Original article | Odaily Odaily( @OdailyChina )

Author|Azuma ( @azuma_eth )

In 2014, CZ, who had only been exposed to the concept of cryptocurrency for a year, made the most daring investment of his life— selling his apartment in Shanghai and "All In" on about 1,500 BTC for a three-figure price. Twelve years later, if CZ had never sold, this investment would have brought in a substantial profit of hundreds of millions of dollars (peak return of about $189 million).

Compared to his subsequent achievements in founding Binance and becoming an industry leader, the returns from this investment are insignificant to CZ. However, from an external perspective, this highly idealistic "all-or-nothing" gamble remains one of CZ's most celebrated moves.

Ironically, even CZ, who is known for his firm beliefs and decisive actions, once missed out on an investment with a potential profit a hundred times greater than "selling his house to buy cryptocurrency" in a highly dramatic way.

Rewinding the clock 1555 days: That feinted acquisition

November 9, 2021, was a sleepless night for the cryptocurrency industry.

Just the day before, FTX, which was once riding high in the industry, suspended withdrawals due to a liquidity crisis . The community panic escalated rapidly, and the musty smell of the ebb and flow of a bloodbath began to spread in the market. As we all know, FTX collapsed, and the rest of the dominoes fell one after another, plunging the market into a long winter that lasted for several years.

In a parallel universe, the story could have taken a different turn. In the early hours of November 9th, SBF and CZ issued statements indicating that FTX had reached a preliminary acquisition agreement with Binance.

SBF: Hi everyone: I have some news to announce. Things have come full circle. FTX's first and last investors are the same group of people—we have reached a strategic transaction agreement with Binance (subject to due diligence).

CZ: This afternoon, FTX sought our assistance. The exchange is currently facing a severe liquidity crisis. To protect our users, we have signed a non-binding letter of intent to acquire FTX in its entirety to alleviate the liquidity crisis. We will conduct comprehensive due diligence in the coming days.

However, the acquisition ultimately failed. Just one day later, Binance officially announced that it was abandoning the acquisition, citing " problems beyond its control, " which became the final straw for FTX.

Did CZ ever genuinely consider acquiring FTX? Was the hastily concluded acquisition saga a deliberate act of assistance, or merely a prying look at its rival's "health bar"? This may forever remain a mystery. In the end, CZ single-handedly crushed its biggest competitor at the time, solidifying Binance's position as the industry leader.

But no one expected that what was once an inconspicuous "idle piece" in FTX's asset pool would appreciate rapidly in just a few years, and its value has now far exceeded the total value of the remaining assets from that unfinished acquisition.

What was once a "casual move" has now become the focus of AI.

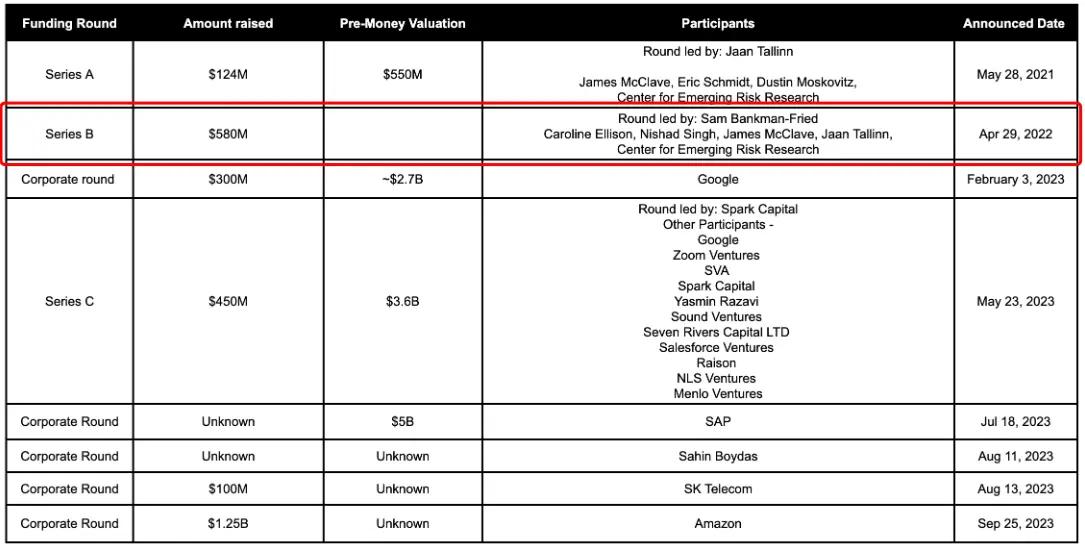

In April 2022 (this is the official announcement date; the transaction was actually completed in 2021), FTX completed its most important investment in the AI field— leading a $580 million funding round for AI startup Anthropic with a $500 million investment, holding a stake as high as 13.56%, which was subsequently diluted to 7.84% as Anthropic completed multiple rounds of financing.

That was an era before the imagination of AI had fully blossomed. Just six months later (at the end of November 2022, the same month FTX collapsed), OpenAI's ChatGPT emerged, and the world irreversibly entered the "Age of Exploration" of AI. Anthropic, with its Claude series of products (especially the programming sub-product Claude Code), has repeatedly amazed the world and gradually become one of the most shining star companies in the AI era.

As Claude continues to evolve, Anthropic's valuation continues to rise. Investors are frantically waving their cash, eager to board Anthropic's IPO journey. The latest market rumors suggest that Anthropic is entering the final stages of a new large-scale funding round, with the amount expected to exceed $20 billion (originally planned for $10 billion, but due to much higher-than-expected investor demand, the final amount is expected to double), valuing the company at a potential $350 billion . The deal could be completed as early as this week.

Based on the latest valuation of $350 billion, FTX's stake in Anthropic was worth approximately $27.44 billion, enough to cover the reserve gaps that led to its bankruptcy several times... But history has already happened, and the outcome is already set.

It's hard not to admire SBF as a rare venture capital genius (besides Anthropic, he also invested in the now-popular Cursor in its seed round), but he's clearly not a competent business operator, especially lacking in risk control. CZ's profile is completely different. He's a top-notch business operator; Binance's dominance is inseparable from his numerous correct strategic decisions. However, CZ often describes himself as not a traditional investor simply pursuing investment returns, not trading cryptocurrencies, but rather wanting to be a builder of the industry.

A hasty ending: This should have been the best intersection between Crypto and AI.

You might be wondering, what happened to FTX's shares in the end?

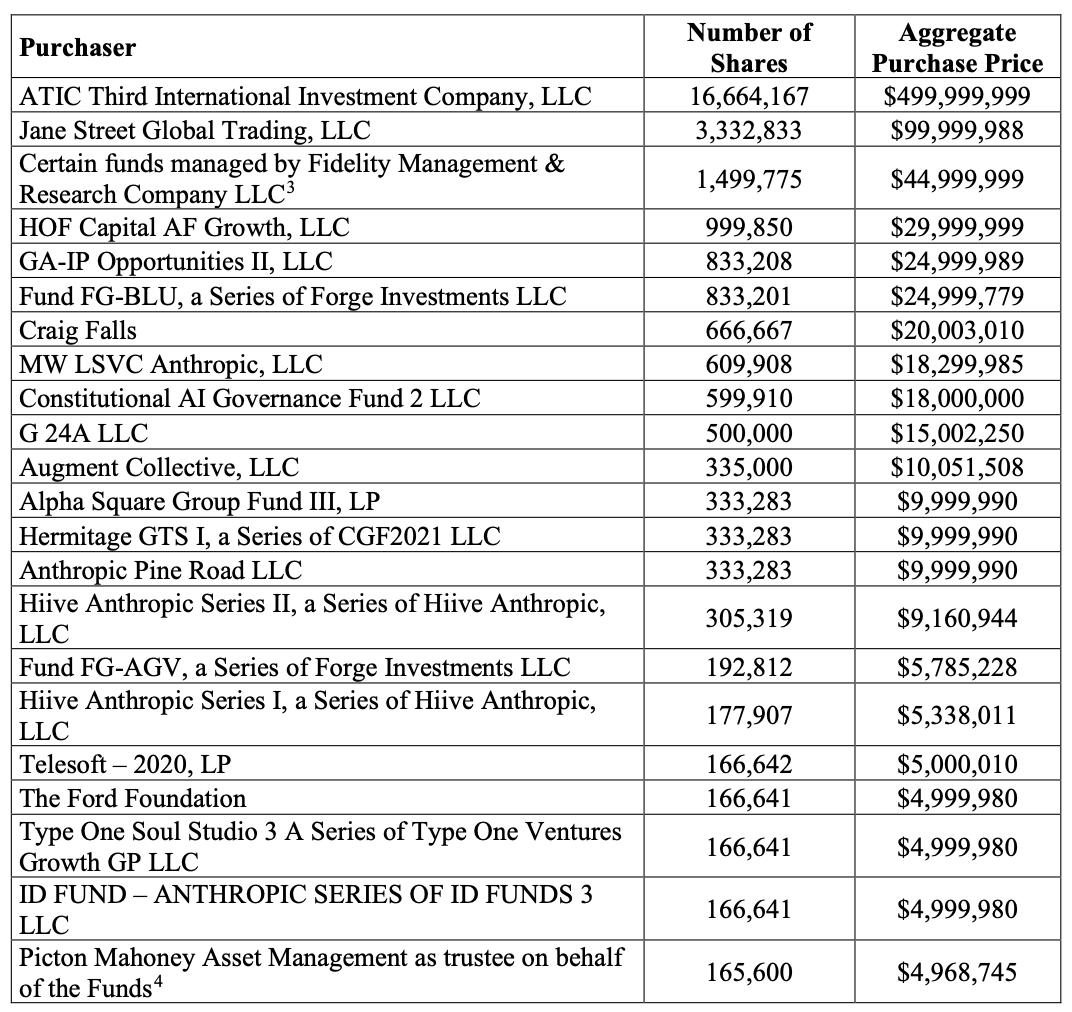

The outcome was not complicated. After FTX's bankruptcy, all assets, including the Anthropic shares, were disposed of by FTX's bankruptcy administration team. In February 2024, the court approved the FTX bankruptcy administration team's right to sell these shares; in March and June of the same year, the FTX bankruptcy administration team sold 29.5 million shares and 15 million shares for a total of $884 million and $450 million respectively, totaling over $1.3 billion.

The buyers of these shares were primarily ATIC Third International Investment from Abu Dhabi, as well as traditional financial institutions from Wall Street such as Jane Street and Fidelity. In other words, no crypto companies got a share of this pie.

Whether these shares were deliberately sold at a low price or whether there was any transfer of benefits under the guise of bankruptcy liquidation is no longer important to the crypto industry.

This should have been the best intersection between Crypto and AI. On another timeline, regardless of whether these shares are held by SBF or CZ, if the leading companies in the crypto world can have a say in the development of the most successful companies in the AI world, then more innovative attempts around Crypto + AI may emerge, leading to unexpected results.

CZ wasn't the only one who broke his own thigh in frustration.