On February 12th, during Consensus 2026 in Hong Kong, a special exhibition focusing on high-end physical collectibles unfolded amidst an atmosphere of industry exchange. This was an invitation-only private exhibition that brought together select collectors and partners to create an immersive collecting experience.

Inside the exhibition hall, multiple themed sections display high-grade rare trading cards and cultural collectibles authenticated by professional institutions. From Pokémon trading cards to top sports player cards, classic comic book originals, retro game consoles and cartridges, K-POP idol collectibles, and representative magazines, a cross-category physical collection matrix is formed.

In the sports collectibles section, a set of glass display cases caught the eye. Inside, several rare Logoman patch cards featuring NBA legends were on display, including Kobe Bryant, Stephen Curry, LeBron James, and Michael Jordan.

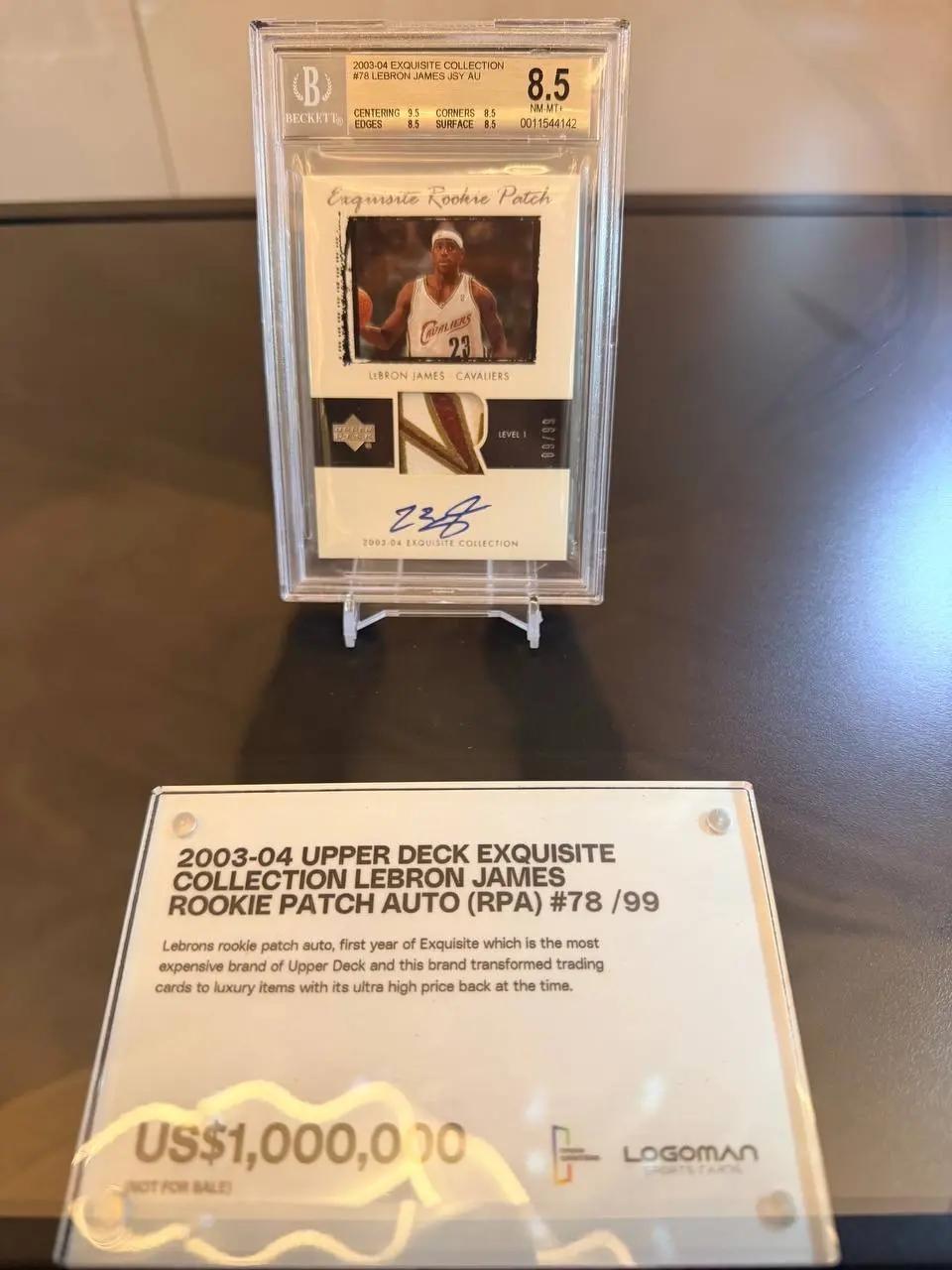

According to the organizers, some of the collectibles are 1/1 scale unique versions, with a single card's estimated value ranging from $1 million to $3 million. For example, one of the exhibited cards, the LeBron James rookie patch auto, comes from Upper Deck's first-year Exquisite premium product line launched in 2003. Exquisite broke the traditional pricing logic of the trading card market with its extremely high prices, and is considered a key milestone in pushing trading cards into the luxury collectibles realm; this particular card is estimated to be worth approximately $1 million.

2003-04 Upper Deck Exquisite LeBron James Rookie Patch Auto (RPA) #78/99 on-site demonstration

On the other side of the exhibition area, the Pokémon trading card display also attracted many visitors. Each card on display has a unique QR code, which visitors can scan to instantly view the corresponding card's on-chain information on BNB Chain, including ownership records, asset origin, custody status, and historical transfer information. All the Pokémon trading cards on display have completed the authentication, verification, custody, and on-chain process through Renaiss Network Vault OS's third-party custody layer infrastructure, achieving synchronous correspondence between physical assets and on-chain data.

Pokémon Trading Cards Display Scene (with Appraisal and Rating)

According to the organizers, this exhibition is a collaboration between Renaiss Protocol, a leading project in the BNB ecosystem collectibles sector, and its sub-brand Renaiss Collectibles, along with Event3, and renowned collectible card retailers LOGOMAN and YAMACARDO. The exhibited items are valued at over US$15 million, making it a large-scale, high-profile physical collectibles showcase rarely seen in recent industry events.

On-chain liquidity infrastructure for physical collectibles

Behind the high-rated Pokémon trading cards on display is an infrastructure system built around authentication, custody, and on-chain circulation records.

Renaiss has deeply integrated globally renowned trading card retailers as ecosystem nodes. Each authenticated and graded Pokémon trading card showcased here has undergone a standardized physical-to-on-chain process. The authentication and verification process is completed by third-party professional organizations, including LegitApp and staff from partner trading card retailers, with on-chain signature confirmation. The physical assets are then received, scanned, and minted via Renaiss Network Vault OS by an approved distributed third-party custodian or vault. Key data such as authentication results, rating information, custodian entity, and asset status are written into the smart contract layer, forming a strong link between on-chain data and off-chain physical assets.

Through this process, a real and traceable asset file is established for physical collectibles before they enter the circulation system, providing a transparent basis for subsequent transactions and circulation.

Window for Upgrading the Circulation of Collectibles Market

In recent years, the global physical collectibles market has remained active. In particular, trading cards (TCGs) have established stable trading systems in many countries and regions, with high-end cards constantly setting new records for transaction prices.

On February 16th, Logan Paul's Pikachu Illustrator trading card sold for nearly $16.5 million, becoming the most expensive single trading card ever sold. According to industry data, the global TCG market is estimated to be worth approximately $8.4 billion in 2025 and is projected to reach $11.6 billion by 2030. As the market expands, high-value physical assets are gradually entering a more professional and large-scale stage.

Against this backdrop, the importance of transparent and verifiable custody and standardized circulation mechanisms is constantly rising. High-value collectibles involve cross-regional transactions and long-term preservation, making asset authenticity verification, ownership records, rating information, and historical provenance key concerns for both buyers and sellers. Meanwhile, physical assets still face objective physical frictions in transportation, storage, and delivery, including practical issues such as delivery cycles, warehousing management, cross-border transfers, and insurance arrangements.

Traditional offline trading systems incur costs in information synchronization and trust transfer, and the operational complexities of physical circulation limit the efficiency of high-value collectible transactions. The market's demand for verifiable, traceable digital records and more efficient circulation coordination mechanisms is gradually increasing.

Blockchain technology is beginning to address this need. Through on-chain records and smart contract mechanisms, physical assets can form verifiable archives, providing a data foundation for subsequent circulation. Collectibles, as an asset type with cultural attributes and a community base, are becoming one of the important scenarios for the practical application of on-chain physical assets.

RWA Practices for Collectibles on the BNB Chain

During the exhibition, Renaiss CEO Winchman also shared his understanding of the integration of collectibles and blockchain. He pointed out that blockchain is the optimal solution for the collectibles industry. In the trading of physical collectibles, the credibility of custody, pricing standards, and liquidity organization methods have always been core issues. Blockchain provides the technological foundation for the global circulation of collectibles and also brings new possibilities for the transparency of asset status.

Winchman stated that Renaiss chose to enter the RWA (Redeem for Affordable and Worn) market through collectibles because of its long-term observation of friction in the circulation of physical assets. The team hopes to eliminate friction in the trading of physical collectibles through standardized custody structures and on-chain recording mechanisms, and to build infrastructure for the financialization of collectibles.

In terms of specific progress, since its launch on BNB Chain in November 2025, Renaiss has completed the Alpha and Closed Beta phases and is currently undergoing continuous iterations in Open Beta. At the application level, since its public beta launch in December 2025, multiple rounds of card pack sales have sold out quickly; the Gacha V1 feature has achieved a transaction volume of $1.37 million, with a secondary market transaction volume of $962,000; and the REFS on-chain credit social protocol for collectibles within the ecosystem project has begun early priority testing.

On the eve of the exhibition, the platform also reached a significant milestone. Its 24-hour limited-time Gacha V2 Beta trading volume exceeded $700,000, and its cumulative trading volume within three months of launch surpassed $3 million. These figures are seen as a sign of the gradual formation of liquidity for on-chain physical collectibles.

During the event, Winchman also exchanged views with Walter, Head of Business Development at BNB Chain, on ecosystem development. Walter shared BNB Chain's focus on AI, stablecoins, RWA, and other related sectors, as well as its continued support for long-term builders. He also mentioned that collectibles are gaining visibility within the BNB Chain ecosystem and discussed his personal emotional connection to Pokémon trading cards.

The cultural dimension of putting everything on the blockchain

As blockchain applications gradually extend to non-financial asset sectors, physical collectibles with strong cultural attributes, community foundations, and real-world value are being regarded as an important component of the tokenized physical asset (RWA) ecosystem. Compared to traditional financial assets, collectibles carry emotional resonance and cultural memories, and their on-chain circulation provides a viable experimental scenario for non-financial RWAs.

In this trend, verifiable custody, pricing mechanisms, liquidity structures, and market transparency of physical collectibles continue to be a focus of industry attention. The BNB Chain ecosystem is also accommodating more cultural asset forms, providing a basic environment for exploring the on-chaining of physical assets.

Renaiss stated that it will continue to advance the construction of on-chain liquidity infrastructure for physical collectibles, deepen cooperation with the global collectibles community and ecosystem partners, and further improve the circulation of collectibles in the digital age.