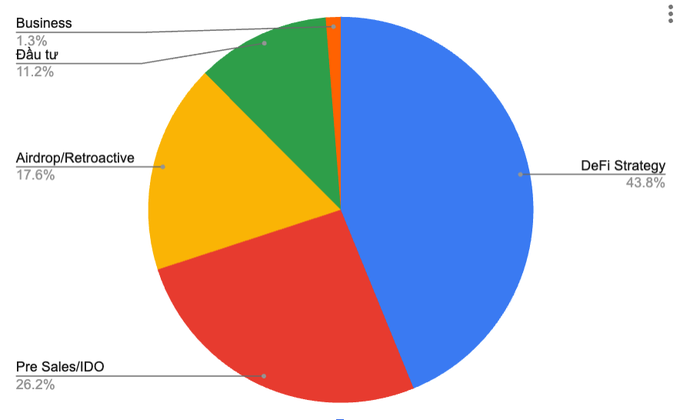

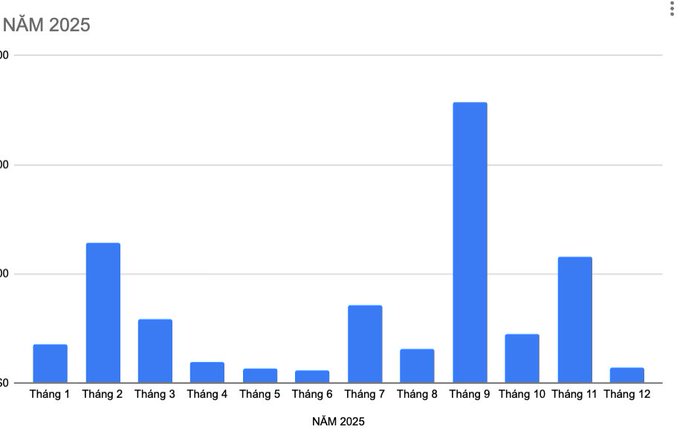

LOOKING BACK AT A YEAR OF DIVERSIFICATIONS IN MAKING MONEY Let's look back at the results and the lessons learned, guys! It's been exactly one year since I Chia with you guys about the importance of DIVERSIFYING MONEY-MAKING STRATEGIES in the Crypto market, and today I'll Chia with you my achievements and lessons learned about this strategy in 2025. First, it's the result of practice. Income in 2025 will come from: - 43.8% comes from strategies in DeFi such as Farming, Adding LP, Arbitrage, etc. - 26.2% came from Pre-Sales/IDO programs that re-emerged a few months ago. - 17.6% comes from Airdrop/Retroactive events. - 11.2% comes from investment work. - 1.3% comes from business/marketing activities in the crypto market. As I've Chia with everyone before, the two most important things this strategy brings are: ✅ Not relying on profits from a single channel will help you avoid being overly dependent on market fluctuations, thus saving you time spent XEM charts, reading news, etc. Peace I personally continue to feel the clear influence of these two factors in 2025 when I don't focus on: - Earn money from Airdrop/Retroactives, thereby eliminating negative thoughts and feelings about how the project treats its users, because the market meta has changed. - Earning money through investing means I don't get caught in the DCA (Double Cash Flow) spiral to the point of death. Because I no longer have this pressure, I invest quite cautiously, which has resulted in a fairly good win rate with some trades like $ASTER $ZAMA From implementing this strategy in 2025, I have also gained new lessons and continued to reinforce old ones, including: 1. Stability in profits is impossible. I've always tried to build financial stability in the crypto market, but 2025 continues to give me a "NO" response, similar to 2024 and even further back to 2023. You can see the 80/20 rule clearly demonstrated when 20% of the months generate 80% of the annual income. Therefore, in 2026, I will no longer use a stability mindset but will shift to an optimization mindset in the market. -> I will try my best during bad market months and focus 100% on months when the market is good and creates many opportunities. -> Don't create Airdrop/Retroactives indiscriminately for the sake of stability, as this will waste time, money, and effort. 2⃣ Accept letting go of things that aren't working One of my bravest decisions in 2025 was to stop 80% of my Airdrop work to focus on other strategies. For me, this was a relatively risky decision because any project would eventually have an Airdrop and generate revenue, while participating in DeFi strategies could result in losses. However, given the increasingly negative state of Airdrop , I decided to remove them, resulting in a significant decrease in the percentage of income from Airdrop during the last six months of the year. However, the success lies in the fact that the percentage of income from other sources skyrocketed. Looking back now, I realize it was a risky but necessary decision! 3⃣ Investment requires precision, not quantity. I started seeing the Altcoin story enter a slow- rug phase after TGE, and I stopped investing heavily in 2025. Instead, I'm investing in the following direction: - According to Narrative - According to personal analysis Essentially, it's still the same as investing in regular Altcoins, but I've added a few points: - Shorten the investment timeframe, focusing on short- to medium-term rather than long-term. - There is a stop-loss order if the Token price does not move as expected. - A positive DCA means the DCA is active when the Token price increases; if the price decreases, there's a high chance of a Stop Loss (SL) as shown above. Thanks to the points above, my investment in 2025 will be effective even with minimal spending. 4. The arguments are becoming increasingly accurate. I have several beliefs about the crypto market that are still valid and effective, including: - Staying in the market, continuously monitoring and closely observing, yields a much higher success rate than exiting and waiting for the market to become active before re-entering. - The market always presents money-making opportunities for those who follow it closely. - The worse the market, the more likely big opportunities are to be missed compared to when the market is doing well. Above are some of the lessons, experiences, and achievements I've accomplished in 2025 that I wanted to Chia with everyone!

This article is machine translated

Show original

Hak Research

@HakResearch

02-08

CHIẾN LƯỢC KIẾM TIỀN CỦA MÌNH TRONG THỊ TRƯỜNG CRYPTO

Muốn giàu nhanh trong thị trường này chỉ có cách giàu chậm thôi anh em à ...

Bắt đầu fulltime cùng với Crypto từ tháng 5/2021 nhưng mãi cho đến 2023 thì mình mới nhận ra rằng: "Muốn kiếm được tiền x.com/HakResearch/st…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content