Backpack Exchange is nearing a $1 billion valuation as it negotiates new Capital and announces a tokenomics strategy aligned with its IPO roadmap.

Backpack Exchange reaches $1 billion valuation after announcing tokenomics.

Backpack Exchange reaches $1 billion valuation after announcing tokenomics.

Backpack Exchange , the CEX developed by the Backpack wallet, is nearing a $1 billion valuation after announcing a new Tokenize strategy, amid reports that the project is negotiating a new Capital round.

According to Axios, crypto trading platform Backpack Exchange is in talks for a new funding round at a $1 billion pre-money valuation. Sources say the company plans to raise $50 million, although the final round size could be larger. Backpack Exchange was founded by former members…

— Wu Blockchain (@WuBlockchain) February 10, 2026

Crypto exchange Backpack reaches $1 billion valuation after developing tokenomics plan.

According to Axios , Backpack is currently in discussions with investors to raise approximately $50 million at a valuation of $1 billion. If the deal is completed, Backpack Exchange will join the rare group of crypto exchange that have reached a valuation of $1 billion during a period of significant market volatility.

- The Capital announcement came shortly after Backpack revealed its plan to develop tokenomics with a different allocation structure to address the issue of insiders Dump Token onto retail investors.

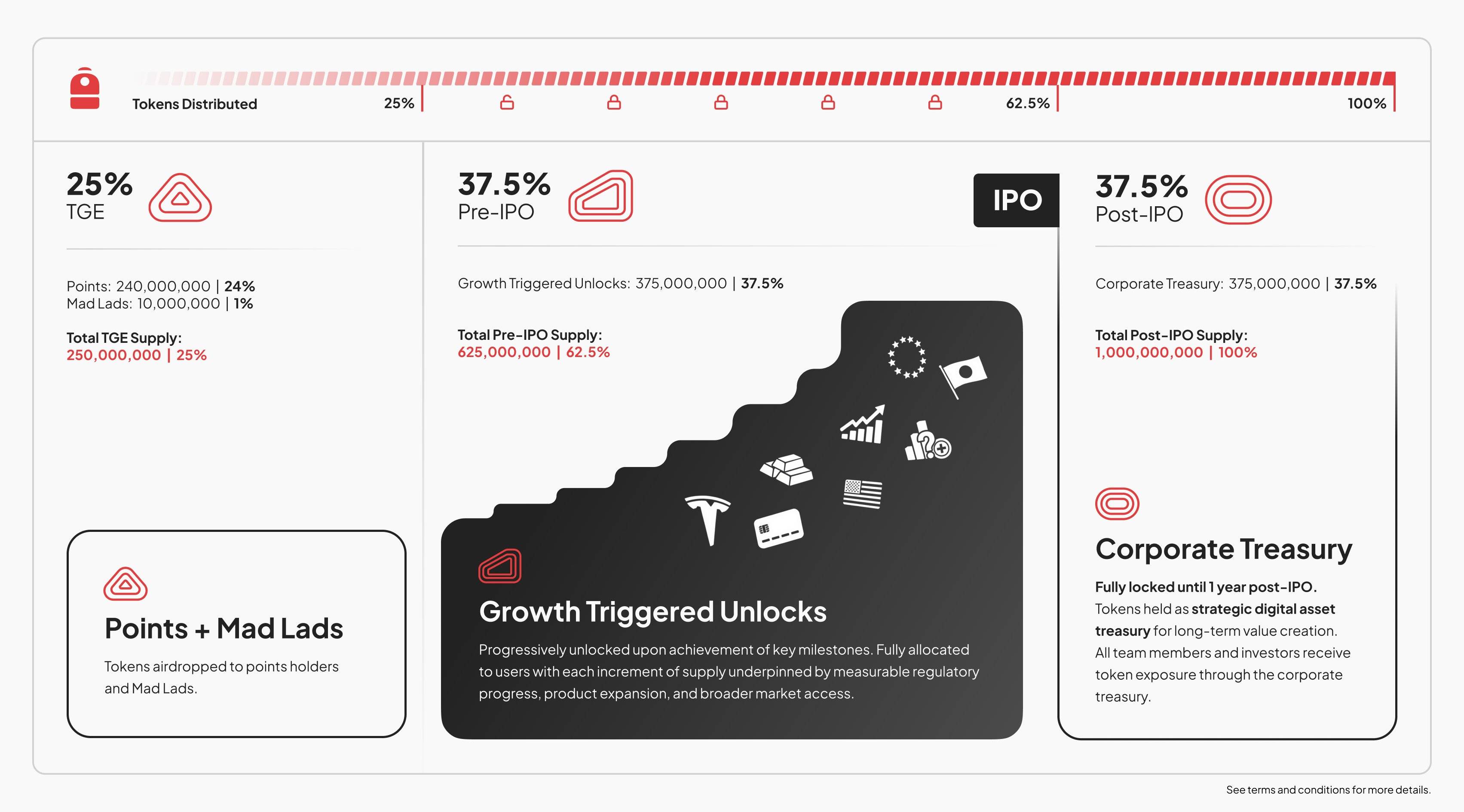

According to Armani co-founder Ferrante, the total supply of Backpack Token will be 1 billion Token, Chia into multiple unlocking phases directly linked to the company's development roadmap and IPO goals.

- Specifically, 25% of the supply (250 million Token) will be unlocked at the time of the TGE, with the majority being Airdrop to early users, including Backpack Points program members and Mad Lads Non-Fungible Token holder .

- Next, 37.5% of the supply will be unlocked before the IPO, but only when Backpack reaches specific growth milestones such as expanding into new regions or launching new products.

- The remaining 37.5% of the total supply will be held in the company's treasury after the IPO and only unlocked after at least one year from the listing, ensuring that the team only benefits when Backpack truly enters large and highly liquidation Capital markets.

Currently, Backpack has not yet announced the official TGE date.

- Ferrante stated that no founders, staff, leaders, or investment funds are directly allocated Token . Instead, the team only holds shares in the company and can only reap financial benefits when Backpack IPOs or a similar Capital event occurs. According to him, the goal is to ensure that insiders cannot dump Token onto retail investors.

In the Backpack tokenomics, we have one guiding principle.

— Armani Ferrante (@armaniferrante) February 9, 2026

- Insiders "dumping on retail" should be impossible: no founder, executive, employee, or venture investor should receive wealth from the Token until the product hits escape velocity.

Of course it begs the question, what… https://t.co/mltBgm5SPu

From Solana wallets to regulated crypto exchange

- Backpack was founded in late 2023 by the team behind the Mad Lads Non-Fungible Token collection, with two prominent figures: Armani Ferrante, former Solana programmer and Alameda Research employee, and Can Sun, former legal counsel for FTX, who testified in the Sam Bankman-Fried trial.

- Initially, Backpack was known as a multi- chain wallet, focusing on user experience and security. However, the project quickly expanded into regulated spot and Derivative Spot Trading , and also ventured into areas such as lending and prediction markets.

- In 2024, Backpack successfully Capital $17 million in a Series A funding round, led by Placeholder VCs, with participation from funds such as Robot Ventures, Wintermute, and Selini. Another significant milestone was Backpack's acquisition of FTX EU for $32.7 million, and the establishment of a new European branch to meet CySEC's MiFID II licensing requirements.

Currently, Backpack is headquartered in Dubai and has been granted a VASP license, providing a legal basis for expanding its operations to various regions.

Unlike many crypto projects that prioritize early Token Issuance to capitalize on market liquidation , Backpack takes a more cautious approach: viewing IPO as the ultimate goal, and designing Token as tools that reflect the value created throughout that journey.

According to Ferrante, the IPO may happen sooner, later, or even never, but setting this goal forces the team to focus on the product, legal compliance, and sustainable growth, rather than maximizing short-term gains from the Token.

Coin68 compilation