This trader made a total of 48 predictions of market movements within 15 minutes, earning a net profit of $80,000 in one day.

Written by: Mahe, Foresight News

The cryptocurrency market is highly volatile, and even top traders sometimes choose to stay on the sidelines due to its notoriously difficult trading environment.

Predicting weekly and monthly charts may not be too difficult, but what if the prediction timeframe is shortened to the minute level? The difficulty level will increase sharply.

However, smart people always have their own ways of making money.

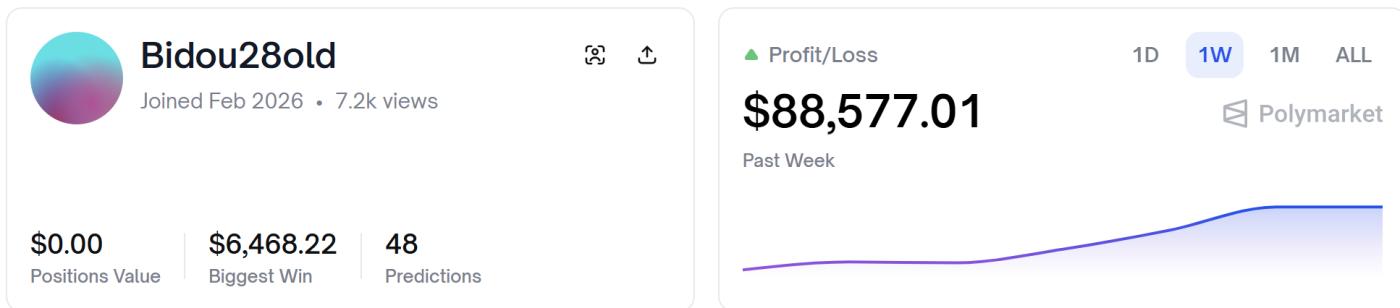

A Polymarket user nicknamed Bidou28old (0x4460bf2c0aa59db412a6493c2c08970797b62970) joined in February of this year and made a net profit of $80,000 in less than a day.

This player is not an ordinary speculator; he is one of the first top players after Polymarket launched its "5-minute/15-minute ultra-short-term prediction market" in February 2026.

It only made 48 predictions in total, but its win rate and profit/loss ratio were extremely impressive. It wasn't "predicting" the future, but rather "hunting" volatility. It's highly likely that it was a quantitative trader or an arbitrageur with extremely low-latency market data, specifically targeting Polymarket's pricing latency for a devastating attack.

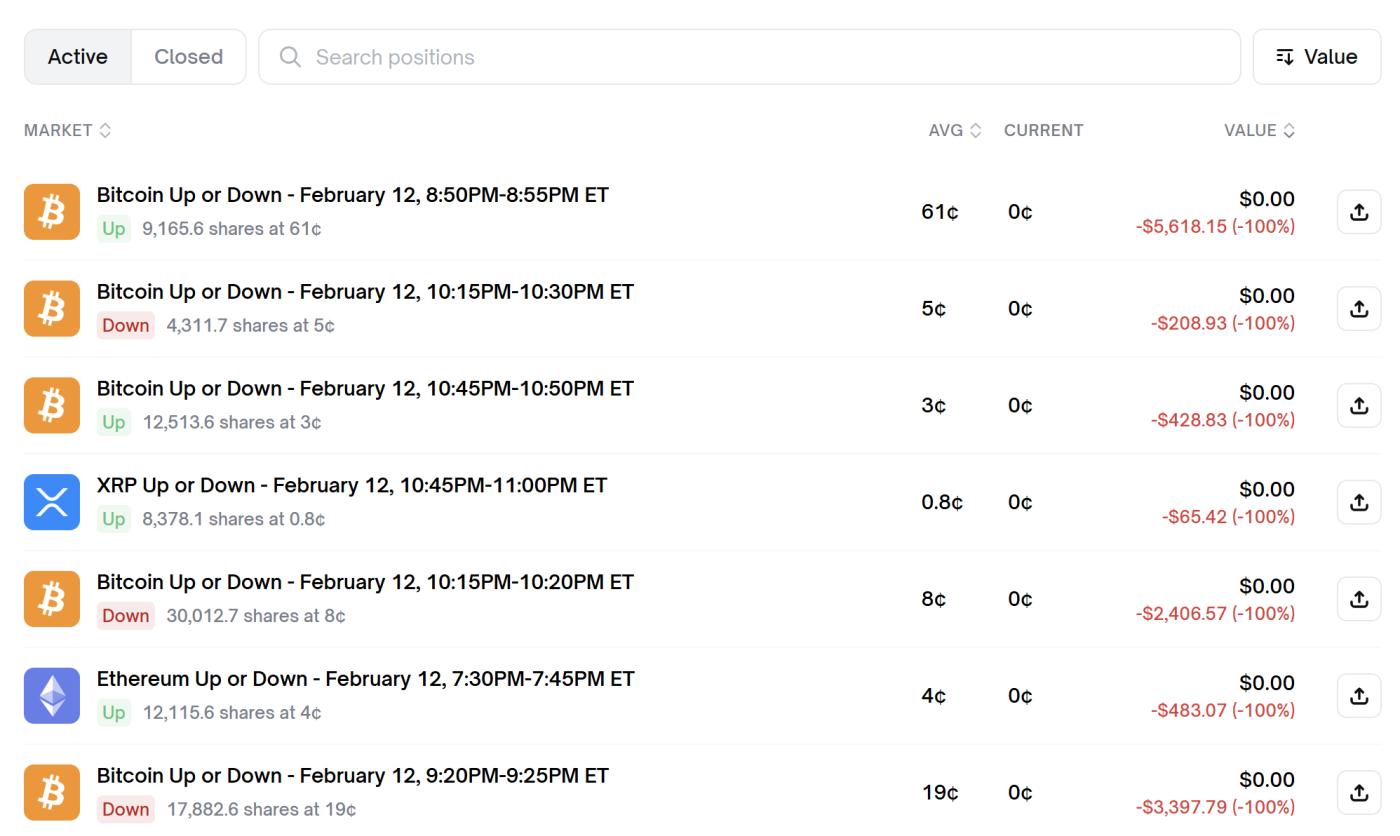

If you scroll down from the trader's Polymarket homepage, you'll be stunned by his "losses"—over $10,000 in just seven losses.

Ordinary people see failure, but players see mathematical logic. Observe its partial transaction prices: 3¢, 5¢, 8¢, 0.8¢. In Polymarket, it specifically buys those things that the market believes have only a 3%-8% probability of happening (such as buying "5-minute rebound" when BTC crashes). If it buys at 3¢, once it guesses correctly, the return is 33 times. This means that even if it fails 30 times, it only needs to succeed once to break even; two successes are pure profit.

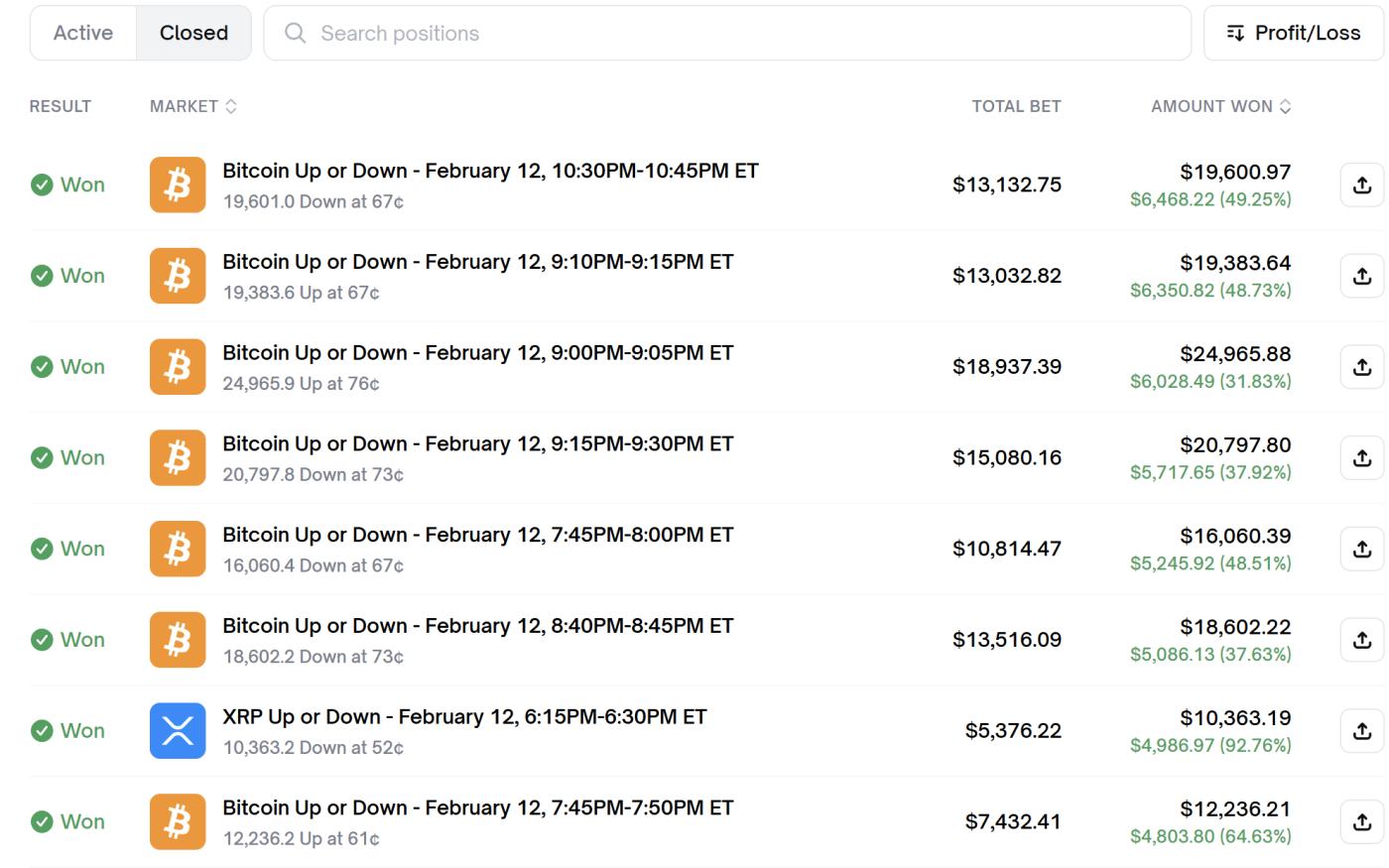

If these failed cases represent high-risk, high-reward strategies with more losses than wins, then when you look at the following high-performing results, you truly see another side of their top-level trading skills.

Observing this screenshot of a win big, you'll notice a striking pattern: extremely high single-bet stakes. Its winning bets consistently range from $7,000 to $19,000 per bet. Furthermore, its profits are remarkably consistent, almost always falling within the $4,800 to $6,400 range.

This demonstrates that it has a strict position management model. It's not betting on "doubling" its money, but on "certainty." As soon as the market shows a signal it approves of, and the trend becomes clear, it invests tens of thousands of dollars, capturing 30%-50% of the gains before withdrawing.

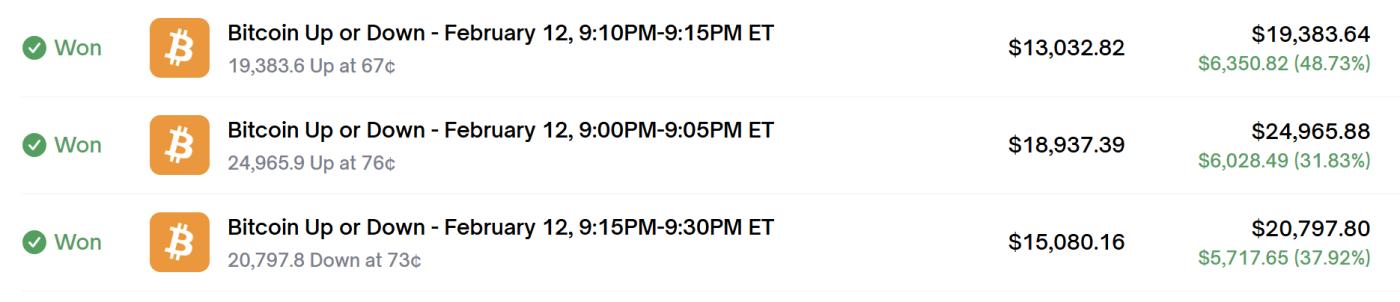

If you think those so-called trend-following techniques are just child's play, then take a look at these three 15-minute timeframe betting examples.

9:00 PM - 9:05 PM: Earn $6,028;

9:10 PM - 9:15 PM: Earned $6,350;

9:15 PM - 9:30 PM: Earned $5,717;

This can be described as a textbook example of high-frequency position switching.

Within 30 minutes, it executed three price predictions for different timeframes, accumulating over $18,000 in profits. This frequency of action suggests it wasn't making decisions based on news reports, but rather by analyzing minute-by-minute candlestick charts or order flows.

A careful review of its past trading records reveals that most of its trading hours are concentrated between 7:30 PM and 11:00 PM Eastern Time, which is between 8:30 AM and 12:00 PM the following day in Beijing Time.

Based on his trading frequency and timing, this trader is either a late-night hunter in North America, perhaps profiting from cryptocurrency fluctuations after the US stock market closes and he has dinner, using his evening rest time. Alternatively, he could be a "day trader" in the Asia-Pacific region, as his extremely calm, high-frequency trading style, involving single trades of tens of thousands of US dollars, aligns with that of a professional quantitative trader based in Asia who treats it as a full-time job.

In terms of target selection, it has a strong preference for BTC, followed by mainstream cryptocurrencies such as ETH, because their volatility is high and they are not easily manipulated by a single force, making them suitable for this kind of large-scale short-term trading.

It allows itself to suffer small losses, but dares to bet heavily on high-probability opportunities (60¢+).

Perhaps this is the self-discipline of top players in Polymarket.