CoinShares argues that concerns about quantum computers are being exaggerated, as only about 10,200 BTC are held in wallets large enough to warrant a hack.

CoinShares: Only about 10,200 BTC are actually at risk of a quantum attack.

CoinShares: Only about 10,200 BTC are actually at risk of a quantum attack.

The digital asset management company CoinShares recently published a new report stating that concerns about quantum computers threatening Bitcoin (BTC) are exaggerated, and only a very small fraction of the BTC supply is likely to be successfully hacked.

Only a small group of BTC is worth attacking.

- The report, written by Christopher Bendiksen, head of Bitcoin research at CoinShares, aims to refute previous estimates suggesting that 20% to 50% of the Bitcoin supply could be at risk from quantum computer attacks.

These statistics are primarily based on a study published by Chaincode Labs in May 2025. The study groups various types of risks together, ranging from theoretical or temporary risks to those with the potential for significant impact. CoinShares argues that this approach is misleading, as it doesn't accurately reflect the actual level of danger posed by each risk group.

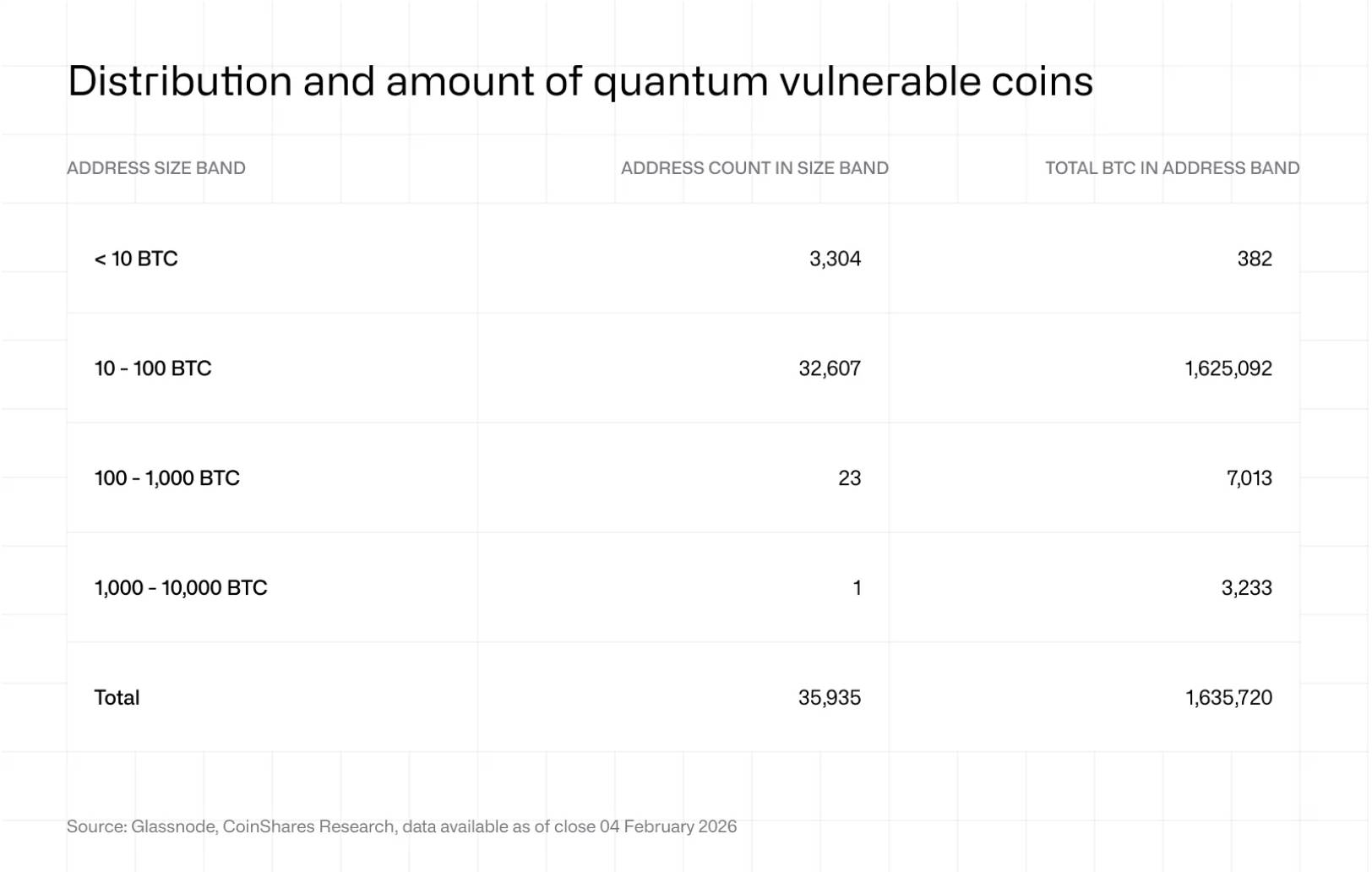

According to CoinShares, the risk from quantum computers doesn't lie in the entire Bitcoin network, but is primarily focused on older Bitcoin addresses in the form of Pay-to-Public-Key (P2PK). These are addresses where the Public Key is publicly displayed and permanently exists on the blockchain, making them theoretically more vulnerable to attacks. In total, approximately 1.6 million BTC , equivalent to about 8% of the Bitcoin supply , are currently held in addresses belonging to this group.

However, not all BTC held in vulnerable addresses is a cause for concern. Even if a Bitcoin address could theoretically be attacked, an attacker would still have to consider many practical factors, including the enormous cost of quantum resources, the fact that they can only target one address at a time, and the inability to launch a mass attack in a short period. Therefore, only wallets holding very large amounts of BTC would have sufficient economic benefit to become worthwhile targets.

Conversely, the vast majority of the remaining wallets are small-scale, and while theoretically vulnerable, CoinShares estimates that each such wallet could take hundreds to thousands of years to crack, even under the most optimistic scenarios regarding the development of quantum technology. Therefore, Bendiksen argues that only about 10,200 BTC are currently stored in wallets large enough that, if successfully breached, could have a significant impact on the market.

- Of this amount, approximately 7,000 BTC is held in wallets containing between 100 and 1,000 BTC, while the remaining 3,230 BTC belongs to the larger group of wallets, ranging from 1,000 to 10,000 BTC, with an estimated total value of approximately $719 million at market prices at the time of reporting.

Statistics on Bitcoin wallets vulnerable to quantum attacks. Source: CoinShares (February 4, 2026)

Statistics on Bitcoin wallets vulnerable to quantum attacks. Source: CoinShares (February 4, 2026)

However, CoinShares also noted that even in a worst-case scenario, if all 10,200 BTC were compromised, the scale of the damage – equivalent to approximately $700 million – would only be comparable to a large daily transaction in the current Bitcoin market. This level would not be enough to disrupt the network, collapse market confidence, or threaten the total supply of 21 million BTC.

Quantum computers are still a long way from surpassing Bitcoin.

CoinShares also devoted significant time in its report to clarifying the vast gap between current quantum computing capabilities and the level needed to truly threaten Bitcoin.

- Based on cited scientific studies, to crack a Bitcoin public key in just 24 hours, an attacker would need a fault-tolerant quantum computer with approximately 13 million physical qubits, a figure about 100,000 times more powerful than the largest quantum computer currently in existence. To shorten the attack time to one hour, the computing power required would be millions of times greater than it is currently.

Meanwhile, Google's most advanced quantum computer at the moment, named Willow , only has 105 qubits. Researchers also point out that increasing qubits is not linear; the complexity of maintaining system stability increases exponentially.

- Ledger's Chief Technology Officer, Charles Guillemet, was also quoted as saying that breaking the widely used asymmetric encryption systems requires millions of stable qubits, a milestone that current technology is still far from.

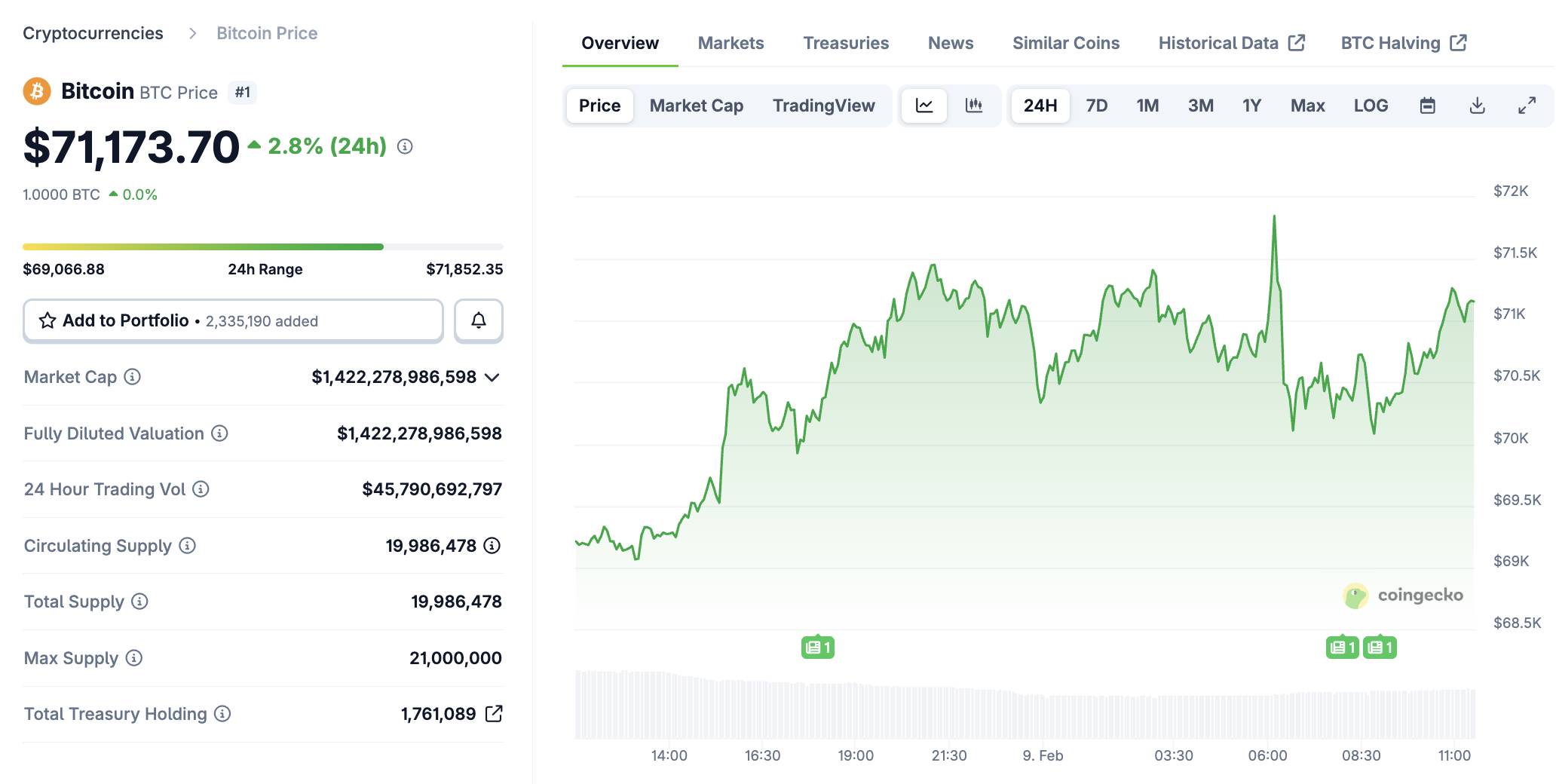

- The CoinShares report was published amidst significant volatility in the crypto market, with Bitcoin having nearly halved from its peak of over $126,000 in October 2025, and at the time of writing, Bitcoin's price is fluctuating around $71,170, up 2.56% in the last 24 hours.

Bitcoin price fluctuations over the past 24 hours, screenshot from CoinGecko at 11:30 AM on February 9, 2026.

Bitcoin price fluctuations over the past 24 hours, screenshot from CoinGecko at 11:30 AM on February 9, 2026.

Coin68 compilation