The cryptocurrency market experienced a sharp decline this afternoon (10th), with Ethereum (ETH) falling below the psychological threshold of $2,000 around 3 PM Taiwan time. As the market accelerated its decline, Taiwanese celebrity Huang Licheng (Machi Big Brother), known for his high-leverage trading on the decentralized derivatives platform Hyperliquid, once again attracted market attention due to his on-chain trading activity.

He sold 1,550 ETH to cut his losses, incurring a loss of nearly $100,000.

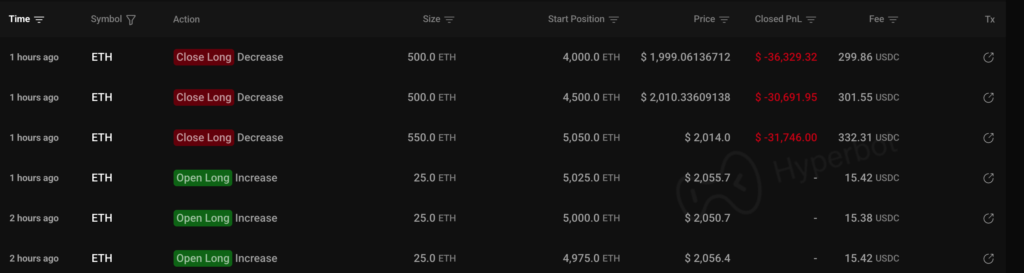

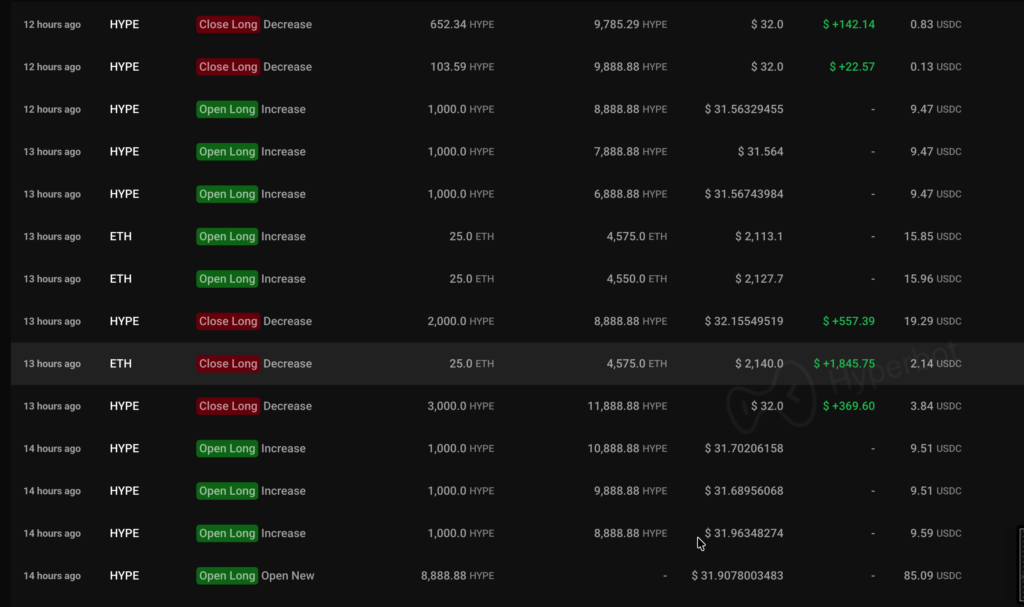

According to real-time monitoring by the on-chain analytics platform Hyperbot, as the market accelerated its decline over the past hour, Huang Licheng cut his losses by reducing his long positions of 1,550 ETH around 3 PM, realizing a loss of approximately $98,767.

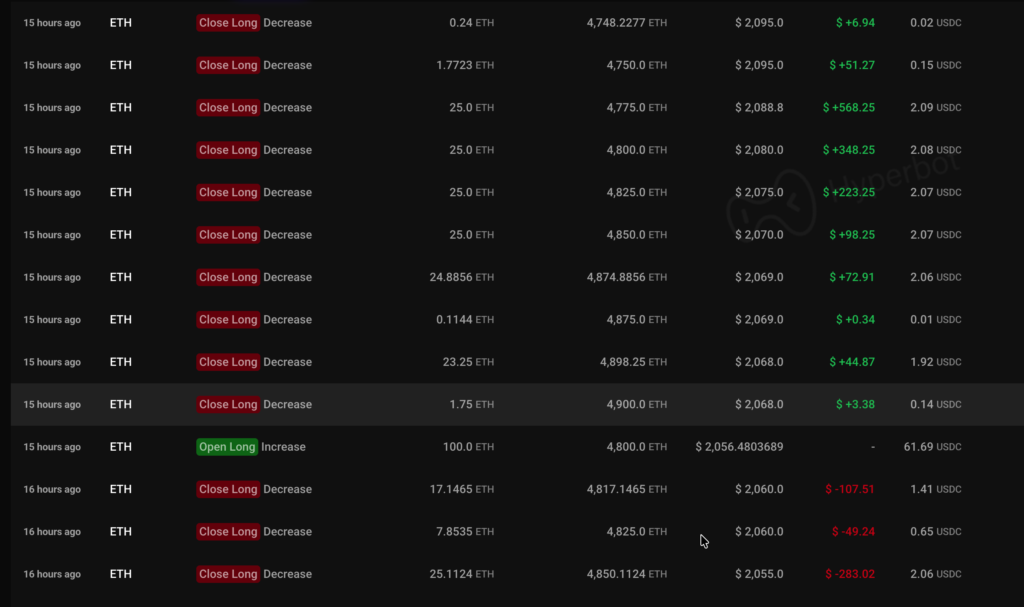

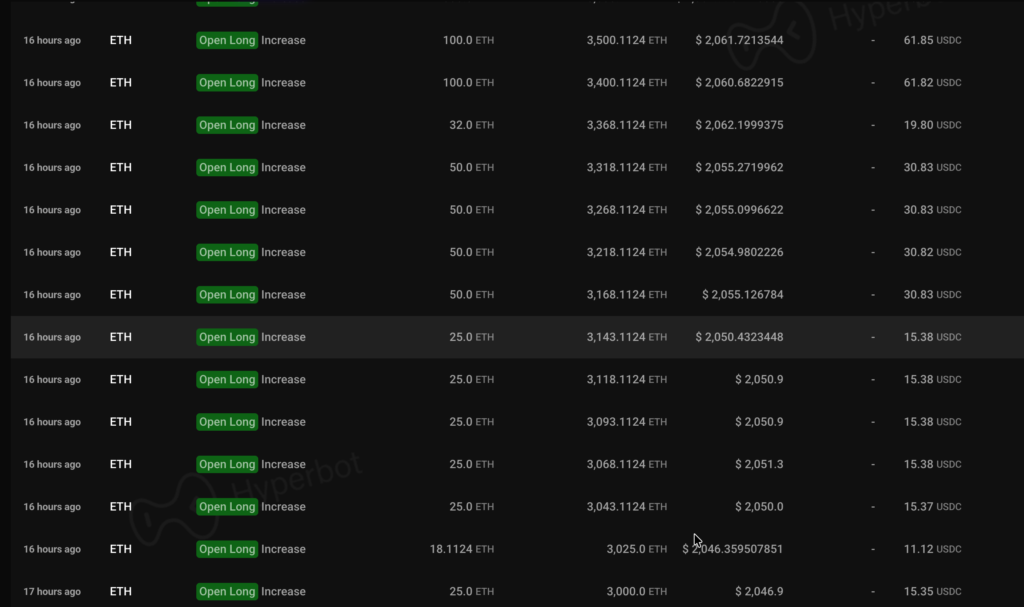

It's worth noting that Huang Licheng just liquidated his long positions of 1,650 ETH yesterday, reducing his holdings to a low of only 3,000 ETH. However, he then bought more ETH at lower prices around 2 or 3 AM, briefly bringing his holdings back to 5,000 ETH. Now, with the market weakening again, he has chosen to reduce his holdings once more.

HYPE long simultaneously liquidated, resulting in losses exceeding $22,000.

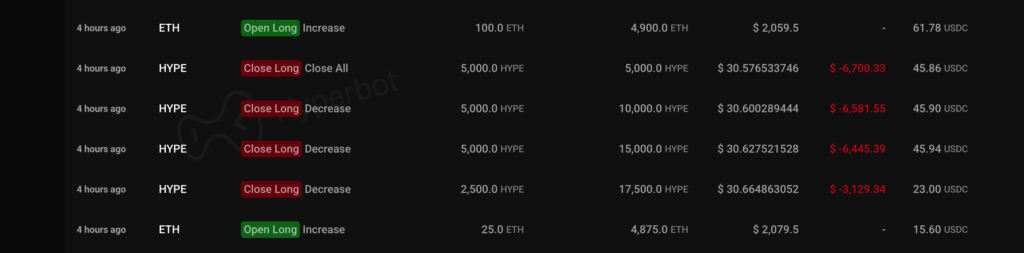

Not only ETH, but Huang Licheng's long positions in HYPE (Hyperliquid's native token) also suffered losses. Monitoring data shows that he continuously opened long in HYPE around 1:00 AM last night, with his holdings reaching a peak of 17,500 tokens. However, earlier today, about four hours before the ETH sell-off, Huang Licheng decisively liquidated his HYPE positions, recognizing a loss of $22,857.

Combined, Huang Licheng lost approximately US$121,624 (approximately NT$3.9 million) today from the two transactions.

Didn't sleep all night? More than 50 transactions in 12 hours.

What's intriguing is that Huang Licheng didn't seem to have slept since the time of writing. He kept monitoring the market from the evening of February 9th to the afternoon of February 10th, with intervals of no more than two hours. He continued to test his opening and closing strategies, and only added to his positions in HYPE and ETH after making a profit. However, the outcome was unsatisfactory, with accumulated losses exceeding $25.5 million.

For observers who have long followed Huang Licheng's on-chain operations, this scenario is not unfamiliar. Since 2025, Huang Licheng long on ETH on Hyperliquid with a leverage of 25x, experiencing more than 250 liquidations and accumulating losses exceeding $25.88 million. Despite his assets having plummeted from a peak of over $50 million to nearly zero, he continues to operate on the platform with a style of "quitting and then immediately opening new positions."

As of press time, Ethereum was priced at approximately $1,980, a drop of over 8% in the past 24 hours. Amidst rising global macroeconomic uncertainty, concerns about an AI bubble, and expectations of a four-year correction, ETH has more than halved from its $5,000 level six months ago, leading to a cautious short-term market sentiment.

Related reports

Related reports