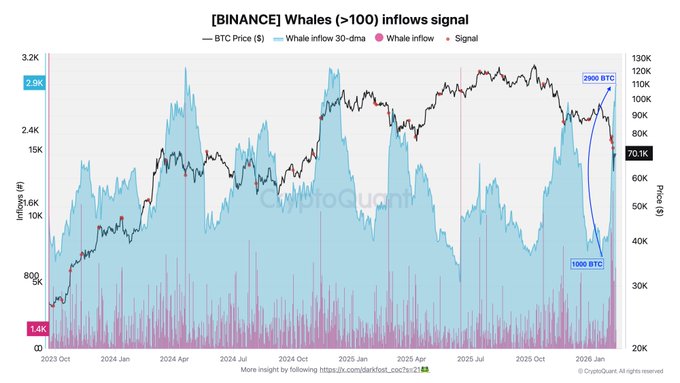

🐳 Whales under pressure as Bitcoin tests key levels Bitcoin’s temporary break below $60,000 triggered a wave of nervousness across the market, including among whales. Contrary to a common belief, these large holders do not systematically represent a form of rational and patient smart money. They also react to market shocks, sometimes opportunistically, sometimes under pressure. 📊 As shown by the chart tracking their inflows to Binance, a platform often favored for large transactions due to its deep liquidity, spikes in inflows tend to appear both during euphoric phases and during market lows. The current situation clearly reflects this dynamic. As BTC fell from $95,000 to $60,000, the average monthly inflows of BTC to Binance from whales increased sharply. 💥 They rose from around 1,000 BTC to nearly 3,000 BTC, with a notable spike of roughly 12,000 BTC on February 6 alone. This type of movement signals an intensification of transfers to exchanges at a time of strong price stress. Since February 1, seven trading days have recorded more than 5,000 BTC in daily inflows from this group of investors. This unusual frequency highlights that some whales remain highly sensitive to rapid market swings and are actively adjusting their positions. 👉 Rising inflows typically signal increasing selling pressure, which is especially concerning in an environment where overall market liquidity is tightening. Given the scale of the volumes they move, whales can abruptly influence price dynamics. Monitoring their flows is therefore essential to anticipate volatility phases and better understand the forces shaping the market.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share