Original author: bootly, BitpushNews

The Ethereum Foundation (EF) is once again at a crossroads of personnel turmoil.

Tomasz Stańczak, co-executive director of the Ethereum Foundation, announced that he will step down at the end of this month. This comes just 11 months after he and Hsiao-Wei Wang took over from long-time leader Aya Miyaguchi in March of last year, forming the new leadership core.

He will be succeeded by Bastian Aue. Very little information about him is publicly available; his X account was registered only eight months ago and has virtually no public activity. He will continue to co-lead this organization, which controls the core resources and direction of the Ethereum ecosystem, alongside Hsiao-Wei Wang.

This seemingly sudden personnel change is actually an inevitable result of the intertwining of internal conflicts, external pressures, and strategic transformation within the Ethereum Foundation.

Taking on a critical mission: A year of turmoil

To understand Stańczak's departure, we must first go back to the context in which he took office.

In early 2025, the Ethereum community was in a period of anxiety. At that time, the cryptocurrency market was generally on the rise after the US election, with Bitcoin repeatedly hitting new highs and competing chains such as Solana showing strong momentum, while Ethereum's price performance was relatively weak, and the Ethereum Foundation itself became the target of criticism.

The criticism was directed at Aya Miyaguchi, the then-executive director. The developer community complained that the foundation was severely disconnected from frontline builders, had conflicting interests in strategic direction, and was not sufficiently promoting Ethereum. Some questioned whether the foundation was being too "laissez-faire," and that its mild stance as a "coordinator" rather than a "leader" was causing Ethereum to lose its first-mover advantage.

As the "central bank" of Ethereum, the foundation is required not to do nothing, but to take a strong stance.

Amid this media storm, Miyaguchi stepped back from the limelight and joined the board of directors. Stańczak and Wang were thrust into the limelight.

Stańczak is not an outsider. He is the founder of Nethermind, a core execution client in the Ethereum ecosystem, playing a key role in infrastructure development. He is technically savvy, has entrepreneurial experience, and a deep understanding of the community's pain points.

In his own words, the instructions he received at the beginning of his tenure were very clear: "The community is telling you—you are too chaotic and need to be more centralized and faster in order to cope with this critical period."

What did I do this year?

The combination of Stańczak and Wang has indeed brought about a visible change.

First, there's the issue of organizational efficiency. The foundation laid off 19 employees, streamlined its structure, and attempted to shed its bureaucratic image. The strategic focus shifted from Layer 2 back to Layer 1 itself, explicitly stating that scaling the Ethereum mainnet would be prioritized over allowing L2 to operate independently. The upgrade pace has noticeably accelerated, and the implementation of EIPs has been more decisive than ever before.

Secondly, there was a shift in approach. The foundation began releasing a series of videos on social media, proactively explaining Ethereum's technical roadmap and development direction to the public. This "going out" communication style contrasts sharply with its previously relatively closed and mysterious image.

Strategically, Stańczak has spearheaded explorations in several new directions: privacy protection, addressing the threats posed by quantum computing, and the integration of artificial intelligence with Ethereum. Particularly in the AI field, he explicitly stated that he sees "agent-based systems" and "AI-assisted discovery" reshaping the world.

On the financial front, the foundation began discussing more transparent budget management and fund allocation strategies in an attempt to address external concerns about the efficiency of treasury use.

Vitalik Buterin's assessment of Stańczak is: "He has greatly helped improve the efficiency of many departments within the foundation, making the organization more agile in responding to the outside world."

The unspoken message of the resignation statement

Why leave when it's been less than a year?

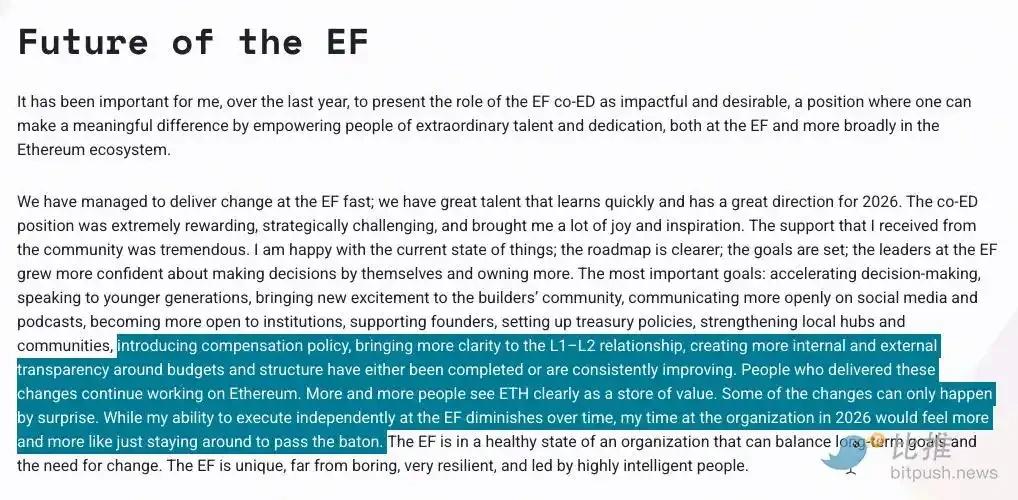

Stańczak's resignation statement was quite candid, and somewhat intriguing. He provided several key points:

First, he believes the Ethereum Foundation and the entire ecosystem are "in good health." It's time to pass the baton.

Secondly, he wants to return to being a "hands-on product builder," focusing on the integration of AI and Ethereum. He says his current mindset is similar to when he founded Nethermind in 2017.

Third, and most intriguingly, is the statement: "The foundation's leadership is increasingly confident in making their own decisions and controlling more affairs. As time goes on, my ability to execute independently within the foundation is diminishing. If I continue to stay, by 2026 I will be more of a 'wait-and-see' situation."

This statement reveals two layers of meaning: first, the new leadership team has become self-driven and no longer needs his intervention in everything; second, his actual power space may be shrinking: for someone who is used to getting involved personally and has a strong entrepreneurial spirit, this feeling is obviously not quite in line with him.

He also mentioned, "I know that many ideas about agent-based AI may not be mature or even useful right now, but it was this kind of game-like experimentation that defined the innovative spirit of early Ethereum."

This passage carries a subtle criticism of the current situation: as organizations become more "mature" and decision-making becomes more "stable," will the experimental spirit of unbridled growth be lost?

Stańczak's departure, ostensibly a personal choice, actually reflects the long-standing predicament faced by the Ethereum Foundation.

From its inception, this organization has been in an awkward position. In theory, Ethereum is decentralized, and the foundation should not be a central authority issuing orders. But in reality, it controls a large amount of funds, core developer resources, and the power to coordinate the ecosystem, objectively assuming the dual roles of a central bank and a national development and reform commission.

This paradoxical identity has long put the foundation in a dilemma: long leads to accusations of centralization; doing too little results in criticism of inaction. During Miyaguchi's time, the foundation leaned towards a "coordinator" role, which resulted in criticism of weakness; Stańczak attempted to shift to an "executor" role, which did improve efficiency, but naturally led to a more centralized distribution of power within the organization.

Stańczak's departure statement precisely exposes this tension: as organizations become more efficient and make more decisive decisions, the individual room for maneuver for founding team members is actually compressed. For an ecosystem that needs to balance the "spirit of decentralization" and "market competition efficiency," such internal friction is almost unavoidable.

What kind of person is Bastian Aue, who succeeded Stańczak?

Very little information is publicly available. His own description on X is that he previously handled "difficult-to-quantify but crucial work" at the foundation: assisting management in decision-making, communicating with team leaders, budget considerations, strategic planning, and prioritization. This low-key style contrasts sharply with Stańczak's distinct entrepreneurial spirit.

In his acceptance speech, Aue stated, "My decision is based on a principled adherence to certain attributes of what we are building. The foundation's mission is to ensure that truly permissionless infrastructure—at its core, the cypherpunk spirit—can be established."

This passage sounds more like the language style of the Miyaguchi period: emphasizing principles, spirit, and coordination rather than dominance.

Does this mean the foundation will rebalance its direction, shifting from "aggressive execution" back to "principled coordination"? Only time will tell.

Ethereum's Confusion

Stańczak's departure comes at a crucial time when Ethereum is discussing a series of major proposals. He revealed that the foundation is about to release several key documents, including a concrete plan for "Lean Ethereum," a future development roadmap, and a DeFi coordination mechanism.

The "Lean Ethereum" proposal has been jokingly referred to by some community members as the "Ethereum era of weight reduction"—aiming to simplify the protocol, reduce the burden, and make the mainnet run more efficiently.

These directional documents will profoundly influence Ethereum's evolution path over the next few years. Changing the core executive at this juncture undoubtedly adds uncertainty to the implementation of these proposals.

On a broader scale, Ethereum is facing challenges from multiple fronts: competition from high-performance chains like Solana, Layer 2 fragmentation, a new narrative window for the integration of AI and blockchain, and the impact of overall sentiment fluctuations in the crypto market on ecosystem funding and attention.

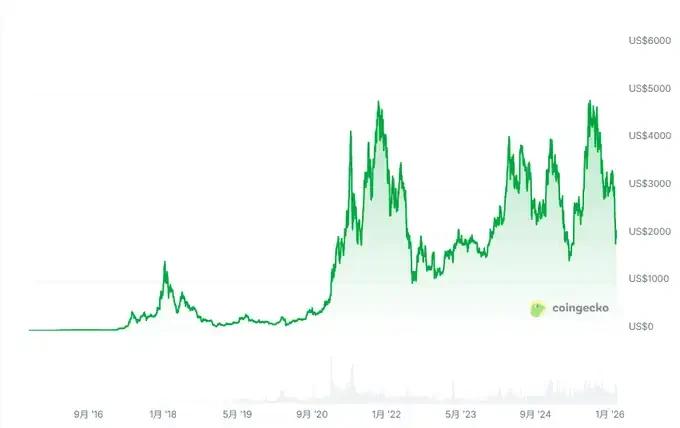

On the same day Stańczak announced his departure, ETH briefly fell into the $1800 range. If it continues to fall below this level, an awkward fact will emerge: the overall return on holding ETH may be lower than the interest rate on USD cash.

The conversion is even more disheartening: In January 2018, ETH first reached $1400. Adjusted for US CPI inflation, that $1400 would be equivalent to approximately $1806 by February 2026.

In other words, if an investor bought ETH in 2018 and has held it naked ever since without staking it, then after eight years, he not only hasn't made any money, but has even underperformed the US dollar cash that would have been sitting in a bank earning interest.

For the "E Guardians" who have been loyal all along, the real question may not be "who won the battle over the right path", but rather: how long can we hold on?

The only certainty is that this core organization, which controls one of the most important ecosystems in the crypto world, is still searching for its place in the rapidly changing industry, and this path is destined to be anything but peaceful.