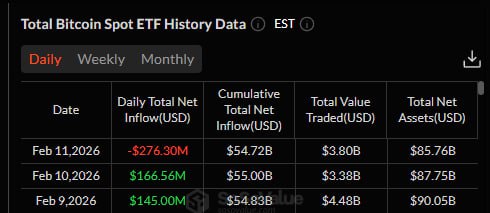

💰 BTC Spot ETFs Turn to Net Outflows in Just Four Trading Days - February 11 (local time): Total net outflow of $275.81 million (approximately KRW 397.5 billion) - The trend that continued for the past four trading days has now turned to net outflows again - Major asset managers are seeing a simultaneous outflow of funds 🪙 Fund Flow by ETF - BlackRock IBIT: -$72.92 million - Fidelity Investments FBTC: -$92.6 million 🔻 (Max) - Bitwise Asset Management BITB: -$21.98 million - ARK Invest ARKB: -$70.51 million - VanEck HODL: -$6.67 million - WisdomTree BTCW: +$6.78 million (only net inflow) - Grayscale Investments GBTC: -$17.91 million Institutional funds are showing a significant increase across the board. This is a trend that's deviating. Note the increased selling pressure centered around Fidelity, BlackRock, and ARK! Ultimately, whether it's Bitcoin or Ether, institutional liquidity inflows from ETFs are likely to have a significant impact on prices in the short term.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content