Solving Spam, State Bloat, and Fee Volatility with a Single Parameter

A Minimum Base Fee for Execution Gas: Bounding EIP-1559 from Below at Scale

EIP-1559’s base fee has no lower bound. As capacity scales, the base fee converges to zero whenever demand falls below the 50% target—which becomes the steady state as Ethereum scales L1 directly (gas limits targeting 100–200M by late 2026). This enables near-free spam (demonstrated by the January 2026 address poisoning crisis), collapses the ETH burn, and erodes the protocol’s economic foundations. We propose adding a single parameter: b_{t} = \max(b_{\min},\, f(b_{t-1}, g_t))bt=max(bmin,f(bt−1,gt)). Ethereum already implements a floor for blob gas (EIP-4844); execution gas has no equivalent bound. A trustless network requires that misbehavior has a cost; when that cost is zero, economic incentives break down and the protocol cannot keep itself honest.

1. The Problem: Unbounded Decay

The EIP-1559 base fee updates as:

where T = G/2T=G/2 is the target gas. At g_t = 0gt=0, the base fee decays by factor 7/87/8 per block, halving every ~5.2 blocks. From any starting value, b_tbt reaches negligible levels within tens of blocks of sustained below-target utilization. As L1 capacity outpaces organic demand, the consequences are severe:

- Near-zero base fees collapse the EIP-1559 burn mechanism, making ETH permanently net inflationary

- They eliminate the cost of spam, enabling industrial-scale address poisoning and phishing contract deployment

- They erode the security budget by shifting validator revenue entirely to MEV extraction

- They accelerate state bloat as junk transactions create permanent storage entries across every full node

At 15 TPS (pre-scaling Ethereum), the ~7.5 TPS target was routinely exceeded by organic demand. At projected capacities of 1,000–10,000+ TPS post-Fusaka and beyond, the target becomes 500–5,000 TPS. As Buterin acknowledged on February 3, 2026, the rollup-centric roadmap “no longer makes sense”—L1 is scaling directly, with gas limits expected to reach 100–200M by late 2026. But this L1 scaling exacerbates the base fee problem: more L1 capacity means the 50% target becomes even harder to sustain, and the base fee spends more time decaying toward zero.

The problem only gets worse from here. The 2026 roadmap includes Glamsterdam (mid-2026) with parallel execution and block-level access lists pushing the gas limit toward 100–200M, with Stańczak suggesting up to 300M by year-end. Each capacity increase widens the gap between target and organic demand, accelerating base fee decay. The pattern is already empirically visible: Dencun (March 2024) began the revenue decline; Fusaka (December 2025) collapsed it. Without a floor, Glamsterdam and subsequent upgrades will lock in near-zero fees as a permanent structural feature—not a temporary low-demand phase, but a mathematical inevitability of scaling capacity faster than demand.

2. Consequences

Revenue Collapse

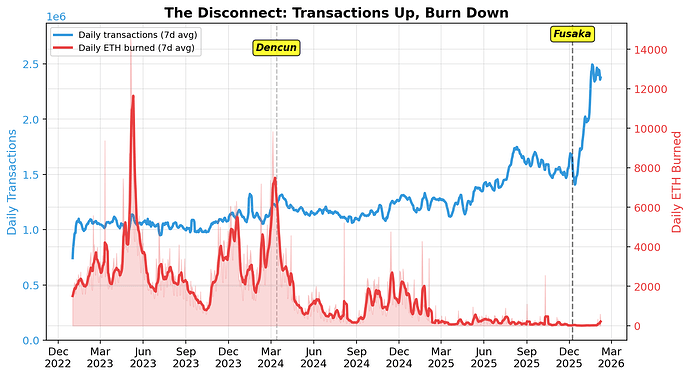

Post-Fusaka, Ethereum hit an all-time high of 2,885,524 daily transactions (January 16, 2026) while daily ETH burned collapsed from a 7-day average of ~150 ETH in November to ~35 ETH in January—a direct manifestation of unbounded base fee decay at increased capacity.

Fig 1: Daily transactions vs daily ETH burned, Jan 2023–Feb 2026. Each capacity upgrade (Dencun, Fusaka) accelerates the disconnect between activity and burn.

Daily fee revenue averaged $12.9M in Q1 2024; by January 2026 it averaged $452K—a 96.5% collapse. The average transaction fee fell from $10.78 to $0.20 over the same period. Average daily burn declined from 3,665 ETH in Q1 2024 to 35 ETH in January 2026—a 99% decline—while average daily transactions rose from 1.15M to 2.26M. This is not merely a burn problem: the entire fee economy has evaporated.

Burn Rate Collapse and Supply Dynamics

EIP-1559 burns the base fee. As b_t \to 0bt→0, burn → 0 regardless of transaction volume, and ETH becomes net inflationary. As of February 2026, the daily ETH burn is approximately 35 ETH, offsetting roughly 1.3% of daily issuance (~2,720 ETH/day at 35.8M staked ETH). At current volumes (~2.5M daily transactions, ~100K average gas), the baseline burn approaches zero as b_t \to 0bt→0. Demand spikes—such as the February 2026 market crash—temporarily restore meaningful burn, but these are transient: the base fee decays back to near-zero within blocks of demand subsiding. The steady-state burn under scaled capacity is negligible, and the mechanism provides no guaranteed minimum.

Adversarial Exploitation

Let an attacker send MM adversarial transactions, each consuming g_aga gas units (~45,000–65,000 for a standard ERC-20 transfer). Attack cost:

When b_t \approx 0bt≈0, C_{\text{attack}} \approx 0Cattack≈0 for any MM. The January 2026 address poisoning attack — M \approx 10^7M≈107 per day, g_a \approxga≈ 45,000–65,000 gas — cost attackers effectively nothing at prevailing base fees, while generating $740K+ in documented victim losses at ~0.01% conversion.

Address poisoning is only one attack vector enabled by near-zero fees. Others include:

- Airdrop scam tokens and wallet drainers. Attackers deploy malicious contracts that airdrop worthless tokens to thousands of wallets. Users who interact with them trigger calls that drain their wallets. Deployment cost scales linearly with b_tbt and approaches zero with it.

- State bloat. Every transaction that creates accounts or writes storage imposes a permanent cost on every full node. Ethereum’s chain data exceeds 3 TB, with state doubling every 12–18 months. Near-zero fees leave this externality unpriced.

- Phishing contracts. He et al. (SIGMETRICS 2025) documented 37,654 malicious contracts, 171,984 victims, and $190.7M stolen. Deployment cost per contract approaches zero as b_t \to 0bt→0.

The common thread: every attack that depends on sending many low-value transactions becomes cheaper as b_t \to 0bt→0. At current base fees, there is no economic deterrent proportional to attack volume.

Security Budget

When b_t \approx 0bt≈0, validator revenue shifts from fees to MEV extraction. The community has invested significant effort mitigating MEV’s centralizing effects—Flashbots’ MEV-Boost, enshrined PBS (EIP-7732), and MEV-burn proposals—yet near-zero base fees make MEV the dominant revenue source by default, undermining those efforts.

Second, persistent zero burn makes ETH permanently net inflationary. At current issuance (~993,000 ETH/year) with negligible burn, ETH faces continuous dilution pressure. Lower ETH price means lower cost to accumulate an attacking stake, weakening the link between network usage and ETH scarcity that underpins the economic security model.

State Growth

Ethereum’s chain data now exceeds 3 TB, with state doubling approximately every 12–18 months. In December 2025, the Ethereum Foundation’s Stateless Consensus team warned that unchecked state growth threatens censorship resistance: if “only a small set of sophisticated operators can afford to store full state,” the network’s decentralization guarantees erode. Full nodes already require 4–8 TB NVMe SSDs.

Near-zero base fees remove the economic deterrent against storage-creating transactions. Address poisoning alone generates millions of new account entries per day—each permanently stored by every archive and full node. State expiry and statelessness are the long-term solutions, but neither is deployed; in the meantime, the externality is unpriced.

3. Empirical Motivation: January 2026 Address Poisoning

In January 2026, Ethereum recorded 2.89M daily transactions (ATH, January 16). Analysis by Sergeenkov and Coin Metrics demonstrated this was driven predominantly by address poisoning:

- Attackers deployed contracts distributing sub-$1 stablecoin dust to millions of addresses

- 67% of new addresses (3.86M / 5.78M) received dust as their first stablecoin transaction

- Post-Fusaka, stablecoin dust rose from 3–5% to 10–15% of transactions; affected addresses rose from 15–20% to 25–35%

- 116+ victims lost $740K+; one individual lost $509K

- Academic study (arXiv:2501.16681) documented 270M+ poisoning attempts

- ScamSniffer reported a single victim losing $12.25M on January 31

4. Precedent: Blob Gas Floor

EIP-4844 specifies MIN_BLOB_GASPRICE = 1 wei. The community has concluded this is too low: EIP-7762 proposes ~$0.01; EIP-7918 bounds blob fees by execution cost. Fusaka itself implemented EIP-7918’s blob floor. The rationale—preventing fee collapse, enabling price discovery—applies identically to execution gas, which remains the only fee market without a floor.

Cross-chain Context: Tron

Tron provides a useful benchmark. According to Arkham’s TRON Stablecoin Ecosystem Report (Jan 9, 2026), Tron hosts over $80B in stablecoin supply, processes $20B+ in daily USDT volume across 2M+ transactions, and dominates 60–80% of stablecoin transfers above $1,000. Growth CAGRs exceed 50% across volume, transactions, and active addresses since 2021—all with a meaningful fee floor.

As of 03:15 UTC on February 9, 2026 (GasFeesNow):

| Chain | USDT Transfer Fee |

|---|---|

| Ethereum (ERC-20) | $0.0034 |

| Tron (TRC-20) | $1.78–$3.72 |

Ethereum is currently 500–1,100× cheaper than the chain widely regarded as the low-cost stablecoin rail. It has eliminated any meaningful cost barrier to spam.

A 1 gwei floor would raise a USDT transfer (~65K gas) to ~$0.13—still 14–29× cheaper than Tron—while restoring minimal spam resistance.

5. Proposal

Specification

Introduce MIN_BASE_FEE (b_{\min}bmin):

One parameter. No changes to transaction format or wallet behavior. Above b_{\min}bmin, the mechanism is unchanged.

Properties

- Minimal change. One constant. No format or encoding changes.

- General. Addresses any attack vector depending on near-zero cost.

- Preserves EIP-1559 dynamics. Unmodified above the floor.

- Bounds supply trajectory. Minimum burn compresses inflation/deflation range.

- Consistent with blob market. Extends an existing protocol pattern.

Mechanism Design

Roughgarden’s DSIC, MMIC, and OCA-proofness are preserved: above b_{\min}bmin, the update rule is unchanged. When the floor binds, the base fee is a protocol-enforced fixed price—users pay the posted price (DSIC), proposers include transactions paying ≥ b_{\min}bmin (MMIC), and no party can collude below the enforced floor (OCA-proofness).

Calibration

A 1 gwei floor makes a standard transfer (21,000 gas) cost a few cents ($0.04–0.06 at current ETH prices)—within demonstrated tolerance—while raising the cost of 10^7107 daily poisoning transactions to ~650 ETH/day. This static parameter provides an immediate safety bound while minimizing complexity; dynamic adjustments remain an area for future work (see Open Questions below).

At the current base fee of ~0.047 gwei (Etherscan, 22:08 UTC Feb 8, 2026), common transactions cost fractions of a penny. A 1 gwei floor raises costs to levels that remain trivial for users but meaningful for spam:

| Transaction | Gas | Current (~0.047 gwei) | With 1 gwei floor |

|---|---|---|---|

| ETH transfer | 21,000 | $0.002 | $0.04 |

| USDT/USDC transfer | 65,000 | $0.006 | $0.14 |

| Uniswap swap | 150,000 | $0.015 | $0.31 |

| NFT mint | 200,000 | $0.020 | $0.42 |

| Complex DeFi | 400,000 | $0.039 | $0.83 |

For context, a USDT transfer on Tron costs $1.78–$3.72 (GasFeesNow, 03:15 UTC Feb 9, 2026), and Tron processes 2M+ stablecoin transactions per day with 50%+ annual growth (Arkham)—demonstrating that users readily pay meaningful fees when the service is reliable. Even the most gas-intensive common operation on Ethereum at a 1 gwei floor ($0.83) remains cheaper than the simplest transfer on Tron.

Spam Resistance

A floor establishes a minimum attack cost: C_{\text{attack}} \geq M \cdot g_a \cdot b_{\min}Cattack≥M⋅ga⋅bmin, where MM is the number of adversarial transactions, g_aga is the gas consumed per transaction, and b_{\min}bmin is the floor base fee. For the January 2026 address poisoning attack — M \approx 10^7M≈107 per day, g_a \approxga≈ 45,000–65,000 gas — at b_{\min} = 1bmin=1 gwei:

At ~0.01% conversion and ~$740K in total documented losses, a 1 gwei floor makes the attack clearly uneconomical at any plausible ETH price.

Burn Restoration

The annualized burn rate BB at a constant base fee bb with NN daily transactions of average gas \bar{g}¯g:

At N = 2.5 \times 10^6N=2.5×106 and \bar{g} = 10^5¯g=105 gas:

| b_{\min}bmin (gwei) | Daily burn (ETH) | Annual burn (ETH) | Issuance offset |

|---|---|---|---|

| 1 | 250 | 91,250 | 11% |

| 3 | 750 | 273,750 | 33% |

| 5 | 1,250 | 456,250 | 55% |

| 9 | 2,250 | 821,250 | 99% |

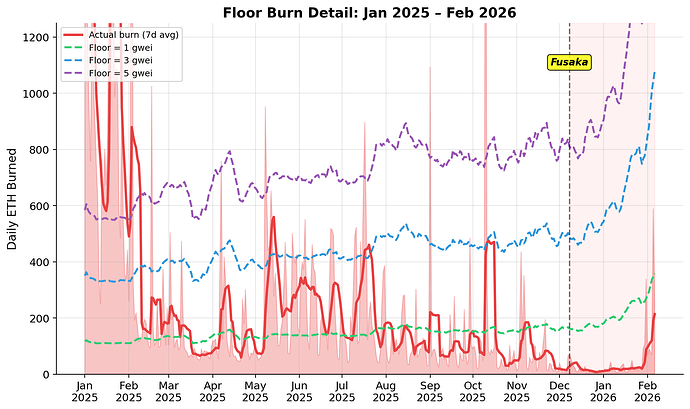

These are lower bounds on burn. When b_t > b_{\min}bt>bmin, the floor does not bind. Backtesting against actual 2025 data using daily gas consumption derived from Etherscan confirms this: with a 1 gwei floor, actual burn already exceeded the floor on 141 of 365 days, so the floor would only have bound on the remaining 224 days—adding ~19,000 ETH of burn (approximately $38M at current prices). A 3 gwei floor binds on 307 days, adding ~101,000 ETH; a 5 gwei floor binds on 333 days, adding ~197,000 ETH.

Using January 2026 transaction volumes (2.26M/day average) and ~100K average gas per transaction, even a 1 gwei floor guarantees ~226 ETH/day—6× the actual burn. A 3 gwei floor guarantees ~678 ETH/day (25% of issuance); a 5 gwei floor guarantees ~1,130 ETH/day (42% of issuance).

Fig 2: Actual daily ETH burn vs minimum burn under floor levels of 1, 3, and 5 gwei. Floor burn computed from actual daily gas consumption.

6. Who Benefits

A common objection to fee floors is that they impose costs on users for the benefit of token holders. In practice, a well-calibrated floor is positive-sum across all stakeholders:

- Users. The primary beneficiaries. Address poisoning, dust spam, and state bloat all impose costs on users—lost funds, polluted transaction histories, degraded wallet UX, and slower state access. A 1 gwei floor makes a standard transfer cost a few cents while making large-scale spam campaigns uneconomical.

- Validators. When b_t \approx 0bt≈0, validator revenue shifts entirely to MEV extraction and consensus rewards. A floor restores a fee revenue component, reducing dependence on MEV and improving staking economics predictability.

- ETH holders and supply dynamics. EIP-1559’s burn mechanism was designed to link network usage to supply reduction. A floor restores this link by bounding the burn rate from below. At January 2026 transaction volumes, even a 1 gwei floor offsets ~9% of issuance; a 5 gwei floor offsets ~43%.

- L2s. Buterin recently argued that L2s should not be “Ethereum but cheaper” but should specialize—privacy VMs, app-specific execution, institutional finance, gaming, AI inference. A floor fee directly enables this transition. When L1 fees → 0, L2s cannot differentiate on price or features. A 5 gwei L1 floor (~$0.80/tx) restores a clear price signal: L2s charge $0.01–$0.05 and remain 15–80× cheaper, giving them room to fund specialized features from sequencer revenue rather than racing to zero.

- Application developers. Near-zero fees attract spam that degrades the on-chain environment applications depend on. DEX interfaces polluted with dust tokens, lending protocols with spam collateral events, and wallets cluttered with poisoning artifacts all impose development and UX costs.

- Node operators. Every spam-created account and storage slot is a permanent addition to Ethereum’s state, which every full node must store and serve. The EF’s Stateless Consensus team warned in December 2025 that state bloat threatens censorship resistance. A floor prices the state externality.

- Institutional participants. Ethereum ETFs attracted $9.9B in inflows in 2025, with BlackRock’s ETHA exceeding $11B in AUM and its staked Ethereum ETF (ETHB) filed in December 2025. Institutions require predictable cost modeling, clean on-chain state, and a sound underlying asset. Near-zero fees undermine all three: fee volatility “impedes transaction cost predictability and hinders institutional adoption” (see also Roughgarden 2021); spam-polluted transaction histories create compliance risks; and permanent net inflation erodes the value of ETH held as collateral or treasury. Notably, Madrigal-Cianci et al. propose addressing fee unpredictability by building a derivatives market (gas options priced via Monte Carlo simulation) on top of the volatile base fee. We argue that a structural fix—bounding the base fee from below—is preferable instead of layering financial complexity on the underlying problem: a derivatives market requires the volatility to function and helps only sophisticated actors who can hedge, while a floor eliminates the pathological regime at the protocol level for all users.

- ZK provers. As Ethereum transitions to ZK-proven execution, provers invest in specialized hardware (GPUs, FPGAs, ASICs) and need predictable economics. A floor ensures meaningful fee revenue exists in the system regardless of utilization. Moreover, ZK proving enables more aggressive L1 scaling — blocks can be verified without re-execution — which pushes gas limits higher and accelerates base fee decay. The floor becomes more necessary as the proving market matures, not less.

The key insight: the current near-zero fee regime is not “cheap Ethereum”—it is unpriced Ethereum, where the costs of spam, state pollution, and fee unpredictability are externalized onto all network participants.

7. Why 1 Gwei Today and Why Dynamic Pricing Matters at Scale Later

At current ETH prices (~$2,080), a 1 gwei floor makes a standard transfer (21,000 gas) cost ~$0.04 — well above one cent, meaningful enough to deter spam at volume, yet trivial for legitimate users.

A static floor becomes increasingly powerful as throughput grows. The annual burn at a 1 gwei floor with NN daily transactions of average gas \bar{g} = 10^5¯g=105 is:

At current volumes, 1 gwei is conservative. At projected L1 scale, it becomes aggressively deflationary:

| Daily TXs | TPS | Annual burn (1 gwei) | vs. ~1M ETH issuance |

|---|---|---|---|

| 2.5M | 29 | 91,250 ETH | 9% offset (inflationary) |

| 5M | 58 | 182,500 ETH | 18% offset (inflationary) |

| 27M | ~315 | ~1,000,000 ETH | ~ breakeven |

| 86M | 1,000 | 3,139,000 ETH | 3× issuance (deflationary) |

| 864M | 10,000 | 31,536,000 ETH | 32× issuance (hyperdeflationary) |

The crossover to deflation occurs around ~315 TPS — a throughput level Ethereum could realistically reach within 1–2 years of Glamsterdam. At 1,000 TPS, even 1 gwei burns 3× issuance per day; at 10,000 TPS (the long-term roadmap target), it burns ~26% of total ETH supply per year from a 1 gwei floor alone.

We propose:

- Starting at 1 gwei — the most conservative static value that still solves the immediate spam/burn problem

- Planning a dynamic floor as a future upgrade — one that at minimum maintains the per-gas price needed for the protocol’s economic mechanisms to function: spam stays uneconomical, the burn mechanism stays alive, state creation stays priced, and validators retain fee revenue. As throughput scales, that per-gas price can decrease — but it can never be zero.

A static 1 gwei floor is the right first step because it requires minimal complexity and solves the acute problem. But the scaling dynamics above make clear that any static floor will eventually need adjustment as L1 throughput grows by orders of magnitude. The design of a dynamic mechanism is left as future work, but the principle is the same at any scale: the floor isn’t about making ETH deflationary — it’s about ensuring the protocol’s economic mechanisms function at all.

8. Open Questions

- Should Ethereum have a minimum execution base fee?

- Static vs. dynamic floor?

- Should the 50% utilization target be revisited as L1 capacity scales, or is it orthogonal to the floor question?

9. Conclusion

A minimum execution base fee is a single-parameter change that addresses multiple structural problems simultaneously. The floor isn’t about making ETH deflationary — it’s about ensuring the protocol’s economic mechanisms function at all. Spam resistance, burn, state pricing, and validator economics all break at zero. A floor fixes all four.

It restores the EIP-1559 burn mechanism as designed. It raises the cost of phishing contracts that have stolen $190M+ from Ethereum users and prices the 1M+ daily address poisoning attempts that the post-Fusaka fee collapse made economical. It slows state bloat that the Ethereum Foundation itself warns threatens decentralization. It preserves the L1/L2 economic gradient that funds the specialization Buterin now calls for. It reduces validator dependence on MEV extraction. And it brings execution gas in line with blob gas, which already has a protocol-enforced floor.

When the cost of misbehavior is zero, economic incentives break down. A floor doesn’t make Ethereum expensive—it makes it honest.