In 2026, the question facing investors will no longer be "whether to allocate funds," but rather "how much to allocate and what tools to use for allocation."

Written by: David Puell and Matthew Mena

Compiled by: Luffy, Foresight News

In 2025, Bitcoin will continue to integrate into the global financial system. The launch and expansion of spot Bitcoin ETFs, the inclusion of digital asset-related listed companies in mainstream stock indices, and the continued clarity of the regulatory environment will drive Bitcoin from a fringe asset in the crypto industry to a new asset class worthy of institutional allocation.

We believe the core theme of the current cycle is Bitcoin's shift from an "optional" new monetary technology to a strategic asset allocation for an increasing number of investors. The following four trends are reinforcing Bitcoin's value proposition:

- Macroeconomic and policy environments are driving demand for scarce digital assets;

- The holdings structure of ETFs, corporations, and sovereign entities is showing a trend of change;

- The relationship between Bitcoin and gold, as well as the broader store of value;

- Compared to previous cycles, Bitcoin's pullbacks and volatility are decreasing.

This article will analyze these trends one by one.

Macroeconomic background in 2026

Monetary environment and liquidity

After a prolonged period of monetary policy tightening, the macroeconomic landscape is changing: the US quantitative tightening (QT) ended last December, the Federal Reserve's rate-cutting cycle is still in its early stages, and more than $10 trillion in low-yield money market funds and fixed-income ETFs may soon shift to risk assets.

Policy and regulatory standardization

Regulatory clarity remains a constraint on institutional adoption, but also a potential catalyst. Policymakers in the United States and around the world are advancing frameworks that clarify digital asset regulation, standardize custody, trading, and information disclosure, and provide more guidance for institutional investors.

Taking the U.S. Clarity Act as an example, this act would have the Commodity Futures Trading Commission (CFTC) regulate digital commodities and the Securities and Exchange Commission (SEC) regulate digital securities, potentially reducing compliance uncertainty for relevant companies and institutions. The act provides a compliance path for the entire lifecycle of digital assets and, through standardized "maturity tests," allows tokens to transition from SEC to CFTC regulation after decentralization. Simultaneously, the dual registration system for brokerages reduces the legal vacuum that has long forced digital asset companies to relocate overseas.

The US government has also taken action specifically against Bitcoin on multiple levels:

- Lawmakers and industry leaders discuss including Bitcoin in the national reserve;

- Regulate the handling of confiscated Bitcoins controlled by the federal government;

- States like Texas were among the first to adopt Bitcoin and include it in their reserve assets.

Structural Demand: ETFs and Digital Asset Treasury

ETFs become a new type of structured buyer.

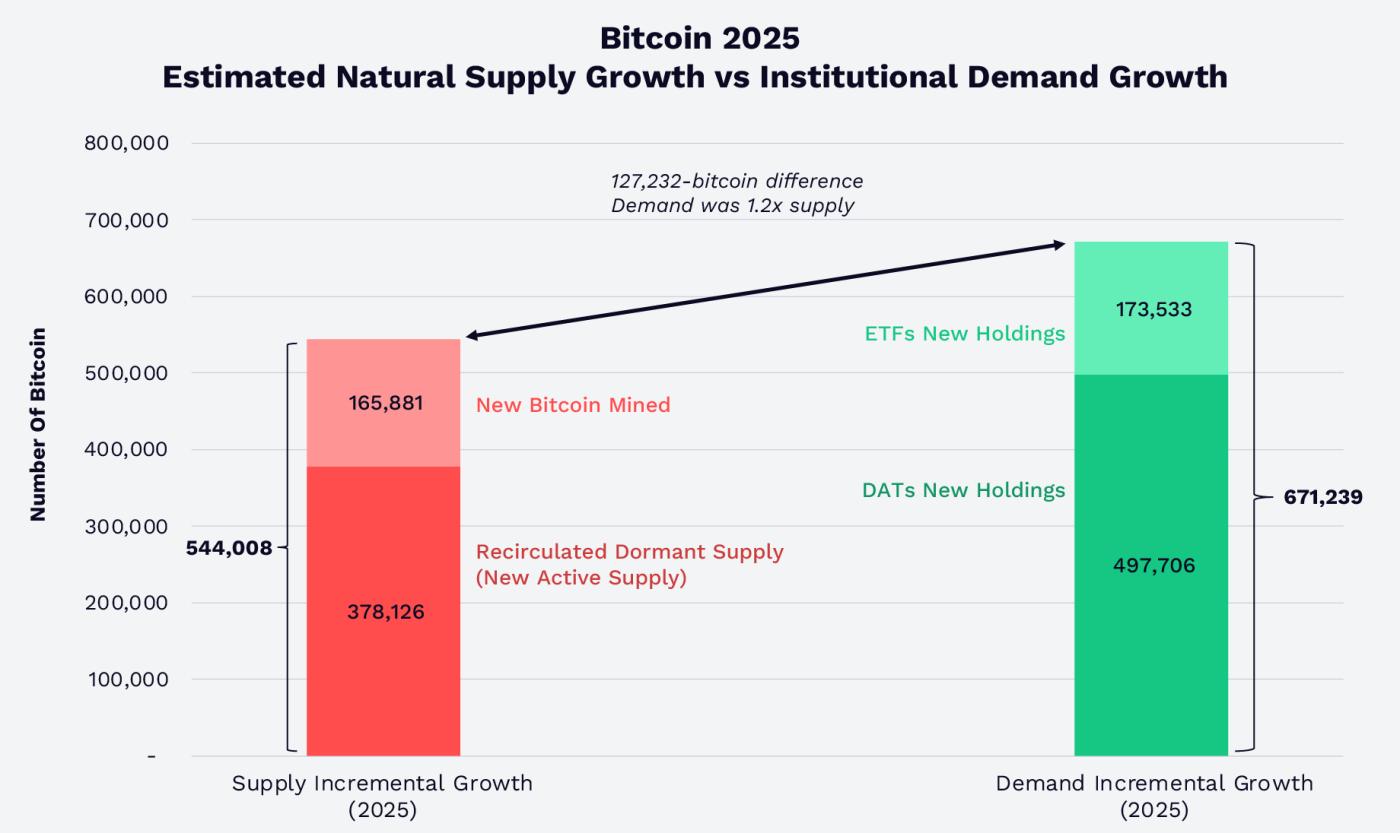

The scaling up of spot Bitcoin ETFs has fundamentally altered the market's supply and demand structure. In 2025, the Bitcoin held by US spot Bitcoin ETFs and the Digital Asset Treasury (DAT) reached 1.2 times the total amount of newly mined Bitcoin plus dormant coins recirculated. By the end of 2025, ETFs and DAT held more than 12% of the total circulating Bitcoin supply.

Despite demand growth outpacing supply, Bitcoin prices still fell, primarily due to external factors: the massive liquidation on October 10th of last year, market concerns about a four-year peak in Bitcoin's cycle, and negative sentiment regarding the threat of quantum computing to Bitcoin cryptography.

Comparison of new circulating supply of Bitcoin to institutional demand in 2025. Source: ARK Investment Management LLC and 21Shares

In the fourth quarter, Morgan Stanley and Vanguard Group both included Bitcoin in their investment platforms:

- Morgan Stanley is offering compliant Bitcoin products to its clients, including spot ETFs.

- Vanguard Group, which has long rejected cryptocurrencies and commodities, has now integrated with a third-party Bitcoin ETF.

As ETFs mature, they will increasingly become a structural bridge between the Bitcoin market and traditional funds.

Corporate Treasury Increases Holdings

Corporate adoption of Bitcoin has expanded from a few early adopters to a wider range of companies. The S&P 500 and Nasdaq 100 have included stocks of companies like Coinbase and Block, allowing mainstream portfolios to indirectly allocate Bitcoin.

Strategy (formerly MicroStrategy), as a representative of digital asset tokens (DATs), has built a massive Bitcoin holding, accounting for 3.5% of the total supply. As of the end of January 2026, various Bitcoin DAT companies collectively held over 1.1 million BTC, representing 5.7% of the total supply, worth approximately $89.9 billion, primarily held by long-term holders.

Sovereign institutions and strategic holdings

In 2025, following El Salvador, the Trump administration used the confiscated Bitcoin to establish the Strategic Bitcoin Reserve (SBR). Currently, the reserve holds approximately 325,437 BTC, representing 1.6% of the total supply, worth $25.6 billion.

Bitcoin vs. Gold: A Comparison of Store-of-Value Assets

Gold leads the way, Bitcoin follows?

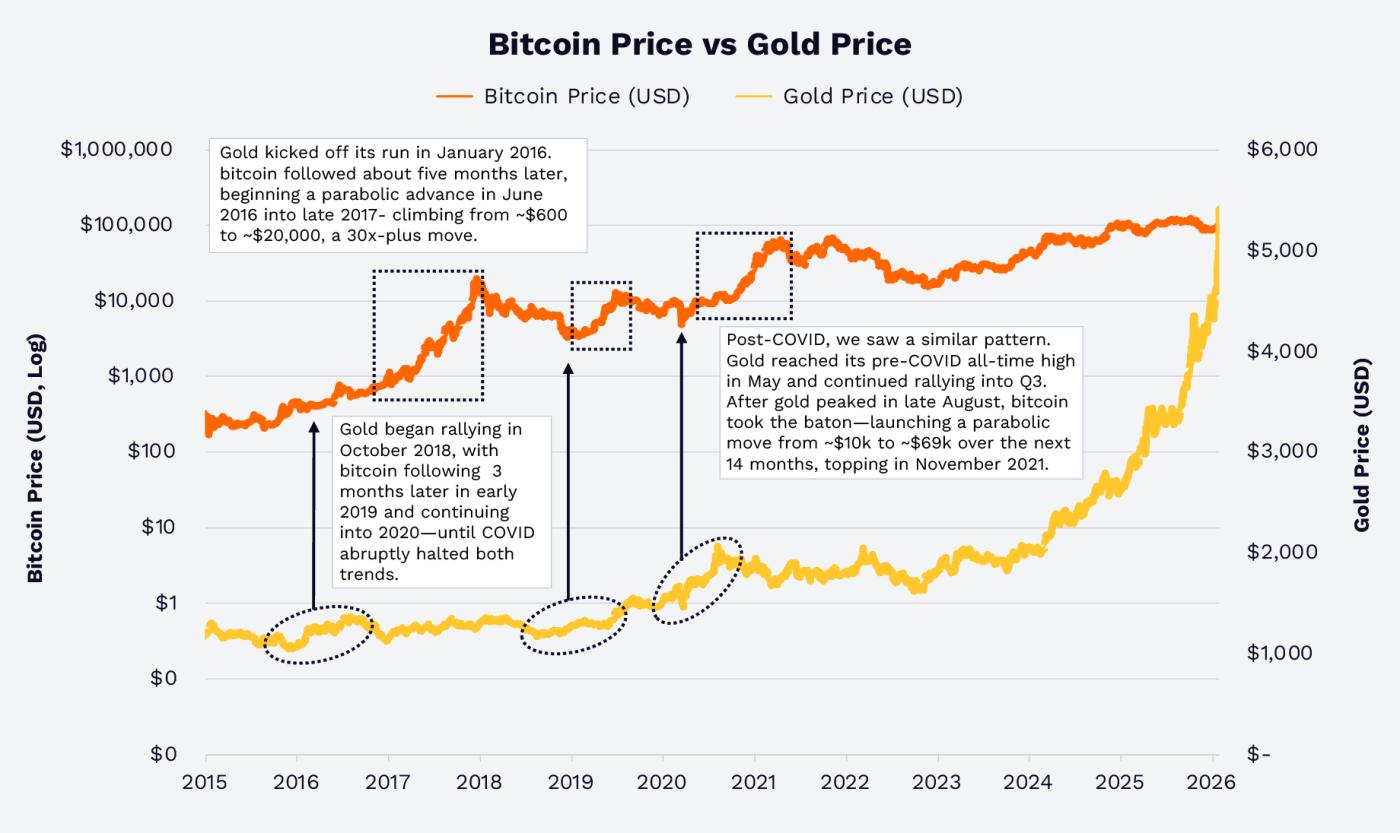

In recent years, gold and Bitcoin have reacted differently to macroeconomic narratives such as currency devaluation, negative real interest rates, and geopolitical risks. In 2025, driven by inflation, fiat currency devaluation, and geopolitical risk concerns, gold prices surged by 64.7%, while Bitcoin prices fell by 6.2%, showing a clear divergence.

But this is not the first time in history:

- In 2016 and 2019, gold prices rose faster than Bitcoin.

- After the initial impact of the COVID-19 pandemic in early 2020, gold prices rebounded first, followed by a surge in Bitcoin prices driven by fiscal and monetary liquidity.

Historically, Bitcoin is a high-beta, natively digital, gold-like macro asset.

Bitcoin vs. Gold Price Comparison, Source: ARK Investment Management LLC and 21Shares

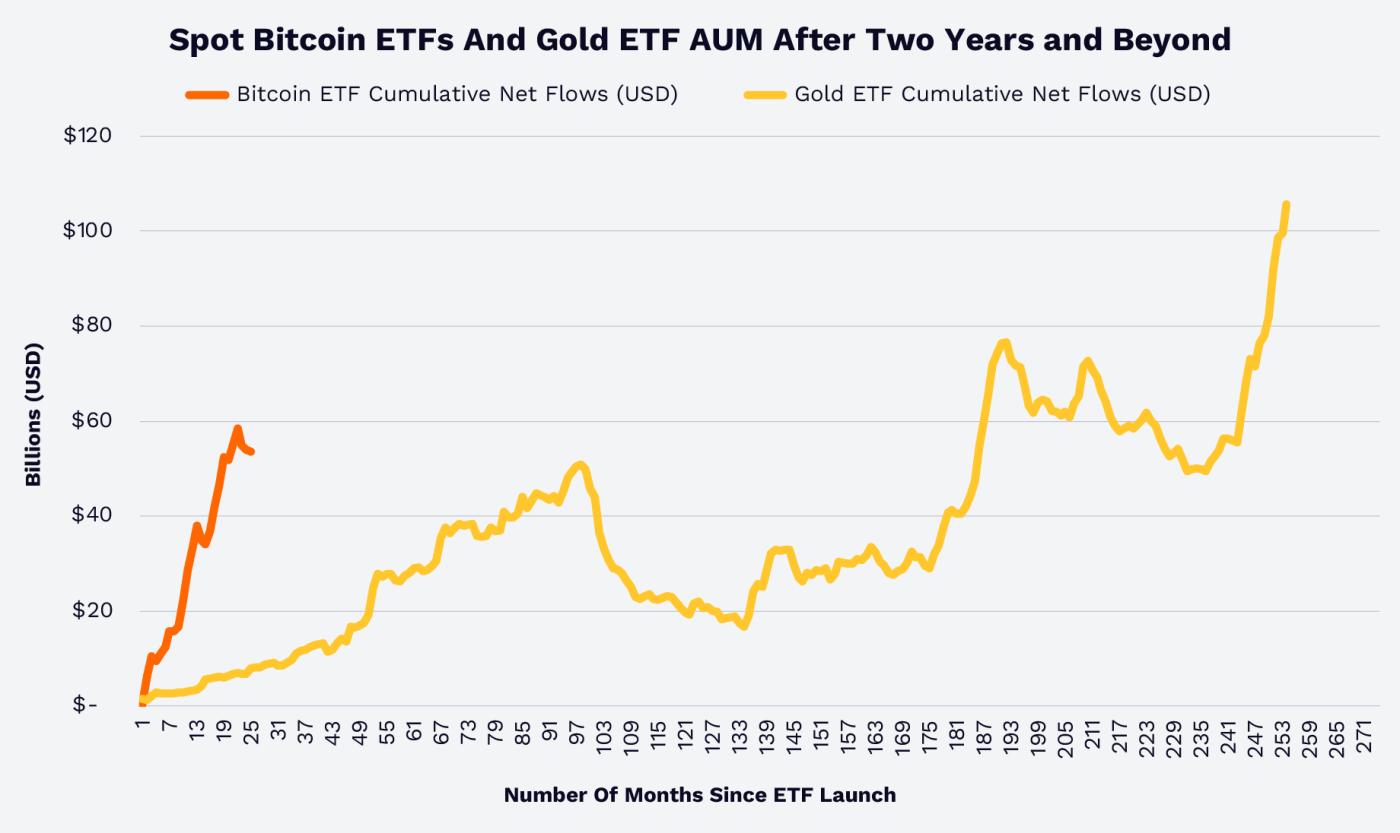

ETF Size: Bitcoin's growth rate far exceeds that of gold.

Looking at cumulative ETF fund flows, Bitcoin spot ETFs have accomplished in less than two years what gold ETFs took over 15 years to achieve. This suggests that financial advisors, institutional investors, and retail investors seem to place greater emphasis on Bitcoin as a store of value, a diversification tool, and a new asset class.

Changes in assets under management for spot Bitcoin ETFs and gold ETFs. Source: ARK Investment Management LLC and 21Shares

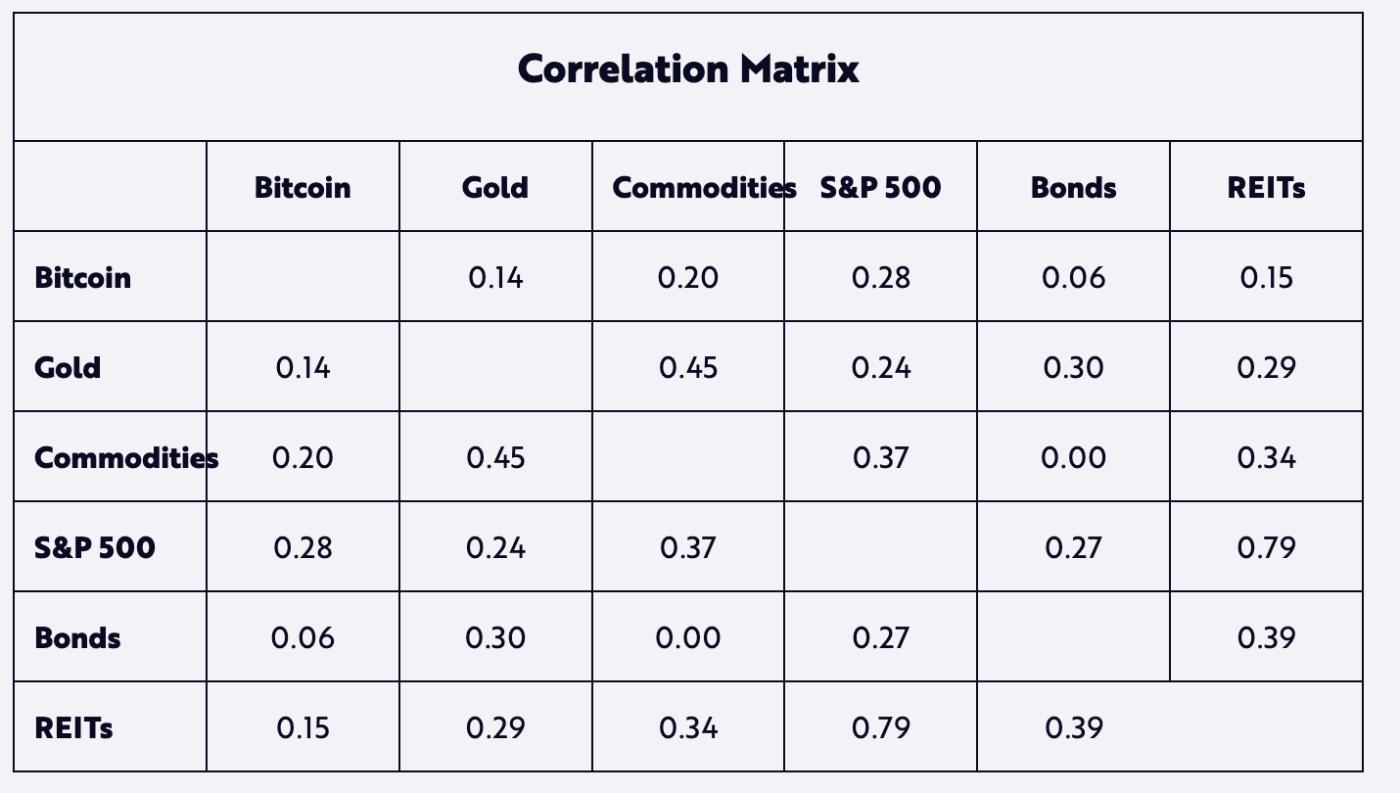

It's worth noting that in the market cycle since 2020, the correlation between Bitcoin and gold returns remains very low. However, gold may still be a leading indicator for Bitcoin.

Correlation matrix of mainstream assets

Market structure and investor behavior

Drawdowns, Volatility and Market Maturity

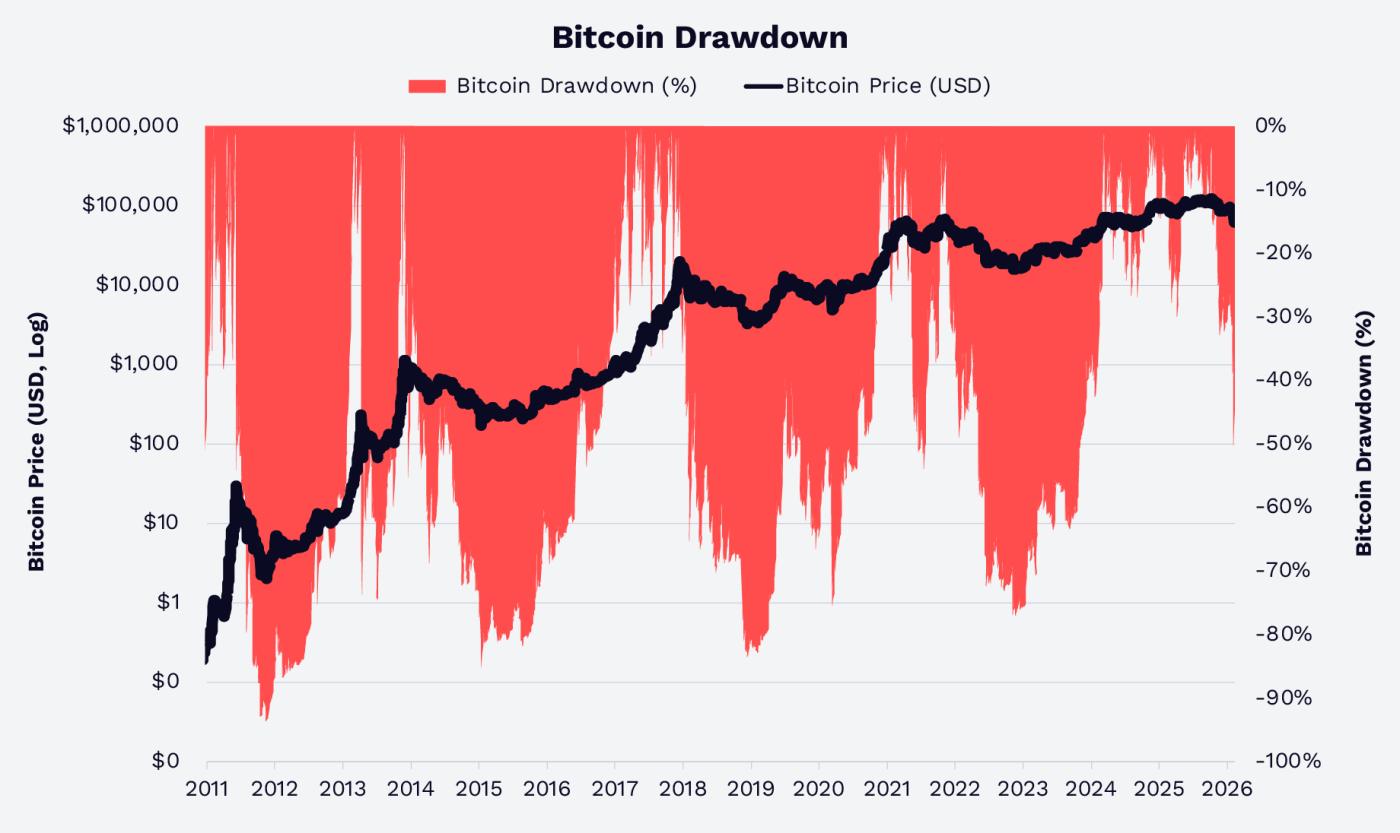

Bitcoin is highly volatile, but its pullbacks are gradually narrowing. In previous cycles, the drop from peak to trough typically exceeded 70% to 80%. However, in the current cycle since 2022, as of February 8, 2026, the price of Bitcoin has never fallen more than 50% from its all-time high (as shown in the chart below), indicating increasing market participation and more abundant liquidity.

Long-term holding is better than market timing

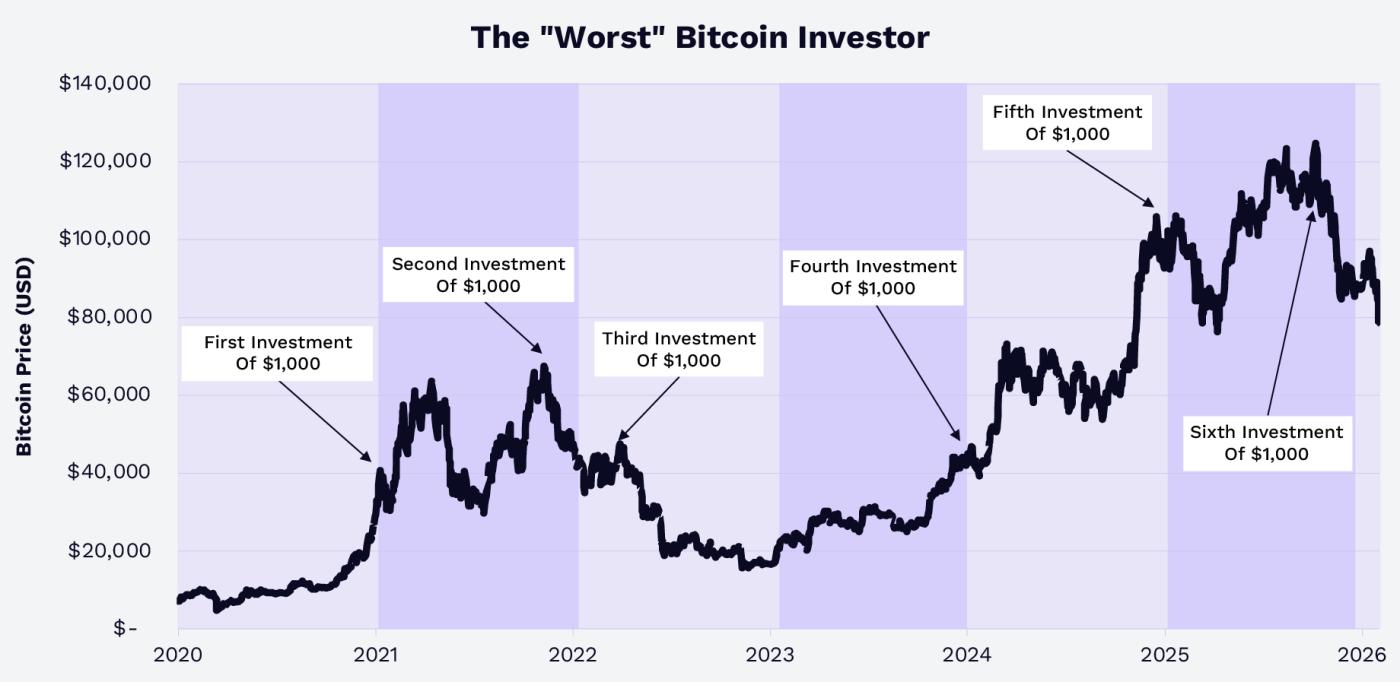

According to Glassnode data, from 2020 to 2025, even the "worst investor" who bought $1,000 at the peak each year would have seen their initial $6,000 grow to approximately $9,660 by the end of 2025, a return of about 61%; by the end of January 2026, they would still have a return of about 45%; and even after the adjustment in early February, they would still have a return of about 29% by February 8.

The conclusion is clear: since 2020, holding period and position management have been far more important than market timing.

Bitcoin's current strategic proposition

By 2026, Bitcoin's core narrative will no longer be "survival," but rather its role in a diversified investment portfolio. Bitcoin is:

- Scarce non-sovereign assets in the context of global monetary policy, fiscal deficits, and trade frictions;

- High-beta derivatives of traditional value stores such as gold;

- Highly liquid global macro assets that can be accessed through compliant tools.

Long-term holders such as ETFs, corporate treasuries, and sovereign institutions have absorbed a significant amount of newly added Bitcoin, and improvements in regulation and infrastructure have further opened up participation channels. Historical data shows that Bitcoin has a low correlation with other assets such as gold. Coupled with the reduced volatility and drawdowns in this cycle, allocating to Bitcoin is expected to improve the risk-adjusted return of an investment portfolio.

We believe that in 2026, the question facing investors will no longer be "whether to allocate funds," but rather "how much to allocate and what tools to use for allocation."