This article is machine translated

Show original

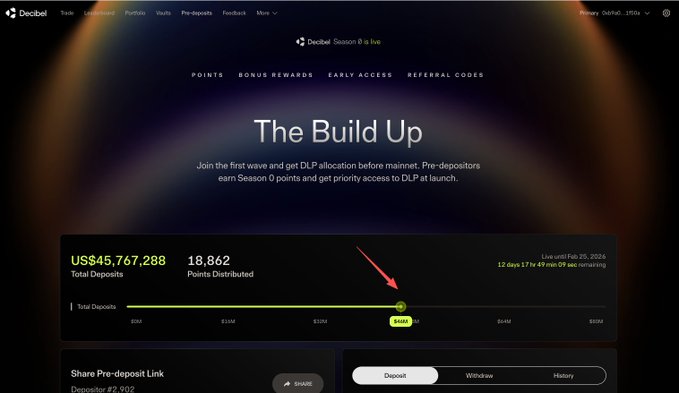

The early-stage Alpha project, Decibel, is currently in the Pre-Deposit phase, and has already deposited $47 million in just one day. The $80 million cap is set, and the deadline is February 25th, leaving 12 days remaining.

Deposit link 🔗 app.decibel.trade/r/evaeva

This pre-deposit isn't simply saving money for airdrops; it uses a time-weighted points system to lock in priority for the mainnet launch. The earlier you deposit and the longer you hold, the higher the weighting. Early, small positions may even be more advantageous than larger ones later. Participating now locks in 0 Season points, USDC-denominated rewards, priority access to the mainnet Beta, and priority access to the DLP (core liquidity pool). The earlier you participate, the better.

Here's the strategy: You can use your main account to recruit secondary accounts, earning 10% AMP from referrals. You can also create accounts with a minimum deposit of 50 USDT. After the mainnet launches, there will be additional rewards for two levels of referrals.

Don't think of Decibel @DecibelTrade as another Perp DEX. There are indeed many Perp DEXs now, and it's impossible for every one of them to succeed. In the end, you still need to see if its product has its own moat, so you have to look at the underlying architecture and liquidity structure design capabilities.

Decibel has a strong team background. It is developed by the Decibel Foundation and has received strong support from Aptos Labs. Its core members come from Aptos core development, Meta, and Goldman Sachs. The team members understand the underlying blockchain architecture and have traditional financial risk control backgrounds. Moreover, it is also targeting Aptos' core ecosystem.

Therefore, in terms of product positioning, it is essentially creating a full-chain trading engine. Spot trading, perpetual bonds, multi-asset margin trading, and liquidity vaults are integrated into a unified platform, with matching and execution all completed on-chain, avoiding the hybrid model of "off-chain matching + on-chain settlement".

Technically, it deeply integrates Aptos' Block-STM parallel architecture, optimizing the Trading VM based on the Move VM to achieve full-chain CLOB matching, continuous funding rates, and multi-asset cross-margin accounts (APT, USDC, BTC, ETH, SOL, etc.), pursuing high concurrency and low latency. Simultaneously, based on Aptos' native X-Chain account, it supports cross-chain deposits, allowing direct participation from Aptos, ETH, Solana, and even CEXs, using USDC for deposits, avoiding a single-chain ecosystem silo model.

Compared to many subsidy-driven Perp DEXs, Decibel places greater emphasis on underlying technology, openness, and security, which is what sets it apart from most projects.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content