The U.S. Bureau of Labor Statistics (BLS) is about to release its January non-farm payroll report, and the market expects the revision to wipe out approximately 1 million jobs.

Article by: Zhao Ying

Article source: Wall Street News

The U.S. Bureau of Labor Statistics (BLS) will release its delayed January non-farm payroll report tonight, along with annual baseline revisions and methodological updates. The market expects this revision to erase approximately one million jobs, one of the largest downward revisions in the history of U.S. employment statistics.

According to preliminary estimates from the Black-Scholes National Institutes of Finance (BLS), job growth for the period from April 2024 to March 2025 will be revised downwards by 750,000 to 900,000 jobs. Furthermore, the BLS will update its business birth-death projections for the period from April to December 2025, which are expected to be reduced by another 500,000 to 700,000 jobs. This means that up to 1 million jobs in the non-farm payroll data up to December 2025 will have never actually existed.

On Wednesday, ZeroHedge and related analyses indicated that this revision will significantly alter the reality of the US labor market. The revised data will show that the labor market had already fallen below the "stall line" by mid-2024, when the three-month moving average job growth was only 55,000, far below the 180,000 needed to maintain a stable unemployment rate. After seasonal adjustment, job growth will be negative for at least five months in 2025.

The core of this adjustment lies in the BLS's decision to finally fix its controversial "birth-death adjustment" model. This model had previously failed to accurately exclude "fake company" data generated during the pandemic to obtain PPP loans, leading to long-term distortions in employment statistics. The new calculation method will incorporate real-time sample information, which, while helping to improve data accuracy in the long run, will lead to a sharp repricing of employment data and higher monthly volatility in the short term.

This "million-level" negative revision is expected to have a direct impact on monetary policy. As the labor market presents a more severe picture than anticipated, the Federal Reserve will face significantly increased pressure to cut interest rates. Market analysts believe that this scenario, similar to the sharp downward revision of data in August 2024, will force the Fed to take action to support the fragile economic recovery; current expectations are that the Fed may cut interest rates by 100 basis points this year.

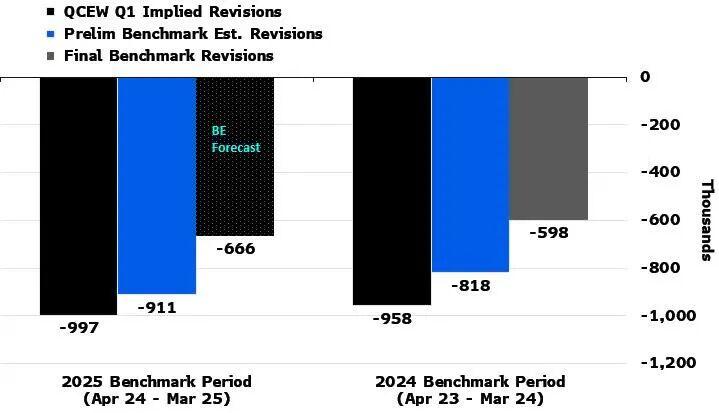

With two downward revisions combined, the correction could exceed one million.

Today's report will include two levels of downward revisions. First, there's the regular annual baseline revision, where the BLS will adjust employment data for April 2024 to March 2025 based on more comprehensive quarterly employment and wage census (QCEW) data. The BLS' initial estimate shows a downward revision of 911,000 jobs for this period, but the final revision may be slightly smaller, projected to be between 750,000 and 900,000.

Secondly, the BLS will apply updated business birth-death projections and recalculated seasonal factors to the period from April to December 2025. This adjustment will incorporate the latest information from the QCEW and monthly employment surveys, and is expected to further revise downwards by 500,000 to 700,000 jobs.

According to estimates by Bloomberg economist Anna Wong, employment will decrease by 3.025 million on an unadjusted basis. However, this uncertainty could cause the employment figure to fluctuate by 40,000 in either direction, as the BLS will recalculate the seasonal adjustment factor to reflect baseline revisions and updates to the Birth-Death model.

Furthermore, due to disruptions caused by the government shutdown, the BLS has postponed its annual population control adjustment, usually released in the January employment report, to the February report next month. Wong expects the adjustment to reduce the population level by at least 700,000, implying a further negative revision next month.

The "birth-death" model is undergoing major adjustments.

The Birth-Death model was originally a reliable statistical adjustment tool for estimating employment changes in startups and closures not covered by monthly surveys. However, after the COVID-19 pandemic, it became one of the biggest statistical gaps in employment reports.

The root of the problem lies in PPP (Paycheck Protection Program) loan fraud during the pandemic. Thousands of fictitious "new companies" were created to take advantage of the government's free funding, severely distorting the underlying statistics on business birth rates. Since the Birth-Death model relies on historical patterns of business births and deaths for prediction, this unusual wave of fictitious business creation caused the model to systematically overestimate actual job growth.

This flaw has triggered several large-scale downward revisions in recent years. In August 2024, the BLS revised down by 818,000 jobs, a revision that became one of the bases for the Federal Reserve to initiate a significant rate-cutting cycle, even though inflation was still at 3% at the time.

Starting with this report, BLS will implement a key methodological change: incorporating current sample information into the "birth-death model" monthly. While this move will reduce the magnitude of future annual revisions, it also has a side effect—significantly increased volatility in monthly non-farm payroll data. This means that future employment reports may more frequently show "outliers" deviating from market expectations, thereby exacerbating overall volatility in financial markets.

The labor market has already cooled, and the pressure on the Federal Reserve to cut interest rates has increased sharply.

After removing statistical noise, the true cooling path of the US labor market becomes clear. Analysis by Bloomberg Economics shows that, according to revised seasonally adjusted data, the labor market had already lost momentum by the summer of 2024, when the three-month moving average job growth was only 55,000, far below the 180,000 needed by analysts to maintain a stable unemployment rate.

Furthermore, hiring activity cooled further due to Trump's announced tariff policies and the subsequent government shutdown. Data shows that, after seasonal adjustments and revisions, job growth will actually be negative for at least five months in 2025. Although the re-estimation of the seasonal adjustment factor may introduce an error of approximately 40,000 jobs, the overall trend points to a significant deterioration.

This massive downward revision of data will reshape market expectations for the Federal Reserve's policy path. Just as the sharp downward revision in August 2024 prompted the Fed to aggressively cut rates by 50 basis points two months before the presidential election, the "grim" state of the labor market revealed this time will again be a catalyst for rate cuts.

While some argue that the labor market bottomed out in mid-2025 and has begun a slow recovery, the foundation for that recovery remains fragile. Combined with the upcoming, potentially mild, January CPI data, the window for a Federal Reserve rate cut is opening. Analysts point out that to address the economic weakness reflected in the revised data, the Fed will not only need to cut rates this year, but potentially by as much as 100 basis points, to prevent further deterioration in the labor market.