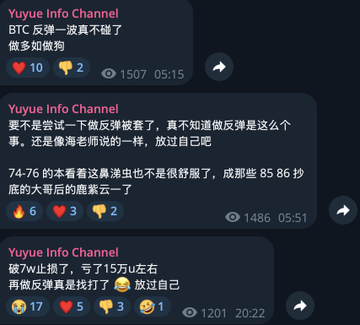

I bought BTC at 75 hoping to profit from a rebound, but then when it dropped to 70, I drastically cut my losses on all my contract positions. Looking back, it's quite frightening. Another insight I gained was seeing this large-scale reversal candlestick pattern on BTC. I thought about why I always long instead of short. If it were this candlestick pattern, I would most likely have bravely gone long. The core reasons for this hesitation are a few: 1. The ingrained mindset of long has not been corrected. 2. My individual short win rate is inherently low; I'm not good at short. 3. Unable to control one's impulses when holding cash, exhibiting a gambling addiction. Long accustomed to maintaining growth and a daily profit-making mindset, one forgets that in a downtrend, the harder you try, the more unfortunate you become. As one group member put it, "The most frightening state is actually becoming numb to the decline, no longer valuing money, reaching a state of 'indifference.' Think carefully about what you could do with the money you lose each day in real life." People don't need to make money every day. This pullback has been significant, but honestly, just surviving is good enough.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content