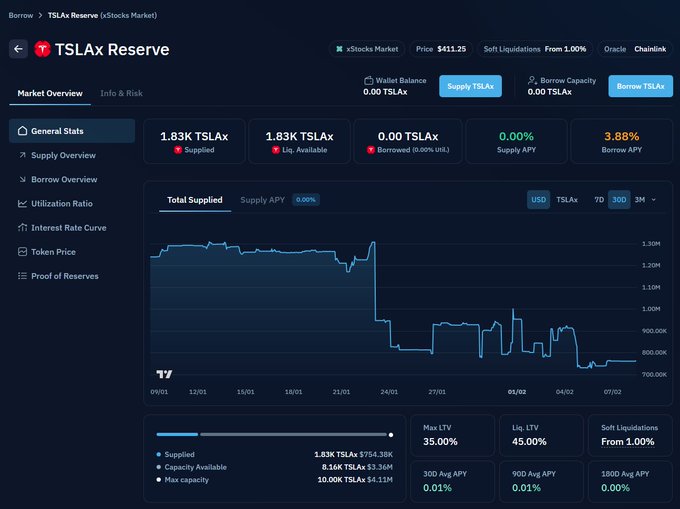

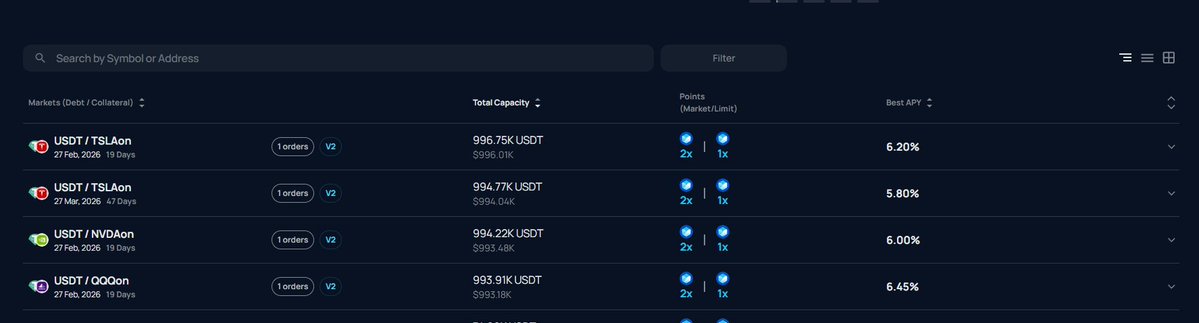

Regarding the integration of US stocks onto blockchain, the most discussed points are essentially two: 24-hour trading and the ability to leverage through DeFi. However, with Nasdaq's plans to implement a 23-hour trading system gaining traction, the former's advantage is reduced to weekends and is not as significant as initially thought. Therefore, enthusiasm has shifted to seamless integration with DeFi. Traditional brokerages, for example, do offer leverage; Interactive Brokers provides 2x leverage (overnight) by default, eliminating the need for borrowing. More professional traders also have their own ways to leverage. However, the advantage of DeFi is its broader capabilities. In the integration of US stock RWA into DeFi, Solana is actually more advanced than Ethereum-based platforms. Currently, Kamino (@kamino) allows lending and borrowing of assets minted by Backed Finance, such as TSLAx. The lending ratio is set at 35%, which is relatively low; Kamino likely considers this a trial product. In the ETH-based market, Ondo (@OndoFinance) currently boasts the largest scale. However, it's a pity that AAVE (@aave) hasn't decided to accept these US stock RWA tokens as collateral. This, however, opens up opportunities for other DeFi platforms, such as Termmax (@TermMaxFi) which recently partnered with Ondo. Ondo's TSLA, NVDA, and QQQ tokens can now be used as collateral for USDT lending on Termmax BSC. If you recall, we previously discussed Termmax, a DeFi platform offering fixed-rate lending. Currently, TSLA offers a 6.8% interest rate with a lock-up period until maturity. This highlights a key difference between DeFi and traditional finance: these US stock RWA tokens (after proving their security) can freely integrate with various DeFi platforms, enabling features not available in traditional finance, such as fixed interest rates, floating interest rates, and revolving loans. Therefore, this is clearly a significant development.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content