Author: Gu Yu, ChainCatcher

With the sharp drop in BTC and ETH prices in recent days, the positions of Jack Yi, founder of Trend Research and Liquid Capital (formerly LD Capital), have attracted the attention of many crypto investors. His leveraged position of 650,000 ETH is in jeopardy under the current market conditions, and he is on the verge of liquidation.

For this staunch ETH bull, a rare on-chain trader with transparent credentials, and a representative of the Asian crypto industry, this situation is truly cruel and poignant. After all, concepts such as "transparency," "bullish sentiment," and "research-driven" align with mainstream crypto values, and Yi Lihua's "battle" is, to some extent, a "battle for legitimization" for the crypto industry.

So how did all this happen? Why did Yi Lihua go from successfully escaping the market peak to getting trapped in a buy the dips? And what insights and lessons can we learn from this?

From buy the dips to selling at the top

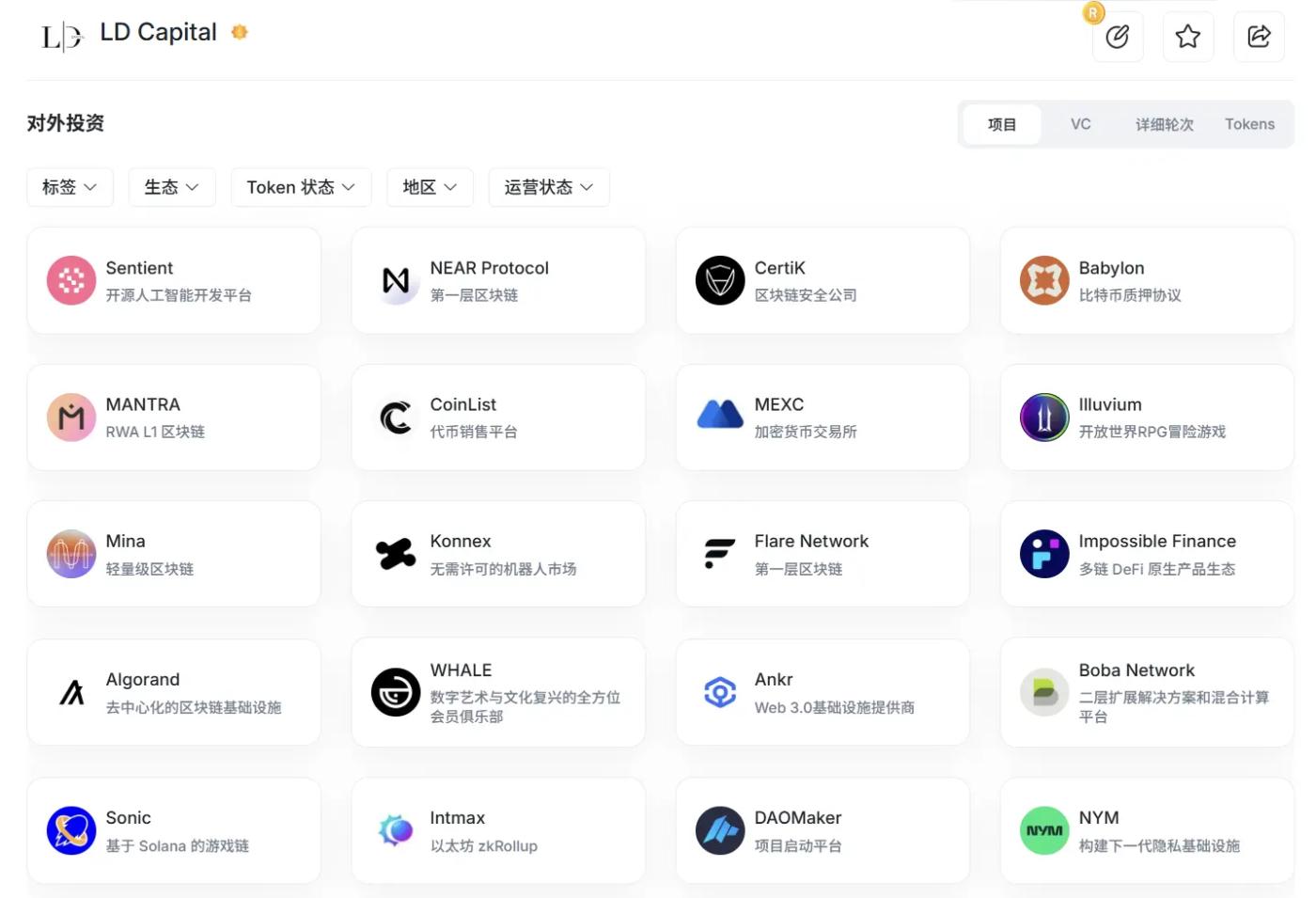

Yi Lihua is an early OG in the Chinese crypto community. Since 2015, he has invested in hundreds of blockchain projects, including early investments in EOS, Qtum, and VeChain. After 2017, through LD Capital, he invested in well-known projects such as Near, CertiK, MEXC, and Sentient.

LD Capital's investment portfolio is partly sourced from RootData .

Since the beginning of 2025, Yi Lihua has shifted his focus from the primary cryptocurrency market to the secondary market. In April 2025, the price of ETH fell to a 22-year low, reaching a low of $1385. Yi Lihua's buy the dips quietly began at this time.

In late April, Trend Research released a bullish report on ETH when it rose to $1,800, stating that "following this trend, further gains in the Crypto market are on the horizon."

In late May 2025, Trend Research's frequent large-scale on-chain purchases were discovered and disclosed by on-chain analyst Yu Jin, and Yi Lihua subsequently claimed these addresses on X. At this time, ETH had risen to $2,600, and Trend Research's on-chain addresses held a total of 133,000 ETH, with a total value of $360 million.

However, it should be noted that Trend Research's operations were not entirely cash-based. A large portion of the funds used to purchase ETH were borrowed from Aave by staking previously purchased ETH, which meant that several times the leverage was applied.

In June 2025, Trend Research published another article titled "Why We Are Bullish on ETH Before the Surge," stating that the underlying logic for their continued bullishness on ETH was: the Trump administration's commitment to establishing a stablecoin system... and Ethereum is the most important infrastructure for stablecoins and on-chain finance. The influx of stablecoins and the continued development of RWA will further boost DeFi, driving up Ethereum's consumption, increasing GAS revenue, and increasing its market capitalization.

At this time, the price of ETH was around $2,800. Yi Lihua also publicly stated that he believes the long-term price of ETH can break through $5,000, and in an optimistic scenario, the price of BTC will rise to over $300,000 in this cycle, with ETH potentially reaching $10,000. Simultaneously, Yi Lihua stated that he had purchased 100,000 ETH options.

In July 2025, Yi Lihua tweeted that the market had completely entered a long bull market, and the traditional four-year cycle pattern might no longer exist. Stablecoins and blockchain are the best opportunities for the US dollar to globalize. With one hand investing in crypto stocks and the other earning interest on stablecoins, the market will continue to add new users and funds.

After that, Yi Lihua added to his position almost every month until early October when he began to warn of market risks and quickly transferred most of his ETH holdings to the Binance exchange to sell. At that time, the price was around $4,700, which just saved him from the 10/11 attacks.

Through this round of precise buy the dips(starting to build positions around $1,800 in the first half of the year) and profit-taking at the high point, Yi Lihua achieved a significant doubling of profits and consolidated his influence as a top trend investor in the Chinese-speaking community.

Secondary position building resulted in losses

In the market reshaped by the 10/11 incident, Yi Lihua saw another opportunity to build positions. In early November, he tweeted that ETH had begun to rebound, remaining optimistic about its future performance and advocating a buy buy the dips strategy. He subsequently stated that $3000-$3300 was the ideal range for buying ETH buy the dips. As ETH continued to correct, Yi Lihua, following his buy buy the dips strategy, stated that he had already gone all-in on ETH at $2700, and continued to add to his position through leveraged borrowing during the subsequent decline. By January of this year, he held over 650,000 ETH, with a reported average cost of $3180.

"When ETH fell to around $1,000, we saw through the main players' intention to shake out the long positions in Ethereum OG and successfully buy the dips. When ETH rose to over $4,500, we saw through the market's rise to the top of the consolidation phase and successfully sold off our positions. Trend Research's successful buy the dips and top-selling performance in 2025 proves that we will not change our investment strategy due to emotions." Yi Lihua was still encouraging the market in January.

But no one could have predicted that the market would deliver a blow to this seasoned investor at this critical moment. In early February, the price of ETH fell below key levels such as $2,200, $2,000, and $1,800, approaching its liquidation price.

Yi Lihua sold approximately 200,000 ETH over several days to cut losses, lowering the liquidation price to around $1,600, thus avoiding a major sell-off in the early hours of today. According to on-chain analyst Yu Jin's analysis today, Trend Research has already lost $763 million on this long, not only wiping out all previous profits but also losing $448 million of its principal.

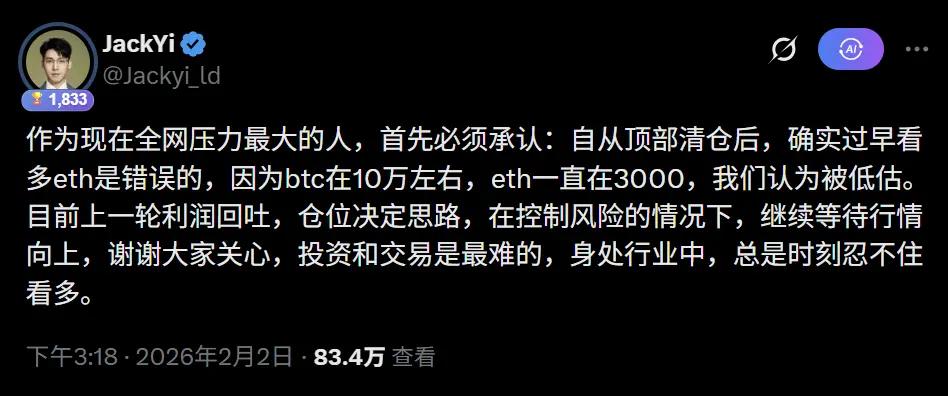

In recent days, Yi Lihua tweeted an admission of his mistake: "Since clearing out his positions at the top, it was indeed a mistake to be bullish on ETH too early, because BTC was around 100,000 while ETH was consistently around 3,000, which we believed was undervalued. Currently, the previous round of profits has been retraced, and position size determines strategy. While controlling risk, we will continue to wait for the market to move upward. Thank you for your concern. Investing and trading are the most difficult things. Being in the industry, it's always hard not to be bullish."

"The reason I always can't help but be bullish is related to my past entrepreneurial experience. Back then, I couldn't find a job, so I started my own business. After earning my first pot of gold, I didn't dare to spend it all but instead invested in tech projects. I entered the crypto in 2015 and caught that golden age, which is the result of continuously going long. But later, I suffered huge losses in the bear market and couldn't hold on to the bear market, so I liquidated my BTC holdings prematurely and missed the big bull market after March 12th. We've experienced two bull markets after bear markets, so this time, after escaping the top, I'm quite confident that I didn't buy the dips too early. I'll continue to wait while controlling the risks."

Zhusu, founder of Three Arrows Capital, posted on X to discuss this matter: "In my experience, selling at a high price is often more dangerous than selling during a downtrend. This is because the excitement of selling at a high price can lead to premature additional buying and overconfidence. I suspect that Jack Yi made a similar mistake of arrogance after making a nine-figure profit on October 10."

Despite these setbacks, Yi Lihua still expressed his firm view on the market outlook: "As bulls in this round, we remain optimistic about the next bull market: ETH has reached over $10,000, and BTC has exceeded $200,000. We only made some adjustments to control risk. I know everyone is disappointed with the industry and leading companies, especially with the liquidity shortage and manipulation by some platforms caused by the 1011 incident. However, I believe the long-term trend of the crypto remains unchanged, and now is definitely the best time to buy spot. Volatility is the biggest characteristic of the crypto. Countless bulls in history have been shaken off by this volatility, but they have often been followed by a doubled rebound. "

Currently, the price of ETH has rebounded to around $1,900, and Trend Research's position risk has decreased significantly. However, the impact and implications of this event on the industry will continue to unfold.

The market needs more bullish pronouncements and open trading.

As one of the very few institutional representatives who choose to "reveal their hand on the blockchain" and disclose all their thoughts and position dynamics, Yi Lihua's every statement and every operation has become an invisible mirror for the industry: it reflects the belief in trend investing, but also amplifies the non-linear risks of leverage; it demonstrates the power of logic realization in a bull market, but also exposes the fragile balance between sentiment and position during a pullback.

However, in a market still dominated by anonymous speculators, platform manipulation, and information asymmetry, Yi Lihua's choice to go public is itself a rare act of courage—he uses real on-chain operations rather than empty talk to verify his judgment. While this approach brings enormous personal pressure and temporary losses, it also provides countless retail investors and small and medium-sized institutions with the most intuitive textbook: how to escape the top in a bull market, how to buy the dips in a bear market, how to manage leverage, and how to control emotions.

In the highly volatile and uncertain arena of the crypto market, even the most brilliant successes and the deepest cyclical insights cannot completely exempt one from the market's harsh lessons—because each cycle brings new challenges to participants with new forms, new intensities, and new variables. In this cycle, the crypto market is closely intertwined with the macroeconomic environment (CPI, US stocks, gold, etc.) and geopolitical events; any significant changes outside the industry can potentially reverse cyclical trends within it.

This experience once again proves that what truly determines whether an investor can weather economic cycles is not the correctness of a single directional choice, but rather whether they have sufficient room for maneuver in every judgment amidst continuous uncertainty, and the ability to cut losses and restart promptly when mistakes occur. Respect for the market is a principle that every investor must always adhere to.

Furthermore, it's worth noting that Trend Research, as one of the top three ETH holders in the market, has become a bellwether for institutional crypto investors in the Asia-Pacific region. Its success or failure is crucial to the Asian market's influence and status within the crypto industry. Some market observers also believe that the Asian market, as a vital source of liquidity in the current crypto market, has a high proportion of retail investors and is more susceptible to sentiment manipulation. If the bullish narrative is broken, the Asian market may become a passive recipient of the North American narrative and liquidity.

Fortunately, Yi Lihua and his Trend Research are still at the table. The crypto industry needs more steadfast bulls, more open strategies, and more people like Yi Lihua.

It's important to understand that Trend Research's story will be seen by more mainstream institutions and deep-pocketed firms. The crypto industry needs more stories of achieving returns by focusing on research, adhering to investment discipline, and controlling risks, rather than more meme-style wealth transfers. The former can bring in new investors, while the latter will only exacerbate the casino-like nature of the crypto industry.