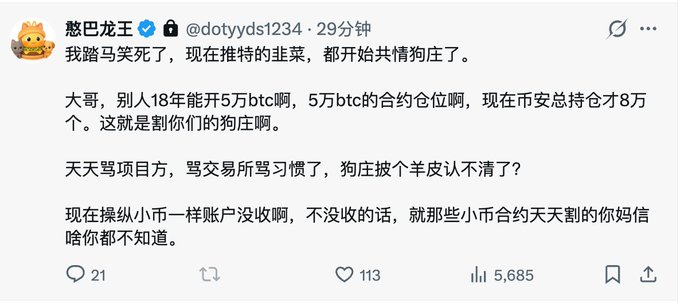

At first glance, it seems like a 50,000 BTC big shot gambling, but this operation is actually more sophisticated. This woman opened a long position on OKX with 20x leverage, and after making a profit, transferred the margin. Then, she opened an equal amount of short positions on Bitmex to hedge, while preparing for the liquidation of her profitable long position on OKX. Essentially, she was profiting from the retail investors on the opposing side of OKX, which is very clever. Therefore, from the perspective of the exchange protecting its users, it's impossible for her to withdraw this money. Bringing up something from 2018 is pointless.

This article is machine translated

Show original

海腾

@Haiteng_okx

这个事件发生在2018年,该用户当年通过高杠杆短时间内建立异常大量的BTC多头仓位,并在平台基于风控多次提出“减仓要求”后拒绝配合,对市场的稳定产生重大影响。根据用户协议对相关账户执行冻结,后续由于杠杆倍率过高和BTC价格下降最终爆仓。如果,当时没有及时制止这种市场操控行为,会对所有交易用户

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share