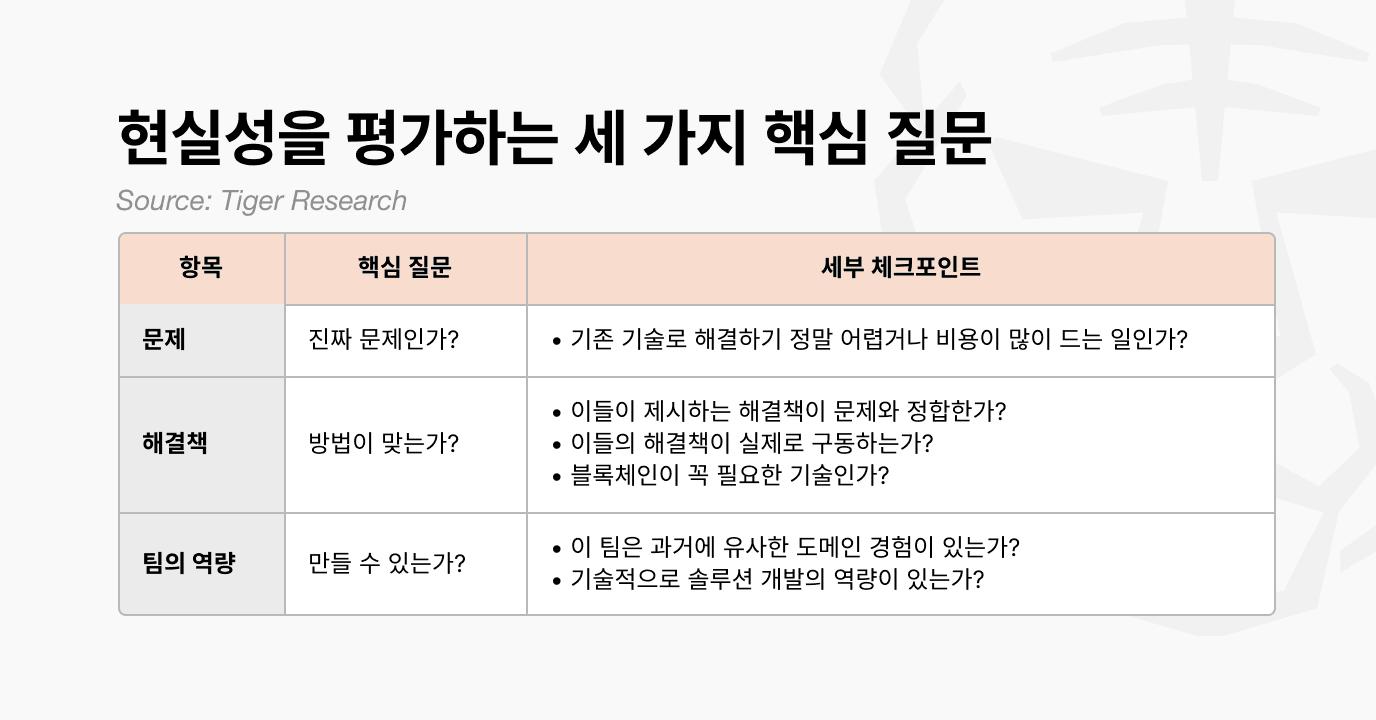

Even for the same project, opinions are often mixed. Some see it as "solving a real problem," while others see it as "just hype." To alleviate this confusion, we should at least ask ourselves the following three questions.

Given that most projects tout rosy futures, properly answering these questions requires considerable time and effort. Weeding out misinformation is no easy feat. However, projects that fail to confidently answer these three questions may see a short-term price surge, but they are likely to be relegated to the dustbin of history when the next downturn arrives.

It's clear that the cryptocurrency market is not doing well. But that doesn't mean it's over. New attempts will continue, and we need to clearly see what they mean.

What you need now is 'realism'.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.