The major Bitcoin price correction of 50% from its October 2025 all-time high continues to stir conversation in the financial world.

Gold advocate Peter Schiff is warning that the real opportunity now is to exit the market. “The real opportunity is to sell Bitcoin before it loses the other half of its market value,” Schiff wrote on X.

He criticized what he described as biased mainstream media coverage portraying the latest crash as a buying opportunity. His comments come as Bitcoin plunges toward the $60,000 region, wiping out roughly half of its value from its peak above $126,000.

Key Points

-

Peter Schiff says now is the time to sell Bitcoin before further losses.

-

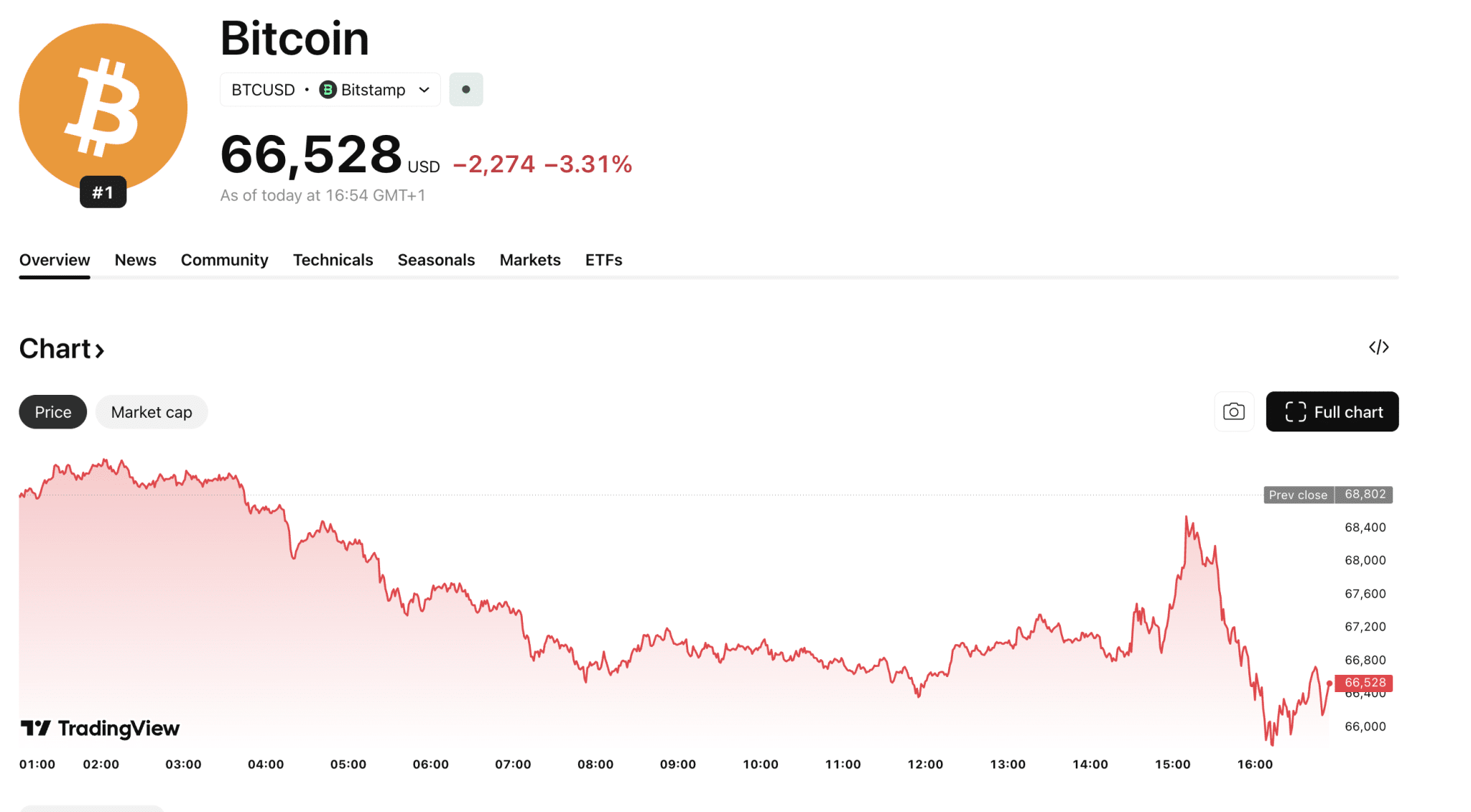

Bitcoin dips to $66K, nearly 50% below its October 2025 high.

-

Saylor calls volatility a “gift to the faithful,” keeps buying $BTC.

-

Gary Vee sees Bitcoin below $70K as an “unexpected buying opportunity.”

Bitcoin Slides Toward $60K

Notably, Bitcoin traded at $60,000 last Friday and has yet to fully recover. The premier cryptocurrency swiftly rebounded by 20% to $72,200 days later. However, bearish pressure is once again taking the upper hand.

Bitcoin is now trading at $66,100, down 4.31% today and 11.55% over the past week. At this price, Bitcoin remains 47.5% below its all-time high.

Market watchers attribute the selloff to profit-taking from early investors, reduced ETF inflows, and broader risk-off sentiment in global markets.

Meanwhile, many industry leaders are calling current prices a generational buying opportunity. However, Schiff does not share this view.

Schiff Doubts Bitcoin Historical Resilience

Responding to Schiff’s tweet, X user Fenak argued that Bitcoin has historically rebounded from similar 50% drawdowns and that entering at $66,000 is preferable to buying at $125,000. Meanwhile, Schiff dismissed the idea, saying past recoveries do not guarantee future gains.

“Bitcoin’s history is too short to conclude that it will always do anything,” he replied.

Bitcoin's history is too short to conclude that it will always do anything.

— Peter Schiff (@PeterSchiff) February 11, 2026

Schiff has long maintained that Bitcoin lacks intrinsic value and has consistently compared it unfavorably to gold, which he views as a more reliable store of wealth.

Another commenter questioned why he focuses so heavily on Bitcoin instead of gold, suggesting he fears it could eventually challenge gold’s monetary role.

X user Bull Brezza said the 50% drop should not be seen as a failure, but as a normal feature of scarce assets. He also pointed out that gold fell about 45% between 2011 and 2015, only to rise again later.

Meanwhile, Strategy Executive Chairman Michael Saylor has called volatility a “gift to the faithful”. He has continued to buy $BTC even as prices dip, with his holdings now sitting at multi-billion-dollar losses. Saylor is also urging investors to buy.

Gary Vee Buying Bitcoin Below $70K, Calls It an “Opportunity”

As The Crypto Basic reported today, VaynerMedia CEO Gary Vaynerchuk said he is accumulating Bitcoin as it trades below $70,000. He describes the current pullback as an “unexpected buying opportunity.”

Analyst Ali Martinez identified $52,040 as a potential bottom based on the −1.0 MVRV Pricing Band.

Meanwhile, Bernstein maintains a $150,000 Bitcoin price target by the end of 2026, arguing that the correction reflects weak sentiment rather than structural damage.